Bruce Kovner is the Greatest Market Wizard you've never heard of.

He averaged ~90% CAGR during his 10 years at Commodities Corp.

Then he generated a 21% CAGR for 28 years at his own fund.

Oh, and before that, he was a cab driver.

Here are his six trading principles ... 🧵

He averaged ~90% CAGR during his 10 years at Commodities Corp.

Then he generated a 21% CAGR for 28 years at his own fund.

Oh, and before that, he was a cab driver.

Here are his six trading principles ... 🧵

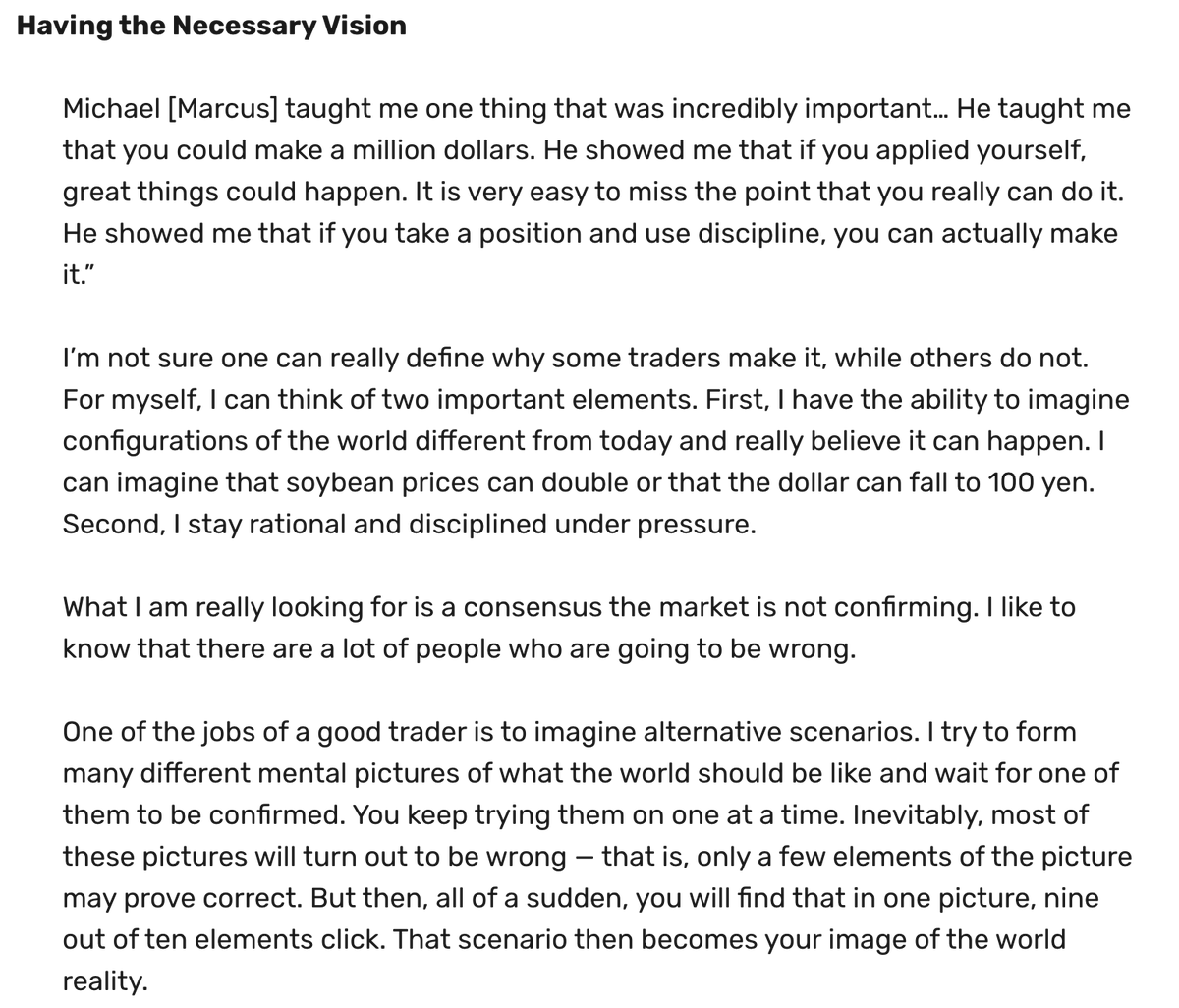

Principle 1: Have The Necessary Vision

"Mindset" gets thrown around a lot.

But it's extremely important.

Kovner's first (and greatest) lesson is that if you apply yourself, great things could happen.

"Michael Marcus taught me that it is possible to make a million dollars."

"Mindset" gets thrown around a lot.

But it's extremely important.

Kovner's first (and greatest) lesson is that if you apply yourself, great things could happen.

"Michael Marcus taught me that it is possible to make a million dollars."

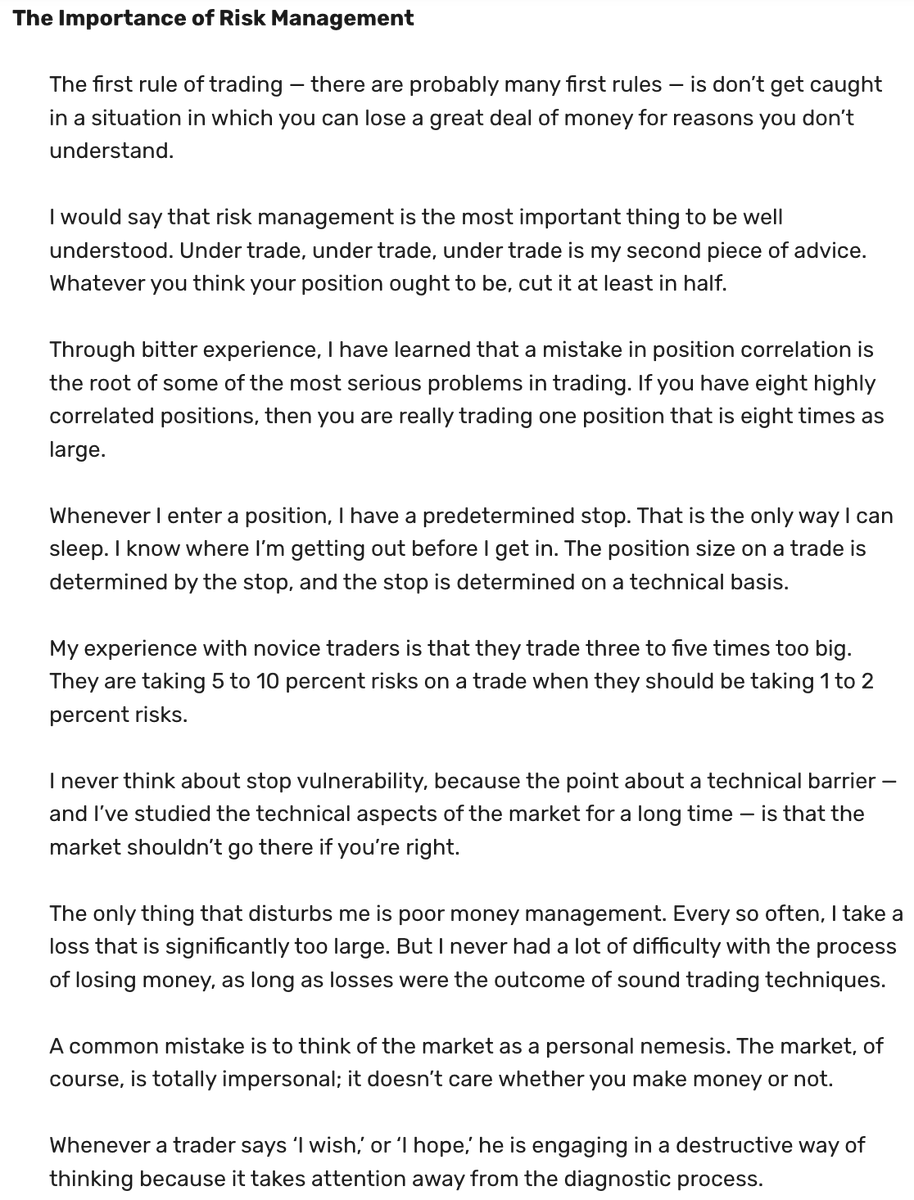

Principle 2: Risk Management Is Paramount

Have you noticed a theme? The world's best traders place risk management above making money.

Kovner ALWAYS uses stops.

Before he enters a position he knows when/where he's getting out.

"It's the only way I can sleep at night."

Have you noticed a theme? The world's best traders place risk management above making money.

Kovner ALWAYS uses stops.

Before he enters a position he knows when/where he's getting out.

"It's the only way I can sleep at night."

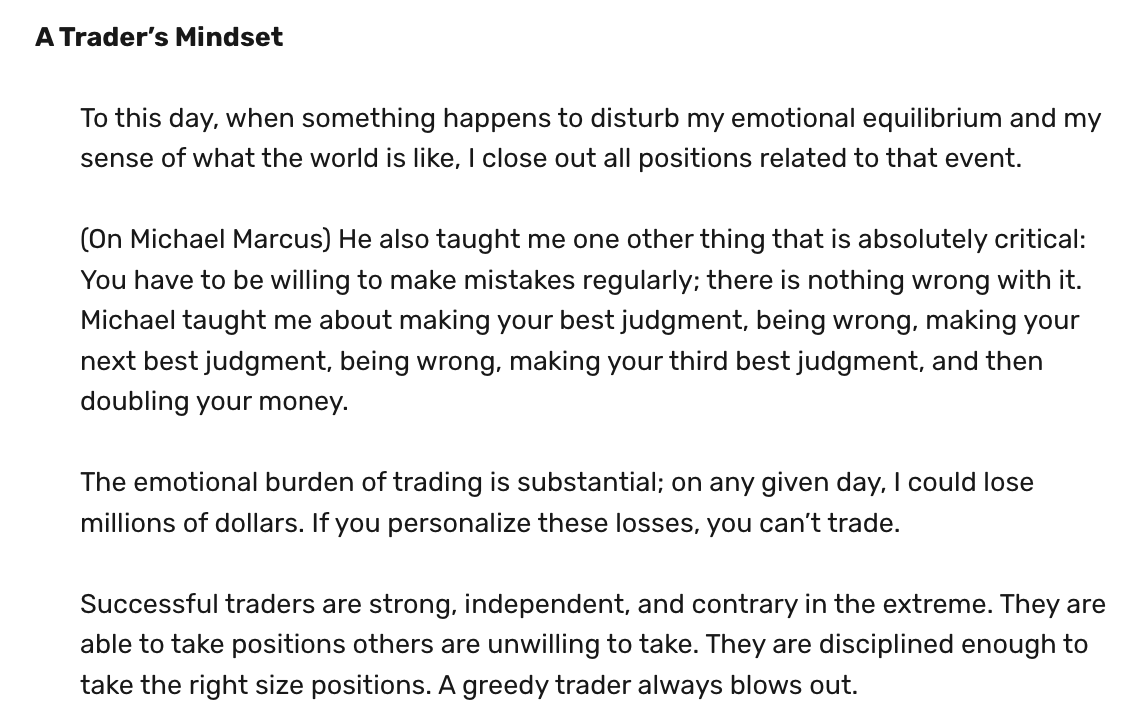

Principle 3: Have A Trader's Mindset

The Trader's Mindset is the willingness to make mistakes regularly.

Losing is part of a winning trading strategy.

Let that sink in.

You MUST lose regularly to win long-term.

"If you personalize these losses, you can't trade."

The Trader's Mindset is the willingness to make mistakes regularly.

Losing is part of a winning trading strategy.

Let that sink in.

You MUST lose regularly to win long-term.

"If you personalize these losses, you can't trade."

Principle 4: Macro Is Important

Kovner can't hold a position unless he understands why the market SHOULD move.

This means he MUST understand the macro picture to place directional bets on those macro views.

"Markets lead because there are people who know more than you do."

Kovner can't hold a position unless he understands why the market SHOULD move.

This means he MUST understand the macro picture to place directional bets on those macro views.

"Markets lead because there are people who know more than you do."

Principle 5: Master Price Action

Kovner believed in combining fundamentals with price action.

"Technical analysis is like a thermometer."

Trading markets without technicals is like a doctor that doesn't take a patient's temperature.

Stacking Edges!

macro-ops.com/conditional-ed…

Kovner believed in combining fundamentals with price action.

"Technical analysis is like a thermometer."

Trading markets without technicals is like a doctor that doesn't take a patient's temperature.

Stacking Edges!

macro-ops.com/conditional-ed…

Principle 6: Obey The Heisenberg Principle

The more closely followed a market or stock, the more prone it is to false signals (breakouts, etc.).

Find Pain Trades (how markets can hurt the most people) and Tight Congestions in stocks that "shouldn't" be breaking out.

Zag-zig.

The more closely followed a market or stock, the more prone it is to false signals (breakouts, etc.).

Find Pain Trades (how markets can hurt the most people) and Tight Congestions in stocks that "shouldn't" be breaking out.

Zag-zig.

Recap: Kovner's Six Trading Principles

1) Have The Necessary Vision

2) Risk Management is Paramount

3) Have a Trader's Mindset

4) Macro is Important

5) Master Price Action

6) Obey Heisenberg

Read more about Kovner here: macro-ops.com/lessons-from-a…

1) Have The Necessary Vision

2) Risk Management is Paramount

3) Have a Trader's Mindset

4) Macro is Important

5) Master Price Action

6) Obey Heisenberg

Read more about Kovner here: macro-ops.com/lessons-from-a…

If you enjoyed this thread, please like and RT!

It goes a long way in helping spread the content!

It goes a long way in helping spread the content!

https://twitter.com/marketplunger1/status/1597258722015051777

Here is my latest essay on Bruce Kovner.

I expanded a bit on this thread to more deeply explain Kovner's trading principles.

I hope you enjoy!

macro-ops.com/three-lessons-…

I expanded a bit on this thread to more deeply explain Kovner's trading principles.

I hope you enjoy!

macro-ops.com/three-lessons-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh