According to his manifesto, Bola Tinubu of the All Progressive Congress (APC) plans to achieve a 10% GDP growth rate for Nigeria over the next four years, if elected.

What is the possibility and implication of this growth plan?

THREAD 1/5

#StearsManifestoWeek

What is the possibility and implication of this growth plan?

THREAD 1/5

#StearsManifestoWeek

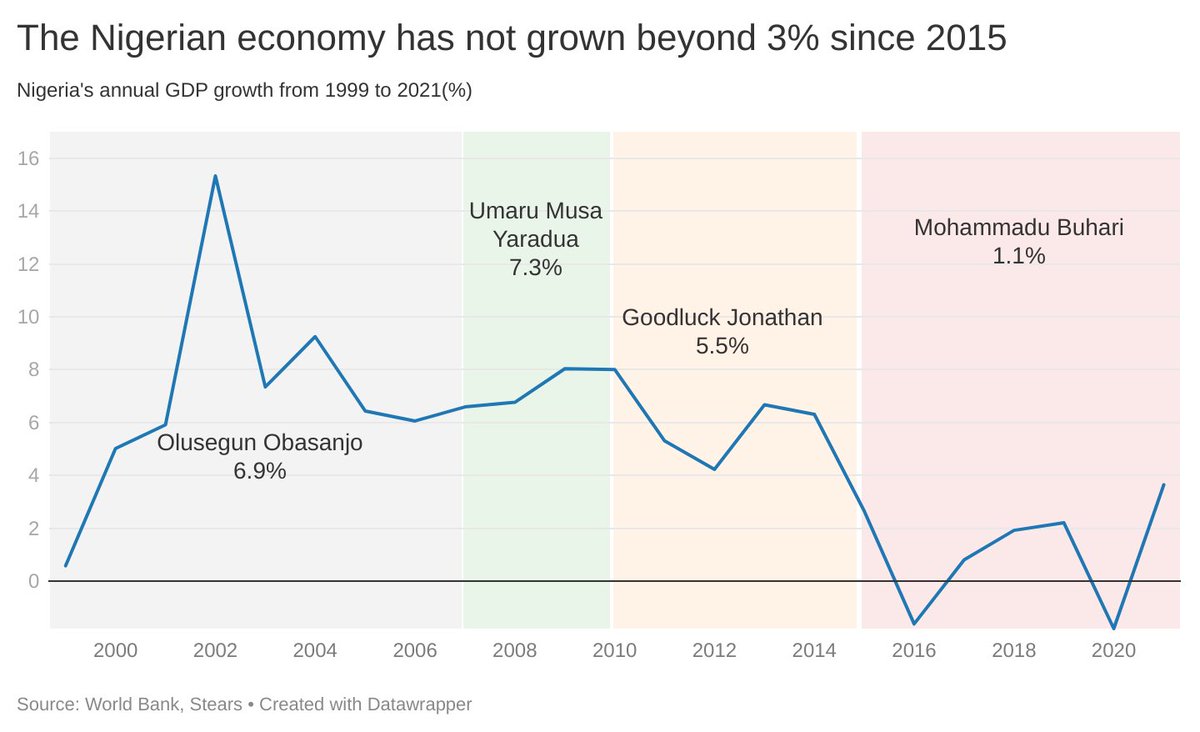

First, Tinubu’s growth plan is audacious, given the current state of the economy. Since 2014, the Nigerian economy hasn’t achieved an annual growth above 4%.

However, this ambition comes at a price.

However, this ambition comes at a price.

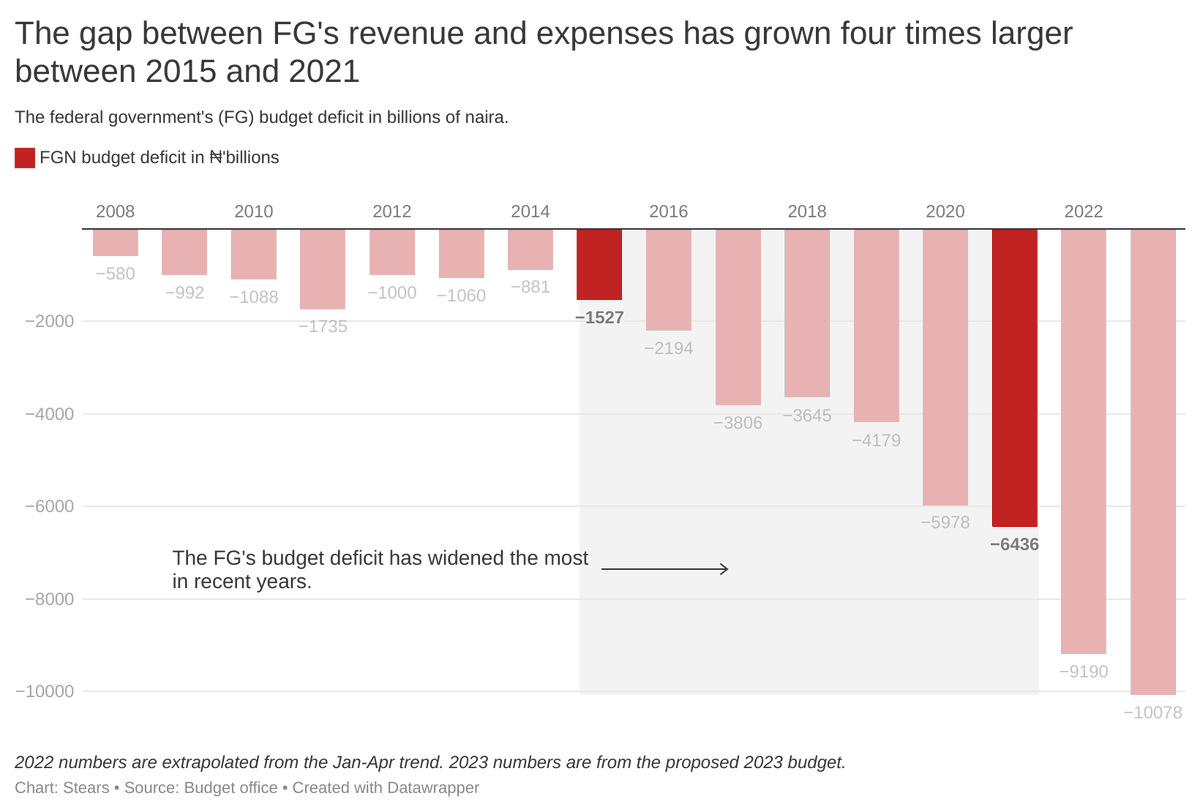

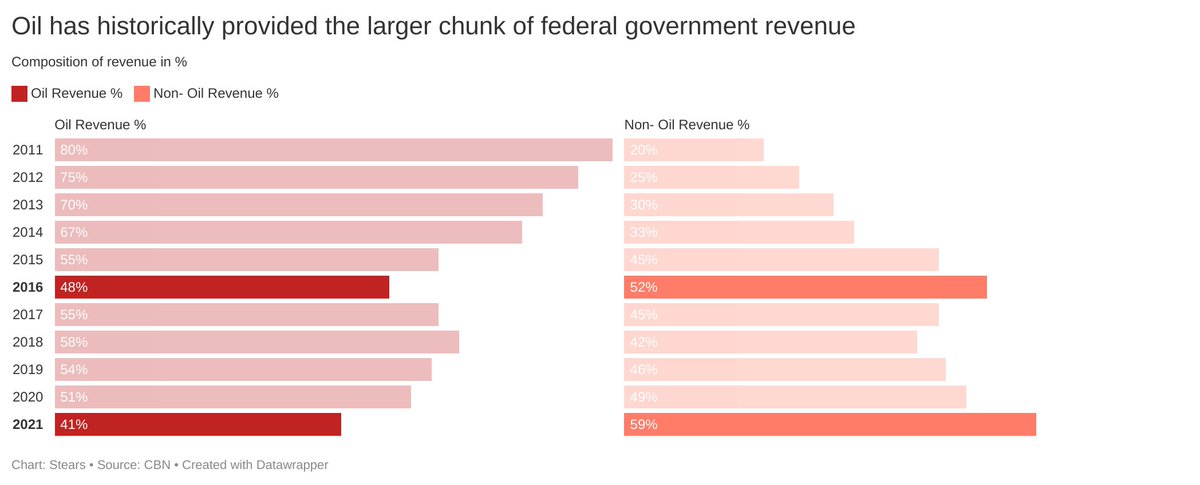

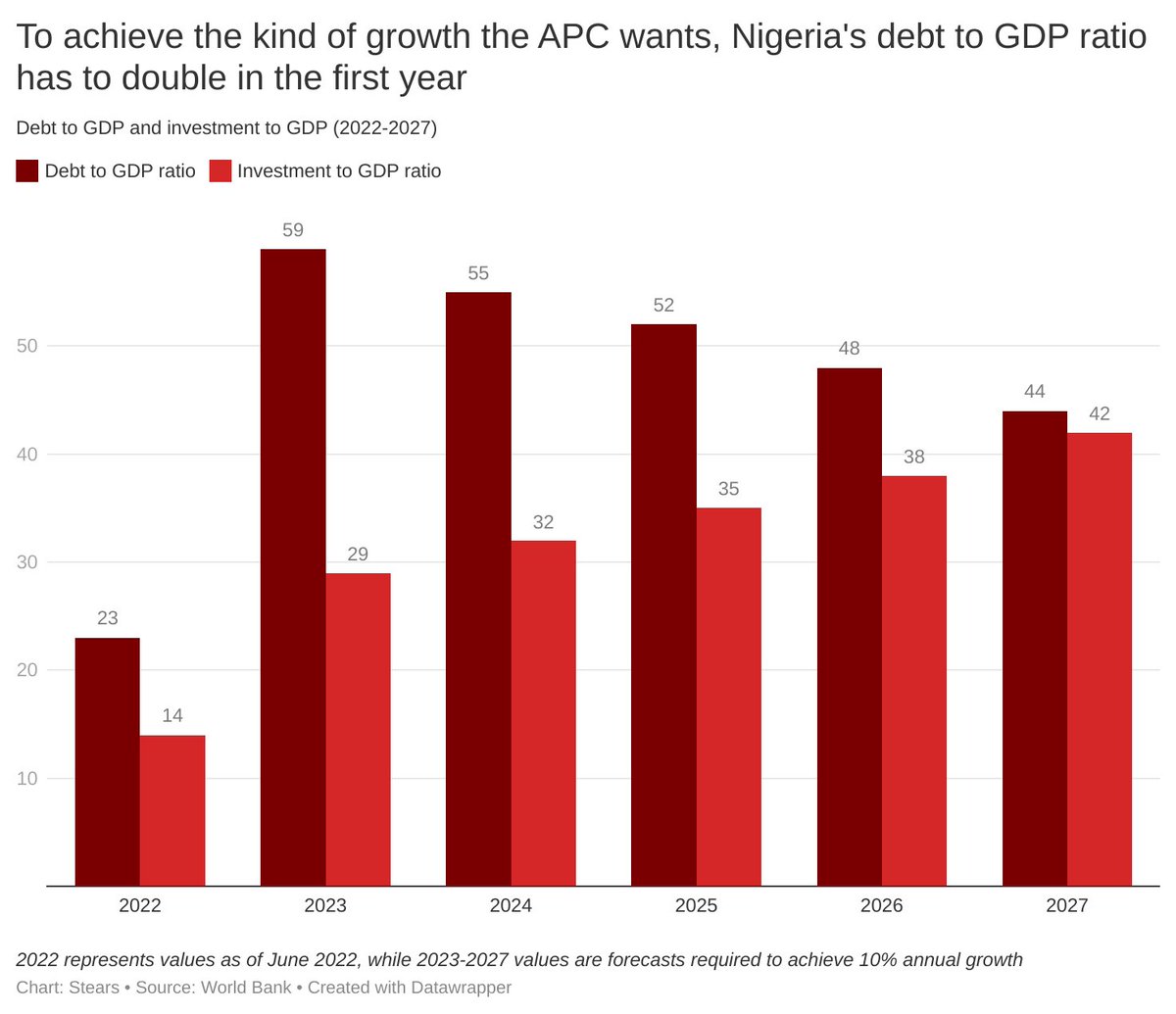

To achieve APC’s growth target, Tinubu will have to spend based on growth plans for the country rather than the amount the country earns. And so, if his government’s revenue doesn’t meet its growth requirement, it will need to borrow until it reaches its desired growth goal.

The idea of increased borrowing is worrisome as Nigeria has a track record of bad fiscal management.

By committing to Tinubu’s plan, we could be sealing Nigeria’s fate as a country trapped in a cycle of escalating borrowing and debt.

By committing to Tinubu’s plan, we could be sealing Nigeria’s fate as a country trapped in a cycle of escalating borrowing and debt.

Find out more about the analysis of the APC’s growth plan in our latest free-to-read article. Also, stay tuned to the rest of our insights examining the proposed policies of the presidential candidates.

#StearsManifestoWeek

bit.ly/3iyaA3g

#StearsManifestoWeek

bit.ly/3iyaA3g

• • •

Missing some Tweet in this thread? You can try to

force a refresh