I read the 30 page FTX Bankruptcy court filing.

How bad were FTX's internal controls?

Here are the worst examples 👇

How bad were FTX's internal controls?

Here are the worst examples 👇

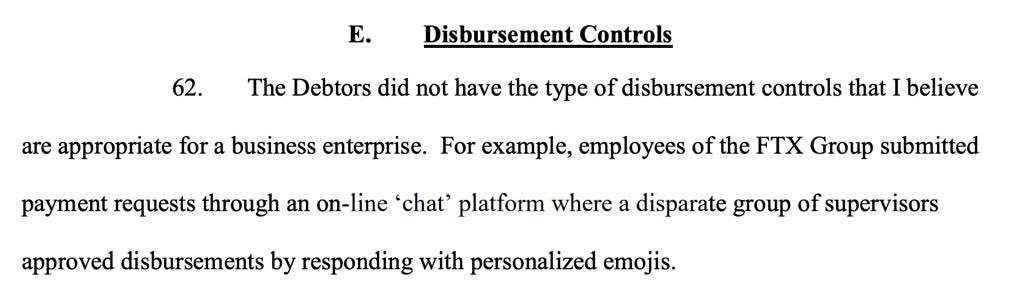

1. Employees submitted expense reimbursements over chat

A random manager would accept or reject those reimbursements with an EMOJI

A random manager would accept or reject those reimbursements with an EMOJI

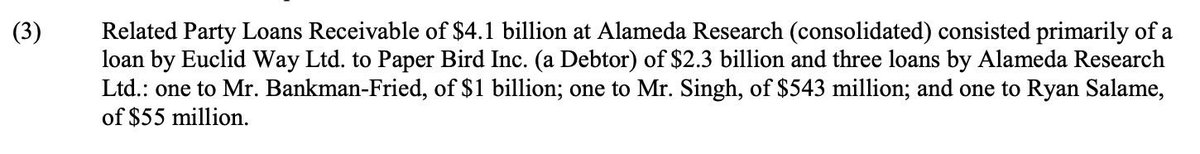

2. Related party loans:

Alameda Research (FTX's hedge fund) gave Sam Bankman-Fried a $1 billion personal loan

They also loaned Director of Engineering Nishad Singh $543 million

Alameda Research (FTX's hedge fund) gave Sam Bankman-Fried a $1 billion personal loan

They also loaned Director of Engineering Nishad Singh $543 million

3. Very few records were kept.

Most decisions were made over chat, with the messages automatically deleted after a certain time.

Most decisions were made over chat, with the messages automatically deleted after a certain time.

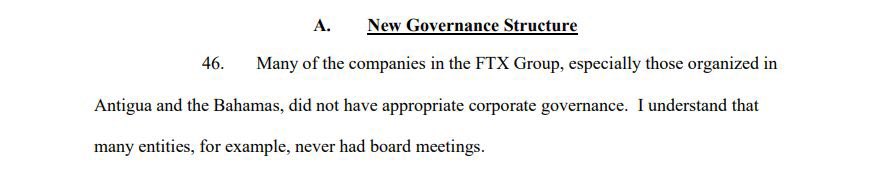

4. FTX, a company valued at $32 billion, never had board meetings. Neither did most of the subsidiaries.

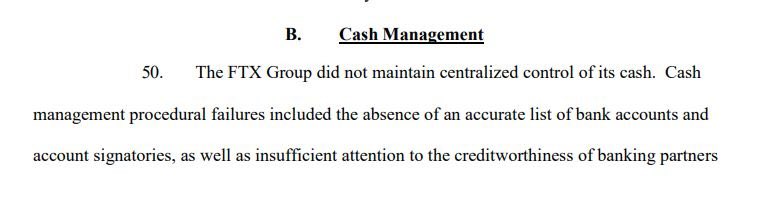

5. FTX had no cash management system.

Management had no idea how much cash was on hand at any given time, or even where all their cash was.

Management had no idea how much cash was on hand at any given time, or even where all their cash was.

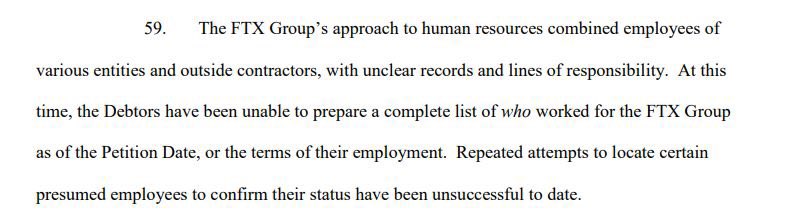

6. FTX didn't keep proper records of who they employed. Employees and contractors co-mingled throughout the different companies without proper documentation of how they spent their time.

Certain employees can't be located: Which could mean that some employees were fake.

Certain employees can't be located: Which could mean that some employees were fake.

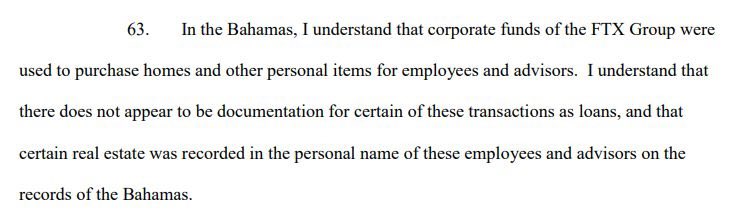

7. Corporate funds were used to purchase personal use real estate. And employees & executives put their names on homes purchased with company funds.

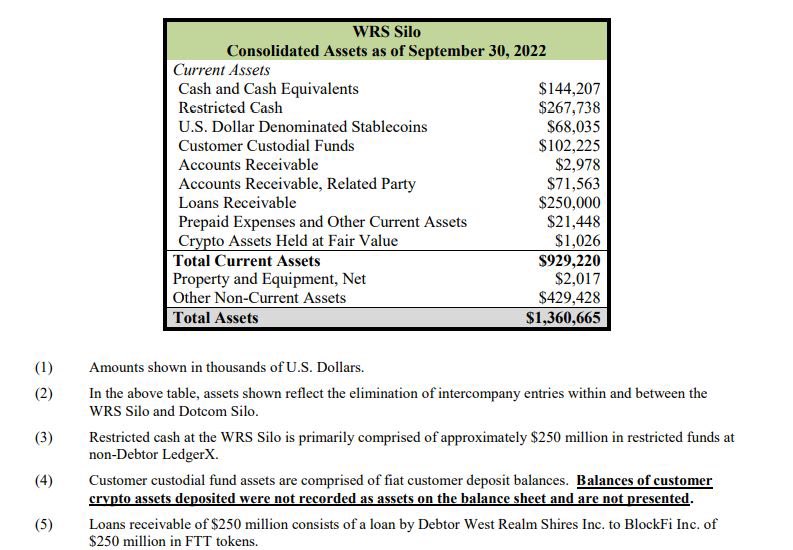

8. Crypto deposited by customers weren't even recorded on the balance sheet. Presumably, all crypto assets just went into one central slush fund used for whatever.

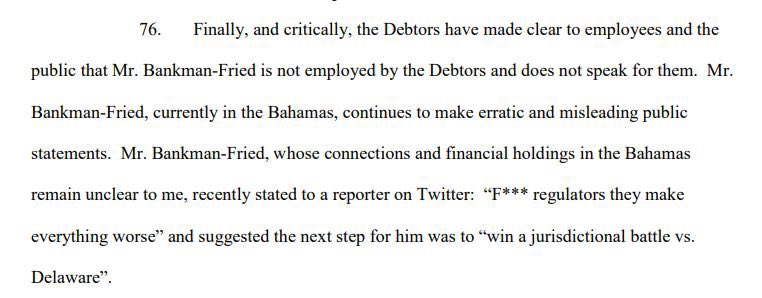

9. The filing makes clear that Sam Bankman-Fried does not speak for the company, and that his erratic and misleading public statements should not be disregarded.

• • •

Missing some Tweet in this thread? You can try to

force a refresh