#Moldtekpackeging

Small Cap Consistent Compounder ?

Detailed Thread 🧵🧵

Like & Retweet for Better reach !

CMP - ₹ 900

Small Cap Consistent Compounder ?

Detailed Thread 🧵🧵

Like & Retweet for Better reach !

CMP - ₹ 900

1. Company Overview

Mold-tek packaging is established in 1985 and it is one of the leading player in the rigid packaging industry in India

Mold-tek was the first company in India to launch

In Mould Labelling (IML) technology in FY 2011

Mold-tek packaging is established in 1985 and it is one of the leading player in the rigid packaging industry in India

Mold-tek was the first company in India to launch

In Mould Labelling (IML) technology in FY 2011

Mold-tek make their own molds, labels and robots

The company has blue chip clientele such as Asian Paints, Akzo Nobel, Kansai Nerolac, Castrol, Shell, BPCL, Cadbury, Amul and HUL

The company has blue chip clientele such as Asian Paints, Akzo Nobel, Kansai Nerolac, Castrol, Shell, BPCL, Cadbury, Amul and HUL

2. Industry Overview

The global packaging market valued at $ 1002 Bn in 2021 and is expected to reach $ 1275 Bn by 2027 with a growth of 4% CAGR

Global rigid packaging market is valued at $187 Bn in 2020 and is expected to reach $ 270.6 Bn by 2028 with a growth of 4.7%

The global packaging market valued at $ 1002 Bn in 2021 and is expected to reach $ 1275 Bn by 2027 with a growth of 4% CAGR

Global rigid packaging market is valued at $187 Bn in 2020 and is expected to reach $ 270.6 Bn by 2028 with a growth of 4.7%

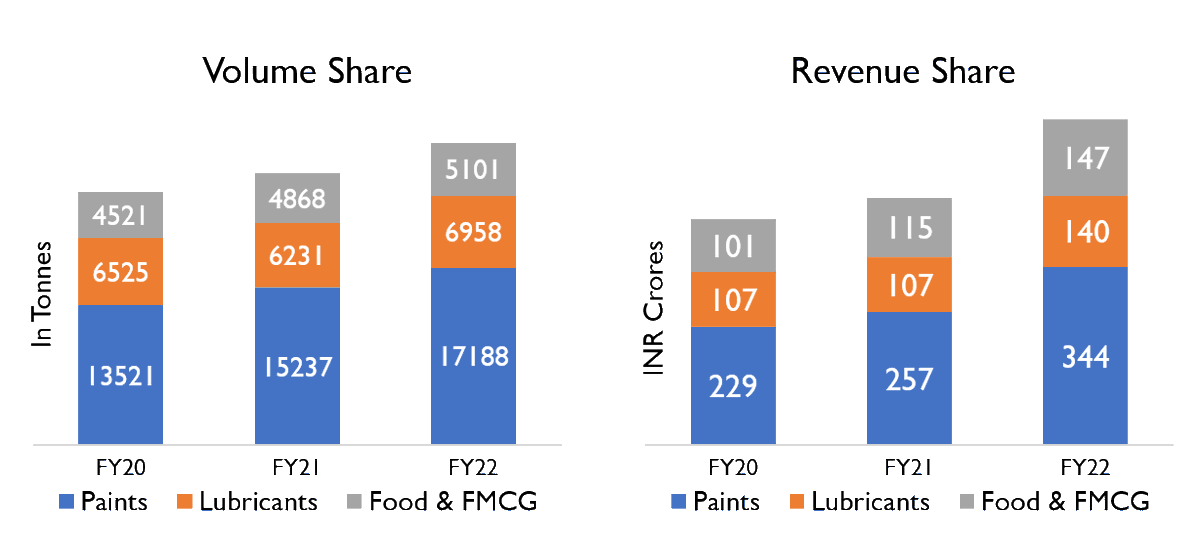

3. Business Segments

Company has 3 business segments :

○Paints

○Lubricants

○Food & FMCG

Both for Paints and Lubricants segments the company manufactures pails, which is nothing but a bucket

Company has 3 business segments :

○Paints

○Lubricants

○Food & FMCG

Both for Paints and Lubricants segments the company manufactures pails, which is nothing but a bucket

Food & FMCG is completely IML but in Paints and Lubricants there is a mix of IML and Non IML (HTL, Screen printing etc.)

IML revenue share in FY22 is 67% as against 65% last year, and it is more or less stagnating

IML volume share in FY22 is 63% as against 61% last year

IML revenue share in FY22 is 67% as against 65% last year, and it is more or less stagnating

IML volume share in FY22 is 63% as against 61% last year

4. In Mould Labelling

IML is a process where Label is put inside the mold into which hot plastic is injected. IML Label have a heat activated adhesive applied to them which gets activated when molten plastic is injected.

IML is a process where Label is put inside the mold into which hot plastic is injected. IML Label have a heat activated adhesive applied to them which gets activated when molten plastic is injected.

After cooling, The label becomes molded on to the container’s surface

In Mould Labelling process eliminates the post-labelling operation which saves both time and labour, because of this it is suitable for mass production.

In Mould Label also gives Photographic Quality

In Mould Labelling process eliminates the post-labelling operation which saves both time and labour, because of this it is suitable for mass production.

In Mould Label also gives Photographic Quality

5. Paints and Lubricants

Paints segment contribute majority of the revenues, The contribution of paints to the revenues for the past 3 years is as follows

○FY22 - 54.5%

○FY21 - 53.5%

○FY20 - 52.5%

Paints segment contribute majority of the revenues, The contribution of paints to the revenues for the past 3 years is as follows

○FY22 - 54.5%

○FY21 - 53.5%

○FY20 - 52.5%

Asian paints is the largest client for the company, which contributes to 25% of total sales

Under Lubricants, recently the company has launched pails for Diesel Exhaust Fluid (DEF) and bagged orders from players like Gulf Oil, Valvoline Cummins, Apar etc

Under Lubricants, recently the company has launched pails for Diesel Exhaust Fluid (DEF) and bagged orders from players like Gulf Oil, Valvoline Cummins, Apar etc

6. Food & FMCG

The company has two divisions in this segment

○Q packs

○Non Q packs

Q packs or Square packs which are mainly used for edible oil packaging, but recently it’s applications are increasing viz detergents, tea, protein powder and micronutrients

The company has two divisions in this segment

○Q packs

○Non Q packs

Q packs or Square packs which are mainly used for edible oil packaging, but recently it’s applications are increasing viz detergents, tea, protein powder and micronutrients

Q packs provide excellent tamper evidence and it is very easily removable pack

Non Q pack have products such as containers for chocolates, ice creams, sweet boxes, coffee cups and heat sealable products

Non Q pack have products such as containers for chocolates, ice creams, sweet boxes, coffee cups and heat sealable products

Food & FMCG containers are thin walled when compared to pails for Paints and Lubricants

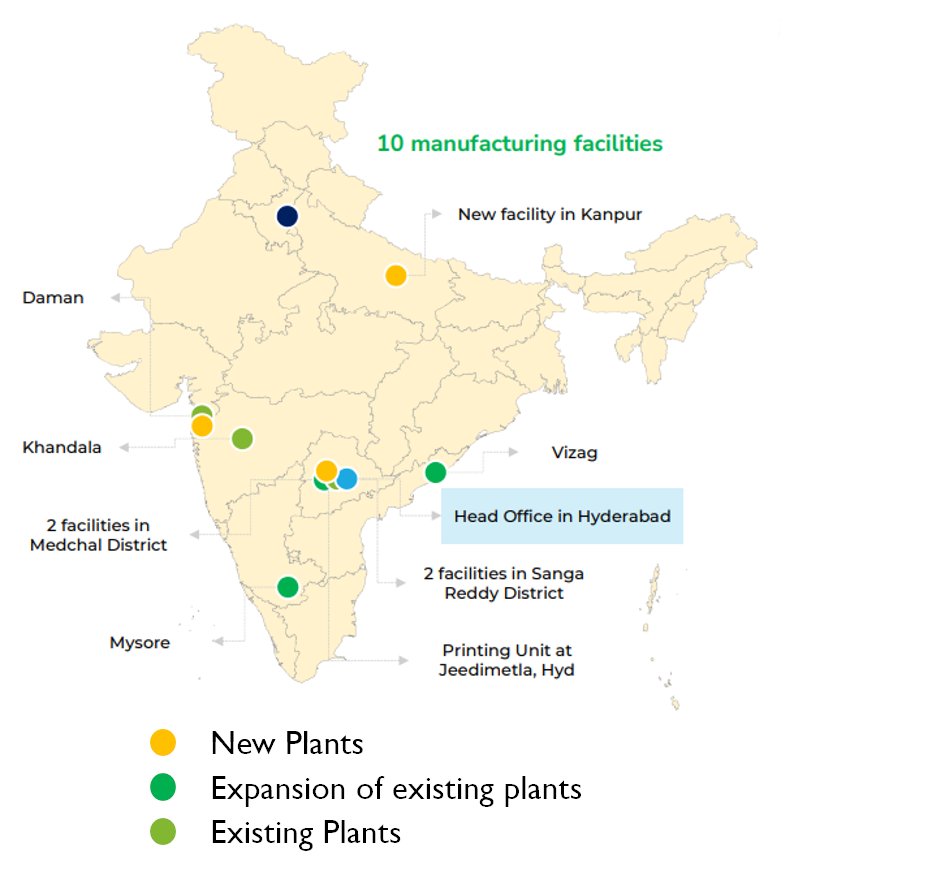

7. Manufacturing Facilities

Currently the company has 10 manufacturing facilities across India and the current installed capacity is of 45,000 Tonnes per annum

7. Manufacturing Facilities

Currently the company has 10 manufacturing facilities across India and the current installed capacity is of 45,000 Tonnes per annum

All the machines are fungible, e.g if food demand drops they can make paint containers on the same machines by changing molds

The molds only cost around 15% of total project, so incase of demand fall in a particular segment, wastage is minimal

The molds only cost around 15% of total project, so incase of demand fall in a particular segment, wastage is minimal

8. Raw materials

The company uses Polypropylene Copolymer as raw materials which is made from Crude Oil

Mold-tek procures raw materials from Reliance (75 to 80%) and IOCL (15 to 20%),company procures 95% of raw materials domestically and the remaining 5% they import from Europe

The company uses Polypropylene Copolymer as raw materials which is made from Crude Oil

Mold-tek procures raw materials from Reliance (75 to 80%) and IOCL (15 to 20%),company procures 95% of raw materials domestically and the remaining 5% they import from Europe

Company always pass the change in raw materials to their customers on a monthly basis

9. Unique Selling Point of Mold-tek

i) Backward Integration : It is one of the few Indian companies which make their own molds, labels and robots.

9. Unique Selling Point of Mold-tek

i) Backward Integration : It is one of the few Indian companies which make their own molds, labels and robots.

Which gives them significant cost advantage over its competitors who import one or all of them

ii) Deep rooted Customer relationships : Track record of quality and reliability of supply which has helped it become one of the preferred supplier for the leading companies

ii) Deep rooted Customer relationships : Track record of quality and reliability of supply which has helped it become one of the preferred supplier for the leading companies

in Paints, Lubes and Food & FMCG

iii) Company also has received the green channel clearance from Asian Paints & Reckitt Benckiser. Green channel clearance means supplied products would not be quality checked they will directly go into manufacturing lines for further processing

iii) Company also has received the green channel clearance from Asian Paints & Reckitt Benckiser. Green channel clearance means supplied products would not be quality checked they will directly go into manufacturing lines for further processing

3.Innovation in Packaging and Widening Product range : Launching new, innovative, value added products in both existing and new industries by collaborating with companies to make company specific products

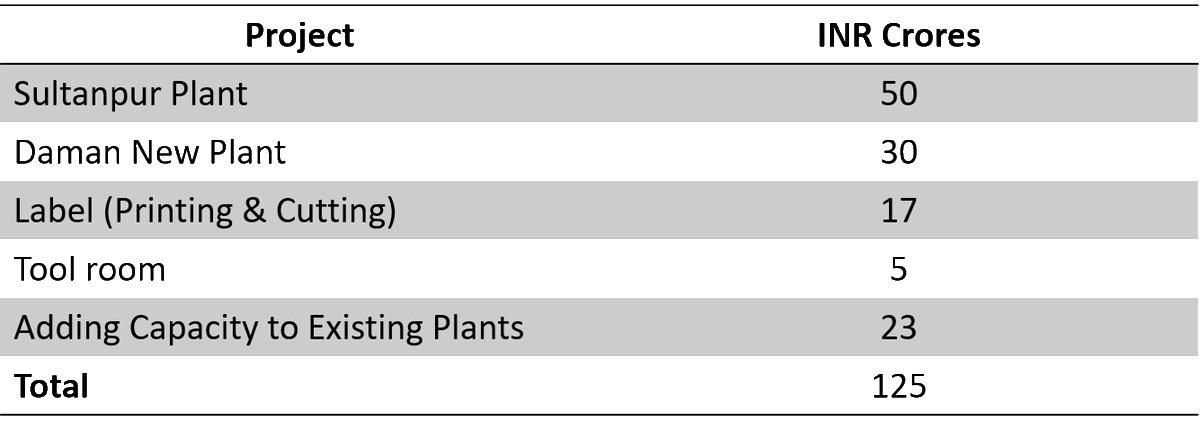

10. Upcoming Capex

At the time of time of QIP i.e Dec 2022, the company has announced Capex plans of 250 Crores in next 2.5 to 3 years

The company has raised 103.6 Crores with QIP

FY23 capex is 125 Crores, which is 2½ times the average of past 5 years capex

At the time of time of QIP i.e Dec 2022, the company has announced Capex plans of 250 Crores in next 2.5 to 3 years

The company has raised 103.6 Crores with QIP

FY23 capex is 125 Crores, which is 2½ times the average of past 5 years capex

After completion of capex for FY23, the company capacity will become 54,000 Tonnes from the existing 44,000 Tonnes

Detailed capex plan for FY23 is given in the image

Detailed capex plan for FY23 is given in the image

11. Future Growth Engines

The company is entering into Injection Blow Molding (IBM)

Capacity for IBM is being constructed at sultanpur, telangana

Primarily IBM facility is for manufacturing of pharma products because of high margins, which is shown in the image

The company is entering into Injection Blow Molding (IBM)

Capacity for IBM is being constructed at sultanpur, telangana

Primarily IBM facility is for manufacturing of pharma products because of high margins, which is shown in the image

Pumps for sanitizers, shampoos : Wipro is the largest client in this segment, In Pumps company have 66% gross margins

Currently pumps are used in sanitizers but the company is planning to use them in other consumer products like shampoos and sprays as well

Currently pumps are used in sanitizers but the company is planning to use them in other consumer products like shampoos and sprays as well

Third, QR Coded IML which was developed by the company in FY21 - Mold tek supplies each container with 2 unique QR codes, one on the surface and another under peel off. Surface QR code provides tracing & tracking information while beneath QR code gives loyalty benefits

such as cashback when the end customer scans it

Recently the company has received a letter from Grasim Industries Limited (Birla paints division) for supplying pails, accordingly a co-located plant will be set by the company at panipat,

(Continued..)

Recently the company has received a letter from Grasim Industries Limited (Birla paints division) for supplying pails, accordingly a co-located plant will be set by the company at panipat,

(Continued..)

this requires a capex of 30 crores which is expected to be operational by the end of CY 2023

12. Financials

Revenues - INR 631 Crores (31% YoY growth)

EBITDA - INR 122 Crores (28% YoY growth)

ROCE - 23%

Debt to equity ratio - 0.08

12. Financials

Revenues - INR 631 Crores (31% YoY growth)

EBITDA - INR 122 Crores (28% YoY growth)

ROCE - 23%

Debt to equity ratio - 0.08

Join Micro Cap Club to know about Unidentified micro cap companies which are current at their growth stage

valueeducator.com/micro-cap-club/

valueeducator.com/micro-cap-club/

• • •

Missing some Tweet in this thread? You can try to

force a refresh