Detailed Analysis on #DeepakNitrite🧪🧪

Monopoly in the Chemical Sector👑

CMP - ₹2,213

Like & Retweet for better reach

Monopoly in the Chemical Sector👑

CMP - ₹2,213

Like & Retweet for better reach

1. Introduction

-Deepak Nitrite is one of the leading chemical intermediates manufacturers of basic as well as specialty chemicals.

-The company initially started off with small-scale manufacturing of sodium nitrite and sodium nitrate and gradually widened its product portfolio

-Deepak Nitrite is one of the leading chemical intermediates manufacturers of basic as well as specialty chemicals.

-The company initially started off with small-scale manufacturing of sodium nitrite and sodium nitrate and gradually widened its product portfolio

to offer more than 100 products to more than 1000 customers across 30 countries.

-It has its presence in Basic Intermediates, Fine & Specialty Chemicals, Performance Products and Phenolics.

-Deepak Nitrite Ltd (DNL) has been a front runner in tapping import substitution

-It has its presence in Basic Intermediates, Fine & Specialty Chemicals, Performance Products and Phenolics.

-Deepak Nitrite Ltd (DNL) has been a front runner in tapping import substitution

opportunities in the Indian chemical space.

2. Business Segments

-On a broad level there are four business segments of Deepak Nitrite- Basic intermediates, Fine and Speciality Chemicals, Performance Products and Phenolics

2. Business Segments

-On a broad level there are four business segments of Deepak Nitrite- Basic intermediates, Fine and Speciality Chemicals, Performance Products and Phenolics

-Basic intermediates segment is basically high volume segment consisting of bulk chemicals & commodities. The products in this division are standard in specification and are not customized as per the customer requirements. Basic intermediates segment includes products such as

Sodium Nitrite, Sodium Nitrate, Nitro Toluidines, fuel additives and nitrosyl sulphuric acid. These products find application in agrochemicals, pharmaceuticals, fuel additives, rubber, dyes and pigments and industrial explosives.

-Fine and specialty chemicals are low volume & high margin products. These products are specially customized as per the client’s needs & require competency in handling complex reactions. Deepak Nitrite manufactures Speciality Chemicals such as Xylidines, Oximes, and Cumidines

and is amongst the top 3 global producers of Xylidines, Cumidines and Oximes. These intermediates find application in agrochemicals, pharmaceuticals, personal care products etc.

-In the performance products segment Deepak manufactures a product called Optical Brightening Agent (OBA) which is basically a brightener commonly used in industries like paper, detergents, textiles and photographic paper. So basically the whitening property of paper is given by

an optical brightening agent. This product needs technical expertise or the chemical should perform in a particular way. This is why it is known as a performance product.

-In the phenolics segment, Deepak Nitrite manufactures phenol and acetone. It has a plant having a 2,00,000

-In the phenolics segment, Deepak Nitrite manufactures phenol and acetone. It has a plant having a 2,00,000

tonnes per annum capacity of phenol and 1,20,000 tonnes per annum capacity of acetone. By further debottlenecking the company has further increased its phenol capacity to 2,50,000 tonnes per annum. Phenol is majorly used in plywood and laminates. Then phenol is also used in

construction. If we check the applications of Acetone, it is used in sanitizers. For example IPA i.e., isopropyl alcohol which is a downstream derivative of acetone is used in sanitizers and pharmaceuticals. Then acetone is also used in paints.

3. Revenue Mix

In FY22 the basic intermediates segment contributed 18%, fine and speciality contributed 12%, performance products contributed 8% whereas the phenolics segment contributed 62% to the overall revenues.

In FY22 the basic intermediates segment contributed 18%, fine and speciality contributed 12%, performance products contributed 8% whereas the phenolics segment contributed 62% to the overall revenues.

4. Reclassification of business segments

-As the businesses have undergone a lot of changes over a period of time, thereby inter-dependence of processes and products has increased, hence due to the increasing number of facilities catering to multiproducts the company’s operation

-As the businesses have undergone a lot of changes over a period of time, thereby inter-dependence of processes and products has increased, hence due to the increasing number of facilities catering to multiproducts the company’s operation

will now be reported as the two business segments, Advanced Intermediates and Phenolics.

-In Q1FY23, the Advanced intermediates segment contributed 35% whereas the phenolics segment contributed 65% to the overall revenues.

-In Q1FY23, the Advanced intermediates segment contributed 35% whereas the phenolics segment contributed 65% to the overall revenues.

5. Geographical Mix

-If we check the geographical mix of Deepak Nitrite, in FY22 the domestic market contributed 78% whereas the export market contributed 22% to the revenues.

-In the export market, US contributed 18%, Asia contributed 36%, contribution from Europe stood at 44%

-If we check the geographical mix of Deepak Nitrite, in FY22 the domestic market contributed 78% whereas the export market contributed 22% to the revenues.

-In the export market, US contributed 18%, Asia contributed 36%, contribution from Europe stood at 44%

8. Manufacturing facilities

-Deepak Nitrite has 6 manufacturing facilities in 3 states of India.

-The Nandesari facility in Gujarat is the first and flagship manufacturing facility which caters to the organic and inorganic chemicals of the basic intermediates segment.

-Deepak Nitrite has 6 manufacturing facilities in 3 states of India.

-The Nandesari facility in Gujarat is the first and flagship manufacturing facility which caters to the organic and inorganic chemicals of the basic intermediates segment.

-The Roha facility in Maharashtra caters to the intermediates for agrochemicals, dyes and speciality chemicals.

-The Taloja facility in Maharashtra caters to the fine and speciality chemicals segment and is strategically connected to Nhava Sheva port.

-The Taloja facility in Maharashtra caters to the fine and speciality chemicals segment and is strategically connected to Nhava Sheva port.

-The Hyderabad facility caters to the Performance Products segment for the manufacture of DASDA.

-The Dahej facility of Deepak Nitrite in Gujarat caters to the basic intermediates segment as well as the performance products segment.

-The Dahej facility of Deepak Nitrite in Gujarat caters to the basic intermediates segment as well as the performance products segment.

-The Dahej facility of Deepak Phenolics in Gujarat caters manufacturing of phenol, acetone and IPA

9.Focus on R&D

-Deepak has an expertise in multiple chemical processes such as Hydrogenation, Nitration, Diazotization, Alkylation, Oxidation, Chlorination etc

9.Focus on R&D

-Deepak has an expertise in multiple chemical processes such as Hydrogenation, Nitration, Diazotization, Alkylation, Oxidation, Chlorination etc

-The R&D center at Nandesari focuses on innovation and development of value added products.

-Deepak Nitrite has also deployed automation technologies to drive efficiency and they use artificial intelligence (AI) and machine learning to use data optimally.

-Deepak Nitrite has also deployed automation technologies to drive efficiency and they use artificial intelligence (AI) and machine learning to use data optimally.

10. Entering new chemistries -Fluorination

-The company is working on various new technology platform developments. In this regard, they have started work related to fluorination as well as Photo chlorination chemistry.

-The company is working on various new technology platform developments. In this regard, they have started work related to fluorination as well as Photo chlorination chemistry.

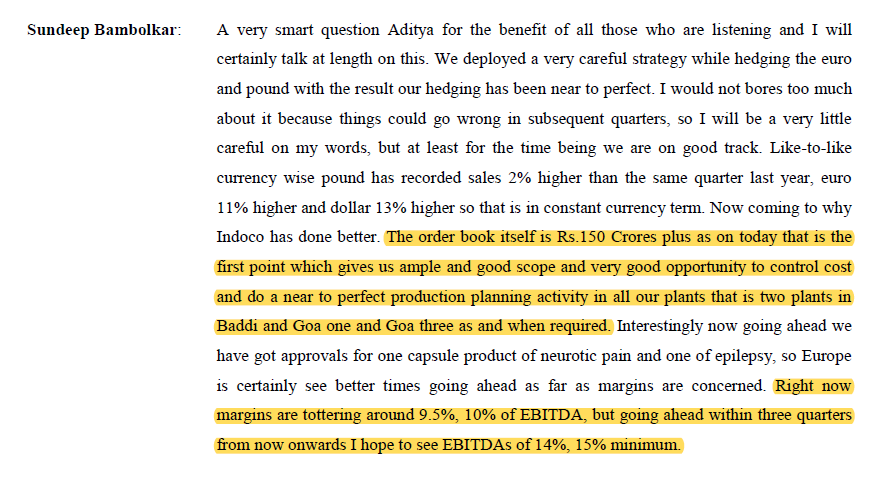

If we check Q2FY22 Concall, Maulik Mehta who is the current CEO mentioned that fluorination is a one unit process. The company is already in nitration, hydrogenation etc and with regards to fluorination, availability of raw material, safety and operational excellence are

those fronts the company should work on. Fluorination is just a step which they are linking with other steps.

11. Key Strengths

-Diversified chemical company: One of its strengths is that it is a diversified chemical company. If we compare the EBIT Margins of various business segments of Deepak Nitrite, we get to know that the performance products EBIT margins fell from 54% in FY20

-Diversified chemical company: One of its strengths is that it is a diversified chemical company. If we compare the EBIT Margins of various business segments of Deepak Nitrite, we get to know that the performance products EBIT margins fell from 54% in FY20

to 7% in FY21 But this did not affect the overall business that much because the fine and specialty segment had picked up the battle and it posted EBIT margins of 43% in FY21. So the overall business didn’t get affected due to the diversified nature of the company.

-Management Execution: Another key strength is the management execution. In Q1FY18 concall the management gave the guidance that the phenol plant will achieve capacity utilization of around 70-75% in the first year of operation. But what happened is Deepak Phenolics achieved

capacity utilization of over 80% within 5 months of operation. And after that they achieved over 100% capacity utilization in phenol.

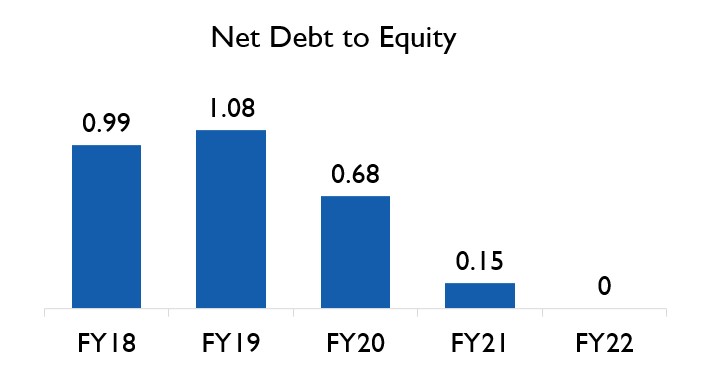

They have also reduced the debt consistently over the years. If we check the net debt to equity ratio it was 0.99 in FY18 then it was 1.08 in FY19 and currently it has become debt free in FY22.

12. Growth Triggers:

-Import Substitution: Deepak Nitrite is the beneficiary of import substitution. Earlier phenol was majorly imported in India. When the demand for phenol in India was around 2.8 lakh tonnes per annum Deepak Nitrite came up with a plan of putting up a phenol

-Import Substitution: Deepak Nitrite is the beneficiary of import substitution. Earlier phenol was majorly imported in India. When the demand for phenol in India was around 2.8 lakh tonnes per annum Deepak Nitrite came up with a plan of putting up a phenol

plant with a capacity of 2 lakh tonnes per annum & the company was successful in replacing most of the imports in phenol. Moreover, now the company is also going to come up with derivatives of phenol and acetone which are also import substitutes. So downstream derivatives of

phenol and acetone will further lead to growth of the company.

-China + 1: Due to pollution issues in China most of the chemical companies were shut down and also due to the covid issue people are reluctant to buy from Chinese manufacturers. They are looking for an alternate

-China + 1: Due to pollution issues in China most of the chemical companies were shut down and also due to the covid issue people are reluctant to buy from Chinese manufacturers. They are looking for an alternate

supplier other than China. MNC’s are shifting their manufacturing plant to Asian countries to diversify their supply chain. Indian chemical companies including Deepak still have a good opportunity due to this trend.

-Government schemes such as PLI and antidumping duties: The government launching a PLI scheme or anti-dumping duty on products will help to boost domestic production & will help the Indian chemical companies and Deepak Nitrite is well positioned to take advantage of that.

Expanding the portfolio of products: The company is expanding its portfolio of products. Now the company is coming up with downstream derivatives of phenol and acetone as well as it is entering into new chemistries such as fluorination and photo chlorination which will drive

the growth in the future. The company also regularly undertakes debottlenecking and cost optimization programs to strengthen its competitive position.

13. Risks:

-Margin volatility: So we saw that the bulk chemical business is a commoditized business but it is very cost efficient. So, their margins have expanded in the last 1 to 2 years. But again this could be due to some shut down in China as well.

-Margin volatility: So we saw that the bulk chemical business is a commoditized business but it is very cost efficient. So, their margins have expanded in the last 1 to 2 years. But again this could be due to some shut down in China as well.

Also in some business segments like if we discuss about performance products we saw how the margins are fluctuating. So margins can be volatile in such divisions.

-Fire: Another risk in the business is the risk of fire. If we check a few incidents of fire in the case of Deepak

-Fire: Another risk in the business is the risk of fire. If we check a few incidents of fire in the case of Deepak

Nitrite we get to know that in 2016 fire broke out at one of the distillation columns of Company’s manufacturing facility at Roha, Maharashtra. Also recently in June 2022 a fire broke out around the warehouse section of the company's manufacturing site located at

Nandesari, Gujarat. So in any chemical business, the risk of fire is a very big risk.

-Global capacities of phenol coming up:If we check recently INEOS Phenol has announced that it has agreed to acquire the entire asset base of Mitsui Phenols Singapore Ltd from Mitsui Chemicals,

-Global capacities of phenol coming up:If we check recently INEOS Phenol has announced that it has agreed to acquire the entire asset base of Mitsui Phenols Singapore Ltd from Mitsui Chemicals,

a leading Japanese chemicals manufacturer, for a total consideration of $330 million.Even though import substitution is present here. But in a scenario if a lot of capacities arrive of phenol then naturally India and China would be the target for exports because India and China

are the two fastest growing markets. So here, we have to constantly see whether the margins do not go down a lot or whether they don’t receive any competition from imports or whether any petrochemical refinery enters in phenol.

Check out the detailed video on Deepak Nitrite:

Micro Cap Club:

valueeducator.com/micro-cap-club/

valueeducator.com/micro-cap-club/

• • •

Missing some Tweet in this thread? You can try to

force a refresh