How to get URL link on X (Twitter) App

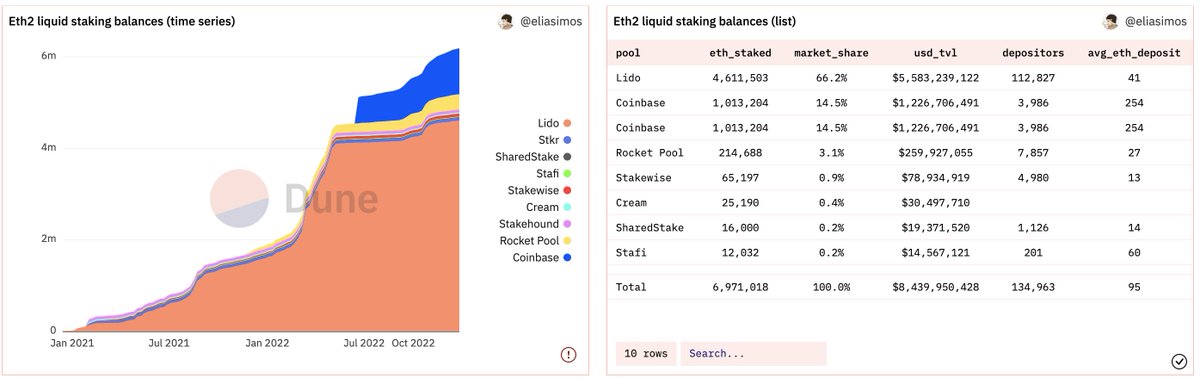

https://twitter.com/WinterSoldierxz/status/1597618624549728256?s=20&t=E42tHXdTUuEOcnD2hCbTqA

Facts:

Facts:

Tokenomics are doubly important in current bleak market conditions.

Tokenomics are doubly important in current bleak market conditions.

All big stablecoin yield farms trend to 10-25%.

All big stablecoin yield farms trend to 10-25%.