Macroeconomist/investment professional. Author: The Collapse of Global Liberalism. Host of the Multipolarity podcast, @MultipolarPod.

16 subscribers

How to get URL link on X (Twitter) App

2/ At the beginning of the war Iran did not have nuclear weapons. The time horizon for a win ranged from one day to two weeks. In this time horizon America could have, in theory, achieved a victory without annihilation.

2/ At the beginning of the war Iran did not have nuclear weapons. The time horizon for a win ranged from one day to two weeks. In this time horizon America could have, in theory, achieved a victory without annihilation.

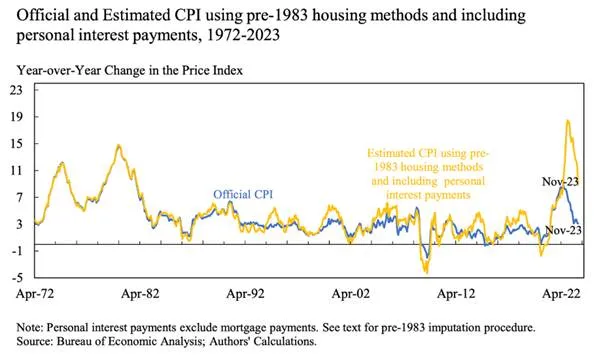

2/ The domestic situation with USD is already bad. Larry Summers and his co-authors showed that measured properly as a cost-of-living jolt, inflation peaked above 18%, not the 9% of the official CPI.

2/ The domestic situation with USD is already bad. Larry Summers and his co-authors showed that measured properly as a cost-of-living jolt, inflation peaked above 18%, not the 9% of the official CPI.

2/ The abortion and birth data tell the story. Since 2022 overall conceptions are roughly the same as in previous years but the British people are opting for abortions. There is a massive reluctance to carry the babies to term.

2/ The abortion and birth data tell the story. Since 2022 overall conceptions are roughly the same as in previous years but the British people are opting for abortions. There is a massive reluctance to carry the babies to term.

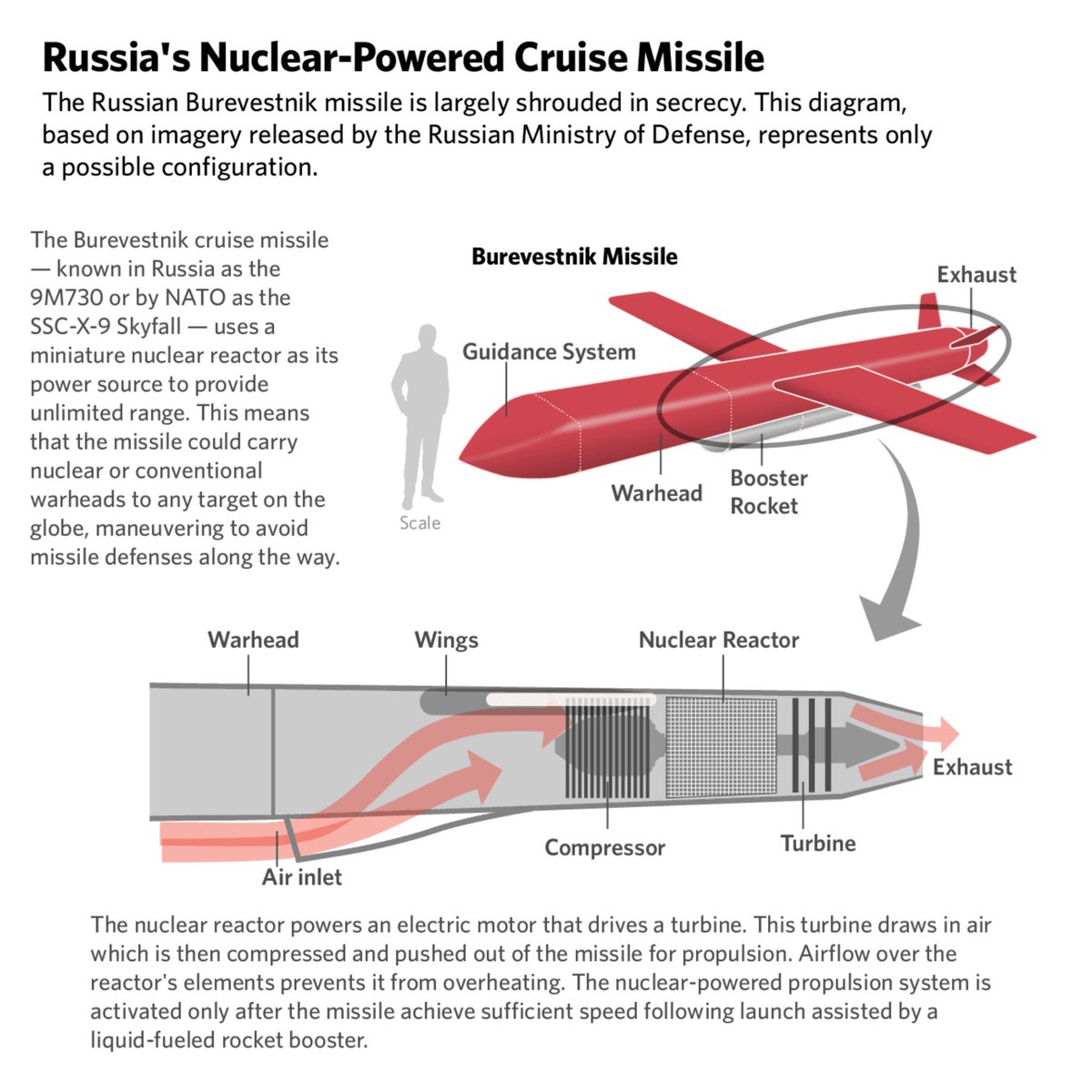

2/ The key to understanding the novelty is twofold. First, its power source: a nuclear-powered ramjet engine. The mini nuclear reactor produces enormous amounts of heat. This heats the air and propels the missile.

2/ The key to understanding the novelty is twofold. First, its power source: a nuclear-powered ramjet engine. The mini nuclear reactor produces enormous amounts of heat. This heats the air and propels the missile.

2/ Central bank independence is a technocratic competency that came out of the new model of "stakeholder democracy" especially associated with Clintonism and Blairism. Basically this is a euphemism for "rule by experts".

2/ Central bank independence is a technocratic competency that came out of the new model of "stakeholder democracy" especially associated with Clintonism and Blairism. Basically this is a euphemism for "rule by experts".

2/ When Milei was first elected he promised to dollarise the Argentinean economy. Like most of his schemes this was unrealistic and so it never happened.

2/ When Milei was first elected he promised to dollarise the Argentinean economy. Like most of his schemes this was unrealistic and so it never happened.

2/ Let’s start with @Harvard. It is the keystone on the entire US elite class. The American system is a “credential aristocracy”. Harvard is the top of the credentialising pyramid. Without Harvard the rest of the system - populated with Harvard grads - starts to fail.

2/ Let’s start with @Harvard. It is the keystone on the entire US elite class. The American system is a “credential aristocracy”. Harvard is the top of the credentialising pyramid. Without Harvard the rest of the system - populated with Harvard grads - starts to fail.

2/ For many years, the British made extensive efforts to maintain the Commonwealth identity of Canada. It was one of the final bastions of British soft power after Suez.

2/ For many years, the British made extensive efforts to maintain the Commonwealth identity of Canada. It was one of the final bastions of British soft power after Suez.

2/ The main source that you see cited for the status of polling around the Hungarian 2026 election is Wikipedia. Everyone is snobby about Wiki, but the reality is that it's a go-to for journalists and researchers.

2/ The main source that you see cited for the status of polling around the Hungarian 2026 election is Wikipedia. Everyone is snobby about Wiki, but the reality is that it's a go-to for journalists and researchers.

2/ $NVDA has been soaring on rapidly growing data centre revenue. Companies are buying up GPUs to gear up for the AI revolution.

2/ $NVDA has been soaring on rapidly growing data centre revenue. Companies are buying up GPUs to gear up for the AI revolution.

2/ The main positive headline is that the Milei government’s cuts have created a government surplus. They have, but this is a distraction as the government deficit was never causing the inflation.

2/ The main positive headline is that the Milei government’s cuts have created a government surplus. They have, but this is a distraction as the government deficit was never causing the inflation.

2/ It started with a new sanctions package quietly rolled out on Nov 21st a few weeks after the election. Most didn’t pay attention as the Russian sanctions have been seen as redundant by smart people for over a year now.

2/ It started with a new sanctions package quietly rolled out on Nov 21st a few weeks after the election. Most didn’t pay attention as the Russian sanctions have been seen as redundant by smart people for over a year now.

2/ The ecosystem is populated with two broad species of creatures. At the top of the hierarchy we have the ‘slopbloggers’ and at the bottom we have the ‘chudpoasters’.

2/ The ecosystem is populated with two broad species of creatures. At the top of the hierarchy we have the ‘slopbloggers’ and at the bottom we have the ‘chudpoasters’.

2/ Here we turn to the latest issue of the China Institute of Contemporary International Relations’ journal. CICIR is an important government-affiliated think tank that has been around since 1965. So borderline official doctrine coming from this shop.

2/ Here we turn to the latest issue of the China Institute of Contemporary International Relations’ journal. CICIR is an important government-affiliated think tank that has been around since 1965. So borderline official doctrine coming from this shop.

2/ The polls show consistent bias against @realDonaldTrump. This is not due to cheating but due to quirks in the polling. More later. For now, let us just look at polls versus outcomes. Here are the November polls in 2020 versus the actual results. They were way off.

2/ The polls show consistent bias against @realDonaldTrump. This is not due to cheating but due to quirks in the polling. More later. For now, let us just look at polls versus outcomes. Here are the November polls in 2020 versus the actual results. They were way off.

2/ @RobertJenrick recognised that one key issue is energy. He advocated switching from green investments into nuclear, specifically small modular reactors (SMR). Britain needs a new energy policy ASAP but it seems highly unlikely the country can develop its own SMRs.

2/ @RobertJenrick recognised that one key issue is energy. He advocated switching from green investments into nuclear, specifically small modular reactors (SMR). Britain needs a new energy policy ASAP but it seems highly unlikely the country can develop its own SMRs.

2/ Start with the silliest first. Some people were circulating a picture of an actual BRICS banknote, as if the BRICS would adopt a single currency like the euro. This would be like the G7 adopting a single currency. Nonsensical.

2/ Start with the silliest first. Some people were circulating a picture of an actual BRICS banknote, as if the BRICS would adopt a single currency like the euro. This would be like the G7 adopting a single currency. Nonsensical.

2/ The first iteration of Blairism was a happy-go-lucky affair. Blair and co were Marxists of a variety, but happy Marxists who rejected state socialism and embraced cultural radicalism - a new, freer society where different groups would live in harmony.

2/ The first iteration of Blairism was a happy-go-lucky affair. Blair and co were Marxists of a variety, but happy Marxists who rejected state socialism and embraced cultural radicalism - a new, freer society where different groups would live in harmony.