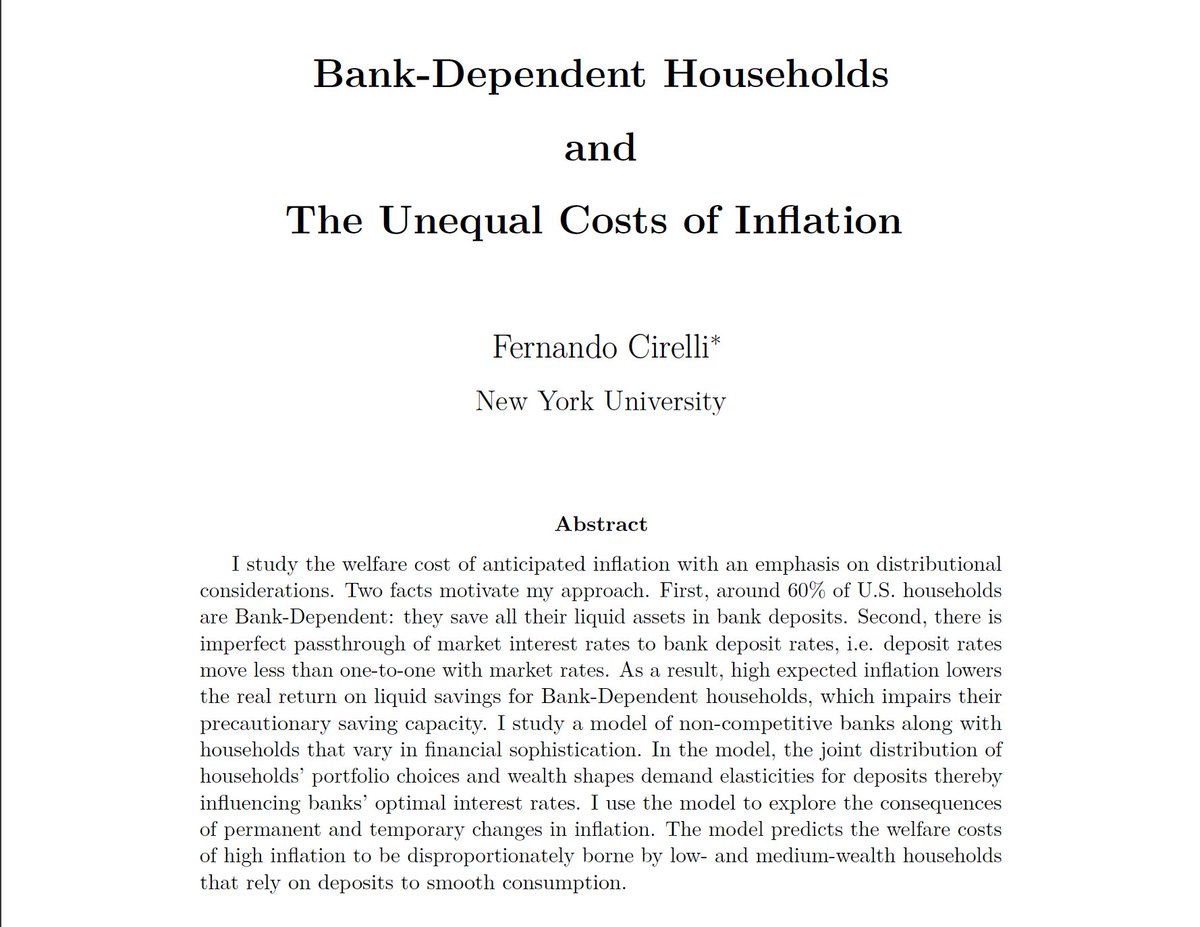

What makes inflation costly? Who bears these costs?

In my JMP, I explore an understudied mechanism:

Inflation impairs households’ ability to save for precautionary reasons

How? Let’s take a look at households’ liquid assets portfolios

#EconTwitter #Econjobmarket

In my JMP, I explore an understudied mechanism:

Inflation impairs households’ ability to save for precautionary reasons

How? Let’s take a look at households’ liquid assets portfolios

#EconTwitter #Econjobmarket

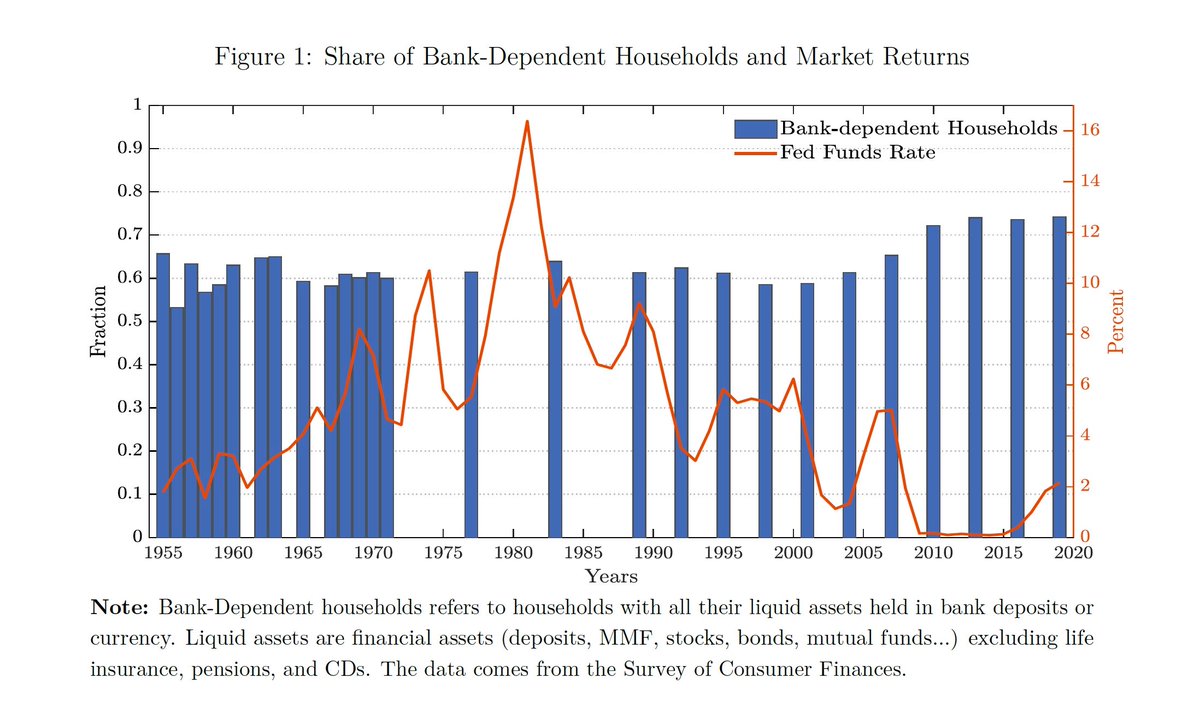

60% ‼️of US households hold all their liquid assets in bank deposits or cash

Maybe surprisingly → this share has remained stable even in periods of high interest rates

Let’s label these households “Bank-Dependent”

Maybe surprisingly → this share has remained stable even in periods of high interest rates

Let’s label these households “Bank-Dependent”

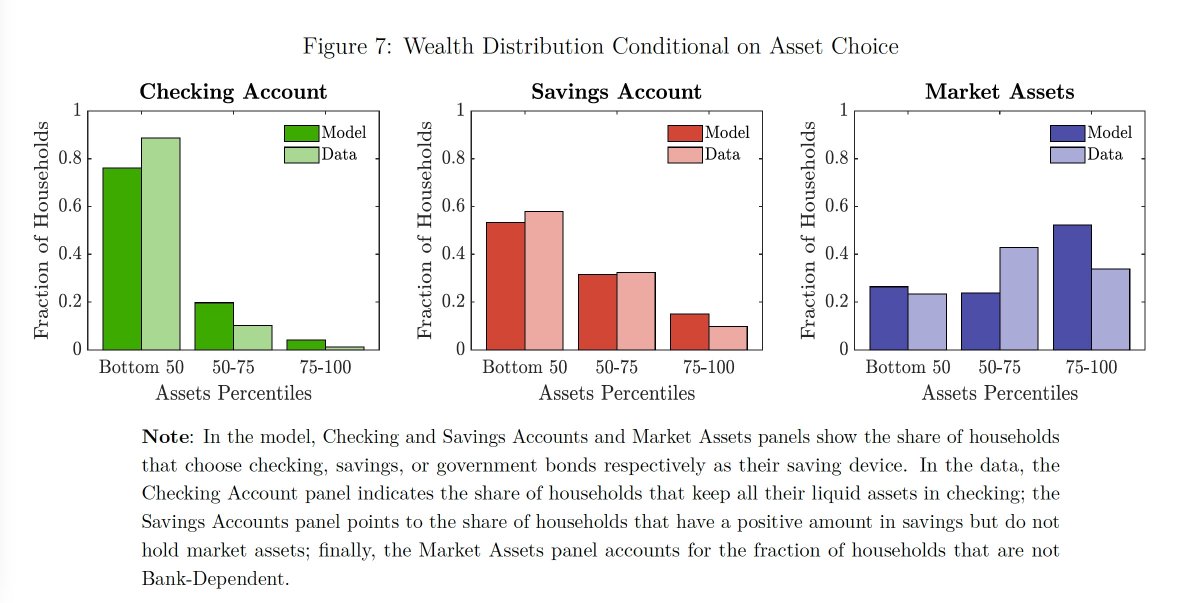

Bank-Dependent households are not poor or hand-to-mouth, they are widely spread along the assets distribution

Eg: among households with 6 months of income in liquid assets → 50% of them are Bank-Dependent

Eg: among households with 6 months of income in liquid assets → 50% of them are Bank-Dependent

Crucial to the story is banks’ rate setting:

‼️Banks keep deposit rates low even when market interest rates are high

Additionally → the spread is larger in periods of higher interest rates

(we knew this from the great work of @schnabl_econ @AlexiSavov @idrechs)

‼️Banks keep deposit rates low even when market interest rates are high

Additionally → the spread is larger in periods of higher interest rates

(we knew this from the great work of @schnabl_econ @AlexiSavov @idrechs)

Therefore, when inflation rises:

🔺 Deposit rates don’t adjust —as opposed to other financial instruments—

🔺 Real return on deposits falls → lower incentives to save

🔺 Households lower their precautionary saving buffer and become more exposed to income uncertainty

🔺 Deposit rates don’t adjust —as opposed to other financial instruments—

🔺 Real return on deposits falls → lower incentives to save

🔺 Households lower their precautionary saving buffer and become more exposed to income uncertainty

I study this mechanism using a HANK model

With new ingredients to account for these facts:

◆ HHs differ in financial sophistication

◆ Discrete portfolio choice: all savings in one asset per period

◆ Monopolistic banks

With new ingredients to account for these facts:

◆ HHs differ in financial sophistication

◆ Discrete portfolio choice: all savings in one asset per period

◆ Monopolistic banks

Unsophisticated households can only save in bank deposits

→ choose between checking or savings accounts

Sophisticated HH can also save in government bonds

Save in high-return assets → pay a nonpecuniary fixed cost

Calibration targets (portfolio ∩ wealth) distribution:

→ choose between checking or savings accounts

Sophisticated HH can also save in government bonds

Save in high-return assets → pay a nonpecuniary fixed cost

Calibration targets (portfolio ∩ wealth) distribution:

Monopolistic banks

Multi-product:

→ offer checking and savings deposits

→ set rates s.t. a zero lower bound

The model matches the level and dynamics of deposit rates

But why do deposit rates not move one-to-one with bond rates?

Multi-product:

→ offer checking and savings deposits

→ set rates s.t. a zero lower bound

The model matches the level and dynamics of deposit rates

But why do deposit rates not move one-to-one with bond rates?

High bond rates → banks can get higher markup on checking from Unsoph

→ so keep the savings rate low to discourage checking funds from moving to savings

→ but raise the savings rate enough to prevent an outflow of funds into bonds

→ imperfect passthrough is optimal

→ so keep the savings rate low to discourage checking funds from moving to savings

→ but raise the savings rate enough to prevent an outflow of funds into bonds

→ imperfect passthrough is optimal

Now back to the question: how much does inflation distort households’ precautionary saving? How costly is it?

I study a rise in trend inflation of 3pp

Result:

❗️On average, the welfare cost of inflation is zero!

‼️But it is 𝘃𝗲𝗿𝘆 costly for low- and mid-wealth households:

I study a rise in trend inflation of 3pp

Result:

❗️On average, the welfare cost of inflation is zero!

‼️But it is 𝘃𝗲𝗿𝘆 costly for low- and mid-wealth households:

New eqm rates shape welfare costs:

→ Checking real rate falls one-to-one with inflation

→ Savings rate raised slightly & bond rate constant

❗️ Long-run passthrough is close to one

→ Why? The wealthy accumulate more wealth → banks raise savings rate to retain them

→ Checking real rate falls one-to-one with inflation

→ Savings rate raised slightly & bond rate constant

❗️ Long-run passthrough is close to one

→ Why? The wealthy accumulate more wealth → banks raise savings rate to retain them

Why are low-wealth households disproportionately affected?

→ mostly Unsophisticated & do not use savings accounts

→ lower real rates disincentivizes wealth accumulation

Inflation affects them even if they hold ≈ zero assets❗️

→ mostly Unsophisticated & do not use savings accounts

→ lower real rates disincentivizes wealth accumulation

Inflation affects them even if they hold ≈ zero assets❗️

Many other interesting exercises in the paper:

◆ temporary inflation shocks

◆ competitive banking counterfactuals

◆ implications for monetary policy

Thanks for reading!

Paper: fercirelli.github.io/personal_websi…

Website: fernandocirelli.com

◆ temporary inflation shocks

◆ competitive banking counterfactuals

◆ implications for monetary policy

Thanks for reading!

Paper: fercirelli.github.io/personal_websi…

Website: fernandocirelli.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh