There is quite clearly a narrative shift away from Centralised Exchange (CEX) trading to Decentralised Exchanges (DEX).

i.e. #NYKNYC

i.e. #NYKNYC

However, despite immense strides being taken by AMM's like @Uniswap, @SushiSwap, and @CurveFinance the majority of SPOT volume is still done on Centralised venues

(16.72% on DEX vs. CEX)

(16.72% on DEX vs. CEX)

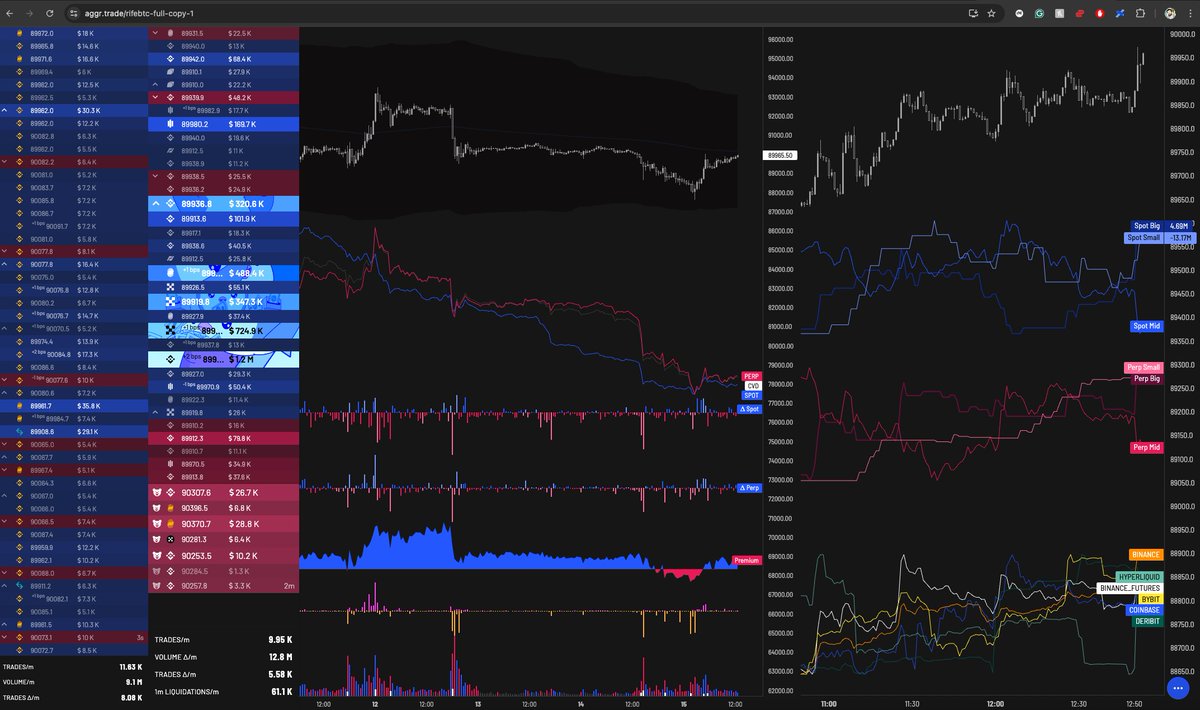

And despite all the success of @GMX_IO , @dYdX and @GainsNetwork_io , almost all the FUTURES volume is done on centralized venues.

that's <2% of the overall futures volume being done on decentralized exchanges.

that's <2% of the overall futures volume being done on decentralized exchanges.

also within CEX-land, Binance is hoovering up the volume in the fallout from FTX, that's not good from a competition perspective..

https://twitter.com/ThanefieldCap/status/1593729514110128128?s=20&t=2sCFi1R2GCdX85Yr12RHQA

whilst trading volume on DEXs remains very cyclical, although they are trending upwards over time.

h/t: @BackTheBunny

h/t: @BackTheBunny

So, the question remains, how do we create a paradigm shift in transitioning CEX volume to being on-chain?

well, the guys at $DEUS (v3) are convinced that the key to this success will be to work directly with brokers and build scalable p2p architecture

well, the guys at $DEUS (v3) are convinced that the key to this success will be to work directly with brokers and build scalable p2p architecture

See the current model of @GMX_IO is such that a liquidity provider puts ETH, BTC, or a stablecoin into a smart contract and then traders borrows from that pool to access leveraged trading with the benefit of of oracle pricing (zero slippage).

but this raises issues for liquidity providers, especially in highly volatile markets. It also opens @GMX_IO and other forks open for price manipulation which means that the short-term fix is to limit open interest and thus scalability..

https://twitter.com/xdev_10/status/1592485169558016000?s=20&t=_jKs-c_P2nusrHrNEB1iZw

which is of course a problem if traders/users can't get access in the times when they need the GMX short hedge position the most e.g.

umamifinance.medium.com/umami-finance-…

umamifinance.medium.com/umami-finance-…

$DEUS invites anyone to build upon their infrastructure to facilitate bilateral OTC trades between a user and a counterparty. This is EXACTLY how TradFi markets can scale - the risk is isolated per transaction and risk can be optimised or transferred.

https://twitter.com/lafachief/status/1594008612182978560?s=20&t=sElepAgL47_iPAAw-NhkZA

The first guys building the front-end for this RFQ style model is @dsynths , which will be deployed on #Arbitrum. Hanging out in the discord it's clear that testnet is likely live v. soon

but see that long YouTube video above, that's where the real alpha drops are:

1hr:28min in : "That counterparty, that broker ... they want to do a whitelabel with their name on it"

"they will disclose themselves...wait until that happens"

in Q&A the following were addressed:

1hr:28min in : "That counterparty, that broker ... they want to do a whitelabel with their name on it"

"they will disclose themselves...wait until that happens"

in Q&A the following were addressed:

i.e. they already have a network of brokers who can provide real liquidity on over 4000 assets across equities, fx, precious metals, crypto etc. The market makers in question love the idea that spreads are MUCH THICKER than in TradFi

https://twitter.com/quantlordd/status/1594025982855237632?s=20&t=sElepAgL47_iPAAw-NhkZA

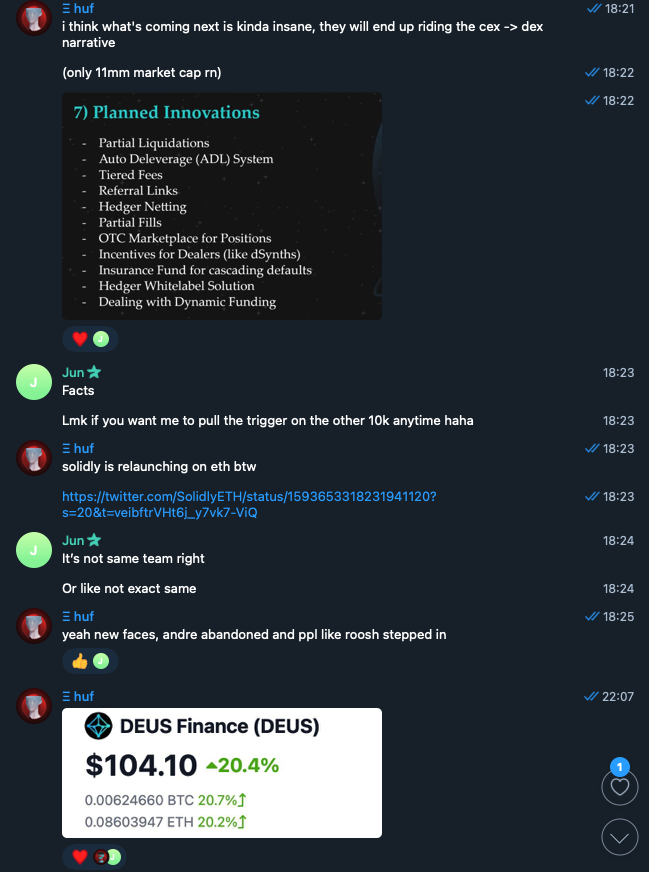

I've spoken to the team about $DEUS utility and it's something they have fully covered in anticipation of the Arbitrum launch. Also note the low max supply.

*cough cough* Solidly ETH re-launch too

https://twitter.com/SolidlyETH/status/1593653318231941120?s=20&t=sElepAgL47_iPAAw-NhkZA

as a Founder myself, I have huge respect for teams that work through a crisis and come back stronger. Yes, these guys had issues with their $DEI stablecoin, and they have gone back to the drawing board to allow trading with USDC as collateral (on Arbitrum). Pivot or Persevere.

it'll be a long climb back to their previous high this year of above $1000, but at $110 or so, and a MC of $14mm I see room for upside when looking at the likes of $SNX. They deeply understand the ISDA based OTC markets and the team has TradFi experts and some great engineers.

here are some screenshots from our internal chat, we've been buying in $10k clips and will continue to do so. Yes it's on Fantom, but liquidity is also likely to migrate over time.

The narrative of on-chain trading volumes will only heat up in the coming years. Clearly the trend is up, with the token up $35 pre-FTX / now over $100 post FTX. I see them winning volume on other asset classes include commodities and FX as crypto dries up a bit.

• • •

Missing some Tweet in this thread? You can try to

force a refresh