Price + Open Interest (OI) + Volume = Deadly Combo

There are many tools for Open Interest. Options Decoder from @TrueData2 is one of the simple yet powerful tools on options and OI.

Below are the 10 Powerful Features of Options Decoder

Thread 🧵🧵

(1/N)

There are many tools for Open Interest. Options Decoder from @TrueData2 is one of the simple yet powerful tools on options and OI.

Below are the 10 Powerful Features of Options Decoder

Thread 🧵🧵

(1/N)

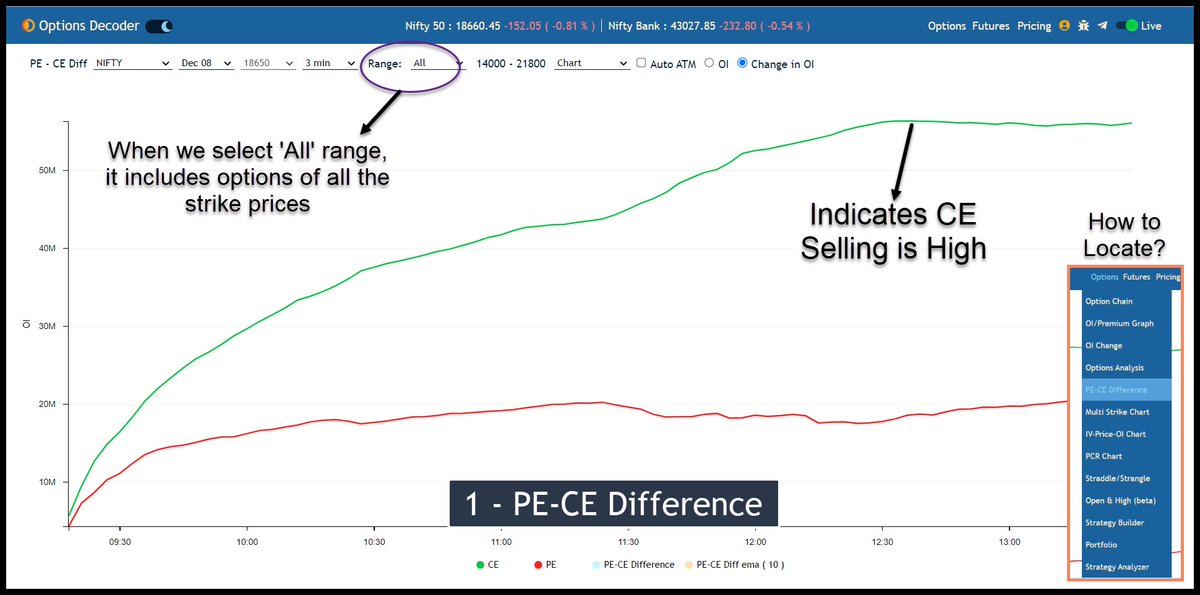

#1 - PE CE Difference

This feature combines the OI of call options and put options and plots against each other.

At one glance, we can know what big players are doing!

(If they are selling more CE means, they are bearish on the underlying instrument)

(2/N)

This feature combines the OI of call options and put options and plots against each other.

At one glance, we can know what big players are doing!

(If they are selling more CE means, they are bearish on the underlying instrument)

(2/N)

#2 - Advance/Decline

This feature displays all the F&O stocks in one place.

In one click, we can see the stocks in any order (like an increase in price, increase in OI, or decrease in volume, etc).

A highly useful feature for options traders!

(3/N)

This feature displays all the F&O stocks in one place.

In one click, we can see the stocks in any order (like an increase in price, increase in OI, or decrease in volume, etc).

A highly useful feature for options traders!

(3/N)

#3 - Open High

This feature displays all the strike prices that have an open high (or open low) for the selected instrument.

If many CE strikes show "Open Low", then the market is bullish!

(4/N)

This feature displays all the strike prices that have an open high (or open low) for the selected instrument.

If many CE strikes show "Open Low", then the market is bullish!

(4/N)

#4 - IV Price-OI Chart

This feature plots CE and PE vs. Open Interest (OI) for the ATM strike price.

Always Remember:

CE Long Build Up + PE Short Build Up = BULLISH

PE Long Build Up + CE Short Build Up = BEARISH

CE Short Build Up + PE Short Build Up = SIDEWAYS

(5/N)

This feature plots CE and PE vs. Open Interest (OI) for the ATM strike price.

Always Remember:

CE Long Build Up + PE Short Build Up = BULLISH

PE Long Build Up + CE Short Build Up = BEARISH

CE Short Build Up + PE Short Build Up = SIDEWAYS

(5/N)

#5 - Future Analysis

This feature provides the future price and open interest interpretation (like long buildup, short buildup, long unwinding, etc)

(6/N)

This feature provides the future price and open interest interpretation (like long buildup, short buildup, long unwinding, etc)

(6/N)

#6 - Future Chart

This feature plots future prices along with VWAP and OI Change.

A highly beneficial feature for intraday traders!

(7/N) #trading

This feature plots future prices along with VWAP and OI Change.

A highly beneficial feature for intraday traders!

(7/N) #trading

#7 - Options Chain

Traders don't need any introduction for this feature.

It provides all the options greeks info along with OI and volume here.

(8/N) #OptionsTrading

Traders don't need any introduction for this feature.

It provides all the options greeks info along with OI and volume here.

(8/N) #OptionsTrading

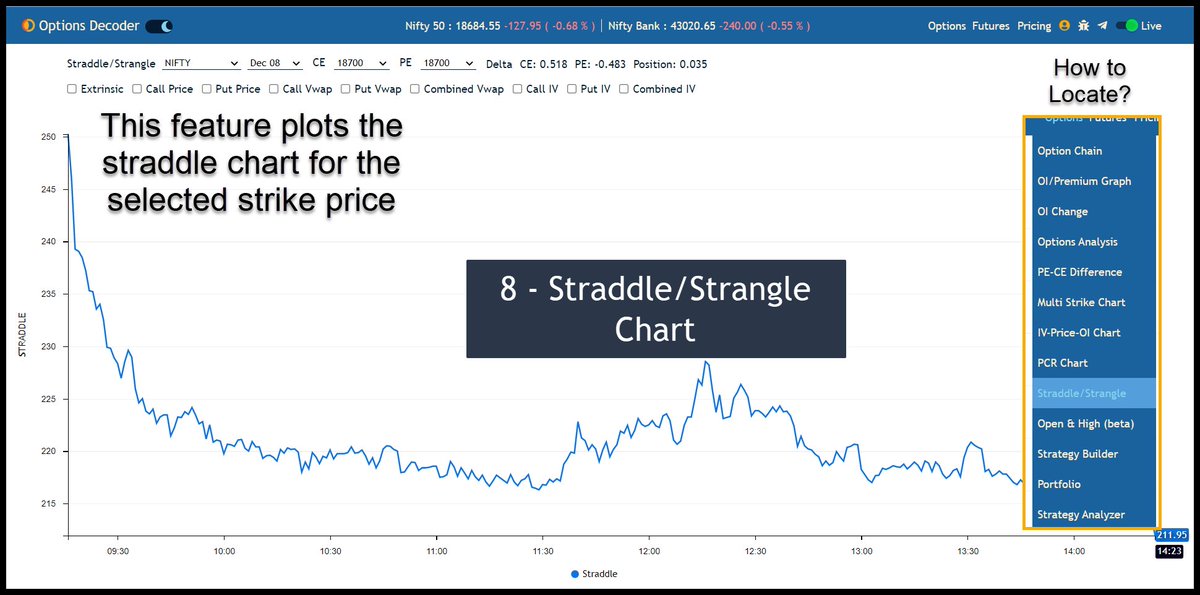

#8 - Straddle/Strangle Chart

Nowadays, most options traders deploy either a straddle or strangle strategy as part of their trading.

This is beneficial for them!

(9/N) #Straddle

Nowadays, most options traders deploy either a straddle or strangle strategy as part of their trading.

This is beneficial for them!

(9/N) #Straddle

#9 - OI Premium Graph

This feature plots cumulative OI and Change in OI for the selected instrument.

Highly beneficial for both option buyers and option sellers!

(10/N)

This feature plots cumulative OI and Change in OI for the selected instrument.

Highly beneficial for both option buyers and option sellers!

(10/N)

#10 - Weekly/Monthly OI

This feature explains price-open interest interpretation on a weekly/monthly basis.

(11/N)

This feature explains price-open interest interpretation on a weekly/monthly basis.

(11/N)

If you are new to open interest (OI), then read this article to learn how to use it in intraday/options trading.

profiletraders.in/post/the-power…

(12/N)

profiletraders.in/post/the-power…

(12/N)

If you like this useful information, please #retweet and share it with your friends 😃😃

Follow me

@indraziths

You can also read my book on Intraday Trading.

amzn.to/3ulWncu

Follow me

@indraziths

You can also read my book on Intraday Trading.

amzn.to/3ulWncu

• • •

Missing some Tweet in this thread? You can try to

force a refresh