Can real yield in perpetuity really exist in crypto?

Let's see if @AmpliFiDeFi has made it possible:

🧵 👇

Let's see if @AmpliFiDeFi has made it possible:

🧵 👇

If you don't know who #AMPLIFI is, check out my full overview below:

In one line, AmpliFi is the first and only crypto annuity.

For reference, annuities are a guaranteed payment for a contracted period, similar to how a pension works.

In one line, AmpliFi is the first and only crypto annuity.

For reference, annuities are a guaranteed payment for a contracted period, similar to how a pension works.

https://twitter.com/LouisCooper_/status/1590026468259598336

The age old question we ask ourselves with a yield protocol is:

1️⃣ Where is the yield coming from?

2️⃣ Is it sustainable?

In an attempt to answer those questions, I had to dig a bit deeper than my previous thread.

Let's begin ↓

1️⃣ Where is the yield coming from?

2️⃣ Is it sustainable?

In an attempt to answer those questions, I had to dig a bit deeper than my previous thread.

Let's begin ↓

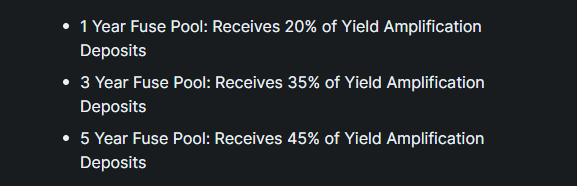

1️⃣ Where is the yield coming from?

From two sources:

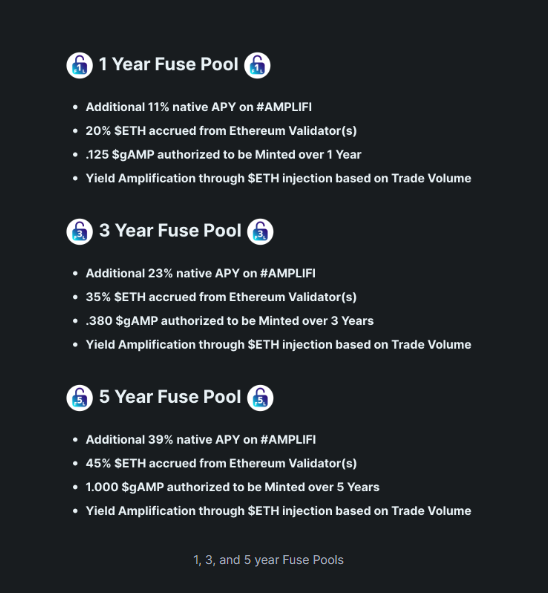

1. #AMPLIFI emissions which cannot be sold until the lock is over

2. $ETH yield (yield amplification)

Only those with their amplifiers fused receive the extra $ETH yield, as a reward for locking their funds.

From two sources:

1. #AMPLIFI emissions which cannot be sold until the lock is over

2. $ETH yield (yield amplification)

Only those with their amplifiers fused receive the extra $ETH yield, as a reward for locking their funds.

1. #AMPLIFI emissions are produced infinitely, but remember we burnt 20 #AMPLIFI to start producing that yield in the first place.

This makes up the base yield assigned to each Amplifier.

This #AMPLIFI is constantly accrued, but only unlocked once the fuse is complete.

This makes up the base yield assigned to each Amplifier.

This #AMPLIFI is constantly accrued, but only unlocked once the fuse is complete.

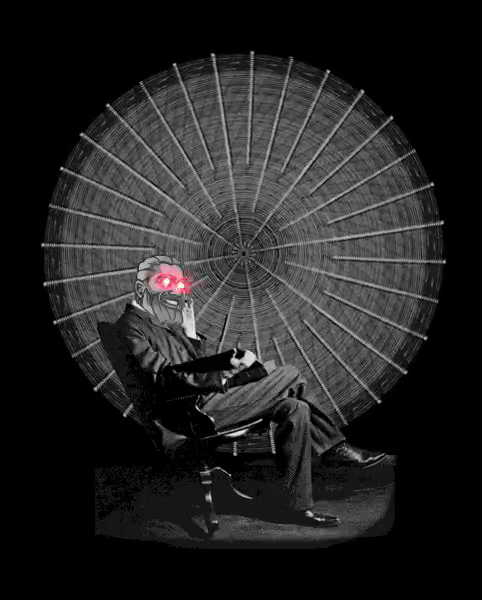

2. Yield amplification accounts for the bonus APR we see for fused amplifiers

Rewarded for their lock, the ETH rewards comes from validators and is collected as if it's protocol trading fees

The APRs are constantly subject to change, with rewards being distributed every 30 days

Rewarded for their lock, the ETH rewards comes from validators and is collected as if it's protocol trading fees

The APRs are constantly subject to change, with rewards being distributed every 30 days

2️⃣ Is it sustainable?

Sustainability is essentially as important as where the yield comes from, which is why @AmpliFiDeFi have introduced a plethora of deflationary mechanics.

Why?

Because each fused Amplifier grants #AMPLIFI rewards, it's necessary to control token supply.

Sustainability is essentially as important as where the yield comes from, which is why @AmpliFiDeFi have introduced a plethora of deflationary mechanics.

Why?

Because each fused Amplifier grants #AMPLIFI rewards, it's necessary to control token supply.

https://twitter.com/LouisCooper_/status/1590026518981357568

Current deflationary measures include:

• 20 #AMPLIFI burns for large Amplifiers

• Long liquidity & reward lock to ensure stable emissions

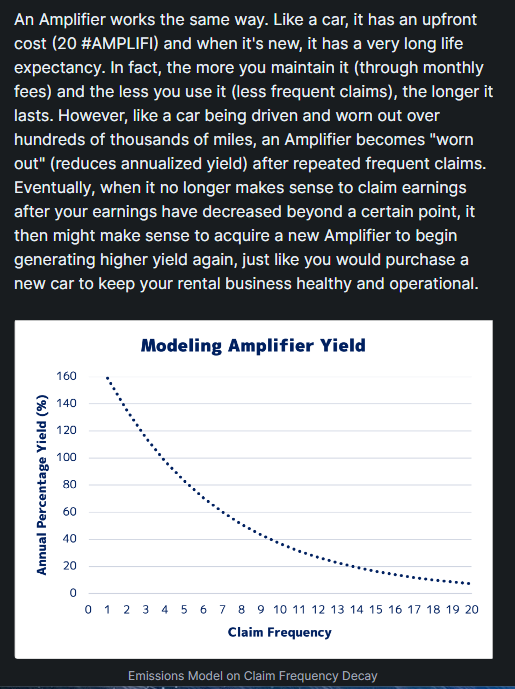

• Claim frequency penalty which creates a finite useful lifespan for each Amplifier

They double as revenue:

• 20 #AMPLIFI burns for large Amplifiers

• Long liquidity & reward lock to ensure stable emissions

• Claim frequency penalty which creates a finite useful lifespan for each Amplifier

They double as revenue:

When I'm talking about 'claims', I'm mentioning their governance token, gAMP, which is accrued daily.

Amplifiers which are locked for 1-5 years receive $ETH rewards from:

• Trade fees

• ETH staking

Redeem your gAMP right before the monthly snapshot to maximize ETH rewards.

Amplifiers which are locked for 1-5 years receive $ETH rewards from:

• Trade fees

• ETH staking

Redeem your gAMP right before the monthly snapshot to maximize ETH rewards.

The analogy the team use to describe an AMPLIFIERS sustainability is similar to renting out a car.

After you pay for the car, it's new and you can rent it for top dollar.

The more miles you put on it, the less demand there is, until it's eventually retired.

After you pay for the car, it's new and you can rent it for top dollar.

The more miles you put on it, the less demand there is, until it's eventually retired.

The reason I harp on about their claim frequency delay is because native token emissions are essential to @AmpliFiDeFi, but also incredibly hard to get right.

The more you incentivize long-term holders and infrequent claims, the easier it is for the protocol to grow.

The more you incentivize long-term holders and infrequent claims, the easier it is for the protocol to grow.

So do you think I summarized it well enough to convict you?

I still maintain my conviction from my previous thread:

A crypto project will inevitably get annuities right, and it might just be @AmpliFiDeFi.

I still maintain my conviction from my previous thread:

A crypto project will inevitably get annuities right, and it might just be @AmpliFiDeFi.

https://twitter.com/LouisCooper_/status/1590026563352817664

They're currently working on their perps platform @AutomaticDeFi, launching on Polygon in Q1 next year.

It sounds like those with fused amplifiers might be in for an airdrop 👀

It sounds like those with fused amplifiers might be in for an airdrop 👀

https://twitter.com/amplifidefi/status/1594465629737603073?s=46&t=HjJaoP5QQ3ceBOy6_21SrA

I will be releasing a few more updates on them in the coming weeks, so stay tuned :)

Follow me @LouisCooper_ for more objective 🧵 's.

RT for the algorithm ↓

Follow me @LouisCooper_ for more objective 🧵 's.

RT for the algorithm ↓

https://twitter.com/LouisCooper_/status/1600460130574745602

• • •

Missing some Tweet in this thread? You can try to

force a refresh