Where finance practitioners get started with Python for quant finance, algorithmic trading, and data analysis | Tweets & threads with free Python code & tools.

39 subscribers

How to get URL link on X (Twitter) App

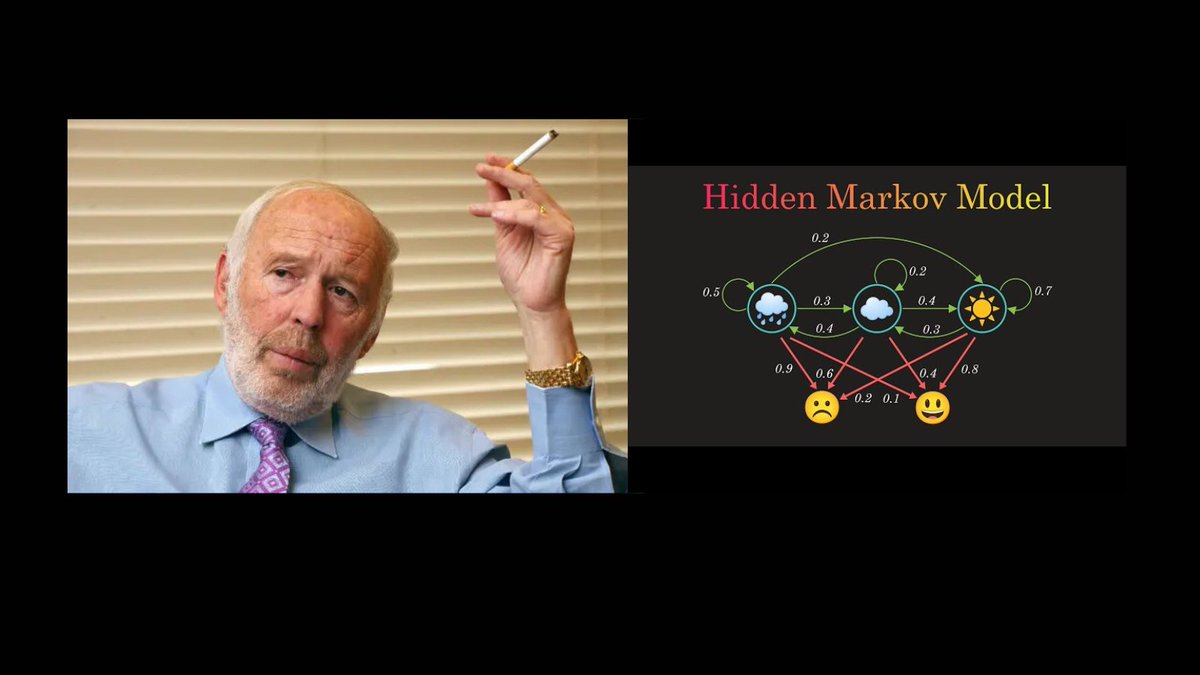

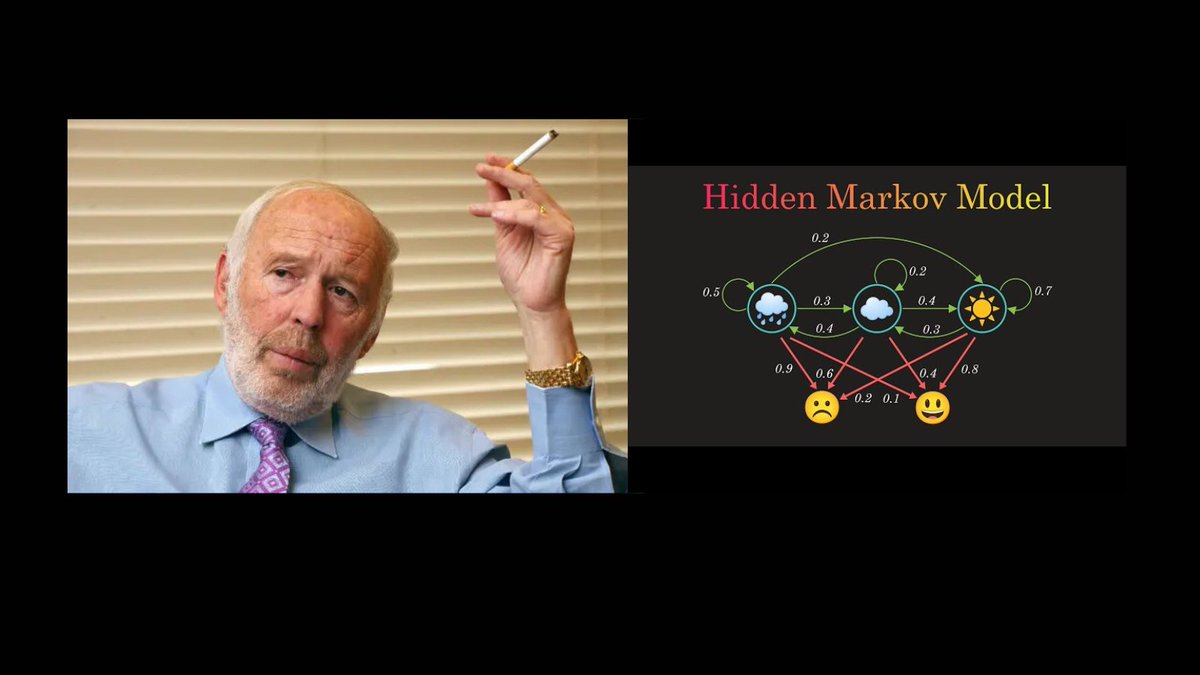

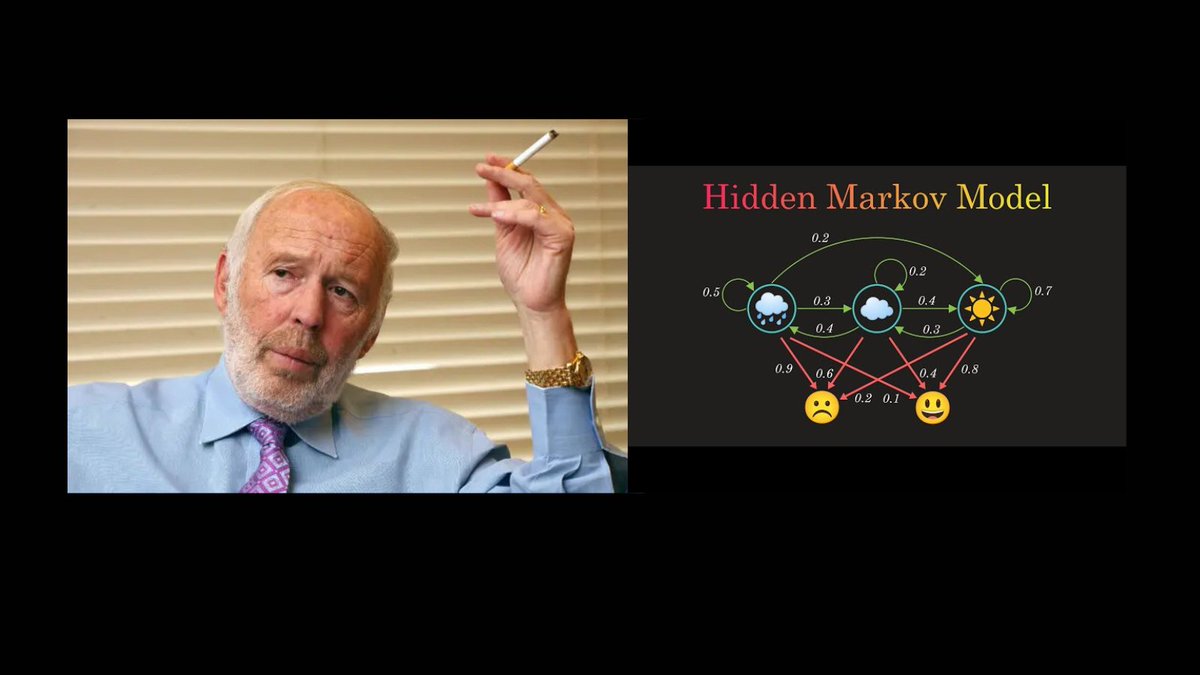

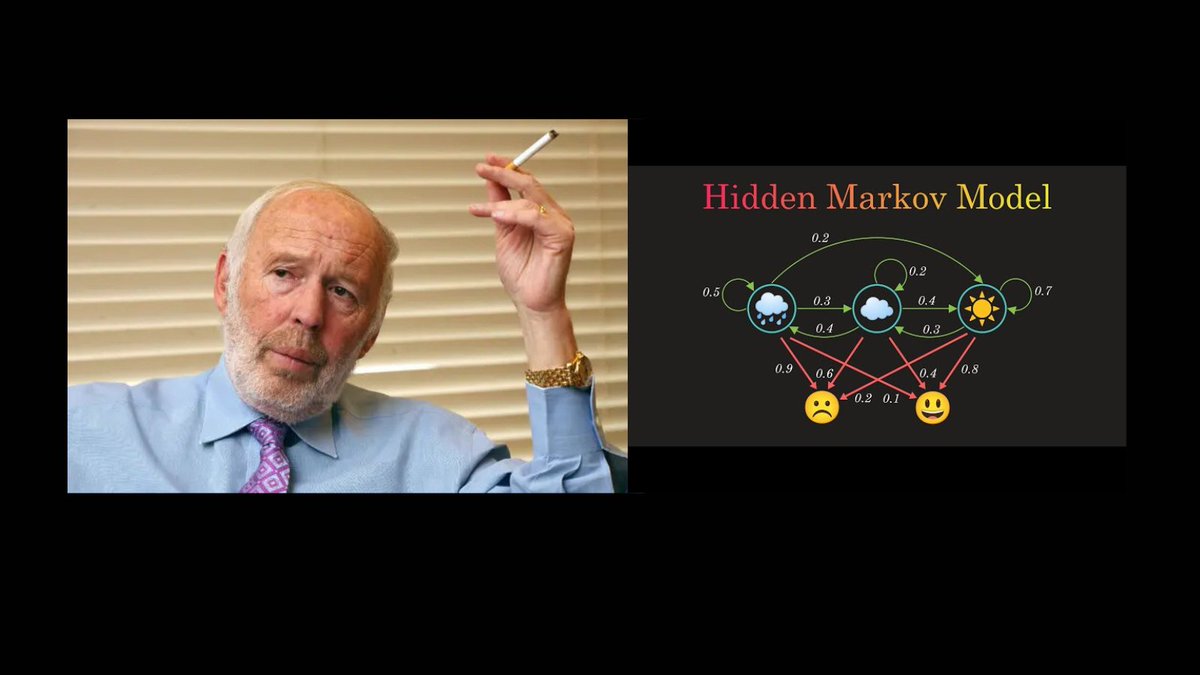

A Hidden Markov Model (HMM) is a statistical model used to represent systems that evolve over time with unobservable (hidden) states.

A Hidden Markov Model (HMM) is a statistical model used to represent systems that evolve over time with unobservable (hidden) states.

Optopsy is an analysis tool for options trading strategies.

Optopsy is an analysis tool for options trading strategies.

OpenBB Terminal

OpenBB Terminal

A quick primer on the Kalman filter if you’re unfamiliar:

A quick primer on the Kalman filter if you’re unfamiliar:

OpenBB

OpenBB

A Hidden Markov Model (HMM) is a statistical model used to represent systems that evolve over time with unobservable (hidden) states.

A Hidden Markov Model (HMM) is a statistical model used to represent systems that evolve over time with unobservable (hidden) states.

Linear and Nonlinear Programming by David G Luenberger and Yin Ye

Linear and Nonlinear Programming by David G Luenberger and Yin Ye

OpenBB

OpenBB

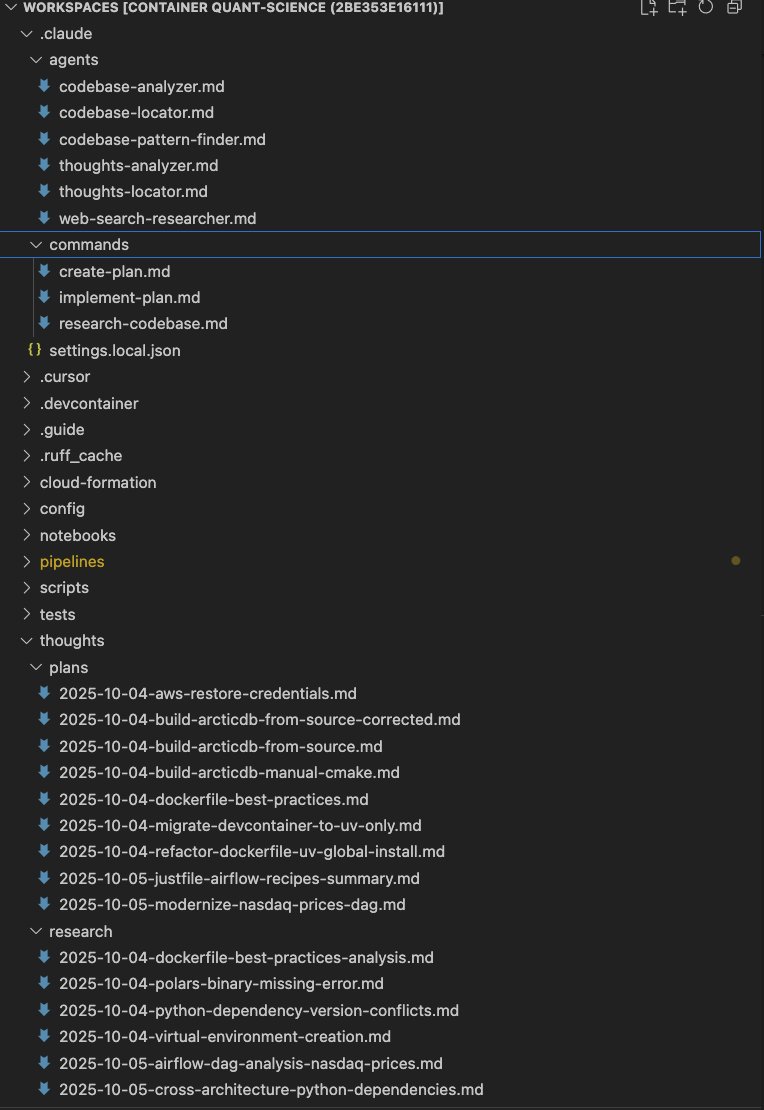

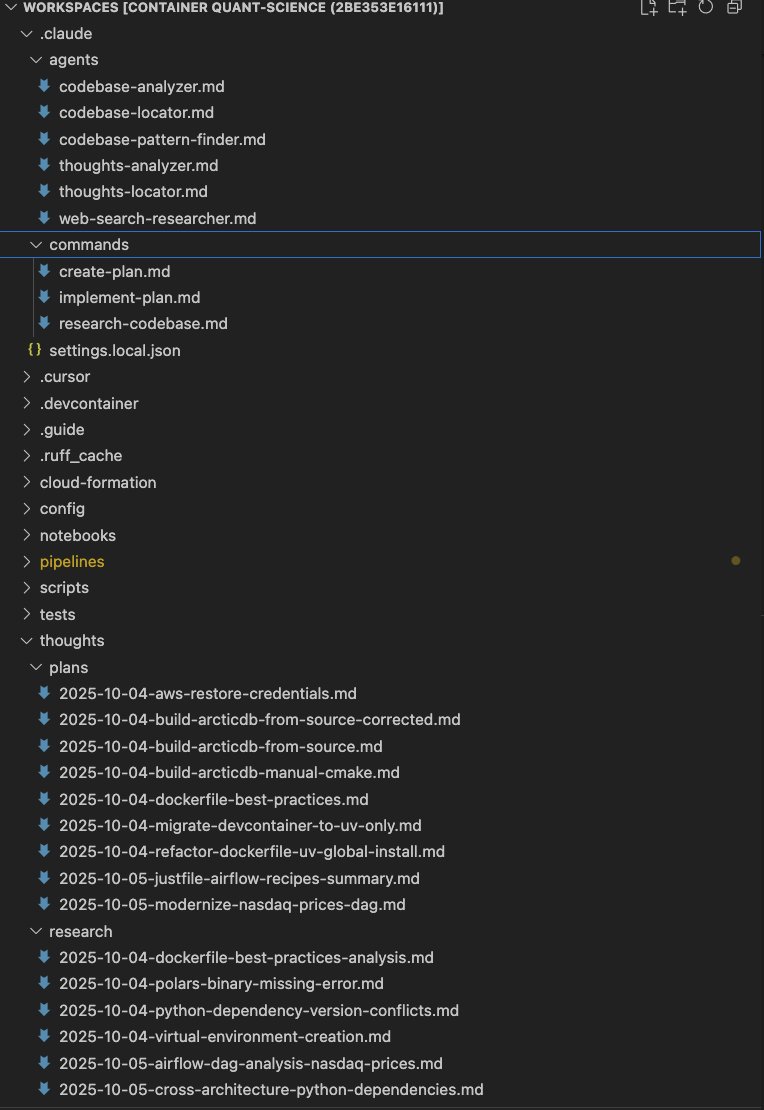

The unlock for me was to create detailed MD files in the commands and agents directory.

The unlock for me was to create detailed MD files in the commands and agents directory.

Jupyter Notebook is a web app for creating and sharing computational documents.

Jupyter Notebook is a web app for creating and sharing computational documents.

The Ultimate Beginner’s Guide to NumPy

The Ultimate Beginner’s Guide to NumPy