Jio Disrupted telecom with cheap data plans

Krsnaa Diagnostics is disrupting diagnostics with very cheap rates for tests!

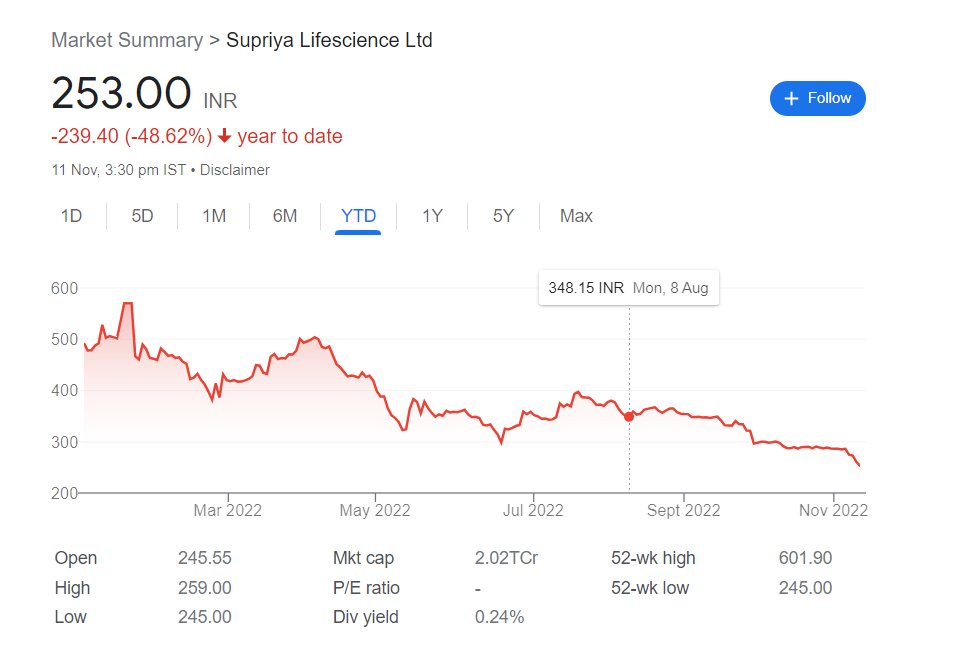

But,the stock has fallen 50% since the IPO!

A thread🧵on the business model of Krsnaa diagnostics and the opportunities ahead

Let's go👇

(1/22)

Krsnaa Diagnostics is disrupting diagnostics with very cheap rates for tests!

But,the stock has fallen 50% since the IPO!

A thread🧵on the business model of Krsnaa diagnostics and the opportunities ahead

Let's go👇

(1/22)

What has happened?

The Stock with an issue price of 933 has fallen by 50% and now trades below Rs 500

Let's find out why?

(2/22)

The Stock with an issue price of 933 has fallen by 50% and now trades below Rs 500

Let's find out why?

(2/22)

What is the business of Krsnaa diagnostics?

Incorporated in 2010, Krsnaa Diagnostics (Krsnaa) is one of the largest

differentiated diagnostic service provider in India.

(3/22)

Incorporated in 2010, Krsnaa Diagnostics (Krsnaa) is one of the largest

differentiated diagnostic service provider in India.

(3/22)

It provides a range of diagnostic services such as imaging (including radiology), pathology/clinical laboratory and tele-radiology services to

public & private hospitals, medical colleges and community health centres pan-India.

(4/22)

public & private hospitals, medical colleges and community health centres pan-India.

(4/22)

The main business for Krsnaa

1. Radiology with 52% of the revenue

2. Pathology at 38% of the revenue

Covid revenues have just fallen away

(5/22)

1. Radiology with 52% of the revenue

2. Pathology at 38% of the revenue

Covid revenues have just fallen away

(5/22)

Krsnaa works under a PPP with the government:-

In Its PPP agreements, to deploy diagnostic

centres for radiology and pathology services are typically long-term contracts that ensure visibility of revenues for its operations.

(6/22)

In Its PPP agreements, to deploy diagnostic

centres for radiology and pathology services are typically long-term contracts that ensure visibility of revenues for its operations.

(6/22)

Long term contracts to provide revenue visibility:-

The terms of contract with public health agencies ranges between two and 10 years and

typically include a term extension clause based on performance and mutual

agreement.

(7/22)

The terms of contract with public health agencies ranges between two and 10 years and

typically include a term extension clause based on performance and mutual

agreement.

(7/22)

Krsnaa offers tests at very low rates:-

Tests such as

🧪CT Brain

🧪MRI BRAIN

🧪CBC

are 25% to 43% cheaper with Krsnaa

(8/22)

Tests such as

🧪CT Brain

🧪MRI BRAIN

🧪CBC

are 25% to 43% cheaper with Krsnaa

(8/22)

Tender System for new contracts:-

Given the low cost model of Krsnaa

The company is a preferred partner for public health agencies in implementing diagnostic centres.

(9/22)

Given the low cost model of Krsnaa

The company is a preferred partner for public health agencies in implementing diagnostic centres.

(9/22)

This is evident from its bid-win rate of

77.59% for tenders that it has bid for since the commencement of operations,

including a 100% qualification rate on technical grounds

(10/22)

77.59% for tenders that it has bid for since the commencement of operations,

including a 100% qualification rate on technical grounds

(10/22)

So is cash flow a problem working with the government?

Ppl always have a concern about how will the government pay its dues.

Lets look at the cashflows for Krsnaa:-

10-year cashflows:-

405cr

Operating Profit:-

189cr

Cash flows say the business has stability

(11/22)

Ppl always have a concern about how will the government pay its dues.

Lets look at the cashflows for Krsnaa:-

10-year cashflows:-

405cr

Operating Profit:-

189cr

Cash flows say the business has stability

(11/22)

🧪The management has kept the receivables at 90days only

🧪If the government fails to pay(which has not happened) they close down the operations at the centre

(12/22)

🧪If the government fails to pay(which has not happened) they close down the operations at the centre

(12/22)

So how were the results this time?

🧪Revenue grew by 10%

🧪Margins came in at 25.1%

🧪Profit fell to 142cr

(13/22)

🧪Revenue grew by 10%

🧪Margins came in at 25.1%

🧪Profit fell to 142cr

(13/22)

Call highlights:-

🧪Margins should improve as the new centers start to mature

🧪The tender in Rajasthan was canceled due to lack of players

🧪The new tender should come up by Q4

(14/22)

🧪Margins should improve as the new centers start to mature

🧪The tender in Rajasthan was canceled due to lack of players

🧪The new tender should come up by Q4

(14/22)

🧪2nd half will be better than the first half

🧪The government generally pays in the second half

🧪The company expects to grow its revenue by 2x and net profit by 3x in next 3 years.

(15/22)

🧪The government generally pays in the second half

🧪The company expects to grow its revenue by 2x and net profit by 3x in next 3 years.

(15/22)

Foray into B2C segment can be a big driver:-

The company’s strength lies in providing quality health care at affordable rate and they

have best-in-class infrastructure.

(16/22)

The company’s strength lies in providing quality health care at affordable rate and they

have best-in-class infrastructure.

(16/22)

The management is willing to leverage their strength

and plans to enter into B2C segment in FY23 by opening 1,000 collection centers mainly

Maharashtra, Punjab, Himachal Pradesh and Jammu & Kashmir

(17/22)

and plans to enter into B2C segment in FY23 by opening 1,000 collection centers mainly

Maharashtra, Punjab, Himachal Pradesh and Jammu & Kashmir

(17/22)

Tele-Radiology – to provide additional growth opportunities

Krsnaa has built India’s largest Tele-Radiology reporting hub which is helping the

company to penetrate in remote locations and provide quality services.

It accounts for 10% of the revenue

(18/22)

Krsnaa has built India’s largest Tele-Radiology reporting hub which is helping the

company to penetrate in remote locations and provide quality services.

It accounts for 10% of the revenue

(18/22)

Tax Raid in the Pune facility:-

In June 2022 Income tax Officials visited the Pune centre of Krsnaa.

The findings of the investigation are not known.

However it was a concerning development for the investors

(19/22)

In June 2022 Income tax Officials visited the Pune centre of Krsnaa.

The findings of the investigation are not known.

However it was a concerning development for the investors

(19/22)

Valuation:-

Krsnaa operates a low cost pathology and radiology model

On an EV/EBIDTA basis it trades at 22x EV/EBIDTA.

It is cheaper than many listed players.

Standalone does not look cheap.

(20/22)

Krsnaa operates a low cost pathology and radiology model

On an EV/EBIDTA basis it trades at 22x EV/EBIDTA.

It is cheaper than many listed players.

Standalone does not look cheap.

(20/22)

Conclusion:-

Krsnaa is in a very good space

1. It operates in the B2G space which guarantees long term demand

2.Low cost model of Krsnaa helps it beat other players

3. Cash flows have been stable.

4. It affords radiology and pathology at cheap rates

(21/22)

Krsnaa is in a very good space

1. It operates in the B2G space which guarantees long term demand

2.Low cost model of Krsnaa helps it beat other players

3. Cash flows have been stable.

4. It affords radiology and pathology at cheap rates

(21/22)

As more governments start to expand healthcare across the country

Krsnaa will be a major beneficiary

(22/22)

Krsnaa will be a major beneficiary

(22/22)

Disclaimer:-

This is my own study

Not an investment recommendation

Please consult your own financial advisor before making any investment decisions

This is my own study

Not an investment recommendation

Please consult your own financial advisor before making any investment decisions

• • •

Missing some Tweet in this thread? You can try to

force a refresh