China electricity analysis & advisory: solar, wind, coal, nuclear, markets.

13yr migrant, currently SH

Rural development enthusiast

@HopkinsNanjing

@LantauGroup

12 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/CleanPowerDave/status/2021166302916698163In a increasingly variable renewables-heavy system, only the coal plants that can ramp, cycle, and stay available on demand will survive. And the plants China's building these days are *tricked out*.

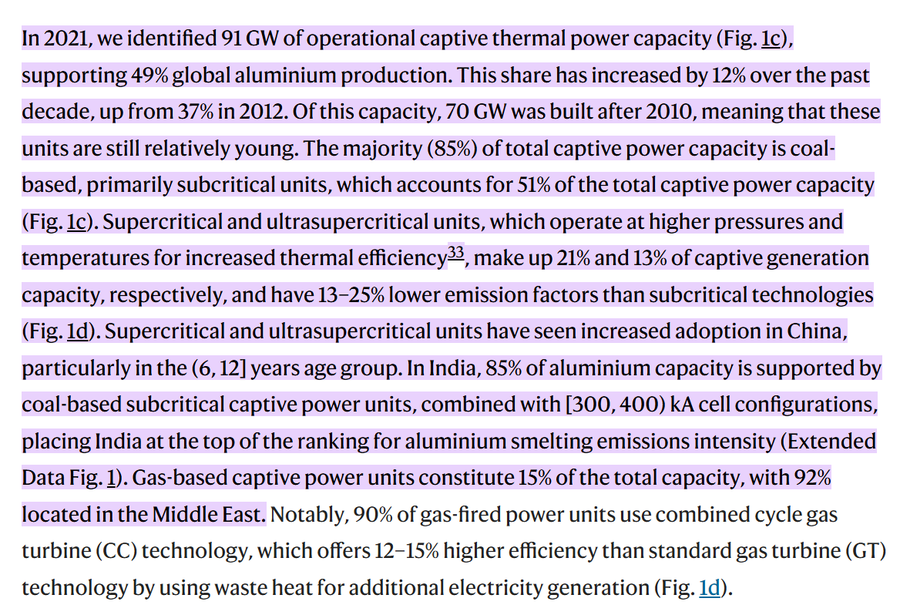

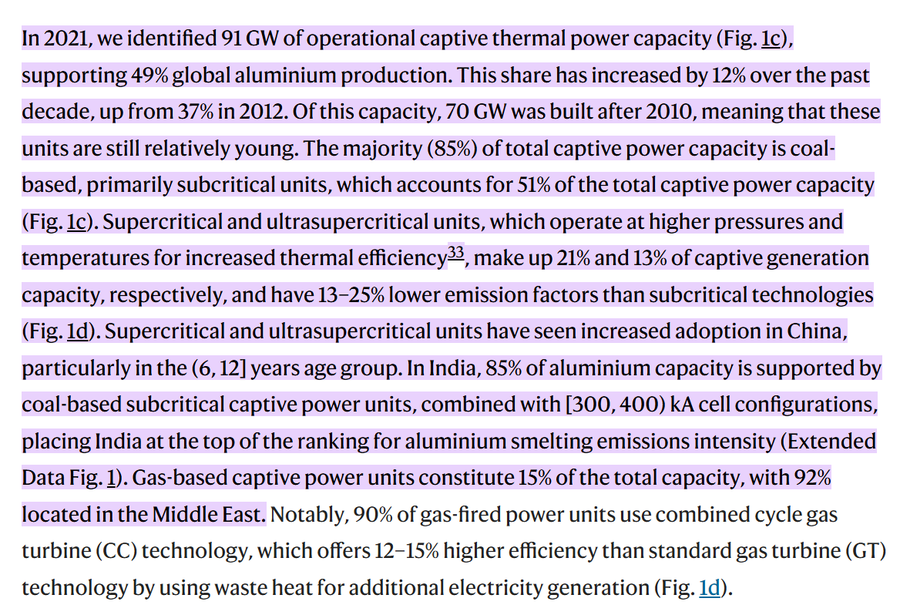

https://twitter.com/AssaadRazzouk/status/20203485324405928012. For this reason, globally, about half of all primary aluminum is produced using captive onsite power plants, and roughly two‑thirds of that captive capacity is subcritical coal.

https://twitter.com/mattyglesias/status/2009796521642840424mea culpa: I contributed to this narrative in the past to make it more palatable in media interviews. It's an easy one for China-skeptical editors and readers to accept: that this "good behavior" on climate issues is driven by self-interest that happens to be socially beneficial.

A Carnot battery, also called a pumped thermal energy storage (PTES), is an energy storage system that converts electricity to heat and cold, then converts it back to power when needed.

A Carnot battery, also called a pumped thermal energy storage (PTES), is an energy storage system that converts electricity to heat and cold, then converts it back to power when needed.

https://twitter.com/robin_j_brooks/status/20042214273824361881. The Premise is Flawed

https://twitter.com/DanCollins2011/status/1989874329308316120The best way to measure "rapid advancement" is not necessarily by the title they currently hold, but the rank within the state civil service system vs. their age.

If you've followed me for a while, you'll know that for 3+ years now, I've protested the over-sampling of opinions from China's 1st-tier cities and pursued this idea of capturing China's "median zeitgest" from smaller cities.

If you've followed me for a while, you'll know that for 3+ years now, I've protested the over-sampling of opinions from China's 1st-tier cities and pursued this idea of capturing China's "median zeitgest" from smaller cities.https://x.com/pretentiouswhat/status/1541753290576531461?s=20

https://twitter.com/slantchev/status/19846345703530990091. "...the massive production, which relies on exports by design".

...oh, and I'm writing this partly as a travel report/guide for others who might like to do a similar tour in the future, and partly as a foundation for the essay content that's coming next.

...oh, and I'm writing this partly as a travel report/guide for others who might like to do a similar tour in the future, and partly as a foundation for the essay content that's coming next.

Actually, the Western Han route of the Yellow is one of the MANY known routes it has taken over the last 2000 years, as you can see from this image.

Actually, the Western Han route of the Yellow is one of the MANY known routes it has taken over the last 2000 years, as you can see from this image.

According to China's renewable consumption quota policy, all new data centers in these hub regions must buy at least 80% of their power from renewable sources.

According to China's renewable consumption quota policy, all new data centers in these hub regions must buy at least 80% of their power from renewable sources.

https://twitter.com/SecretaryWright/status/1962861731174097195First, this this broader idea about not conflating energy with electricity is fine, even good and necessary. 💯

These comments were from Deputy Director Liu Mingyang of the NEA's Electric Power Department:

These comments were from Deputy Director Liu Mingyang of the NEA's Electric Power Department:

Industrial power consumption was up 4.7% YoY, rising to almost 600 TWh in the monthly of July.

Industrial power consumption was up 4.7% YoY, rising to almost 600 TWh in the monthly of July.

https://twitter.com/michaeljmcnair/status/1959134225447182439Installed Capacity vs. Peak Load:

So...Chongqing is huge. It's a direct-governed municipality covering 82,000 sqkm /31,000 sqm, roughly the size of Austria or Czechia or Panama.

So...Chongqing is huge. It's a direct-governed municipality covering 82,000 sqkm /31,000 sqm, roughly the size of Austria or Czechia or Panama.