Myth:

You need a PhD to get started with Python for quant finance.

Reality:

You need Jupyter Notebooks pre-built with quant code.

Get 20 with Getting Started With Python for Quant Finance.

Here's a breakdown of all 20:

You need a PhD to get started with Python for quant finance.

Reality:

You need Jupyter Notebooks pre-built with quant code.

Get 20 with Getting Started With Python for Quant Finance.

Here's a breakdown of all 20:

And here's what else you get:

• $1,000 at IB

• 6 deep dives

• 10 live sessions

• Private community

• 10-module curriculum

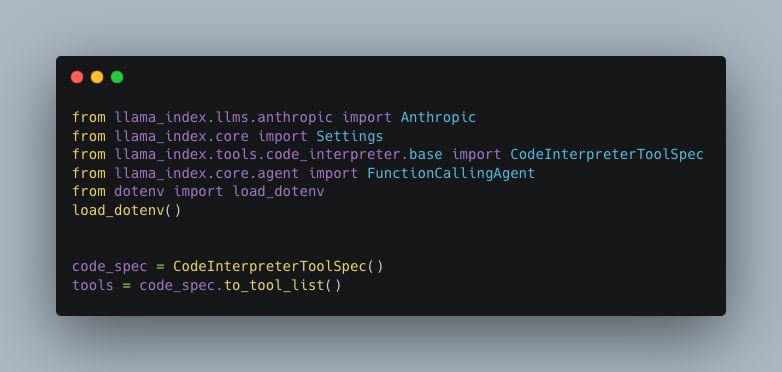

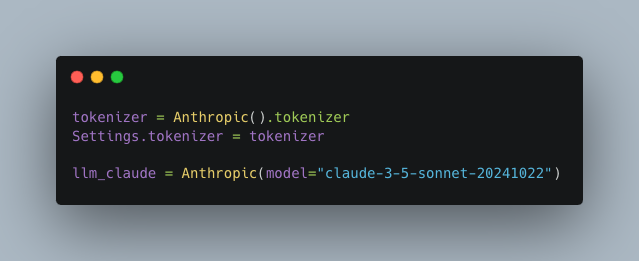

• Deep Dive into OpenBB

• Lifetime access to recordings

• A free copy of 2 options ebooks

Now, on to the Notebooks!

…gstartedwithpythonforquantfinance.com

• $1,000 at IB

• 6 deep dives

• 10 live sessions

• Private community

• 10-module curriculum

• Deep Dive into OpenBB

• Lifetime access to recordings

• A free copy of 2 options ebooks

Now, on to the Notebooks!

…gstartedwithpythonforquantfinance.com

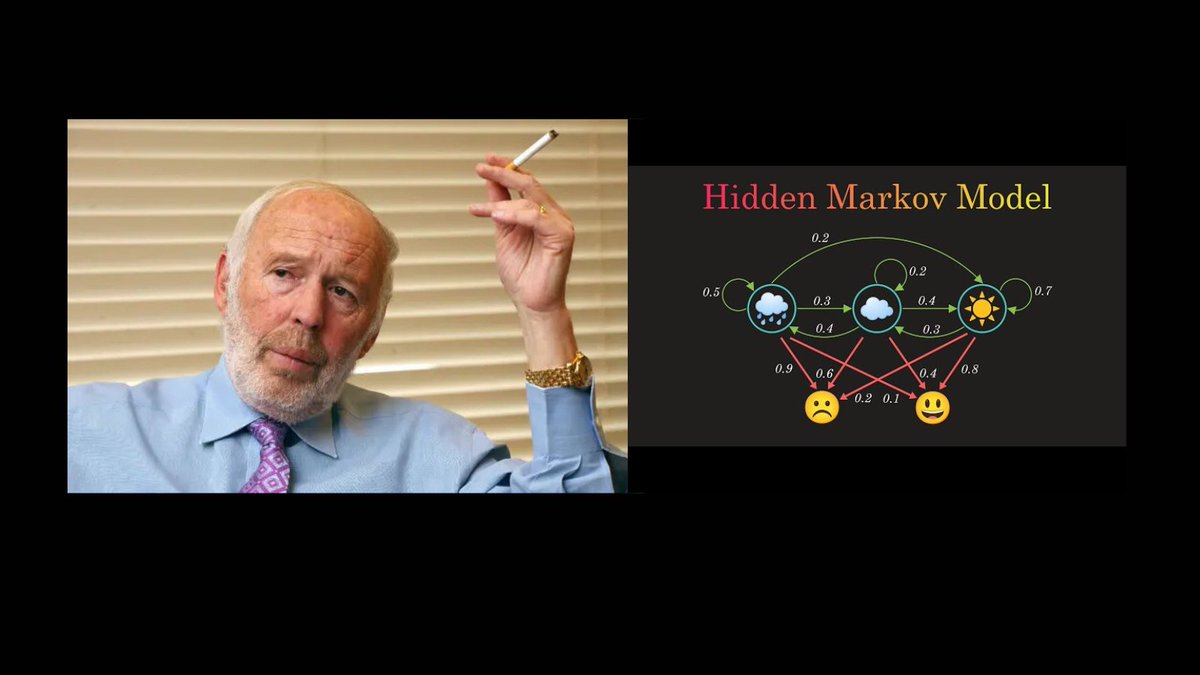

Assess a real trading strategy

Algorithmic trading is hard for retail traders. Don't spend 6 months building a backtest for one that doesn't work.

This Notebook shows you how to assess a working trading strategy quickly.

Algorithmic trading is hard for retail traders. Don't spend 6 months building a backtest for one that doesn't work.

This Notebook shows you how to assess a working trading strategy quickly.

Backtest a trading strategy with bt

When you're ready, use a backtesting framework to analyze the risk and performance metrics of your strategy.

This Notebook walks you through a backtest with bt.

When you're ready, use a backtesting framework to analyze the risk and performance metrics of your strategy.

This Notebook walks you through a backtest with bt.

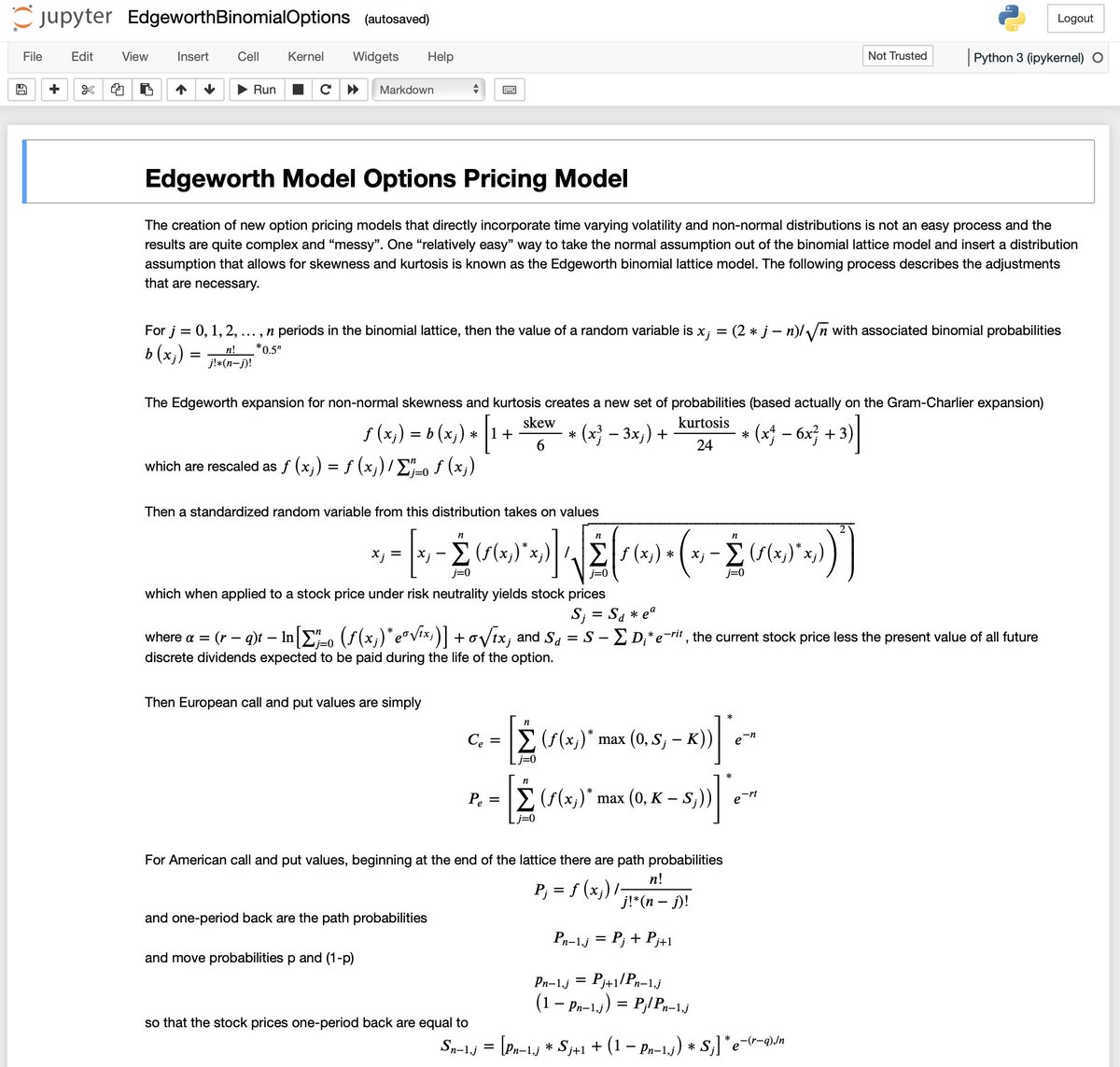

Price options with the Edgeworth model

Pricing models assume stock returns are normally distributed. They're not. The Edgeworth model introduces skew and kurtosis.

This Notebook shows you how to price an option with the Edgeworth odel.

Pricing models assume stock returns are normally distributed. They're not. The Edgeworth model introduces skew and kurtosis.

This Notebook shows you how to price an option with the Edgeworth odel.

Use GARCH to forecast volatility

Quants use volatility forecasting to find market mispricings. Most volatility forecasts start with GARCH.

This Notebook shows you how you find market mispricings.

Quants use volatility forecasting to find market mispricings. Most volatility forecasts start with GARCH.

This Notebook shows you how you find market mispricings.

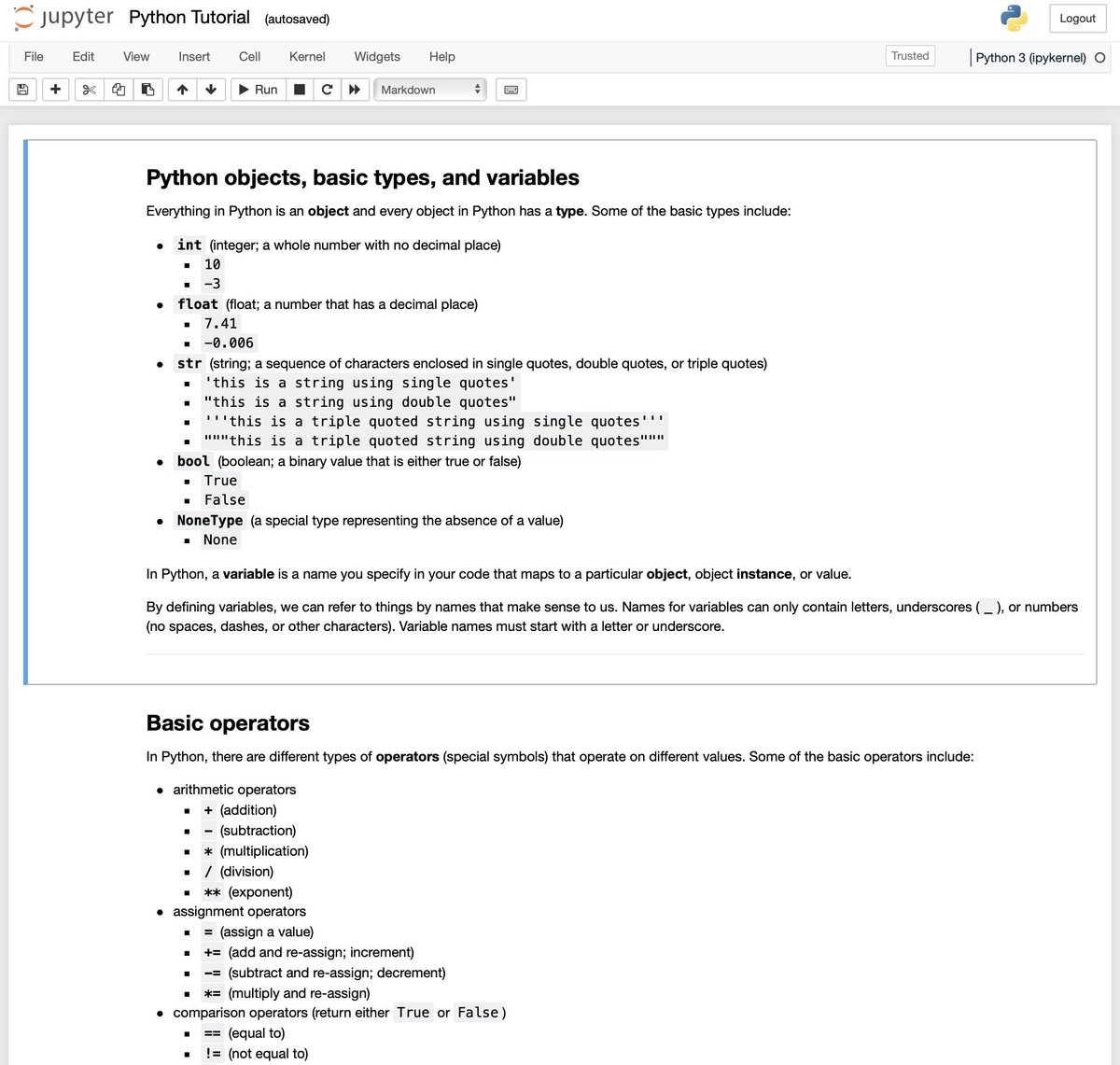

Python basics tutorial and walkthrough

If you're just getting started with Python, you need a good walkthrough of the basics.

This Notebook shows you how to get started with Python.

If you're just getting started with Python, you need a good walkthrough of the basics.

This Notebook shows you how to get started with Python.

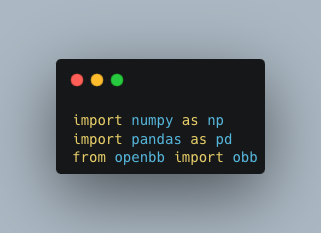

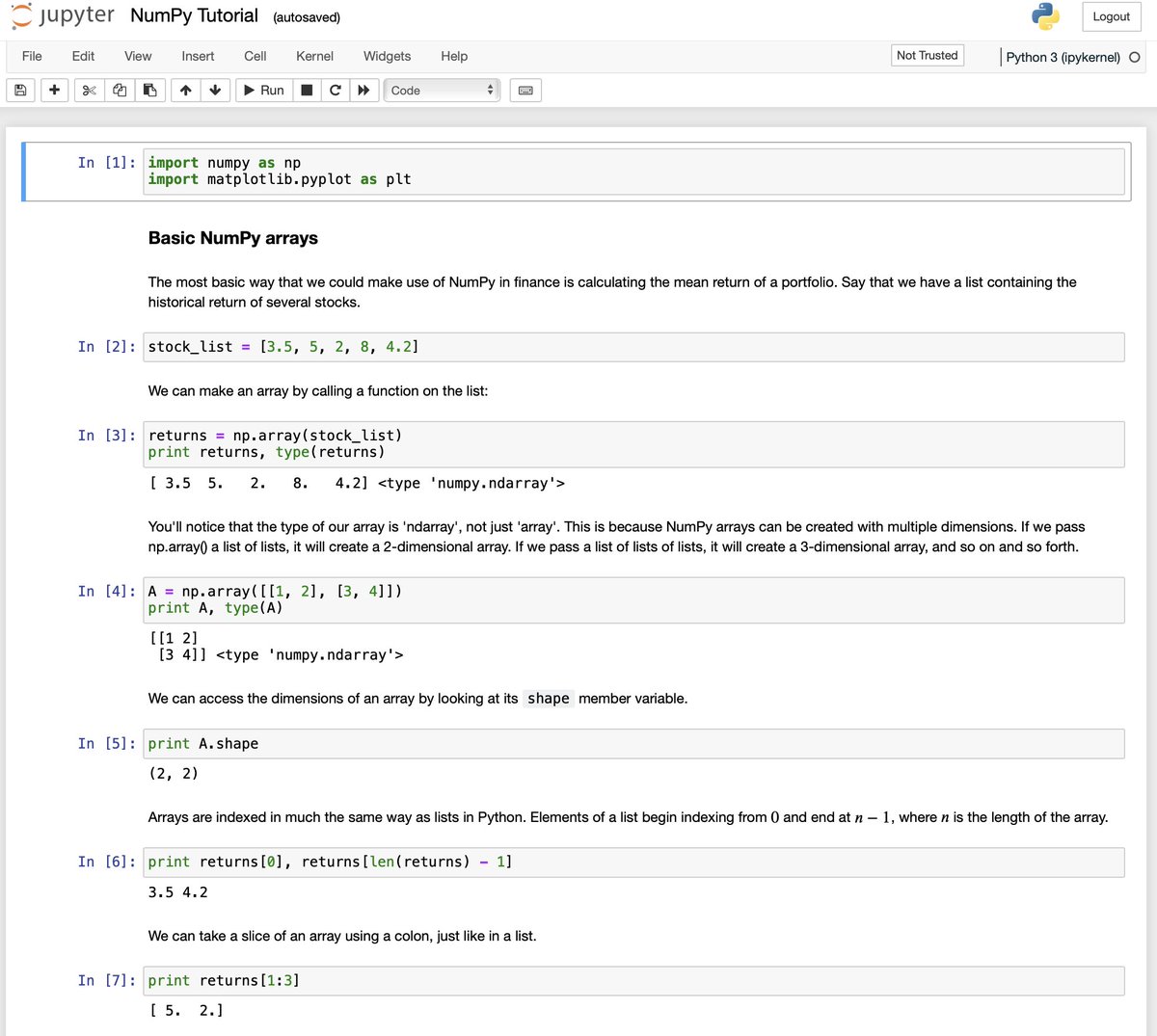

NumPy tutorial and walkthrough

The entire Python quant stack is based on NumPy. It's the standard tool for all scientific computing in Python.

This Notebook shows you how to use it.

The entire Python quant stack is based on NumPy. It's the standard tool for all scientific computing in Python.

This Notebook shows you how to use it.

pandas tutorial and walkthrough

Working with data starts with pandas. It's the standard tool for data manipulation in Python. It was started by a hedge fund.

This Notebook walks through the most important parts of pandas.

Working with data starts with pandas. It's the standard tool for data manipulation in Python. It was started by a hedge fund.

This Notebook walks through the most important parts of pandas.

SciPy tutorial and walkthrough

The statistical functions like probability distributions that underpin quant finance are in SciPy.

This Notebook shows you what you need to use SciPy for quant finance.

The statistical functions like probability distributions that underpin quant finance are in SciPy.

This Notebook shows you what you need to use SciPy for quant finance.

yfinance tutorial and walkthrough

To build trading algorithims, you need stock and options data. yfinance is your gateway to free market data.

This Notebook walks you through the basics of using yfinance.

To build trading algorithims, you need stock and options data. yfinance is your gateway to free market data.

This Notebook walks you through the basics of using yfinance.

Theta Data tutorial and walkthrough

Historic and real time options data is expensive and hard to find. Theta Data gives you an API to access historic and real time options data.

This Notebook shows you how to use the API.

Historic and real time options data is expensive and hard to find. Theta Data gives you an API to access historic and real time options data.

This Notebook shows you how to use the API.

Riskfolio-Lib tutorial and walkthrough

Teams of Ph.D.s spent decades refining the portfolio optimization. Riskfolio-Lib wraps up dozens of portfolio and risk optimizations in one library.

This Notebook walks you through an example of how to use it.

Teams of Ph.D.s spent decades refining the portfolio optimization. Riskfolio-Lib wraps up dozens of portfolio and risk optimizations in one library.

This Notebook walks you through an example of how to use it.

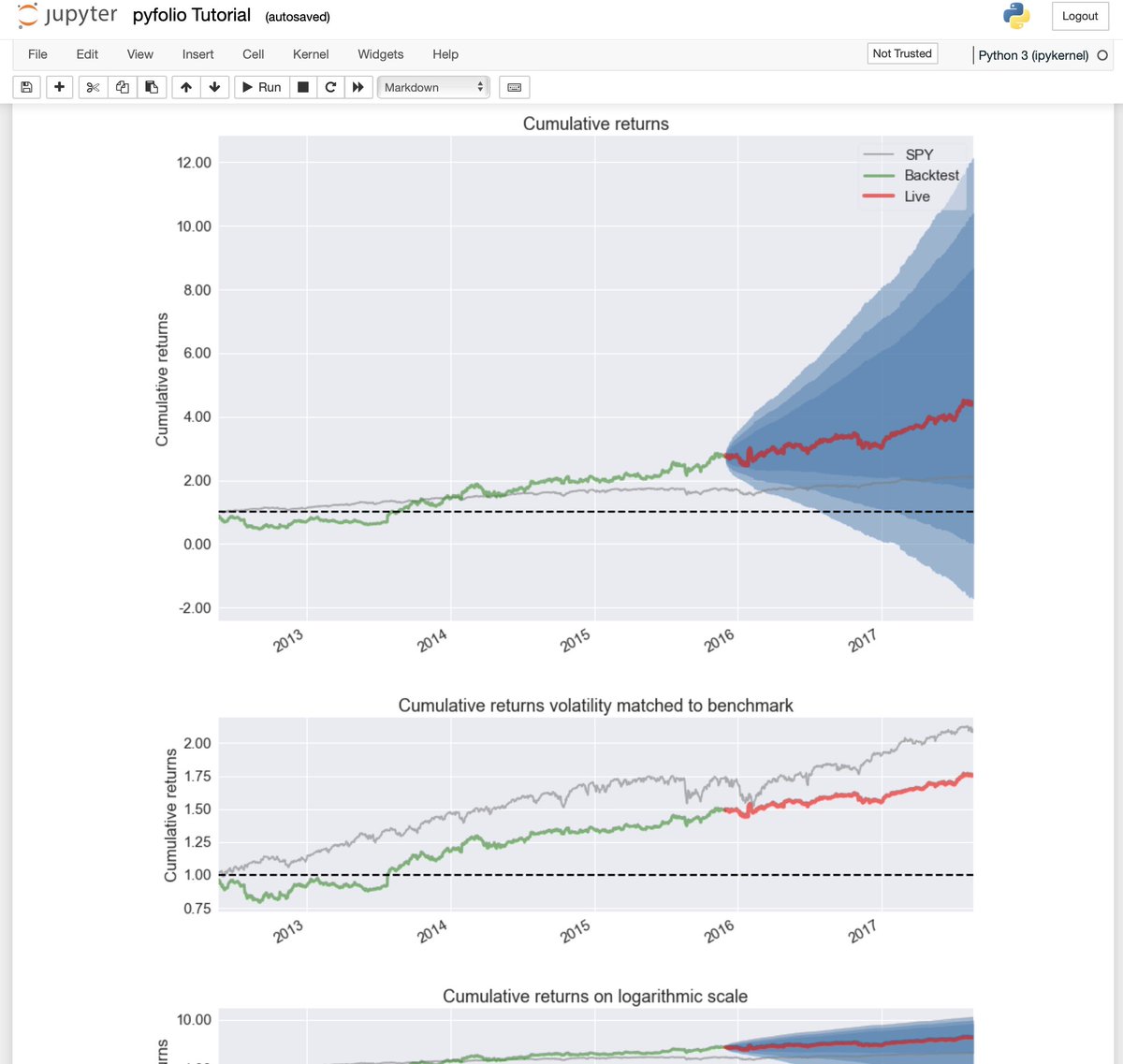

pyfolio tutorial and walkthrough

Risk and performance reporting is critical for measuring your trading algorithms. pyfolio has a suite of tear sheets that gives you an in-depth view of your portfolio in one line of code.

This Notebook shows you how to use it.

Risk and performance reporting is critical for measuring your trading algorithms. pyfolio has a suite of tear sheets that gives you an in-depth view of your portfolio in one line of code.

This Notebook shows you how to use it.

Empyrical tutorial and walkthrough

Don't rebuild the statistical functions you need for risk and performance reporting. Empyrical gives you a library of common risk and performance metrics ready to use.

This Notebook outlines common use cases.

Don't rebuild the statistical functions you need for risk and performance reporting. Empyrical gives you a library of common risk and performance metrics ready to use.

This Notebook outlines common use cases.

Connect to Interactive Brokers with Python

The first step in automatic execution is connecting to your broker.

This Notebook gives you the code to make the connection.

The first step in automatic execution is connecting to your broker.

This Notebook gives you the code to make the connection.

Risk management with value at risk

Hedge funds and trading firms value at risk to capture probability of losing money. You can use it too.

This Notebook shows you how to build your own value at risk measure.

Hedge funds and trading firms value at risk to capture probability of losing money. You can use it too.

This Notebook shows you how to build your own value at risk measure.

Risk management with drawdown analysis

Drawdown is an important factor to consider when analyzing trading strategies. It's used to help undertand risk of going broke.

This Notebook calculates drawdown for a stock or portfolio.

Drawdown is an important factor to consider when analyzing trading strategies. It's used to help undertand risk of going broke.

This Notebook calculates drawdown for a stock or portfolio.

Simulate stock prices with Geometric Brownian Motion

The foundation of all derivative pricing is asset price simulation. One of the most common methods is Geometric Brownian Motion.

This Notebook shows you how to simulate stock prices.

The foundation of all derivative pricing is asset price simulation. One of the most common methods is Geometric Brownian Motion.

This Notebook shows you how to simulate stock prices.

Simple order execution on Interactive Brokers with Python

Once you connect, you need to test simple trade execution.

This Notebook shows you how to send simple buy orders to Interactive Brokers.

Once you connect, you need to test simple trade execution.

This Notebook shows you how to send simple buy orders to Interactive Brokers.

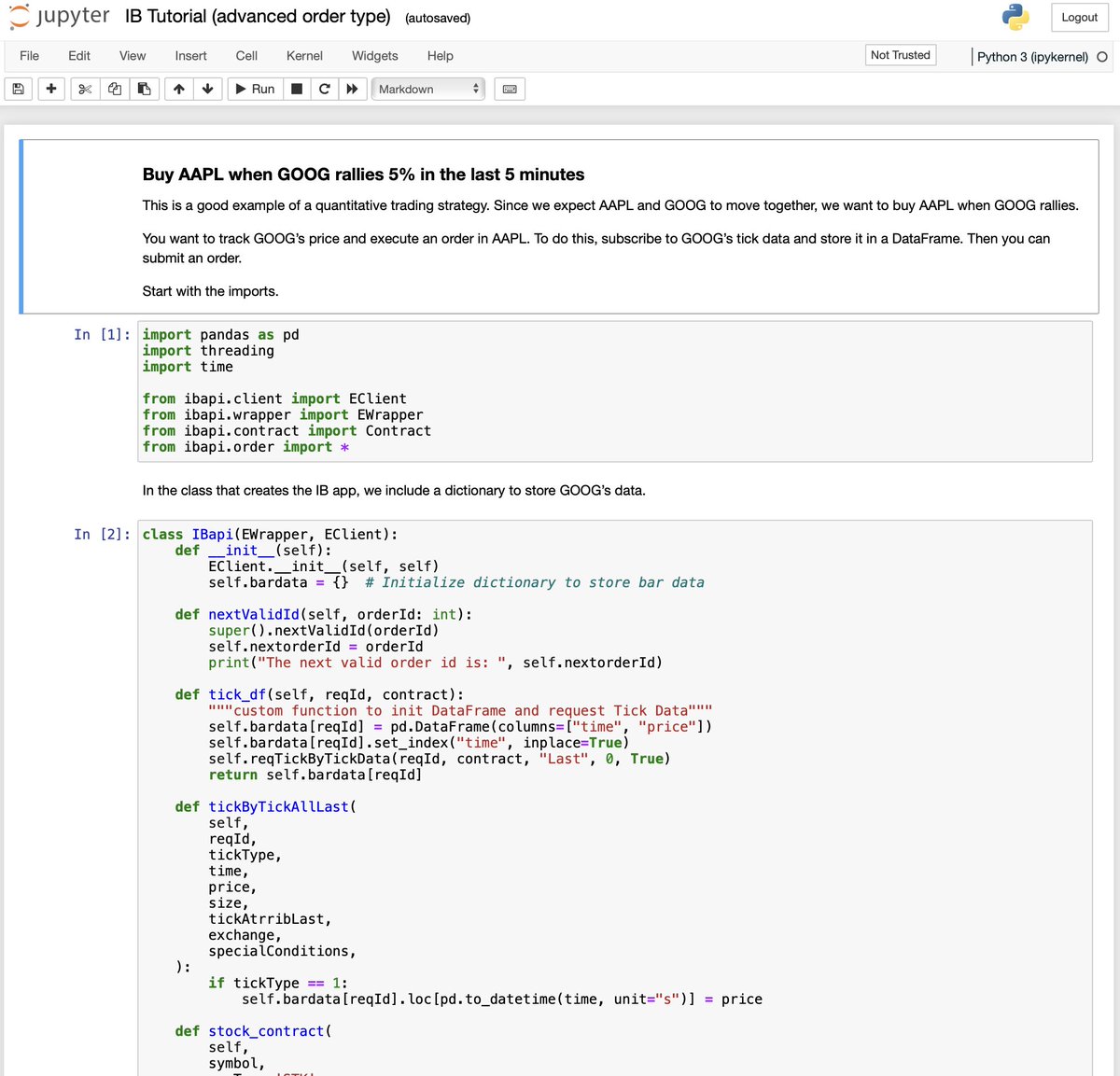

Advanced algo trading on Interactive Brokers with Python

Once you get the connection set and a trade done, add complexity to your trading algorithms.

This Notebook demonstrates an advanced trading strategy executing on Interactive Brokers.

Once you get the connection set and a trade done, add complexity to your trading algorithms.

This Notebook demonstrates an advanced trading strategy executing on Interactive Brokers.

Store real time market data from Interactive Brokers with Python

All quants need data. The free sources are ok, but if you need something more complex, save it from Interactive Brokers.

This Notebook shows you how to save market data directly from the market.

All quants need data. The free sources are ok, but if you need something more complex, save it from Interactive Brokers.

This Notebook shows you how to save market data directly from the market.

Get all this plus:

• 6 deep dives

• 10 live sessions

• Private community

• 10-module curriculum

• Deep Dive into OpenBB

• Lifetime access to recordings

• A free copy of 2 options ebooks

In one course.

January cohort is open:

…gstartedwithpythonforquantfinance.com

• 6 deep dives

• 10 live sessions

• Private community

• 10-module curriculum

• Deep Dive into OpenBB

• Lifetime access to recordings

• A free copy of 2 options ebooks

In one course.

January cohort is open:

…gstartedwithpythonforquantfinance.com

There are limited seats for the course. If you're not ready yet, retweet the top tweet to remind yourself.

If you want more Python for quant finance, follow @pyquantnews.

If you want more Python for quant finance, follow @pyquantnews.

• • •

Missing some Tweet in this thread? You can try to

force a refresh