Live Tweet thread 🧵

“Tanker shipping outlook - Geopolitics and beyond”, an HSBC webinar by Arrow's Head of Research, Burak Cetinok, on 23 Nov 2022.

$DHT $FRO $DHT $OET $ASC $TRMD $STNG $HAFNI

“Tanker shipping outlook - Geopolitics and beyond”, an HSBC webinar by Arrow's Head of Research, Burak Cetinok, on 23 Nov 2022.

$DHT $FRO $DHT $OET $ASC $TRMD $STNG $HAFNI

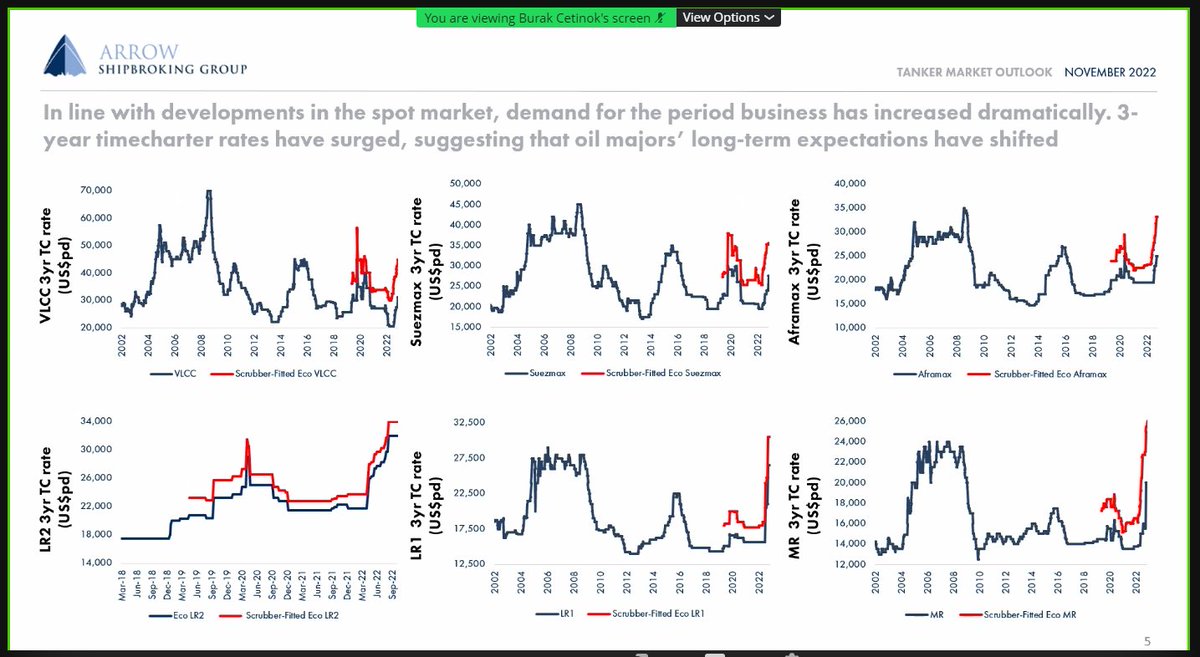

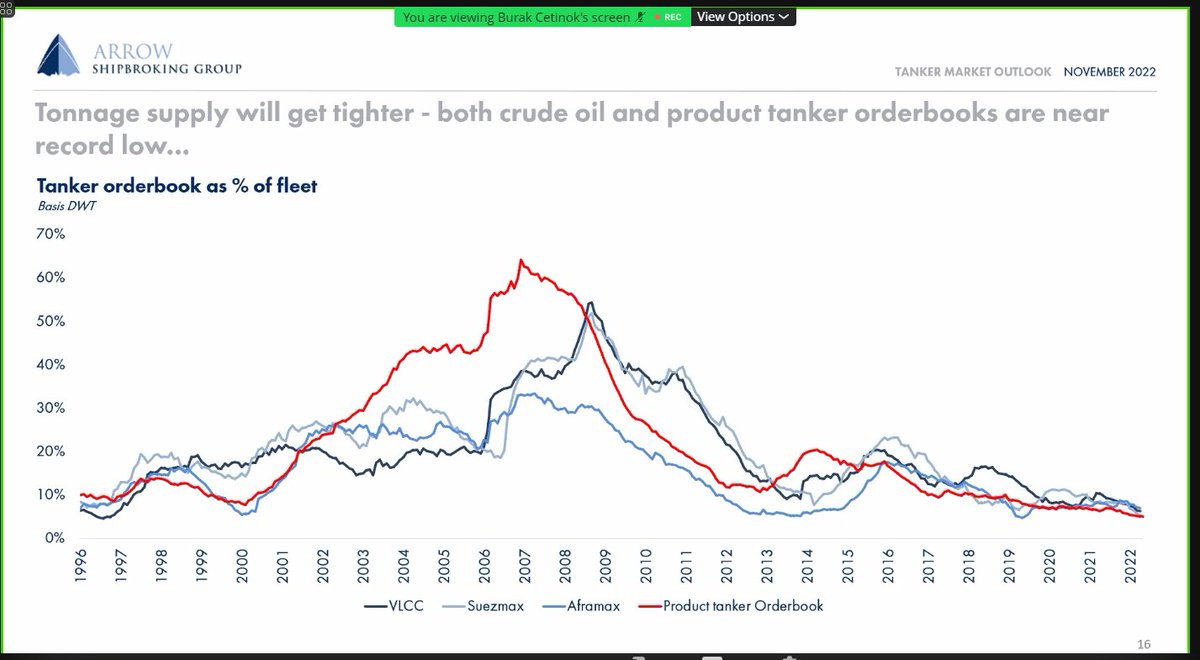

Burak Cetinok: "I've been in this for 15 years, and we've never seen so many factors converging to tighten the market. We think it will sustain for 12-18 mos more at least."

Ship to ship transfers are tying up tonnage. The global fleet is much more productive, and utilization is higher because of all this extra demand. The reshuffling of global demand for crude & product is boosted tremendously by the conflict.

We use tonne-days as a demand proxy

We use tonne-days as a demand proxy

Seasonality = beg and end of year is strong. But since the conflict started that seasonality has gone out the windows. We have seen a steady increase is rates. The market is scrambling to secure tonnage.

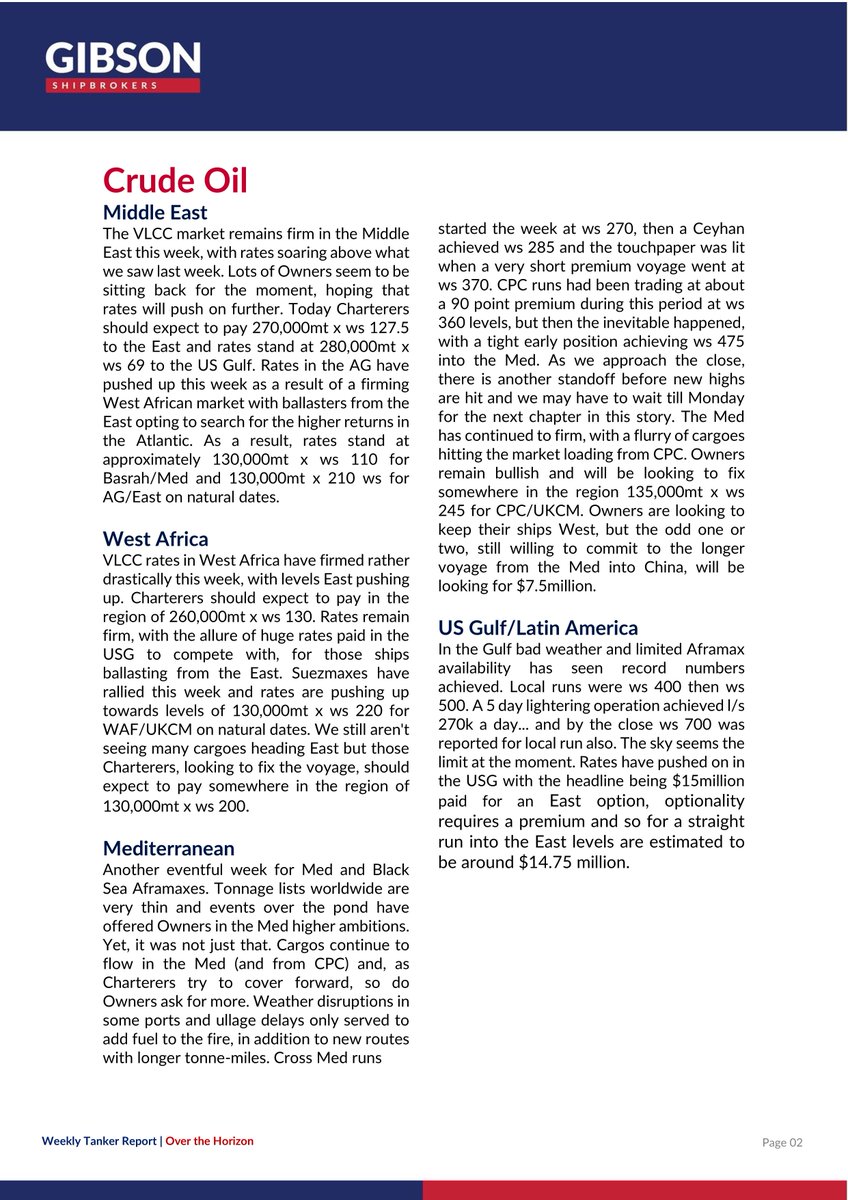

The oil majors' long term sentiment has shifted. 3y period charters are a good proxy for sentiment. In a nutshell, it is becoming clear that the rally we are seeing has legs. It will be sustained for 12-18 mos.

The latest news is that sanctions implementation will be slightly delayed, but the nature of the sanctions has not been changed. My interpretation is that EU officials are coming to terms with the fact that in order to satisfy oil demand, Western tonnage will need to move RU oil.

We expect EU demand for crude to be satisfied by Mid East (Saudi Arabia) and West Africa, and also from the US. There is also a mismatch between US crude and European refineries, which like to yield middle distillates. But EU becoming desperate. African oil to EU = + tonne miles.

We expect RU oil to go to South Africa, Latin America, India...and all of this is positive for ton miles. RU Eastern ports will have to ramp up capacity. Ice class tankers will be needed. Smaller producers may import RU barrels, export their own. All of this pushes ton miles.

I've seen estimates 10-20% increase in ton miles. Add opposite extremes. 10-20 TIMES additional ton miles. It's very hard to model. But no matter how things pan out, this is a big positive for tankers.

In terms of refineries, West of Suez refining capacity started long before the UKR/RU conflict. But this has been accelerated by the conflict. West of Suez is desperate for clean product. All additional refinery capacity is East of Suez.

This chart gives an idea of how short of product supplies the West is. And that demand will have to be satisfied by sources further afield.

Before conflict, RU accounted for 55% of EU's diesel (2021). It will be VERY difficult to replace RU barrels.

Before conflict, RU accounted for 55% of EU's diesel (2021). It will be VERY difficult to replace RU barrels.

RU diesel will be replaced by Middle Eastern volumes, Indian too, and US. We expect demand destruction taking place too.

RU exports of diesel, we see similar dramatic changes in flows. Most will be directed to Africa, Latin America, and elsewhere.

RU exports of diesel, we see similar dramatic changes in flows. Most will be directed to Africa, Latin America, and elsewhere.

Europe distillates will be at the center of all these changes. EU's nearest trade partners don't have the capacity to replace Russia's distillates. Perhaps even imports of distillates from ...China!

All of this is difficult to model.

All of this is difficult to model.

Even if war ends soon, sanctions will be in place for a long time.

I've been getting lots of questions about the impacts of a recession. Recessions are correlated with reduced oil demand, that's true. But demand is getting more inelastic.

There are other factors:

I've been getting lots of questions about the impacts of a recession. Recessions are correlated with reduced oil demand, that's true. But demand is getting more inelastic.

There are other factors:

One of them is the depleting stocks of crude & product. Major economies released significant amounts of barrels from strategic and commercial reserves.

This is true across the OECD countries:

This is true across the OECD countries:

Even if we see demand destruction, and prices easing, this could trigger a restocking cycle for inventories, which would also support tanker demand.

In the N Hemisphere, heating season is upon us, and fuel oil is becoming an attractive alternative (EU, Asia).

In the N Hemisphere, heating season is upon us, and fuel oil is becoming an attractive alternative (EU, Asia).

IHS is already seeing lots of switching, documented in this slide. And there is a global shortage (esp in Europe) of middle distillates, esp diesel.

Demand side v. bullish, driven by tradeflow shifts

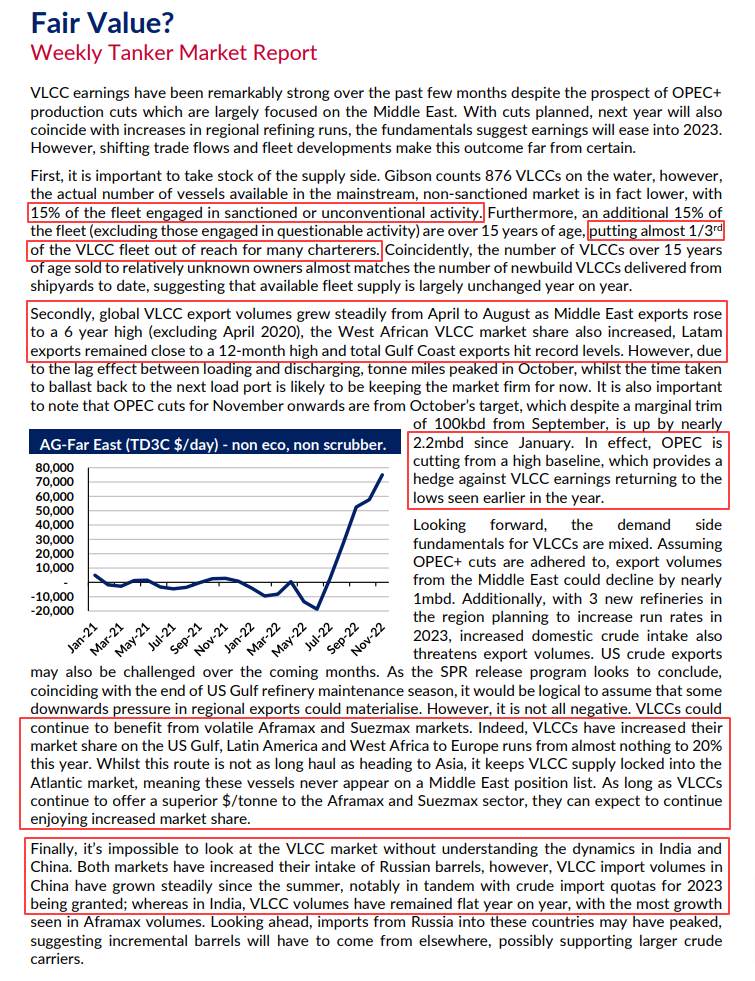

Now let's think about the vessel supply side, which is tightening as all of this is happening:

Now let's think about the vessel supply side, which is tightening as all of this is happening:

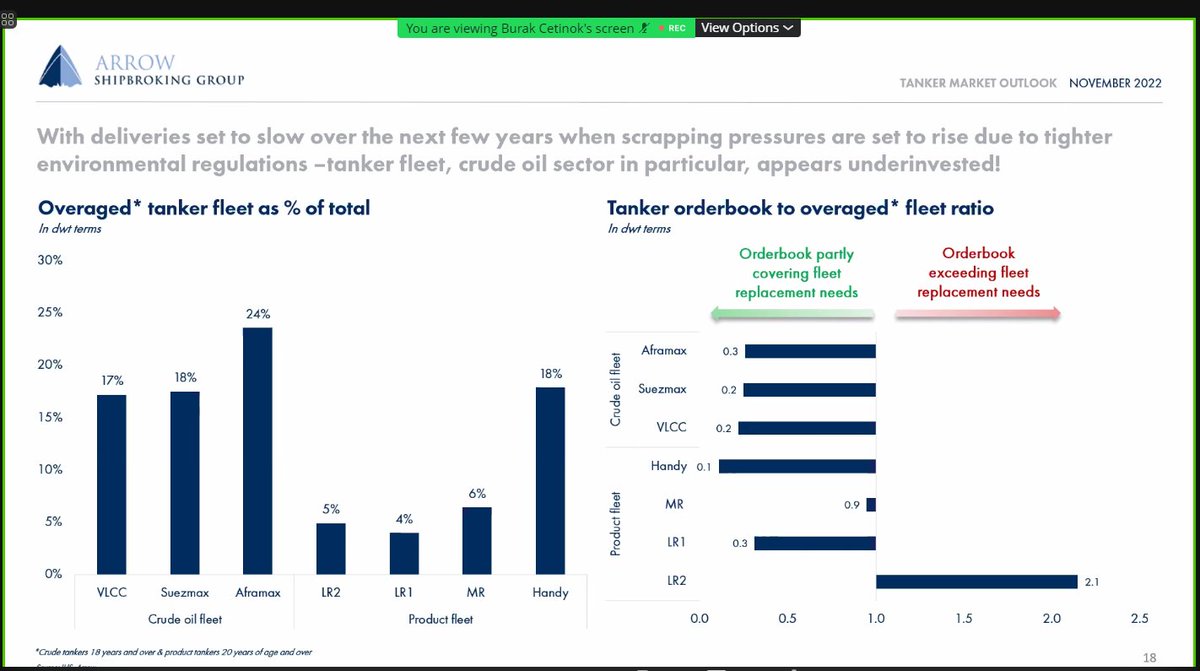

The world fleet is getting older, a lack of investment is becoming really obvious in the crude fleet in particular. 19% fleet is overaged (>18y and above). Scrapping pressures will come into play.

Product tanker orderbook still small, and barely satisfies replacement needs.

Any reading below 1 on this chart means we are not replacing the fleet quickly enough:

Any reading below 1 on this chart means we are not replacing the fleet quickly enough:

Questions: what if RU/UKR stops tomorrow?

Leaving aside equity market panic. How would physical market react?

BC: Sanctions will be in place for a long time, otherwise it wouldn't discourage conflicts. Sanctions = restriction of trade flows.

Leaving aside equity market panic. How would physical market react?

BC: Sanctions will be in place for a long time, otherwise it wouldn't discourage conflicts. Sanctions = restriction of trade flows.

It would have an effect on market sentiment, but I don't see it having an effect on the physical side.

Next Q: Can you talk about the price cap, what happens to tanker capacity in RU cargo. Will they be able to serve RU flow? What about insurance dominated by EU/UK?

Next Q: Can you talk about the price cap, what happens to tanker capacity in RU cargo. Will they be able to serve RU flow? What about insurance dominated by EU/UK?

BC: The price cap is one of the big uncertainties. EU meeting today. Cap should be above RU's costs, below world price. Today Russian Urals price is $66/barrel. I would guess it would be $60/barrel.

I don't expect RU to accept this. They want prices higher.

I don't expect RU to accept this. They want prices higher.

If you look at last 6-9 mos in S&P market, huge increase in purchases by unknown players, to be used in RU trades. We expect there to be enough tonnage for RU oil. Oil traders will improvise solutions, to be able to move the oil.

One of the loopholes is: traders can issue two different bills of lading, one for regulators (to show compliance), another with the "real" price.

Chinese, Indian, other insurance cos will surface to supplement coverage where necessary. The payout will be so attractive ...

Chinese, Indian, other insurance cos will surface to supplement coverage where necessary. The payout will be so attractive ...

I'm more concerned with this: is there enough demand for RU demand from China, India, S Africa and other players? Probably yes, but we still do expect some production destruction too.

Q: Outlook. Given that orderbooks at low levels, lowest for 2 decades, why only positive for 12-18 mos

BC: I'm uncertain about what future will bring beyond 18 months. How/if sanctions would be lifted? Will increased ordering take place?

BC: I'm uncertain about what future will bring beyond 18 months. How/if sanctions would be lifted? Will increased ordering take place?

Main message is I am pretty certain for next 12-18 mos, but the risks increase beyond that time horizon, because uncertainties of what can happen increase beyond that timeframe.

Q Can asset values go higher from here?

Also, if someone has has $1 bn to spare, and could get a slot for 2024 or 25, would you buy one? Would you differentiate between product and crude?

BC: That's a billion dollar question :)

Also, if someone has has $1 bn to spare, and could get a slot for 2024 or 25, would you buy one? Would you differentiate between product and crude?

BC: That's a billion dollar question :)

Most players have positioned themselves for sanctions market already. Now people are in "wait and see" mode, to see if the sanctions trade will play out as we expect. If we see that playing out as expected, we'll see people now on the sidelines flooding in.

Short-term 2024-25 the supply side is unlikely to change dramatically. We will probably see increased ordering, but not on the scale of the past, because no one wants to be first mover on new technology, an asset class that could become obsolete.

Also, lead time already far out

Also, lead time already far out

Interest rates are V high, making financing asset purchases more and more difficult. I expect numbers to increase, but not up to the levels we saw during previous cycles.

Renewables are making a killing right now. And high energy prices will encourage peak oil.

Renewables are making a killing right now. And high energy prices will encourage peak oil.

Q: China's lockdowns vis a vis demand.

Shouldn't Chinese imports decrease ton-mile demand?

A: China will still buy from Middle East, and buy discounted from RU, buying less from ME. That will be ton-mile negative.

But then MEG oil will go increasingly to EU, which is a +

Shouldn't Chinese imports decrease ton-mile demand?

A: China will still buy from Middle East, and buy discounted from RU, buying less from ME. That will be ton-mile negative.

But then MEG oil will go increasingly to EU, which is a +

So more barrels for longer haul trades (MEG->EU)

And re: Chinese lockdowns, major drag on oil demand. China's return will be positive for tanker demand too. But short-term will be volatile. Positive: 11 Nov released 20 measures for easing & real estate, that's a critical pivot.

And re: Chinese lockdowns, major drag on oil demand. China's return will be positive for tanker demand too. But short-term will be volatile. Positive: 11 Nov released 20 measures for easing & real estate, that's a critical pivot.

BC: The changes we are seeing are structural. And we are mid-cycle in terms of trade flow shuffling.

The pre 5 December window is now closed. We haven't see all of the shuffling yet. 1H 2023 it will play out.

This is the new norm, until sanctions lifted (medium term)

The pre 5 December window is now closed. We haven't see all of the shuffling yet. 1H 2023 it will play out.

This is the new norm, until sanctions lifted (medium term)

Q How will EEXI & CII affect tankers?

EEXI = speed limit,

We will probably see trading speeds come down, esp for older tankers.

CII operational measure. Impact more long-term.

Don't expect big change next year. Impact will grow progressively.

EEXI = speed limit,

We will probably see trading speeds come down, esp for older tankers.

CII operational measure. Impact more long-term.

Don't expect big change next year. Impact will grow progressively.

Tanker markets have been chronically oversupplied since 2016. In beg 2022 tanker market was beginning to balance, then the conflict happen. So this cycle could indeed reach the heights of previous cycles.

Maybe two questions about dry bulk:

Maybe two questions about dry bulk:

Looking back, what were the inflection points? What should be looking at to know whether dry bulk has legs? China's real estate sector demand? Easing?

2023 seems like it will be an improvement on 2022. Are you positive on dry bulk? Or sideways from here?

2023 seems like it will be an improvement on 2022. Are you positive on dry bulk? Or sideways from here?

BC: Chinese demand has probably bottomed out. Doesn't mean we rebound quickly. But ex-China demand... not necessarily. Western world in opposite part of business cycle.

Geared segments won't be as affected, but Capes should benefit.

Geared segments won't be as affected, but Capes should benefit.

Excavator sales turned positive for the first time in 15 months. Construction companies invest in heavy equipment, only if they anticipate a demand recovery. Infrastructure investments up strongly this year, incl 16 measures to deal with property sector.

Next 12 mos ex-China demand should be weak.

China should be better from here.

Panamaxes are in best place now, Russian coal trade shifts are benefitting them (grain & coal = 85% of trade).

Geared segments look shaky, weakening minor bulks demand. Congestion high for handysize

China should be better from here.

Panamaxes are in best place now, Russian coal trade shifts are benefitting them (grain & coal = 85% of trade).

Geared segments look shaky, weakening minor bulks demand. Congestion high for handysize

But we think Capesize segment has bottomed in terms of demand.

$SHIP $GOGL $SBLK $GNK etc

/FIN

$SHIP $GOGL $SBLK $GNK etc

/FIN

• • •

Missing some Tweet in this thread? You can try to

force a refresh