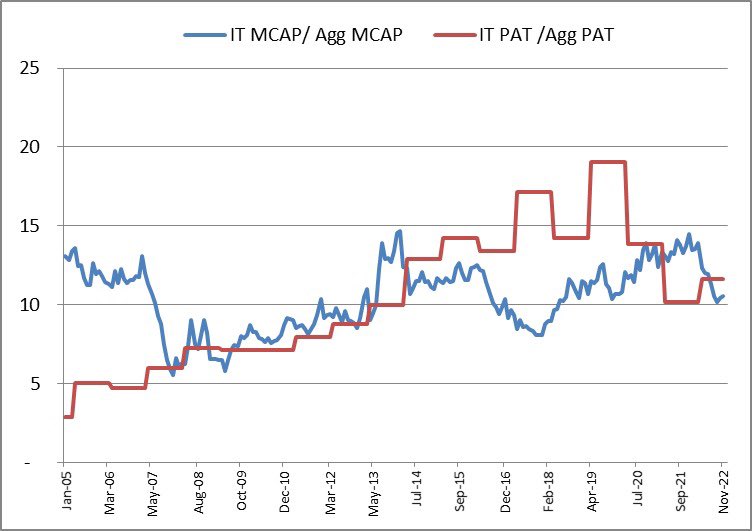

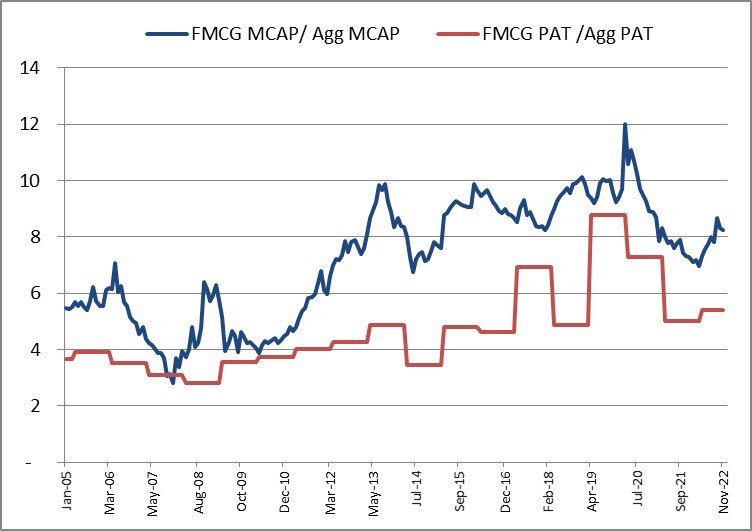

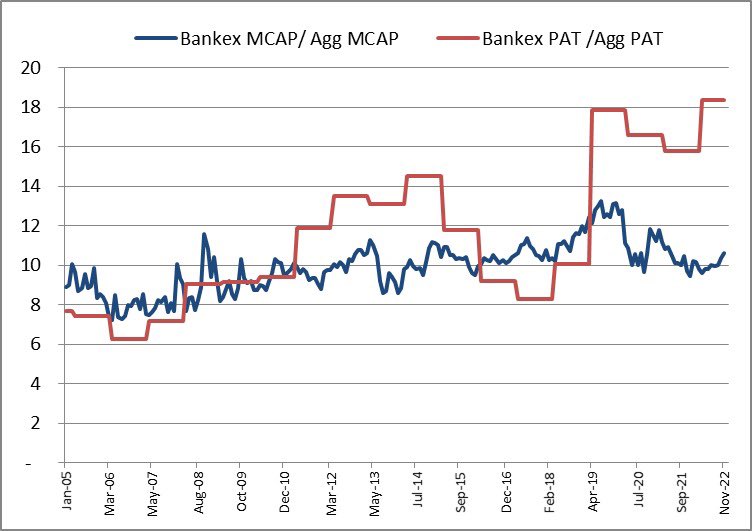

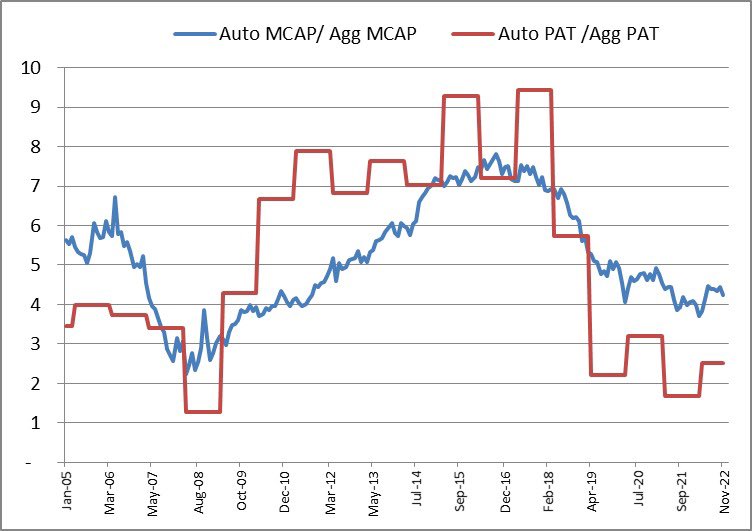

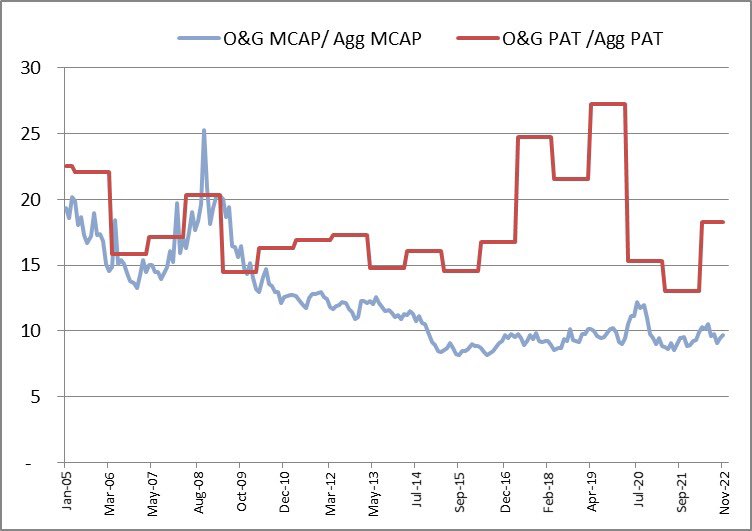

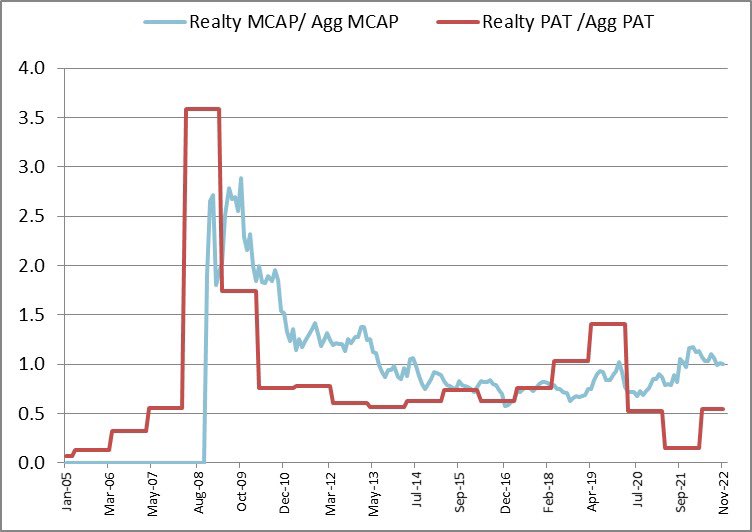

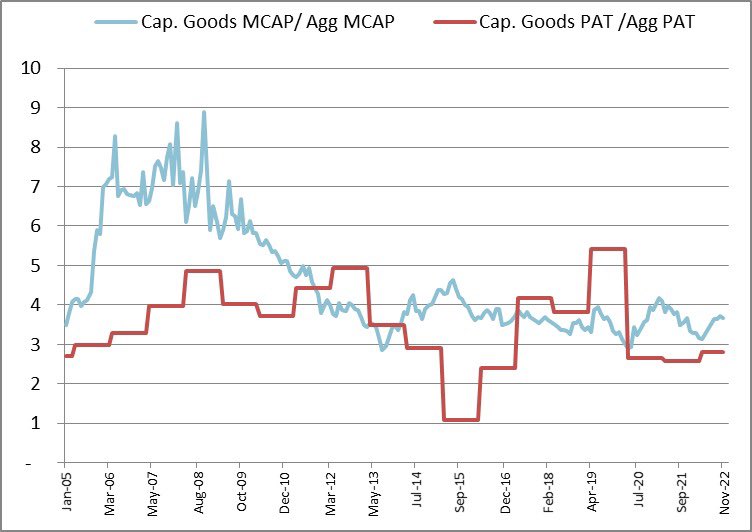

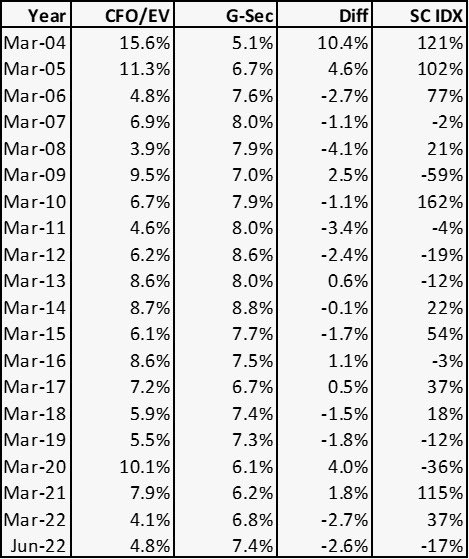

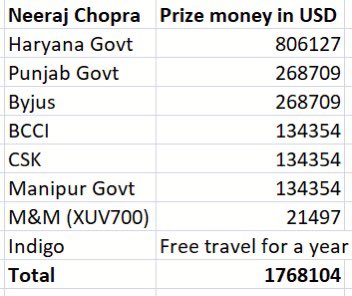

Some charts to help understand where each sector is at in terms of their aggregate profits and aggregate market cap. (1/9)

Starting with metals: does market know something that we don’t?

Starting with metals: does market know something that we don’t?

• • •

Missing some Tweet in this thread? You can try to

force a refresh