Impermanent Loss(IL) is major problem for AMM model Dex currently. At the situation that defi and whole blockchain are gradually being accepted. more ideas comes from both new Dex and famous Dex to handle IL.

A thread to find out how they solve potential IL problems

A thread to find out how they solve potential IL problems

(1)

First let me explain what is AMM and why Impermanent loss will happened

Automated market makers (AMM) allow users trades tokens in a automatic way, and all trades happened on Liquidity Pool. In the pool, the price is determined by a mathematical formula.

First let me explain what is AMM and why Impermanent loss will happened

Automated market makers (AMM) allow users trades tokens in a automatic way, and all trades happened on Liquidity Pool. In the pool, the price is determined by a mathematical formula.

(2)

For example @Uniswap using "x*y = k" in their token pool,and other formula also being use like "x+y=k" which aims to provide zero price impact trade for users.

For liquidity pool, we need liquidity provides to provides liquidity, and Impermanent loss mainly happened on LP

For example @Uniswap using "x*y = k" in their token pool,and other formula also being use like "x+y=k" which aims to provide zero price impact trade for users.

For liquidity pool, we need liquidity provides to provides liquidity, and Impermanent loss mainly happened on LP

(3)

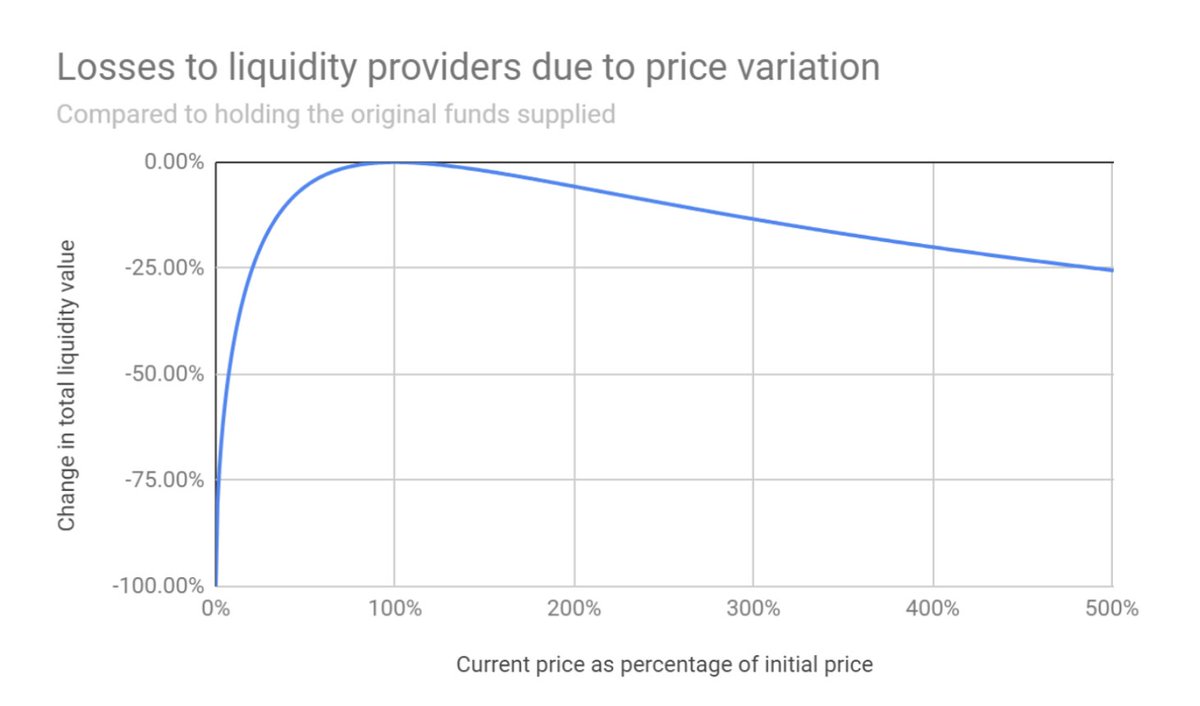

So why Impermanent Loss will happened?

If LPs provide liquidity to pool and the relative price of token change during the time of deposit and compare it with their initial prices. The loss will happened. The price gap bigger it is, and more losses for LPs

So why Impermanent Loss will happened?

If LPs provide liquidity to pool and the relative price of token change during the time of deposit and compare it with their initial prices. The loss will happened. The price gap bigger it is, and more losses for LPs

(4)

Impermanent loss seems inevitable for Liquidity Provides.

As Liquidity Provides, they earning trading fees as rewards. So the key is to hedge potential loss and guarantee LPs profits in the long run.

Impermanent loss seems inevitable for Liquidity Provides.

As Liquidity Provides, they earning trading fees as rewards. So the key is to hedge potential loss and guarantee LPs profits in the long run.

(5)

Several protocols applied two formula in the pool.

for example, @CamelotDEX using x*y = k for volatile pairs and using x3y+y3x=k (3 as upper index) for stablecoin. while curve using linear exchange rate and become parabolic only once liquidity pool is pushed to its limits

Several protocols applied two formula in the pool.

for example, @CamelotDEX using x*y = k for volatile pairs and using x3y+y3x=k (3 as upper index) for stablecoin. while curve using linear exchange rate and become parabolic only once liquidity pool is pushed to its limits

(6)

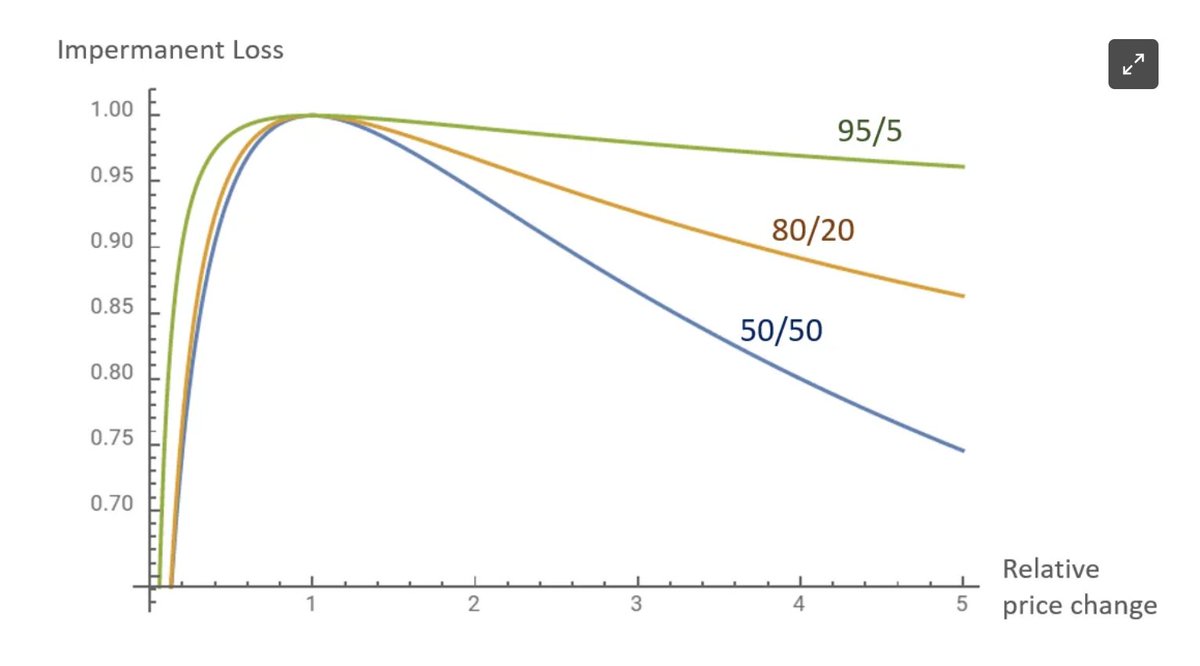

Some famous Dex has found the problem of Impermanent loss.

@Balancer is one of them by introducing flexible Liquidity Pool Ratio, which allow LP deposit assets with customise ratio.

If you choose providing more stables for pool then less IL while obvious with less rewards

Some famous Dex has found the problem of Impermanent loss.

@Balancer is one of them by introducing flexible Liquidity Pool Ratio, which allow LP deposit assets with customise ratio.

If you choose providing more stables for pool then less IL while obvious with less rewards

(7)

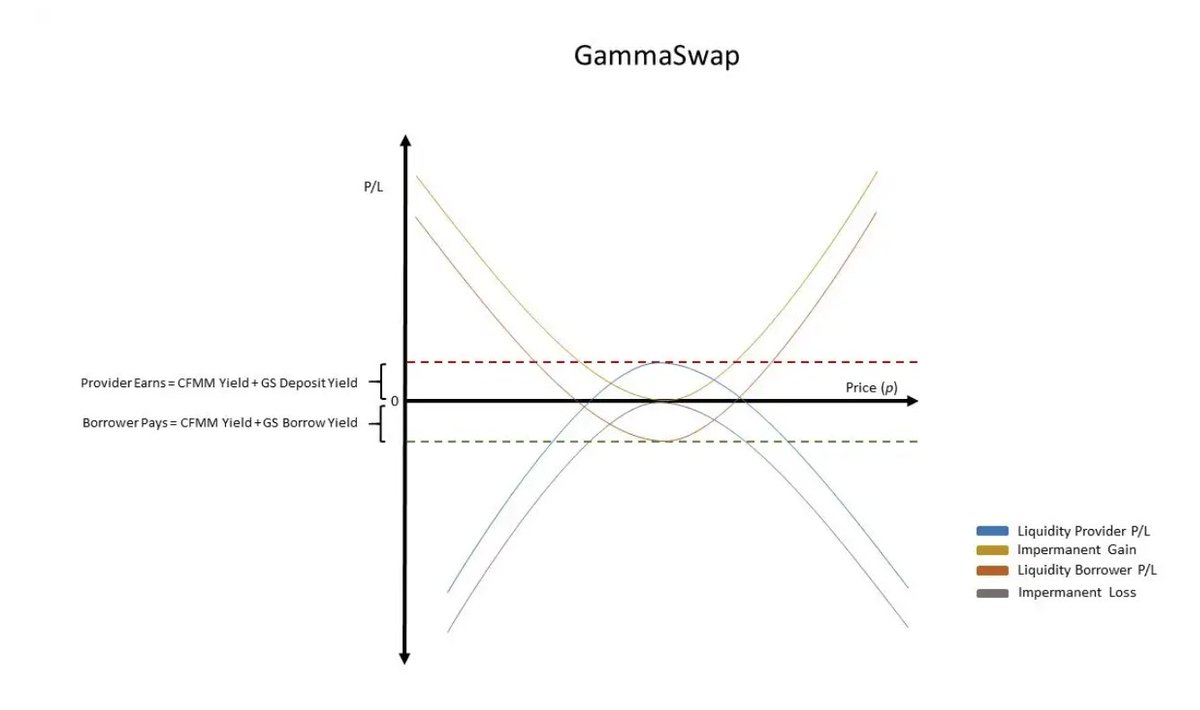

Trading volume is good for LPs while volatility is harmful for LPs.

@GammaSwapLabs has wonderful idea by using loans,vaults,synthetic call and puts which allow users to take the opposite side of the liquidity provision trade and turn impermanent loss into impermanent gain.

Trading volume is good for LPs while volatility is harmful for LPs.

@GammaSwapLabs has wonderful idea by using loans,vaults,synthetic call and puts which allow users to take the opposite side of the liquidity provision trade and turn impermanent loss into impermanent gain.

(8)

Currently, lots of Dex will choose to concentrates liquidity for trading pair to achieve zero price impact.

At this situation, it will amplify LPs’ gains and IL.

With more attention on #Defi we will see more innovation in order to hedge IL problems

Currently, lots of Dex will choose to concentrates liquidity for trading pair to achieve zero price impact.

At this situation, it will amplify LPs’ gains and IL.

With more attention on #Defi we will see more innovation in order to hedge IL problems

(9)

Hope you guys enjoy the content, pls RT,like and follow me

some mentions

@rektdiomedes

@DAdvisoor

@defiprincess_

@defipleb

@TheDeFISaint

@Only1temmy

@zerototom

@defi_mochi

@DeFiMinty

@crypto_linn

@WinterSoldierxz

@CryptoShiro_

@kindahangry

Hope you guys enjoy the content, pls RT,like and follow me

some mentions

@rektdiomedes

@DAdvisoor

@defiprincess_

@defipleb

@TheDeFISaint

@Only1temmy

@zerototom

@defi_mochi

@DeFiMinty

@crypto_linn

@WinterSoldierxz

@CryptoShiro_

@kindahangry

• • •

Missing some Tweet in this thread? You can try to

force a refresh