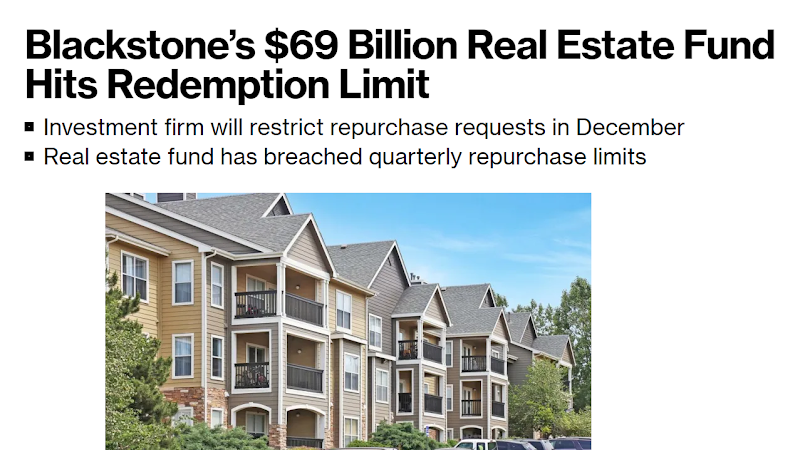

Blackstone’s $69 billion real estate fund announced today that it’s limiting redemptions.

This is a scary sign for the real estate market.

Let’s dive in 🧵

This is a scary sign for the real estate market.

Let’s dive in 🧵

Blackstone Real Estate Income Trust (BREIT) is a real estate investment trust that invests in apartments, industrial, retail, and hotels.

It’s one of the largest real estate funds in the world, even though it only started in 2016.

It’s one of the largest real estate funds in the world, even though it only started in 2016.

The fund is only sold to wealthy investors through select financial advisers and isn’t available to the general public.

Their website says that 3-year annualized returns are 15.5% with a 4.4% distribution rate.

Their website says that 3-year annualized returns are 15.5% with a 4.4% distribution rate.

So what’s going on with the fund now?

This week, Blackstone announced the fund had hit its quarterly withdrawal limit.

Too many investors are trying to pull their money out at once.

This week, Blackstone announced the fund had hit its quarterly withdrawal limit.

Too many investors are trying to pull their money out at once.

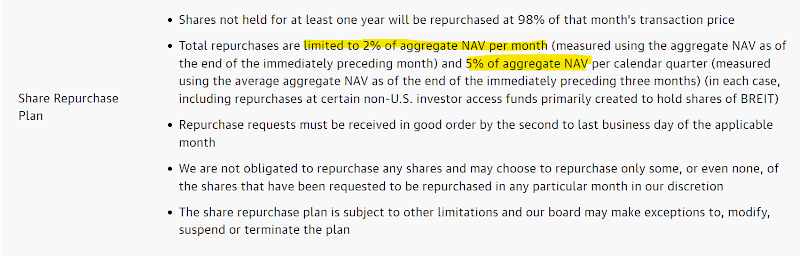

Blackstone is able to limit withdrawals to avoid having to liquidate real estate assets suddenly.

The limits are 2% of NAV monthly or 5% quarterly.

The quarterly limit has now been exceeded, so Blackstone can limit how much money investors are able to pull out.

The limits are 2% of NAV monthly or 5% quarterly.

The quarterly limit has now been exceeded, so Blackstone can limit how much money investors are able to pull out.

Blackstone shares are down about 7% on this news.

Coincidentally, BREIT accounts for about 7% of Blackstone’s assets under management.

So what’s the market worried about?

Redemptions aren’t the problem. Blackstone can limit those to avoid a “run on the bank” scenario.

Coincidentally, BREIT accounts for about 7% of Blackstone’s assets under management.

So what’s the market worried about?

Redemptions aren’t the problem. Blackstone can limit those to avoid a “run on the bank” scenario.

But the redemption limit being hit could be a sign that the fund’s performance is in trouble.

Investors are nervous that others are pulling their money out because the fund won’t do well going forward.

Investors are nervous that others are pulling their money out because the fund won’t do well going forward.

But could the fund be in serious trouble?

The cost to borrow has obviously risen this year, so the fund won’t be able to aggressively purchase apartments and industrial buildings like it has over the past 5 years.

The cost to borrow has obviously risen this year, so the fund won’t be able to aggressively purchase apartments and industrial buildings like it has over the past 5 years.

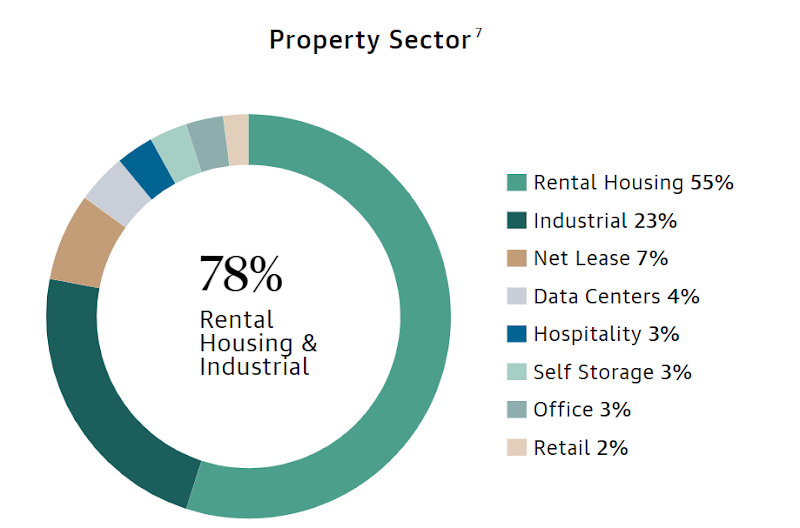

A majority of the fund is in apartments (about 55%)

The housing market is slowing down, which we’ve known for several months.

Here’s how the fund is invested:

The housing market is slowing down, which we’ve known for several months.

Here’s how the fund is invested:

There’s one other factor to consider here: Blackstone doesn’t just make money from the performance of the fund.

They also make a management fee of 1.25% per year, paid monthly.

Even if the fund returns zero, Blackstone gets about $862 million a year for running the fund.

They also make a management fee of 1.25% per year, paid monthly.

Even if the fund returns zero, Blackstone gets about $862 million a year for running the fund.

Every redemption lowers the fee that Blackstone collects for managing the fund.

They also collect 12.5% of the returns, with a 5% hurdle.

Blackstone’s stock is down because both the management and the performance fees are expected to be lower.

They also collect 12.5% of the returns, with a 5% hurdle.

Blackstone’s stock is down because both the management and the performance fees are expected to be lower.

Blackstone’s redemption limit being hit is a definitive sign that the real estate market is slowing, and the outlook for real estate investing is not good.

I’ll keep following the story and keep you updated on what happens.

I’ll keep following the story and keep you updated on what happens.

• • •

Missing some Tweet in this thread? You can try to

force a refresh