I presented Sarthak metals in IAS today. Here is a quick thread discussing what i presented

Have a ~5% position. 🧵

Have a ~5% position. 🧵

Whatever i present, is always just sharing of knowledge. I am NOT a sebi registered advisor. This is not a buy or sell.

Market is worst place to find out your conviction is borrowed. Chaddi bhi chali jaaegi. Please do not mindlessly coattail me or ANYONE.

Market is worst place to find out your conviction is borrowed. Chaddi bhi chali jaaegi. Please do not mindlessly coattail me or ANYONE.

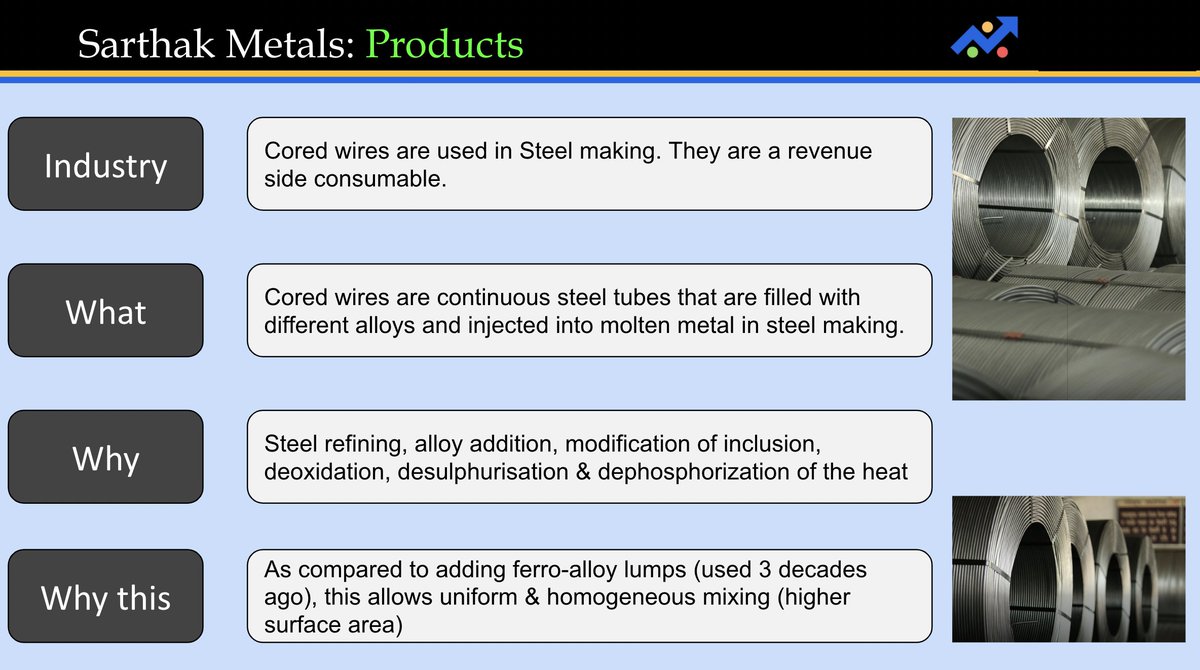

Sarthak makes Coiled wires and Aluminium flipping coils. These are delivery vehicles which ensure that the steel has desirable properties.

Aluminium segment has > 50% contribution to topline.

Aluminium segment has > 50% contribution to topline.

They allow us to impart desirable properties to the steel melt like deoxidation, desulphurisation & dephosphorization (better structural properties for the steel)

Pre wire era, we used to drop ferro alloy lumps into the laddle. Wire allow uniform homogeneous addition.

Pre wire era, we used to drop ferro alloy lumps into the laddle. Wire allow uniform homogeneous addition.

1 slide thesis: Capex, higher margins, strategic intent, capex & reinvestment moat, good & improving industry structure, cheap starting valuations.

The bulk of growth part of thesis is from aluminium segment where

(i) past execution

(ii) current capacity addition

(iii) medium term triggers of new segment like aluminium electrical wires & rods

(i) past execution

(ii) current capacity addition

(iii) medium term triggers of new segment like aluminium electrical wires & rods

These products have been around for 3-4 decades. Longevity hai.

Also, Cored wire segment has consolidated profit pools.

Covid reduced competitive intensity further consolidating profit pools & expanding gross margins.

Check how competitor Minex has degrown

Also, Cored wire segment has consolidated profit pools.

Covid reduced competitive intensity further consolidating profit pools & expanding gross margins.

Check how competitor Minex has degrown

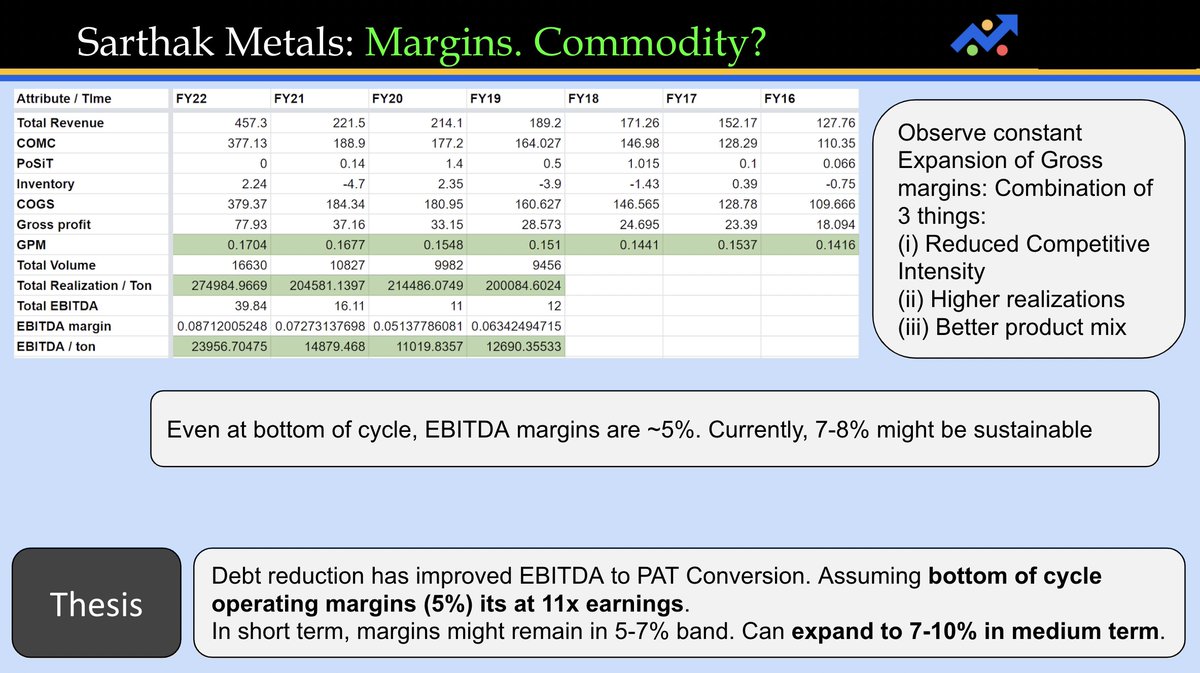

Is this a commodity?

I wont answer that in a yes or no. It has elements of commodity (steel is commodity)

It also has elements of specialty (gross margins have expanded from 14% in FY16 to 18% in Q2FY23)

I wont answer that in a yes or no. It has elements of commodity (steel is commodity)

It also has elements of specialty (gross margins have expanded from 14% in FY16 to 18% in Q2FY23)

I always like seeing strong clients because it enables better quality receivables (check debtor days) and also quality of receivables (only credit loss of 28 lakh on 57cr receivables in FY22).

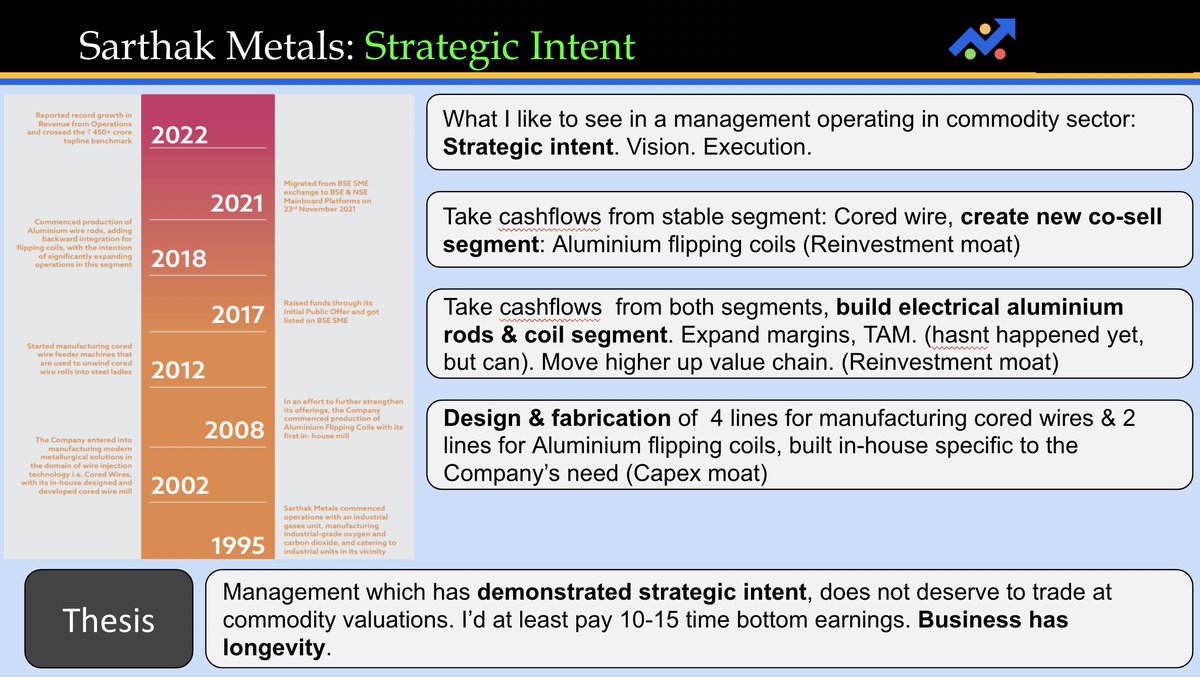

Probably most IMPORTANT slide.

This management has strategic intent. Uses existing secured cashflows to create NEW cashflows. Reinvestment moat.

Fabrication & design of machines which make products. Capex moat.

This management has strategic intent. Uses existing secured cashflows to create NEW cashflows. Reinvestment moat.

Fabrication & design of machines which make products. Capex moat.

This co definitely has cyclicality linked to the cyclicality of steel sector. Thus id value it at bottom of cycle type margins. I think co should trade at at least 10-15x bottom of cycle earnings at least , conservatively.

Lets talk about the risks now.

Realizations have grown 30-40% pre-covid & also EBITDA/ton has doubled basis pre-covid. Are these sustainable? Probably not.

Until now co was paying down debt. Ab kya karenge cash ka? Cash allocation risk.

Realizations have grown 30-40% pre-covid & also EBITDA/ton has doubled basis pre-covid. Are these sustainable? Probably not.

Until now co was paying down debt. Ab kya karenge cash ka? Cash allocation risk.

Government regulations is another big risk. Just yesterday govt announced removal of export duties. But can be opposite too.

Risk of volume offtake too, since steel industry is very linked to macro factors: recession, interest, war etc.

Risk of volume offtake too, since steel industry is very linked to macro factors: recession, interest, war etc.

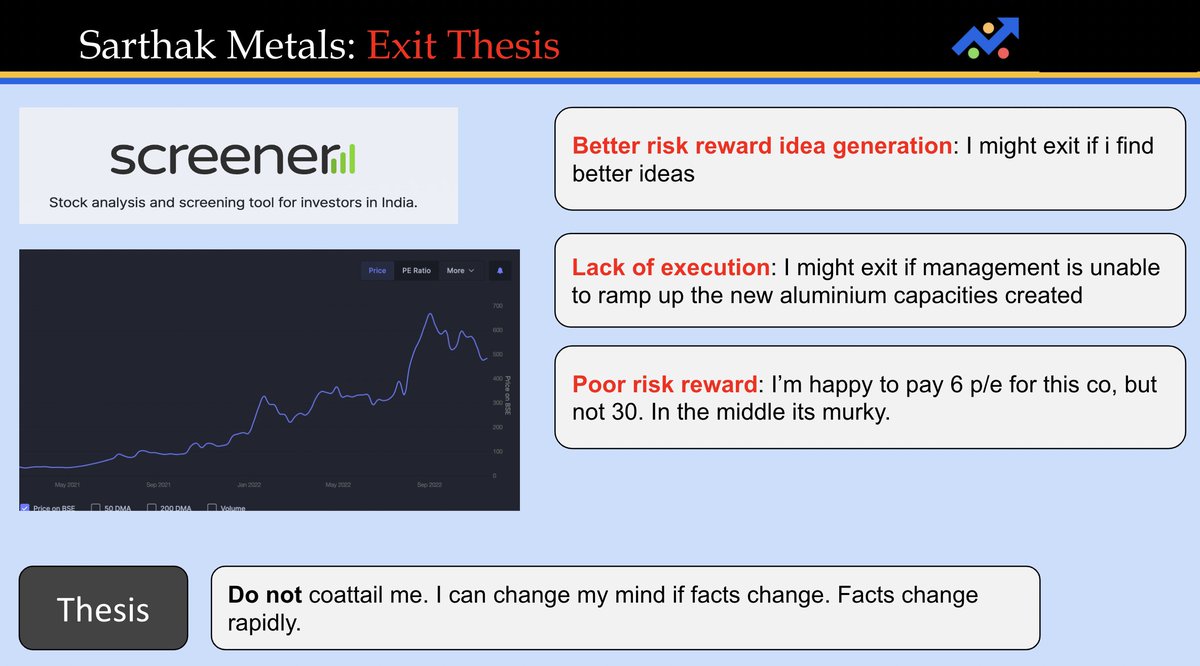

Lastly, do remember that I can always change my mind when i find new PORTFOLIO level facts (not just this company)

Do not coattail me blindly. Do your own due diligence. I might or might not share when or how i sell.

Do not coattail me blindly. Do your own due diligence. I might or might not share when or how i sell.

End of thread.

Some of previous company analyses:

If you liked the thread, please consider following me at @sahil_vi & retweeting the thread.

Some of previous company analyses:

https://twitter.com/sahil_vi/status/1406848206181335046?s=20&t=FjrpQrmUCeEJ_J65mZ_xbw

If you liked the thread, please consider following me at @sahil_vi & retweeting the thread.

• • •

Missing some Tweet in this thread? You can try to

force a refresh