1/ FT report today that gas demand has fallen. But in reality this is just the beginning of Europe’s coming deindustrialisation. Short 🧵.

2/ The paper notes that most of the decline in use is due to industry paring back. With prices so high, gas usage is disincentivised.

3/ This is reflected in the PMI which started to go negative (>50) in the summer months, at the same time as the FT chart shows gas usage falling below normal levels. With high gas prices, producing goods in Europe stopped making economic sense.

4/ And the paper notes what many of us have been saying for some time: this isn’t a single year crisis. If something doesn’t change, this will be ongoing for years and European industry will cease to exist. The continent will be impoverished.

5/ Recently Russia has confirmed it will not sell oil to countries engaged in the price cap. Russian oil makes up 20-30% of European supply. Unless something changes layer oil shortages on top of deindustrialisation. This will mean major supply chain breakdowns and shortages.

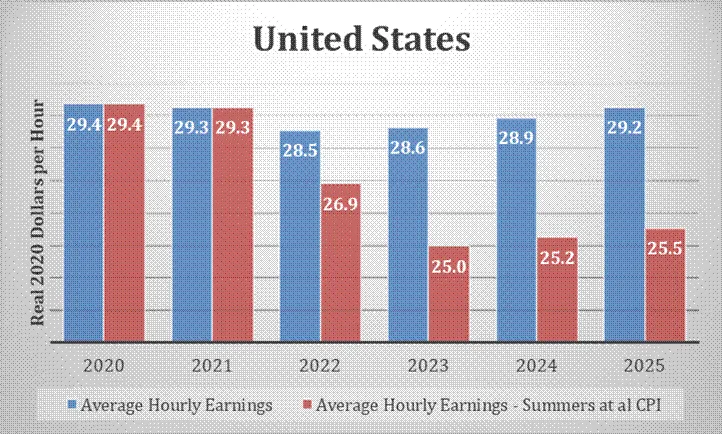

6/ British business groups are already warning of a ‘lost decade’. Unless something changes on the energy front what that really means is a sharp fall in living standards and possibly a depression.

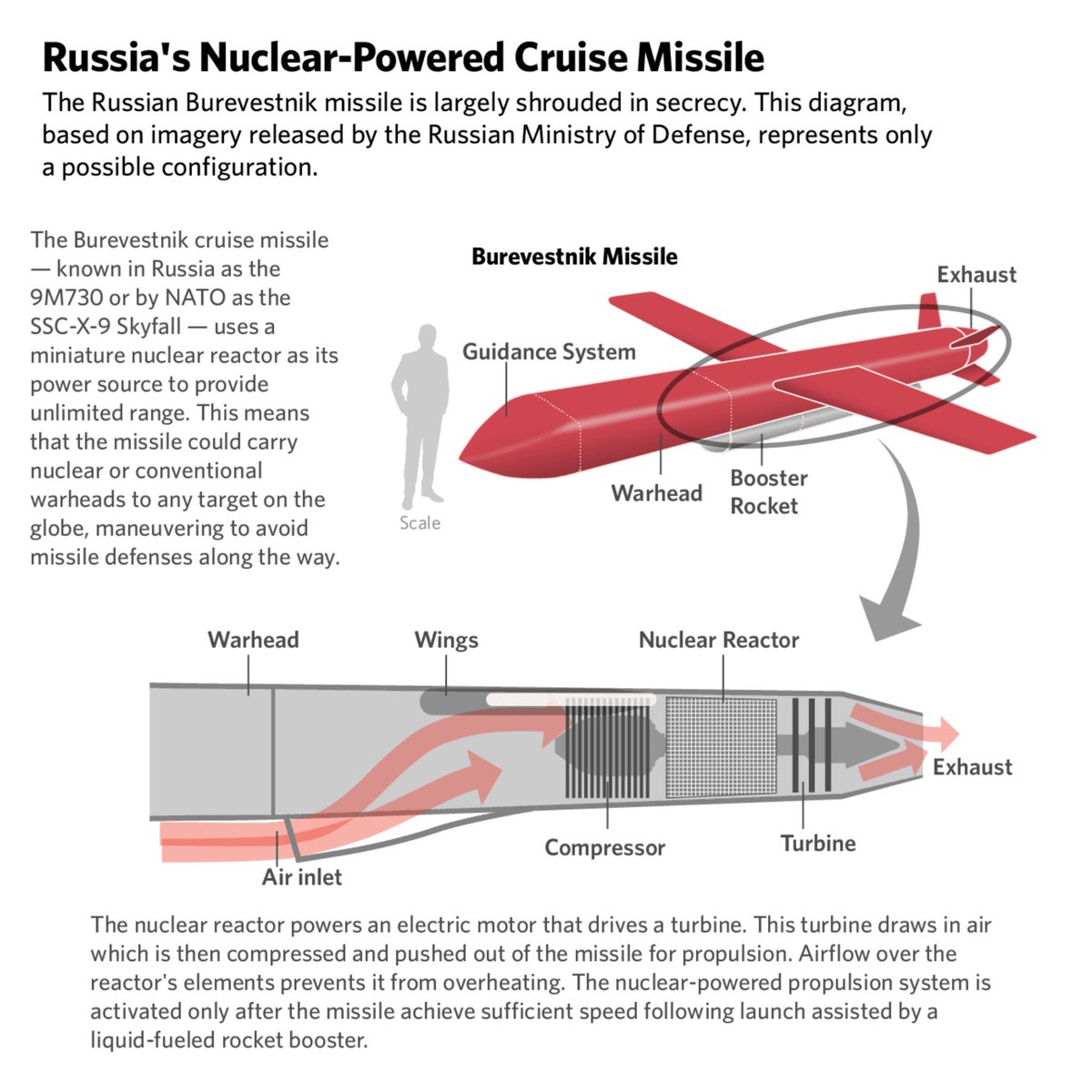

7/ For those who think that Europe can rearm with its industry shut down, inflation and shortages, runaway inflation and falling living standards: please take an intro level economics course and figure out how armies etc are paid for.

8/ The recent decline in the European PMI is just the beginning. It’s this next six months that we’ll start seeing a serious collapse of European manufacturing.

9/ Looks like it’ll be primary products that’ll be hit worst. Expect shortages of metals, chemicals (including fertiliser), plastic and food. Food and fertiliser shortages will at least create serious food inflation, at worst serious food shortages and malnutrition.

• • •

Missing some Tweet in this thread? You can try to

force a refresh