How to get URL link on X (Twitter) App

steps:

steps:

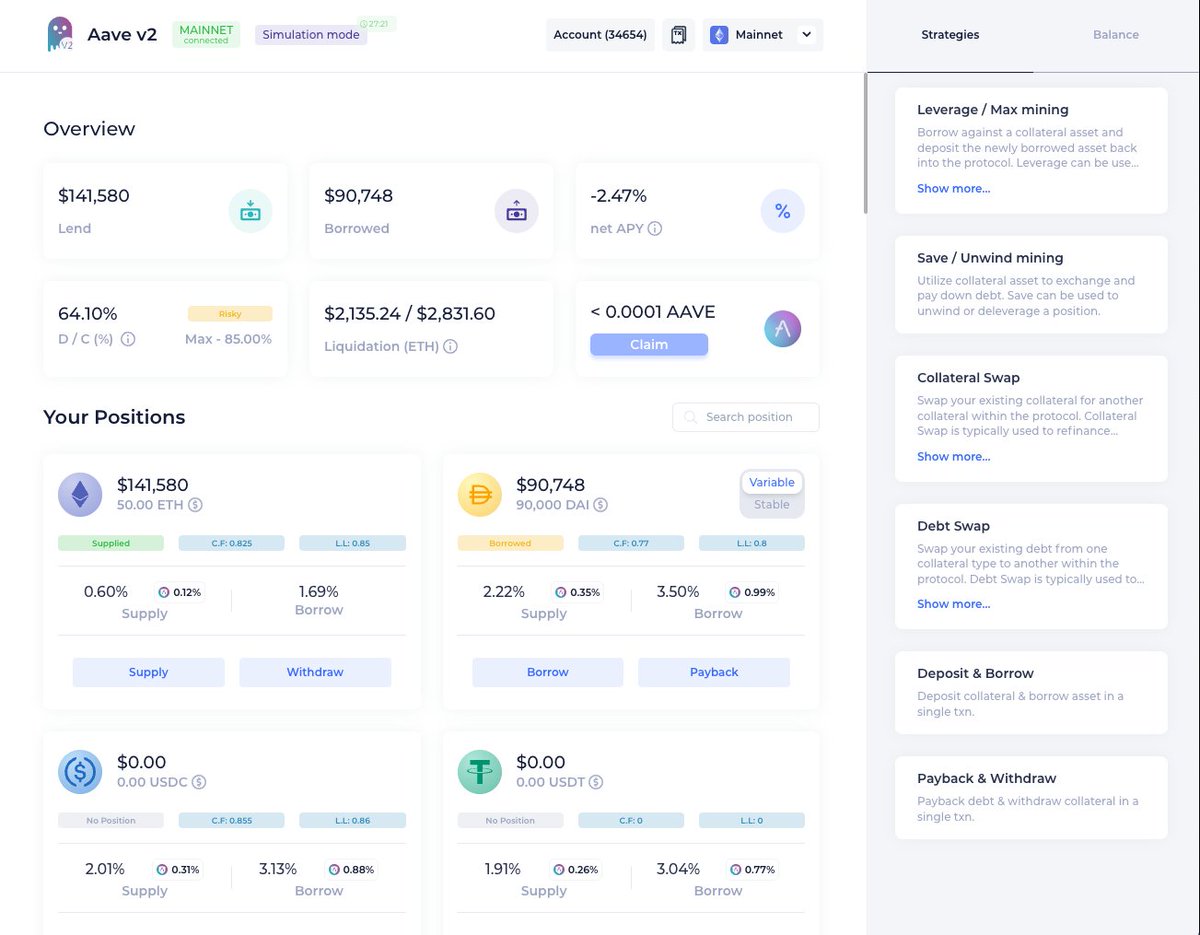

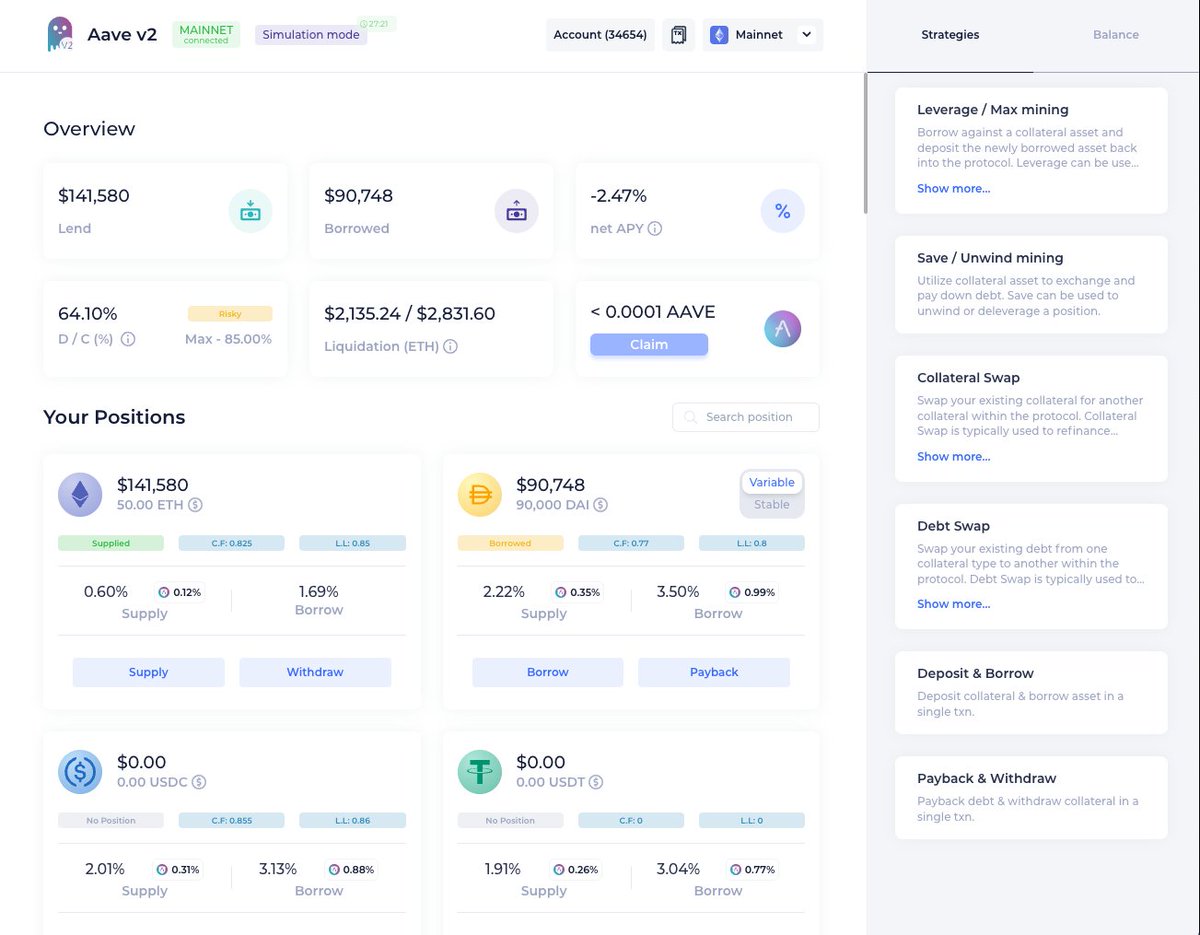

📍The Liquidation Problem

📍The Liquidation Problem

There are 2 ways of pair trading:

There are 2 ways of pair trading:

https://twitter.com/EricBalchunas/status/17255599949955730861. If you, as a retail buyer want to buy $IBTC (the iShares spot bitcoin ETF), then you'd go to your broker/online platform and swap your $ for shares in the ETF. The broker would go and buy the shares on the exchange (Nasdaq) on your behalf. Easy.

Recap: Grayscale sued the SEC last yr for not letting them convert GBTC to a spot ETF

Recap: Grayscale sued the SEC last yr for not letting them convert GBTC to a spot ETF

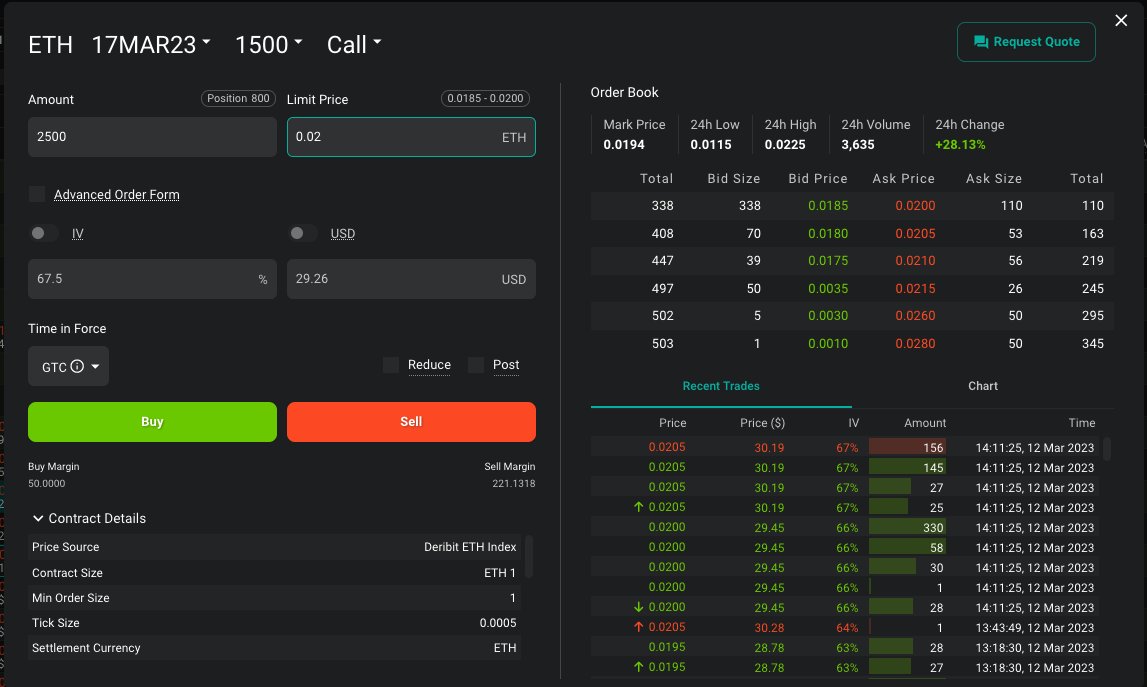

In Dec 2021 there was a lot of yield to be captured in DeFi - think back to OHM forks on Avalanche, incentivized pools on Fantom, and the launch of the first systematic call overwriting vaults on $ETH.

In Dec 2021 there was a lot of yield to be captured in DeFi - think back to OHM forks on Avalanche, incentivized pools on Fantom, and the launch of the first systematic call overwriting vaults on $ETH.

There is quite clearly a narrative shift away from Centralised Exchange (CEX) trading to Decentralised Exchanges (DEX).

There is quite clearly a narrative shift away from Centralised Exchange (CEX) trading to Decentralised Exchanges (DEX).

But first, a real-time example from 15th September when we shorted $ATOM at $15.22

But first, a real-time example from 15th September when we shorted $ATOM at $15.22

2. @zhangwins from @cega_fi

2. @zhangwins from @cega_fi

https://twitter.com/porterfinance_/status/1533738150761115648See, most of the large (DeFi) DAOs have their total treasury value in their native token. They can't really sell it (perhaps OTC), but they do need to a) diversify their treasury and b) raise cash for operational purposes.

2. Aggregrated indicators for Open Interest (OI) and Cumulative Delta Volume (CDV). It helps understand the volume and direction of futures and options markets.

2. Aggregrated indicators for Open Interest (OI) and Cumulative Delta Volume (CDV). It helps understand the volume and direction of futures and options markets.

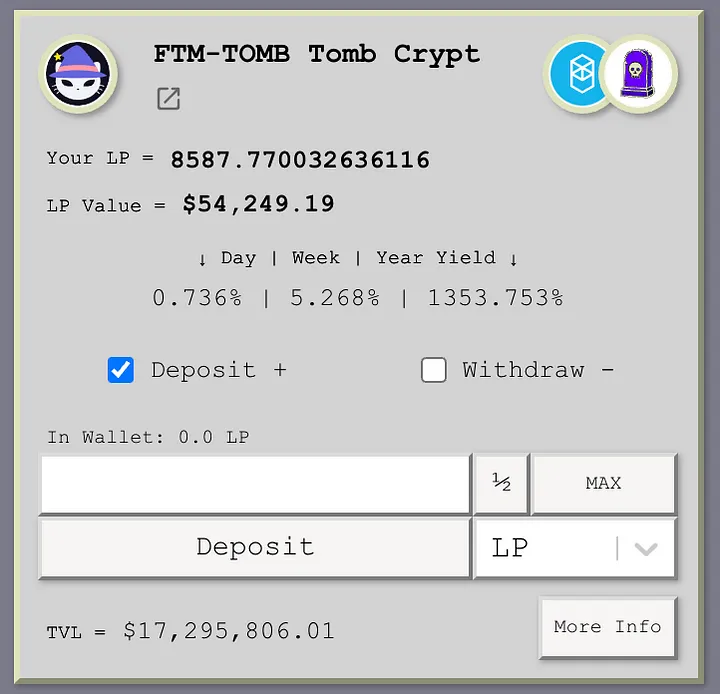

We have taken more profits on some trades in the high-risk bucket. Proceeds used to accumulate and stake some $PTP in order to accrue vePTP - so we can get some boosted yield on our stablecoin deposits on Avalanche. By Tuesday, the boosted APR on stables (USDT) should be 32.1%.

We have taken more profits on some trades in the high-risk bucket. Proceeds used to accumulate and stake some $PTP in order to accrue vePTP - so we can get some boosted yield on our stablecoin deposits on Avalanche. By Tuesday, the boosted APR on stables (USDT) should be 32.1%.