I've spent 22+ years studying Finance with the last 7 as a CFO, and

I'll teach you How to Read a Balance Sheet in the next 7 minutes:

I'll teach you How to Read a Balance Sheet in the next 7 minutes:

A balance sheet is a snapshot of your business at a specific point in time, and

It tells you whether your business is stable and financially healthy:

• Is there cash

• Can you pay your bills

• How much debt do you have

• What is the book value of the business

It tells you whether your business is stable and financially healthy:

• Is there cash

• Can you pay your bills

• How much debt do you have

• What is the book value of the business

• Balance Sheet Structure

The structure of a balance sheet is:

Assets = Liabilities + Equity

This formula is intuitive when you remember,

A company has to pay for what it owns (assets) by either:

• borrowing money (liabilities), or

• bringing on investors (equity)

The structure of a balance sheet is:

Assets = Liabilities + Equity

This formula is intuitive when you remember,

A company has to pay for what it owns (assets) by either:

• borrowing money (liabilities), or

• bringing on investors (equity)

• Assets are What You Own

Listed top to bottom in order of liquidity, which is how fast they can be converted to cash:

• cash

• inventory (goods available for sale)

• accounts receivable (what people owe you)

• Fixed assets (land, machinery, equipment, and buildings)

Listed top to bottom in order of liquidity, which is how fast they can be converted to cash:

• cash

• inventory (goods available for sale)

• accounts receivable (what people owe you)

• Fixed assets (land, machinery, equipment, and buildings)

• Liabilities are What You Owe

Current liabilities are due within 1 year:

• accounts payable

• income tax payable

• current portion of debt

Long-term liabilities are due at any point after that:

• long-term debt

• mortgages payable

Current liabilities are due within 1 year:

• accounts payable

• income tax payable

• current portion of debt

Long-term liabilities are due at any point after that:

• long-term debt

• mortgages payable

• Equity is What You're Worth

If you sold your assets and paid your liabilities, equity's what's left over:

• money contributed (common shares)

• profits taken out of the business (dividends)

• earnings retained in the business (retained earnings)

If you sold your assets and paid your liabilities, equity's what's left over:

• money contributed (common shares)

• profits taken out of the business (dividends)

• earnings retained in the business (retained earnings)

• Balance Sheet Analysis

Now that we know how the financial statement is structured,

we can talk about how to analyze it.

There are three types of ratios we'll review on the balance sheet:

• liquidity

• solvency

• profitability

Now that we know how the financial statement is structured,

we can talk about how to analyze it.

There are three types of ratios we'll review on the balance sheet:

• liquidity

• solvency

• profitability

• Liquidity Ratios

Liquidity ratios show your ability to turn assets into cash and include:

• cash ratio

• quick ratio

• current ratio

Liquidity ratios show your ability to turn assets into cash and include:

• cash ratio

• quick ratio

• current ratio

• Solvency Ratios

Solvency ratios show your ability to pay off debts and include:

• cash ratio

• quick ratio

• current ratio

• debt to equity

• interest coverage

• essential solvency ratio

Solvency ratios show your ability to pay off debts and include:

• cash ratio

• quick ratio

• current ratio

• debt to equity

• interest coverage

• essential solvency ratio

• Profitability Ratios

Profitability ratios show your ability to generate income from your balance sheet assets and include:

• return on assets

• return on equity

• return on invested capital

• return on capital employed

Profitability ratios show your ability to generate income from your balance sheet assets and include:

• return on assets

• return on equity

• return on invested capital

• return on capital employed

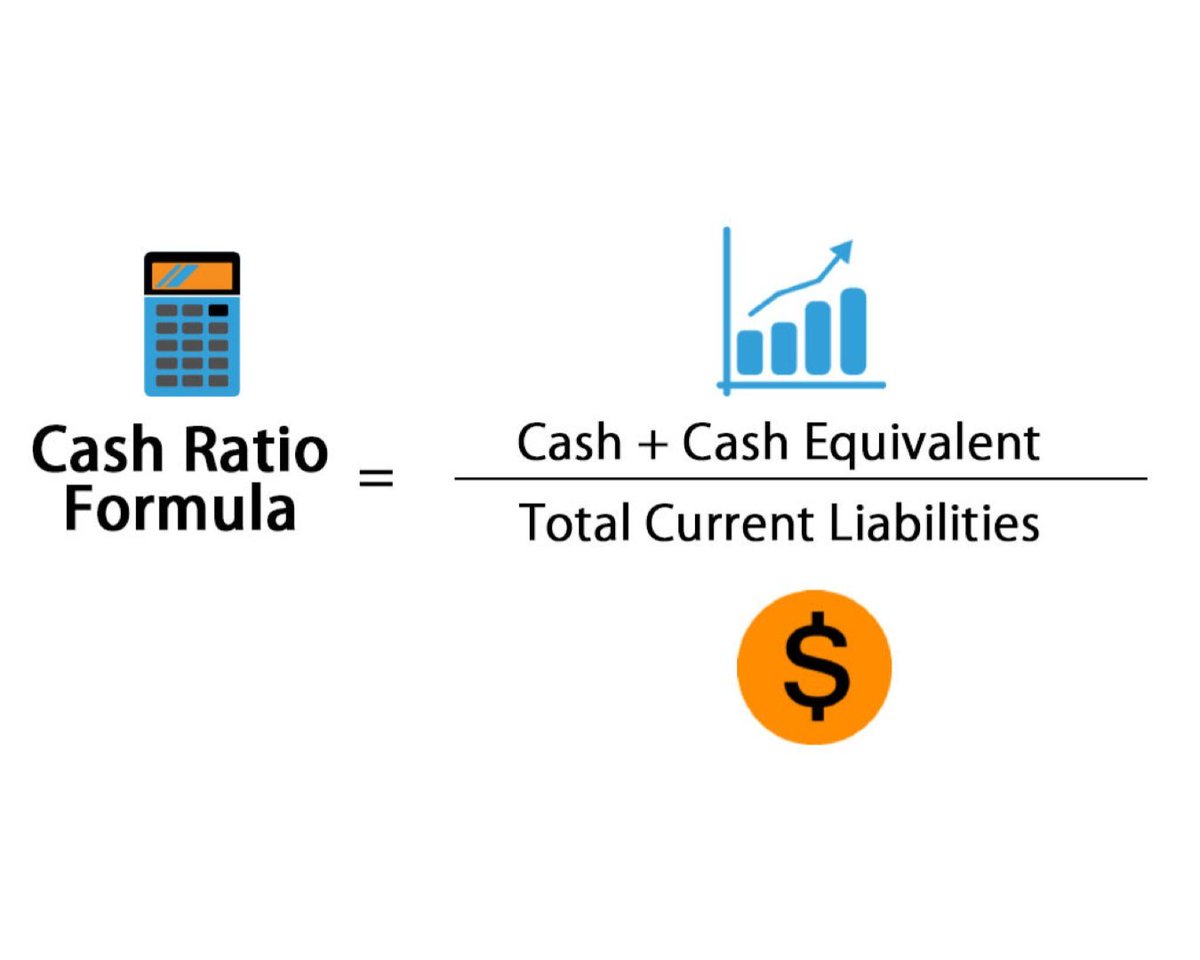

• Cash Ratio

The cash ratio measures your total cash and cash equivalents against your total liabilities.

It is an indicator of your value under a worst case scenario, such as a bankruptcy or business shutdown.

A larger ratio is better.

The cash ratio measures your total cash and cash equivalents against your total liabilities.

It is an indicator of your value under a worst case scenario, such as a bankruptcy or business shutdown.

A larger ratio is better.

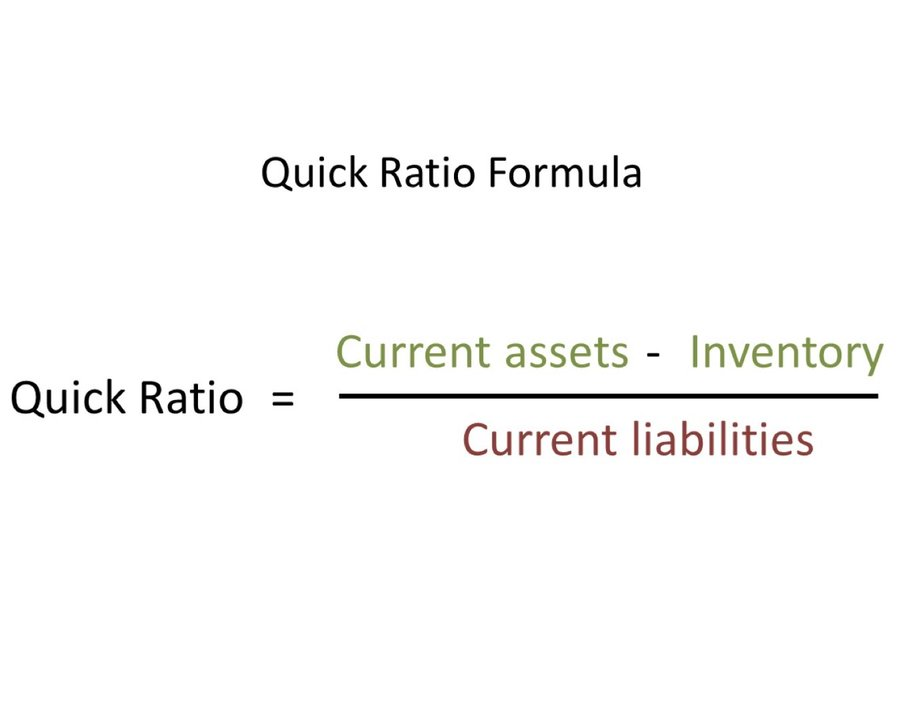

• Quick Ratio

The quick ratio measures your ability to meet your short-term obligations with your most liquid assets - also called the acid test ratio.

A higher ratio = better liquidity and financial health.

The quick ratio measures your ability to meet your short-term obligations with your most liquid assets - also called the acid test ratio.

A higher ratio = better liquidity and financial health.

• Current Ratio

The current ratio measures your ability to pay short-term obligations or those due within one year, sometimes called the working capital ratio.

A ratio less than one indicates any debts due within one year are greater than your current assets.

The current ratio measures your ability to pay short-term obligations or those due within one year, sometimes called the working capital ratio.

A ratio less than one indicates any debts due within one year are greater than your current assets.

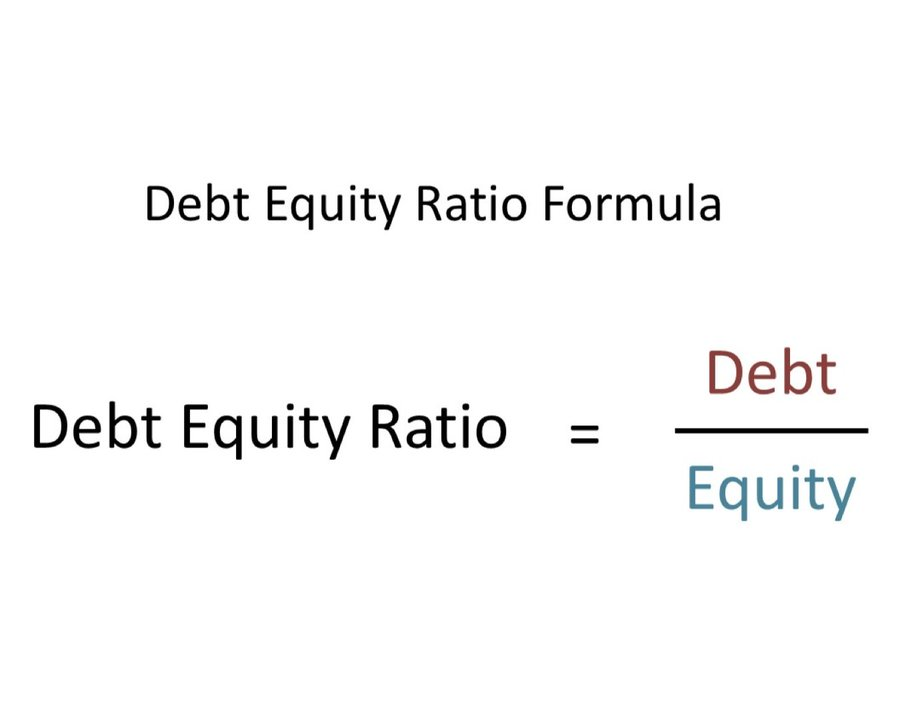

• Debt to Equity

The debt-to-equity ratio compares total liabilities against total equity, and

It's used to evaluate how much leverage you're using in your business.

Less than 1 = safe

Greater than 2 = risky

Debt-to-equity is heavily dependent on the industry.

The debt-to-equity ratio compares total liabilities against total equity, and

It's used to evaluate how much leverage you're using in your business.

Less than 1 = safe

Greater than 2 = risky

Debt-to-equity is heavily dependent on the industry.

• Future ratios

The following ratios will be reviewed when we look at the income statement:

Solvency:

• interest coverage

• essential solvency ratio

Profitability:

• return on assets

• return on equity

• return on invested capital

• return on capital employed

The following ratios will be reviewed when we look at the income statement:

Solvency:

• interest coverage

• essential solvency ratio

Profitability:

• return on assets

• return on equity

• return on invested capital

• return on capital employed

Join @KurtisHanni and me in our upcoming cohort - Beyond the Numbers.

Over 4 weeks we’ll help you:

• make numbers-informed decisions

• stop leaving money on the table

Join now:

maven.com/practical-fina…

Over 4 weeks we’ll help you:

• make numbers-informed decisions

• stop leaving money on the table

Join now:

maven.com/practical-fina…

@KurtisHanni Thanks for reading!

Follow me @IAmClintMurphy for more content like this.

Retweet the first tweet to help more people see content you enjoy:

Follow me @IAmClintMurphy for more content like this.

Retweet the first tweet to help more people see content you enjoy:

https://twitter.com/IAmClintMurphy/status/1595788496542785538

@KurtisHanni P.S. If you want to be better, achieve more and become financially free, you'll want to listen to my Podcast.

Every Tuesday, I interview an author to help you and me grow personally, professionally and financially.

podcasts.apple.com/ca/podcast/the…

Every Tuesday, I interview an author to help you and me grow personally, professionally and financially.

podcasts.apple.com/ca/podcast/the…

P.S. If you want to be better, achieve more and become financially free, you will love my free weekly newsletter.

Every Thursday morning I'll simplify psychology, success and money straight to your inbox.

getrevue.co/profile/Clint_…

Every Thursday morning I'll simplify psychology, success and money straight to your inbox.

getrevue.co/profile/Clint_…

When I first joined Twitter, I had no idea what I was doing.

One year later, I have 185,000 friends and am obsessed with learning everything Twitter.

I'd like the opportunity to teach more people the magic of this App and if that's you, then let's go:

maven.com/growth-academy…

One year later, I have 185,000 friends and am obsessed with learning everything Twitter.

I'd like the opportunity to teach more people the magic of this App and if that's you, then let's go:

maven.com/growth-academy…

• • •

Missing some Tweet in this thread? You can try to

force a refresh