1) 🚨 ARBITRUM NETWORK AIRDROP 🚨

Missed that 1000$ + Aptos airdrop? The closest thing to a FREE lunch in crypto are airdrops.

A complete step-by-step guide to receive this upcoming token in LESS than 5 tweets.

🧵👇

#Arbitrum #Arbi #Airdrop #Airdrops

Missed that 1000$ + Aptos airdrop? The closest thing to a FREE lunch in crypto are airdrops.

A complete step-by-step guide to receive this upcoming token in LESS than 5 tweets.

🧵👇

#Arbitrum #Arbi #Airdrop #Airdrops

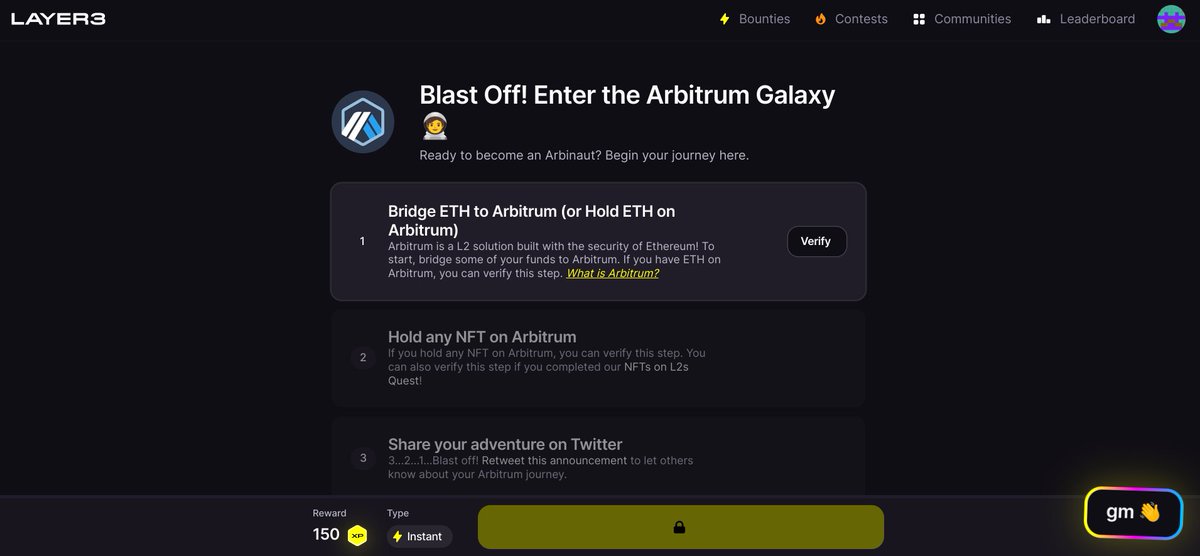

2) ARBITRUM BRIDGING

• Visit bridge.arbitrum.io

• Connect your Ethereum wallet

• Enter the amount you want to transfer

• Approve transaction

>> Any amount will do to register your wallet and be eligible. Although usually the higher the better.

• Visit bridge.arbitrum.io

• Connect your Ethereum wallet

• Enter the amount you want to transfer

• Approve transaction

>> Any amount will do to register your wallet and be eligible. Although usually the higher the better.

3) INTERACT WITH ARBITRUM DAPPS

• Visit gmx.io

• Click the launch exchange button

• Connect wallet

• Open a trade

>> ANY interaction on any #Arbitrum dApp will do. $GMX was just an example.

• Visit gmx.io

• Click the launch exchange button

• Connect wallet

• Open a trade

>> ANY interaction on any #Arbitrum dApp will do. $GMX was just an example.

5) There are various other speculative tasks circulating the internet.

Bridging onto the network AND interacting with dApps are usually the only requirements.

Even the team debunked the famous ''guild roles'' speculation.

Tweet 2 and 3 will likely be the only requirement.

Bridging onto the network AND interacting with dApps are usually the only requirements.

Even the team debunked the famous ''guild roles'' speculation.

Tweet 2 and 3 will likely be the only requirement.

6) AIRDROP REGISTRATION COMPLETE ✅

#Airdrop registrations are usually made BEFORE the official confirmation.

While #Arbitrum hasn't made any official statement yet, there have been hints of an airdrop on the way.

These steps will ensure your wallet is registrated.

#Airdrop registrations are usually made BEFORE the official confirmation.

While #Arbitrum hasn't made any official statement yet, there have been hints of an airdrop on the way.

These steps will ensure your wallet is registrated.

7) If you want to keep up to date to most of my content give me a follow @CryptoGirlNova.

AIRDROP SERIES 3-5 is also to be released soon ⏰

Would love the support if you could like and retweet the first tweet. Thank you 🙏❤️

First tweet 👇

AIRDROP SERIES 3-5 is also to be released soon ⏰

Would love the support if you could like and retweet the first tweet. Thank you 🙏❤️

First tweet 👇

https://twitter.com/CryptoGirlNova/status/1592600948207067137?t=z7c8DTaAc71j5q8ZzK8I5A&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh