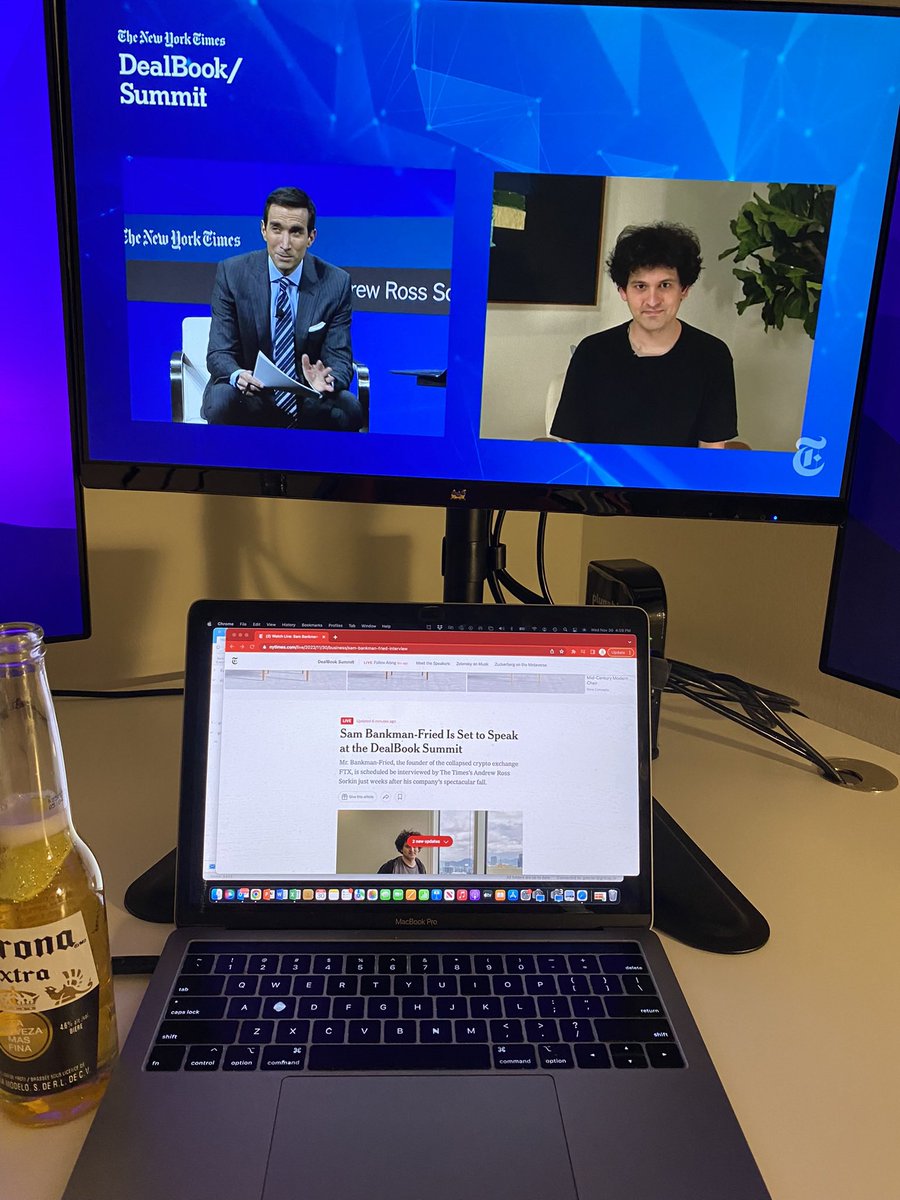

Sam Bankman-Fried is speaking live now at the New York Times DealBook Summit.

Here's what he's saying: twitter.com/i/web/status/1…

Here's what he's saying: twitter.com/i/web/status/1…

“Says he didn’t try to commit fraud”

Interviewer Andrew Sorkin read a letter from a user who lost $2 million in FTX and wants to know if Sam thinks that fraud was committed.

Sam says that FTX US "could be opened up today and every customer could be made whole"

Sam says that FTX US "could be opened up today and every customer could be made whole"

But FTX International is a different story, Sam says. He has limited access to data (since he was forced out as CEO), but he says that Alameda was using 10x leverage by the end due to the crypto market crashing.

Sorkin cuts Sam off and says "let's get back to the bigger question." He wants to know if FTX was comingling funds, and to what extent.

Where did Alameda's funds come from?

Where did Alameda's funds come from?

Sam nervously fidgets and takes a sip of a Pamplemousse flavored LaCroix before answering.

"I didn't knowingly comingle funds."

"I didn't knowingly comingle funds."

Sam emphasizes that he had little to do with Alameda and keeps referring to the fund as "them" instead of "we" (classic distancing language)

He says that he made a mistake with oversight, but doesn't know what happened besides that.

He says that he made a mistake with oversight, but doesn't know what happened besides that.

Sorkin asks about an interview Sam gave this summer where he said that FTX and Alameda are completely separate, with no shared personnel.

He also asks Sam if he still lives with members of Alameda in his penthouse

He also asks Sam if he still lives with members of Alameda in his penthouse

But Sam says he moved out of the penthouse and no longer lives there.

And he also says he tried not getting involved with oversight of Alameda because of the "conflict of interest".

And he also says he tried not getting involved with oversight of Alameda because of the "conflict of interest".

Q: "When did the comingling of assets being?"

Sam: "I think the [margin] position got substantially higher during 2022"

Sam: "I think the [margin] position got substantially higher during 2022"

Andrew keeps asking Sam a specific question about the amount of comingling of funds, when it started, who did it, etc.

Sam won't answer directly and just says that he didn't give the proper oversight.

Sam won't answer directly and just says that he didn't give the proper oversight.

Sam says that FTX and Alameda had always comingled funds, since FTX used Alameda's bank accounts when the exchange first started in 2019.

Andrew says FTX "flouted Know Your Customer laws", but Sam shoots back that customers still had to go through KYC onboarding, even if the funds weren't going directly to FTX.

Andrew asks when Sam first knew FTX had a problem.

He says November 6th (which was 5 days before they filed for bankruptcy.

"I could see a run on the bank starting...I was nervous" Sam says.

He says November 6th (which was 5 days before they filed for bankruptcy.

"I could see a run on the bank starting...I was nervous" Sam says.

Andrew asks what Sam was nervous about.

"I was nervous that it would lead to massive losses for Alameda" - Meaning that Alameda's margin trades were in danger. But he wasn't concerned about FTX at all early in November.

"I was nervous that it would lead to massive losses for Alameda" - Meaning that Alameda's margin trades were in danger. But he wasn't concerned about FTX at all early in November.

But by November 6th to 7th, Sam said he realized that FTX might also be in trouble as the comingling of funds became more clear.

Now Andrew asks about the comparisons between SBF and JP Morgan earlier this year - specifically if his deals to bail out BlockFi and others were an effort to keep the price of FTX Token (FTT) up

But Sam insists that those efforts were to help the industry as a whole, and not to keep FTX or Alameda liquid.

He says those deals had little effect on Alameda's trading positions.

He says those deals had little effect on Alameda's trading positions.

Again, Sam says he "wasn't nearly cautious enough" and didn't anticipate the extent to how correlated all of his assets were and how quickly everything could collapse.

Q: "What are your lawyers telling you right now? Do they suggest this is a good idea to be speaking?"

Audience laughs

Sam: "No, they are not...But I do have a duty to help customers out"

Audience laughs

Sam: "No, they are not...But I do have a duty to help customers out"

Q: "Are you in the Bahamas because you think you can't leave?"

Sam: "I've been in the Bahamas for the last year."

Q: "Do you think you could go to the US?"

Sam: "I think I could."

Sam: "I've been in the Bahamas for the last year."

Q: "Do you think you could go to the US?"

Sam: "I think I could."

Q: "How much are you concerned about criminally liability at this point?"

Sam stutters for a few seconds, then says that's not what he's focusing on. "There will be a time and place to think about my own future."

Sam stutters for a few seconds, then says that's not what he's focusing on. "There will be a time and place to think about my own future."

We've zeroed in on Nov. 7th being the day where "everything shifted." Before then, Sam believed everything was fine. But on that day, he worried that FTX and Alameda were in trouble.

However, he tweeted that FTX doesn't invest customer funds on that day (he later deleted it)

However, he tweeted that FTX doesn't invest customer funds on that day (he later deleted it)

Andrew asks if hundreds of millions were stolen from the exchange as FTX collapsed.

Sam says he had already been cut off from systems by then and couldn't have done it, and doesn't know who did.

Sam says he had already been cut off from systems by then and couldn't have done it, and doesn't know who did.

Sam is asked about the infamous Twitter DMs that were made public where Sam basically said that his effective altruism was a facade.

He says that he does want to help people, but he also says companies do a lot of "bullsh*t" to look good.

He says that he does want to help people, but he also says companies do a lot of "bullsh*t" to look good.

Now he's asked about his donations to the Democratic party and his lobbying efforts.

Sam says that their main effort was to get permission to offer leveraged trading products to customers in the US.

Sam says that their main effort was to get permission to offer leveraged trading products to customers in the US.

Now Sam is asked about his meeting with SEC Chairman Gary Gensler, and whether or not he felt he needed to buy his way into those meetings.

Sam said it's not about "buying" or "donating", but it's more about influence and navigating bureaucracy.

Sam said it's not about "buying" or "donating", but it's more about influence and navigating bureaucracy.

Q: "Your parents are law professors. What did you tell them when this all happened?"

Sam: "I called them and said 'I think there might be a problem here'".

Sam: "I called them and said 'I think there might be a problem here'".

Now he's asking about the infamous real estate purchases.

He says that his parent's property was "intended to be the company's property" and they just happened to stay there while they worked with the company.

He says that his parent's property was "intended to be the company's property" and they just happened to stay there while they worked with the company.

Q: "Can I ask you about the drugs?"

Sam says he had his first sip of alcohol after his 21st birthday, and he has "half a glass of alcohol a year".

He says there were no 'wild' parties or rampant drug use at FTX.

Sam says he had his first sip of alcohol after his 21st birthday, and he has "half a glass of alcohol a year".

He says there were no 'wild' parties or rampant drug use at FTX.

Q: "What do you see as your future?"

Sam: "I don't know what my future is...A lot of it's not in my hands at this point. I want to helpful to regulators to help FTX customers."

Sam: "I don't know what my future is...A lot of it's not in my hands at this point. I want to helpful to regulators to help FTX customers."

Sam's feed just cut out in the middle of a sentence.

And he's back to defend his company's lack of a Board of Directors.

But he says "we actually had to many boards." There was a board for FTX Japan, FTX Singapore, and about 10 others.

But there was no one board in charge.

But he says "we actually had to many boards." There was a board for FTX Japan, FTX Singapore, and about 10 others.

But there was no one board in charge.

Q: "How much money do you have left?"

Sam: "Close to nothing...I put everything in the company"

Sam: "Close to nothing...I put everything in the company"

He adds that he has "no hidden funds or anything like that." Just one credit card and $100,000 in a bank account.

Last question: "Do you agree that over time, you lied?"

Sam repeats the question back to himself, then says he was "acting as a marketer for FTX". Not sure what that means, but that none answer is a good summary of this interview!

Sam repeats the question back to himself, then says he was "acting as a marketer for FTX". Not sure what that means, but that none answer is a good summary of this interview!

Want more?

Subscribe to GRIT.

We will tell you what CNBC won’t.

gritcapital.substack.com/?showWelcome=t…

Subscribe to GRIT.

We will tell you what CNBC won’t.

gritcapital.substack.com/?showWelcome=t…

• • •

Missing some Tweet in this thread? You can try to

force a refresh