#RPG #rpglife life science business analysis,

It's was my diwali pick trying make two cent to add some value

A turnaround company with margins expansion & get rid off from DPCO specially your monopoly product ✨🧵

It's was my diwali pick trying make two cent to add some value

A turnaround company with margins expansion & get rid off from DPCO specially your monopoly product ✨🧵

1/n

👉Leader in immunosuppressant segment

👉50+ year rich legacy, integrated operation with capabilities of both development & mfg in API & formulation,

👉company operating in domestic & international mkts in branded formulation,

👉global generic, API🧬💊

👉Leader in immunosuppressant segment

👉50+ year rich legacy, integrated operation with capabilities of both development & mfg in API & formulation,

👉company operating in domestic & international mkts in branded formulation,

👉global generic, API🧬💊

2/n

👉6 text book brand are trusted by doctor and patient

👉3 mfg units

👉1100+ permanent employee

👉50+ countries presence,

👉Enduring relationship with leading generic players of World 🌍

👉6 text book brand are trusted by doctor and patient

👉3 mfg units

👉1100+ permanent employee

👉50+ countries presence,

👉Enduring relationship with leading generic players of World 🌍

3/n

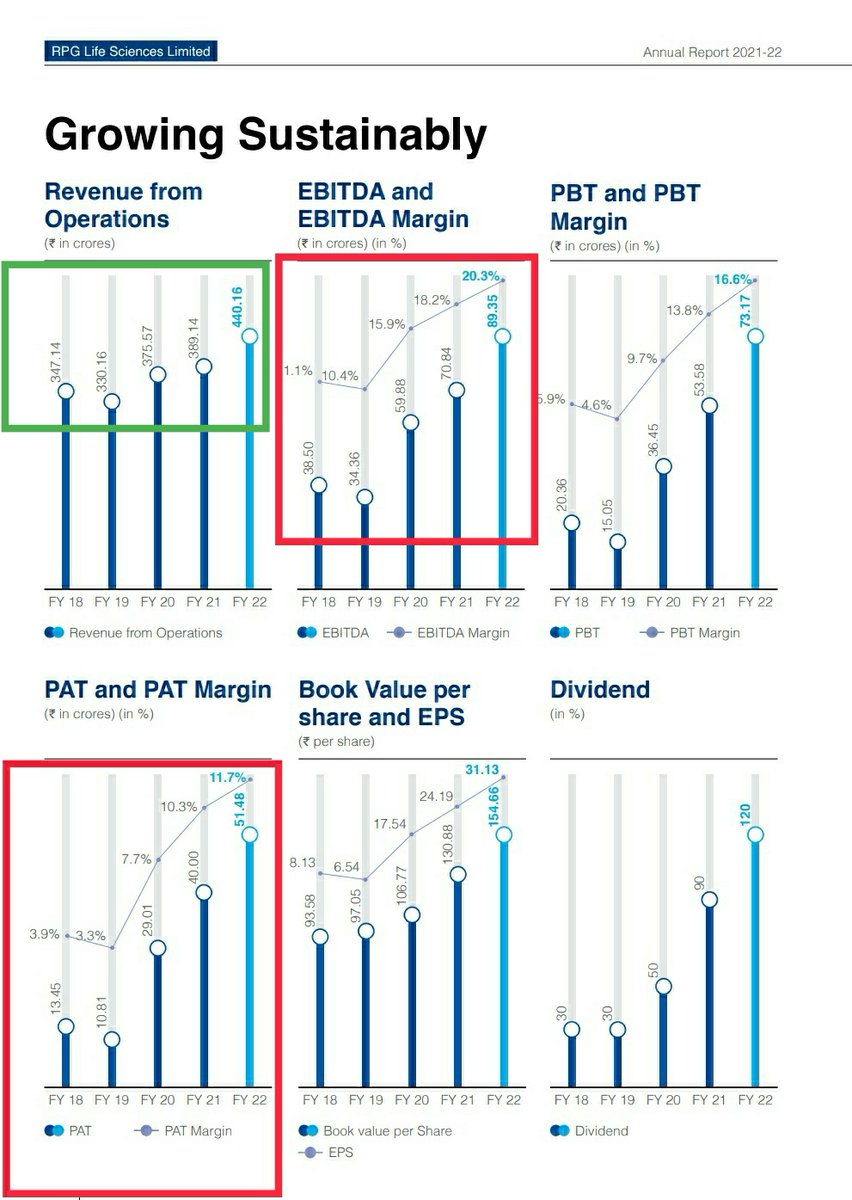

Company is almost debt free, good profit growth of 29% CAGR last 5 years, healthy dividend paying

65% boz comes from domestic formulation

19% biz comes from international formulation

16% biz comes from API,

all segments growth is really good

Company is almost debt free, good profit growth of 29% CAGR last 5 years, healthy dividend paying

65% boz comes from domestic formulation

19% biz comes from international formulation

16% biz comes from API,

all segments growth is really good

4/n

👉Yugal sikri sir joined in oct18.

👉Rajat Bhargava joined in Jan21.

What make company turnaround,Management change

When in India in domestic cut throat competition,when your moated product is in dpco category

Raw material price hike but you cant making price hike dueto DPCO

👉Yugal sikri sir joined in oct18.

👉Rajat Bhargava joined in Jan21.

What make company turnaround,Management change

When in India in domestic cut throat competition,when your moated product is in dpco category

Raw material price hike but you cant making price hike dueto DPCO

6/n

👉Naprosyn

Used in jointpain, headache, some cases in fever also.

👉Naprosyn D especially used in migraine

👉Naxdom sun Pharma is mkt leader

👉Napra D (intas) vgood brand

👉Naprosyn

Used in jointpain, headache, some cases in fever also.

👉Naprosyn D especially used in migraine

👉Naxdom sun Pharma is mkt leader

👉Napra D (intas) vgood brand

8/n

Now added sodium in product,

Coming rid of dpco now company got pricing power,

its almost 80 rs of 10 tab means 8 rs tab

Now added sodium in product,

Coming rid of dpco now company got pricing power,

its almost 80 rs of 10 tab means 8 rs tab

11/n

👉Azoran

Immunosuppresants mainly used in transplant

👉Aldactone specially used as diuretics ( potassium sparing) in heart failure,blood pressure, oedema ,removing excess salt & water from body.

👉Lomotil treatment for diarrhoea

👉Serenace treatment for psychosis,mania😴

👉Azoran

Immunosuppresants mainly used in transplant

👉Aldactone specially used as diuretics ( potassium sparing) in heart failure,blood pressure, oedema ,removing excess salt & water from body.

👉Lomotil treatment for diarrhoea

👉Serenace treatment for psychosis,mania😴

12/n

👉Romilast BL uses for anti allergic condition sneezing 🤧

👉Tricaine almagel used for heartburn🔥

👉T jaki uses in moderate to severe joint pain

👉Gliptin mainly used in TYPE 2 DIABETES,

I covered uses only but all drug had side effects also,don't take any medicine direct

👉Romilast BL uses for anti allergic condition sneezing 🤧

👉Tricaine almagel used for heartburn🔥

👉T jaki uses in moderate to severe joint pain

👉Gliptin mainly used in TYPE 2 DIABETES,

I covered uses only but all drug had side effects also,don't take any medicine direct

13/n

👉84000/- Doctor👨⚕️🩺 Q2fy23,

👉500 MR TODAY APPROX,

👉20% covering speciality division

👉80% covering mass division

👉MR PRODUCTIVITY IS ALMOST 5.5 LALH from 3.5 LAKH

👉84000/- Doctor👨⚕️🩺 Q2fy23,

👉500 MR TODAY APPROX,

👉20% covering speciality division

👉80% covering mass division

👉MR PRODUCTIVITY IS ALMOST 5.5 LALH from 3.5 LAKH

16/n

👉Thesis

Margin expansion of main moated product, step by step increase their portfolio,

MR productivity is good.

👉Anti thesis

Political instability in Myanmar,

Margin expansion almost done now work on growth also, frequent change in management in past track

👉Thesis

Margin expansion of main moated product, step by step increase their portfolio,

MR productivity is good.

👉Anti thesis

Political instability in Myanmar,

Margin expansion almost done now work on growth also, frequent change in management in past track

17/n

👉Credit rating ICRA

LONG TERM 35 cr A STABLE.

LONG TERM FUND BASED 40 CR A STABLE.

SHORT TERM 25 CR A1

👉Must read all concall company recent give me answer who steal the show in asking questions 🫡

👉Credit rating ICRA

LONG TERM 35 cr A STABLE.

LONG TERM FUND BASED 40 CR A STABLE.

SHORT TERM 25 CR A1

👉Must read all concall company recent give me answer who steal the show in asking questions 🫡

18/n

👉On valuation part no so expert imho fairly priced

MKT CAP - 1470/-

Cmp - 890/-

P/E- 24.

ROCE -31 %

ROE - 21%

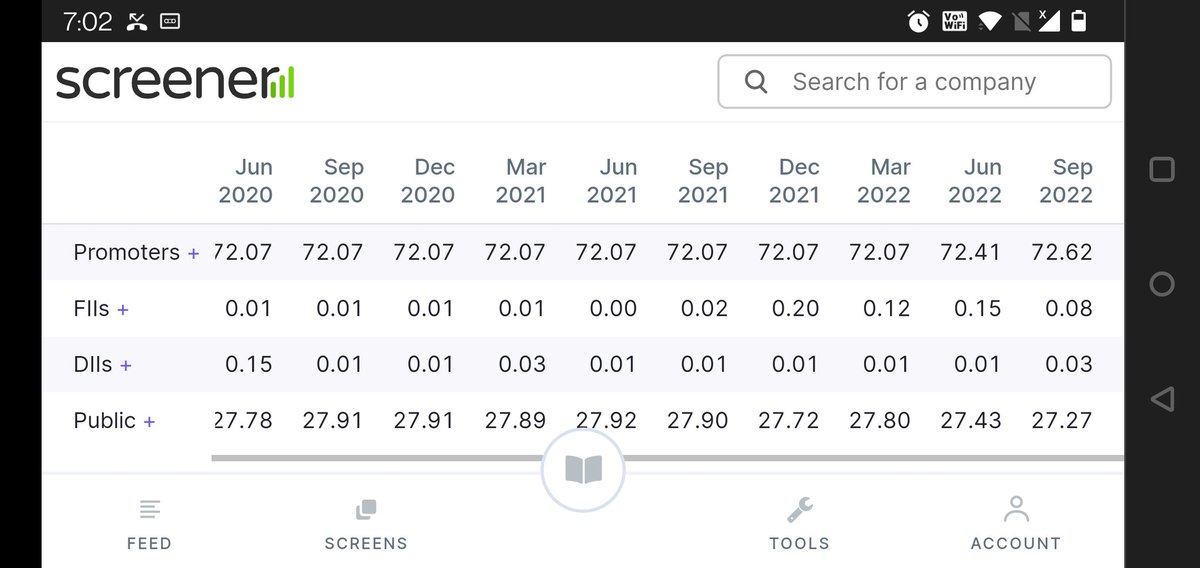

Debt free with high promoter holding,

👉Sources

concall ,investor presentation, AR, LinkedIn, scuttlebutt, screener,valuepicker.

👉DPCO - Drug price control org.

👉On valuation part no so expert imho fairly priced

MKT CAP - 1470/-

Cmp - 890/-

P/E- 24.

ROCE -31 %

ROE - 21%

Debt free with high promoter holding,

👉Sources

concall ,investor presentation, AR, LinkedIn, scuttlebutt, screener,valuepicker.

👉DPCO - Drug price control org.

19 / n

If like this thread pls LIKE & RT,

Not so good analyst, definitely something missed , always learner 🙏

Thread ends 🧵🧵🧵

If like this thread pls LIKE & RT,

Not so good analyst, definitely something missed , always learner 🙏

Thread ends 🧵🧵🧵

• • •

Missing some Tweet in this thread? You can try to

force a refresh