MISES BROWSER EARLY USERS AIRDROP

Shared this with my private group, felt criminal to not share here. Claim your early $MIS Tokens.

#Airdop. CONFIRMED. Infact na over confirmation dey worry am

How to claim under ONE MINUTE: 🧵

Shared this with my private group, felt criminal to not share here. Claim your early $MIS Tokens.

#Airdop. CONFIRMED. Infact na over confirmation dey worry am

How to claim under ONE MINUTE: 🧵

2. On the top right corner, you would see an "Airdrop" option, open it & click to verify your Twitter;

3. You would be asked in the process to create or restore a Mises ID, from here, you simply create one.

4. You'd be given a secret phrase and allowed to choose a password.

4. You'd be given a secret phrase and allowed to choose a password.

4. After clicking "I agree", you should be taken to the Twitter authorization section.

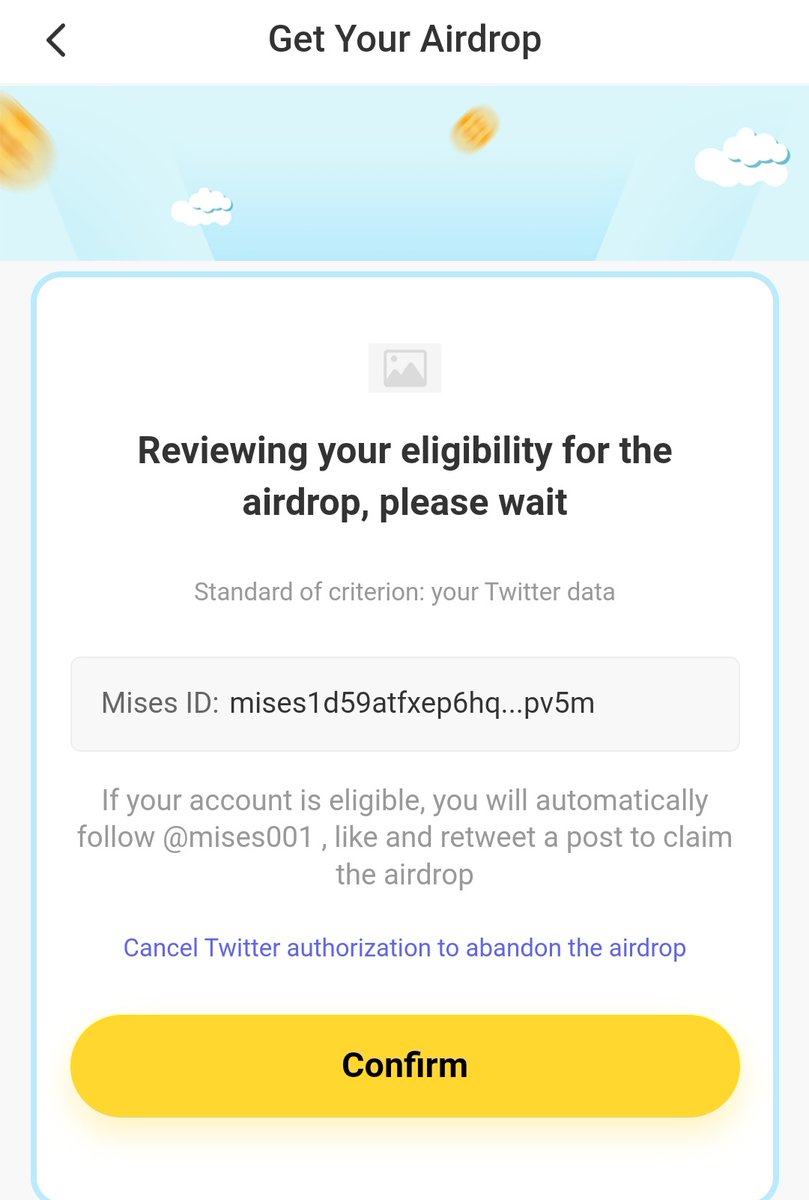

The left panel is what would you be shown before authorization, the right is what would be shown after.

The left panel is what would you be shown before authorization, the right is what would be shown after.

5. All done!

For some, if it shows the first panel, all you need to do is go back, & check in a few minutes, then your tokens will be dropped into the Mises Extension wallet you just created.

Only Criteria for eligibility: A Twitter account before May 2022. An alt can be used.

For some, if it shows the first panel, all you need to do is go back, & check in a few minutes, then your tokens will be dropped into the Mises Extension wallet you just created.

Only Criteria for eligibility: A Twitter account before May 2022. An alt can be used.

If you liked this, don't forget to Like & Retweet the original tweet:

Tag a friend so he/she doesn't miss out, and follow @TheEwansEffect with 🔔 on for more, I'm funny and sometimes post Educative content🤫 stay blessed.

https://twitter.com/TheEwansEffect/status/1593975705737502726?t=_tUpfaRurhYpfm3jouh9dg&s=19

Tag a friend so he/she doesn't miss out, and follow @TheEwansEffect with 🔔 on for more, I'm funny and sometimes post Educative content🤫 stay blessed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh