Feeling lost in the market?

Don't want to keep getting chopped up?

Want to DCA, chill and win, plus get an airdrop in the process?

Here is the ultimate alpha please “All Weather” portfolio to survive this bear and thrive in the bull.

🧵

Don't want to keep getting chopped up?

Want to DCA, chill and win, plus get an airdrop in the process?

Here is the ultimate alpha please “All Weather” portfolio to survive this bear and thrive in the bull.

🧵

Copy the #AWAP All Weather @alphapleaseHQ portfolio on nested.fi and as a bonus be entered into the draw for a $500 USDC prize!

$ETH + 8 other assets (discussed below)

$ETH + 8 other assets (discussed below)

For the twitter breakdown on @NestedFi ('etoro' of crypto) see @alpha_pls thread

Read on below for the portfolio explainer, why we chose the assets and how to copy/enter the draw!

https://twitter.com/alpha_pls/status/1592934626628366339?s=20&t=b3CvwziacAKlFS_-unMi1A

Read on below for the portfolio explainer, why we chose the assets and how to copy/enter the draw!

The #AWAP portfolio is meant to be a set, DCA and forget portfolio. The crypto twitter token of the month might not be here in 2024-2025, whereas the tokens we’ve put in this portfolio we believe will be around next bull market, and at higher prices than now. Simple.

We do not believe this will achieve the significant outsized returns most active traders seek. This is not a 100x, but it has a lower risk profile than portfolios chasing those sort of returns.

app.nested.fi/explorer/bsc:1… click through to copy now, or read on for further details

app.nested.fi/explorer/bsc:1… click through to copy now, or read on for further details

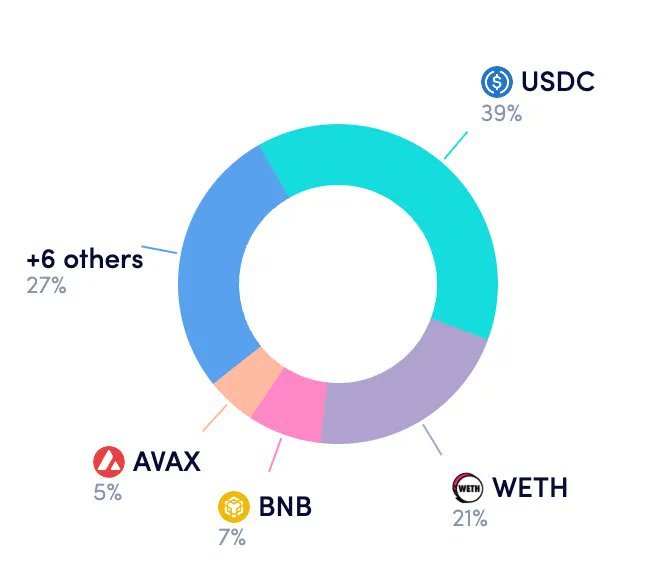

60% of the portfolio is deployed in the proportions below. 40% is USDC, this will be DCAed in monthly, to be fully deployed by Q2 2023. We may be wrong, but we think this will catch the market bottom (barring nuclear war/black swans) if not already in.

this portfolio won’t be adjusted based on general market movements, but tokens may be removed if there is a legitimate chance of absolute failure (think along the lines of Terra $LUNA)

We do not plan to rebalance the portfolio unless any one token significantly outperforms, and this will be signaled at the time. We will largely be ‘letting winners ride’ which seems to be a successful strategy when applied retroactively to previous crypto bullmarkets.

The portfolio is deployed on BNB Chain - cheap fees, most assets we desired. I understand for various reasons people may not want to use BNB. Once Nested goes cross-chain (CCIP pls) this may change, until then, it's the best solution.

Let's get to the assets!

Let's get to the assets!

$ETH - 35%

Little to say here. Safest asset alongside $BTC, lots of bullish events, likely to be around and outperform it's previous ATHs in future.

Little to say here. Safest asset alongside $BTC, lots of bullish events, likely to be around and outperform it's previous ATHs in future.

$BNB - 12.5%

don't fade @cz_binance . Biggest CEX by a huge margin, most used L1 by a large margin. Billions in dollar reserves. I don't see this going anywhere, at the very least it will be carried up in the next bullmarket.

don't fade @cz_binance . Biggest CEX by a huge margin, most used L1 by a large margin. Billions in dollar reserves. I don't see this going anywhere, at the very least it will be carried up in the next bullmarket.

$SOL - 7.5%

organic NFT/gaming activity. We like Solana for it’s very different approach vs Eth - focus on speed and low fees over uptime (‘move fast and break things’). Different programming language and VM resulting in a completely different ecosystem of protocols and users

organic NFT/gaming activity. We like Solana for it’s very different approach vs Eth - focus on speed and low fees over uptime (‘move fast and break things’). Different programming language and VM resulting in a completely different ecosystem of protocols and users

$ATOM - 7.5%

2.0 rollout will eventually begin, interchain security will give the token more value. Like Solana, a very different approach to scaling compared to Ethereum, with a vision of use specific appchains with secure and fast bridging (IBC) between.

2.0 rollout will eventually begin, interchain security will give the token more value. Like Solana, a very different approach to scaling compared to Ethereum, with a vision of use specific appchains with secure and fast bridging (IBC) between.

$AVAX - 7.5%

EVM competitor to what Ethereum is trying to achieve - decentralisation, security, scalability, cheap. If the vision of Eth is achieved on another L1, it would be Avalanche. For the same reason, being in direct competition with Ethereum makes it more vulnerable

EVM competitor to what Ethereum is trying to achieve - decentralisation, security, scalability, cheap. If the vision of Eth is achieved on another L1, it would be Avalanche. For the same reason, being in direct competition with Ethereum makes it more vulnerable

$MATIC - 7.5%

The sidechain/L2 on Eth with the most adoption and users currently, with an incredible bizdev team who have snagged major partnerships alongside several projects in the work to create various rollups. Polygon may well end up eating all other L2’s lunches one day.

The sidechain/L2 on Eth with the most adoption and users currently, with an incredible bizdev team who have snagged major partnerships alongside several projects in the work to create various rollups. Polygon may well end up eating all other L2’s lunches one day.

$AAVE - 7.5%

The preeminent money market that is innovating. Multichain and eventually crosschain when CCIP is ready. Stablecoin $GHO soon. Probably the most important protocol to shine through DeFi Summer, with (importantly) a low issuance rate and few to no VCs.

The preeminent money market that is innovating. Multichain and eventually crosschain when CCIP is ready. Stablecoin $GHO soon. Probably the most important protocol to shine through DeFi Summer, with (importantly) a low issuance rate and few to no VCs.

$LINK - 7.5%

The MOST important infrastructure protocol in crypto. Enabled most of DeFi to exist. Expanding beyond oracle and VRF. CCIP will enable another wave of innovation. Process of making the token much more valuable with staking rollout in December is imminent.

The MOST important infrastructure protocol in crypto. Enabled most of DeFi to exist. Expanding beyond oracle and VRF. CCIP will enable another wave of innovation. Process of making the token much more valuable with staking rollout in December is imminent.

$DOGE - 7.5%

Most memecoins come and go, but DOGE is going to stick around. It has a tendency to have isolated runs which makes it worthwhile as a diversifier. With Elon’s acquisition of Twitter, suggestions of DOGE integration will continue to provide speculative rallies.

Most memecoins come and go, but DOGE is going to stick around. It has a tendency to have isolated runs which makes it worthwhile as a diversifier. With Elon’s acquisition of Twitter, suggestions of DOGE integration will continue to provide speculative rallies.

To copy, Ensure you have your stables on BNB chain and a little BNB for gas, we suggest USDC as your asset to deploy.

We are also going to send $500 to a wallet that copies the portfolio with a minimum of $100 (or equivalent in an asset)!

app.nested.fi/explorer/bsc:1…

We are also going to send $500 to a wallet that copies the portfolio with a minimum of $100 (or equivalent in an asset)!

app.nested.fi/explorer/bsc:1…

For the more detailed and easier to read article regarding both the portfolio and nested, including the airdrop for $NST please feel free to check out our substack

alphapls.substack.com/p/onboard-your…

alphapls.substack.com/p/onboard-your…

To be clear, THIS IS NOT FINANCIAL ADVICE. We make no guarantees of returns. We welcome discussion of the assets in the portfolio and ratios we have put them in at.

We will provide intermittent portfolio updates via @alpha_pls weekly newsletter and on twitter via our accounts.

We will provide intermittent portfolio updates via @alpha_pls weekly newsletter and on twitter via our accounts.

• • •

Missing some Tweet in this thread? You can try to

force a refresh