NOW: At UK #COP27 pavilion, an update on #StopFundingFossils pledge promised last year by 39 countries & public banks to end all international public 💵 for fossils abroad and instead “fully prioritize” finance for clean & just energy transition by the end of 2022. Follow here 👇

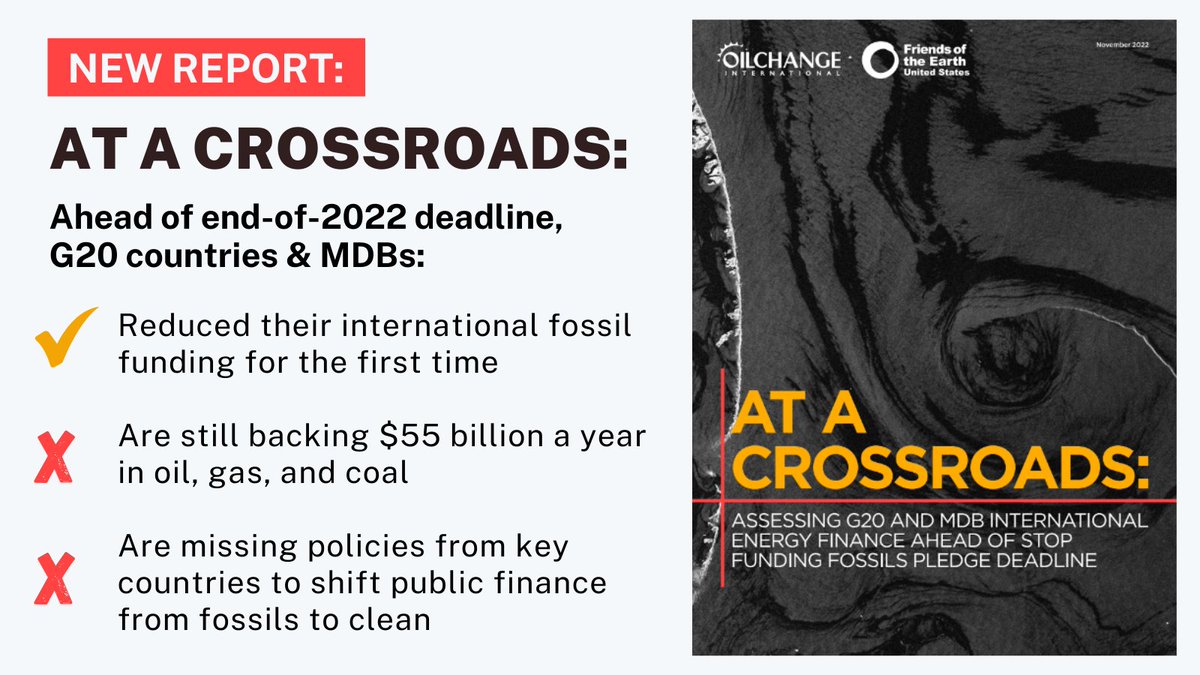

Of the 16 major financing countries who signed onto the pledge, 6 have new policies that fully or almost fully #StopFundingFossils. More are expected in the coming days and weeks to meet 2022 deadline. Check for updates on our tracking briefing here ➡️ priceofoil.org/2022/10/07/lea…

If signatories follow through on their commitment, this will directly shift USD 28 billion a year out of fossil fuels and into clean energy, which would help shift even larger sums of public and private money.

The UK event will hear from signatories that have delivered strong fossil fuel exclusion policies: @UKEF, Sweden, and France. We will also hear from the Netherlands - which released a policy but with some major flaws, which they need to address.

🚨 BREAKING 🚨Nepal 🇳🇵 and Guatemala 🇬🇹 announced as new signatories to Glasgow Statement at #COP27, making them the 40th and 41st signatories!

UK climate envoy, @JohnMurton: "If anything, Russia’s illegal invasion of Ukraine requires an accelerated transition to clean energy. If your country hasn’t joined [the Glasgow pledge] - please leave this room and put pressure on your government to join the initiative."

Kofi Mbuk, @CarbonBubble: “We are seeing European nations renege on their climate promises. Now Europe is looking to Africa for natural gas supply. To African leaders here: Do not be misled. Gas infrastructure to Europe will be stranded in the long-term future.”

Kofi Mbuk, @CarbonBubble: "There is no energy security without investing in remewables. Don't be misled. We believe that new gas infrastructure from Africa to Europe will become stranded."

#Cop27 #StopFundingFossils #DontGasAfrica

#Cop27 #StopFundingFossils #DontGasAfrica

Stefan Crouzat, 🇫🇷: "We said we’ll end support for oil & gas in 2025 & 2035, but that wasn't good enough. Now I'm happy to say in the next financial budget, we are going to ban all export credits for all fossil fuels, as of first of January 2023. It’s all about acceleration."

Hearing from @JanWahlberg from Finland now: “We have a new policy banning most fossil finance from January - any exemptions will be in line with 1.5C and meticulously reported.”

.@RobJetten from the Netherlands says that 🇳🇱 got pressured to join the initiative by the UK government and Dutch youth climate activists. He says he’s very happy that they did.

Now 🇳🇱 must address current loopholes that include: A widely-defined exemption for projects that enhance “energy security”, a 1-year transition period to the end of 2023, continued fossil support in specific sectors in low-income countries bit.ly/3X48s2R

Julia Beck from @UKEF says: “We know fossil fuels are not compatible with 1.5C pathways… we are no longer supporting fossil fuels overseas.”

Hope you are paying attention @OlafScholz, @ItalyMFA, @EximBankUS 👀

Hope you are paying attention @OlafScholz, @ItalyMFA, @EximBankUS 👀

Julia Beck from @UKEF says: “Last financial year we did £7.4bn exports with not a penny going to fossil fuels overseas.”

Next up is 🇩🇪. Since signing on, @OlafScholz has sent worrying signals by aggressively pursuing gas deals in Senegal & elsewhere. Germany must keep its climate promise to #StopFundingFossils and shift this public money to clean 💸

.@StefWenzel talking a good game for 🇩🇪 climate leadership here but Germany must follow the UK in fully implementing the Glasgow Statement. @OlafScholz, will you keep your promise?

#COP27

#COP27

.@StefWenzel: “We will keep our Glasgow Commitment and end international public finance for FFs, with exemptions only in line with the Paris Agreement and 1.5C."

However this isn’t what we’ve been hearing from @OlafScholz. German leadership remains to be seen.

However this isn’t what we’ve been hearing from @OlafScholz. German leadership remains to be seen.

Edward Okot Omoya, @EADBank talks about the bank's intention to develop a policy to stop funding fossil fuels. “Green funding works.”

Our @LaurievdBurg asks @StefWenzel: We have seen concerning signs of backsliding from 🇩🇪. Will Germany keep its promise?

.@steven_herz, Sierra Club with another question for @StefWenzel - "You say 🇩🇪 will only have exemptions for gas where its compatible with 1.5C but how do you define that? Some analysis says no new gas is permitted."

.@StefWenzel gives vague answer to questions on 🇩🇪’s Glasgow policy. Will @Die_Gruenen allow 🇩🇪 to break its Glasgow promise?

@Samuelokulony from @afiego challenges 🇩🇪 @StefWenzel on Glasgow policy - “the more you backslide, the more we suffer.” Urges Germany to commit to its Glasgow promise.

Edward Okot Omoya, @EADBank: “When you become a signatory, you have to play by the rule of the game. There is no way we’re going back on what we’ve signed for. We are going forward - we are going to align our policy and not finance any fossil fuel related project.”

And that’s a wrap! All eyes on @OlafScholz, @ItalyMFA, @EximBankUS and @JustinTrudeau - will they keep their climate promises?

@OlafScholz @ItalyMFA @EximBankUS @JustinTrudeau And a joint civil society response hot off the presses!

41 signatories now signed on to #StopFundingFossils abroad, but gas backtracking by @Bundeskanzler, @SecYellen, @AlessandrRicci, @s_guilbeault risks undermining it all! Where are your policies?

priceofoil.org/2022/11/15/ger…

41 signatories now signed on to #StopFundingFossils abroad, but gas backtracking by @Bundeskanzler, @SecYellen, @AlessandrRicci, @s_guilbeault risks undermining it all! Where are your policies?

priceofoil.org/2022/11/15/ger…

• • •

Missing some Tweet in this thread? You can try to

force a refresh