The market is worried about Coinbase’s solvency.

Here’s what I know:

Here’s what I know:

Coinbase bonds are trading at a massive discount, about 50% to par value.

The bonds are yielding 16%. A yield that high is a sign that investors are worried about the company’s ability to make the interest payments.

The bonds are yielding 16%. A yield that high is a sign that investors are worried about the company’s ability to make the interest payments.

Back in May, Coinebase’s CFO warned that there was a “small risk of bankruptcy”.

Not something a perfectly healthy business would say.

Not something a perfectly healthy business would say.

https://twitter.com/Kevin_W81/status/1525092187095961600?s=20&t=ON7IVweg2QvTZ83u8Iu0eg

Coinbase CEO Brian Armstrong is defending his company’s financials after Binance CEO CZ suggested that Coinbase may not actually have enough reserves

However, CZ deleted the tweet and retracted the statement

However, CZ deleted the tweet and retracted the statement

https://twitter.com/brian_armstrong/status/1595126123439923200?s=20&t=UuBlrk7q6DJriF3aGGU69Q

Unlike FTX, Coinbase is an SEC-regulated company with much higher reporting standards, so they have to be more transparent.

According to their latest 10-Q, Coinbase holds over $95 billion in customer crypto assets, plus $6.5 billion in US dollars held on behalf of customers.

According to their latest 10-Q, Coinbase holds over $95 billion in customer crypto assets, plus $6.5 billion in US dollars held on behalf of customers.

Here’s the asset portion of Coinbase’s balance sheet below.

At least with Coinbase we have access to these numbers, unlike FTX.

At least with Coinbase we have access to these numbers, unlike FTX.

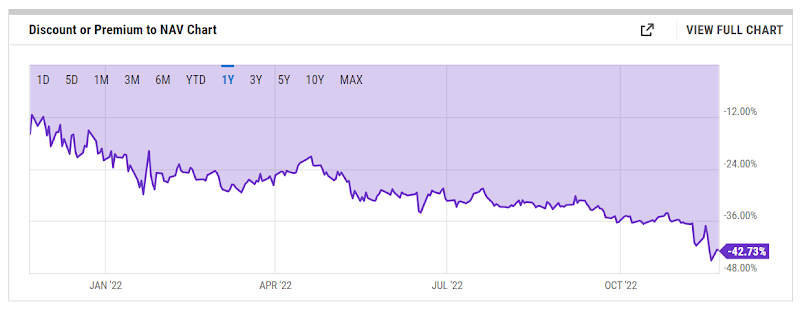

Coinbase stock is down 83% since it debuted last spring.

It went from trading around $340 to $43 today.

I wonder if Cramer still likes it to $475

It went from trading around $340 to $43 today.

I wonder if Cramer still likes it to $475

Coinbase has a fairly high short interest: About 17% of the float is being shorted.

Legendary short seller Jim Chanos said that Coinbase is ““symptomatic of the predatory junkyard that is crypto”

His short thesis:

Legendary short seller Jim Chanos said that Coinbase is ““symptomatic of the predatory junkyard that is crypto”

His short thesis:

Coinbase requires very high trading volumes to make enough commissions to cover its massive operational costs.

But with cryptocurrencies in a bear market, that trading activity is drying up in two ways:

But with cryptocurrencies in a bear market, that trading activity is drying up in two ways:

Customers’ accounts are less valuable than they were a year ago

and the lowered interest in crypto means people will trade less often.

Fewer trades and lower average transaction volume is bad news for Coinbase’s margins.

and the lowered interest in crypto means people will trade less often.

Fewer trades and lower average transaction volume is bad news for Coinbase’s margins.

This dynamic was already playing out by the end of Q2 this year.

Net revenue is down about 60% year-over-year and net losses are growing.

Net revenue is down about 60% year-over-year and net losses are growing.

So there are two dimensions that concern investors:

Coinbase the business.

And Coinbase the exchange.

The business has shrinking margins. And after what happened to FTX, which exchanges can we trust?

Coinbase the business.

And Coinbase the exchange.

The business has shrinking margins. And after what happened to FTX, which exchanges can we trust?

There are still a lot of questions to be answered.

Follow along and I’ll update you as I dig more into this.

gritcapital.substack.com

Follow along and I’ll update you as I dig more into this.

gritcapital.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh