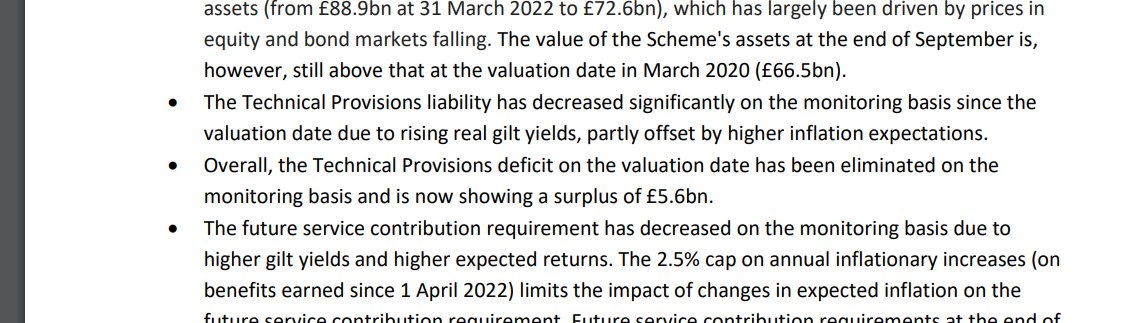

NEW: The #USS pension scheme, at the centre of an industrial disupte involving thousands of higher education sector workers, showed a £5.6bn surplus at the end of August, according to the latest scheme monitoring update.

NEW: The #USS said that a deficit (£14bn) identified in the 2020 valuation, had been "eliminated" as of the end of August with the scheme showing a £5.6bn surplus.

The controversial 2020 scheme valuation led to a range of benefit cuts for tens of thousands of #USS members.

The controversial 2020 scheme valuation led to a range of benefit cuts for tens of thousands of #USS members.

However, the #USS said market conditions had remained highly volatile since 31 March this year & as a result, the exact position of the Scheme at the end of September "cannot be established with any

certainty" with the most recent figures to be

viewed with a "degree of caution".

certainty" with the most recent figures to be

viewed with a "degree of caution".

The #UCU is pressing for recent cuts to #pension benefits to be reversed given the scheme's improving finances, but the #USS remained cautious saying the funding position remained volatile.

• • •

Missing some Tweet in this thread? You can try to

force a refresh