City Gas Distribution is an excellent business with no inventory and Cash sales

Mahanagar Gas is the sole gas supplier in Mumbai

Still,the stock has lost 20% in the last 5 years!

A thread🧵on the business of Mahanagar Gas and the opportunities ahead

Lets go👇

(1/17)

Mahanagar Gas is the sole gas supplier in Mumbai

Still,the stock has lost 20% in the last 5 years!

A thread🧵on the business of Mahanagar Gas and the opportunities ahead

Lets go👇

(1/17)

What has happened?

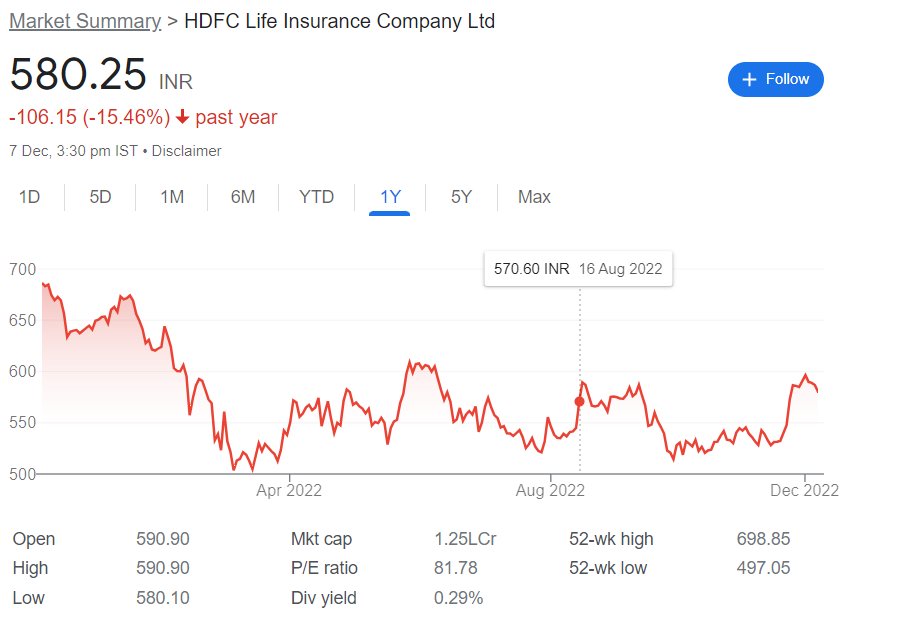

The Mahanagar Gas stock has lost 20% value in the last 5 years

Let's find out what is happening?

(2/17)

The Mahanagar Gas stock has lost 20% value in the last 5 years

Let's find out what is happening?

(2/17)

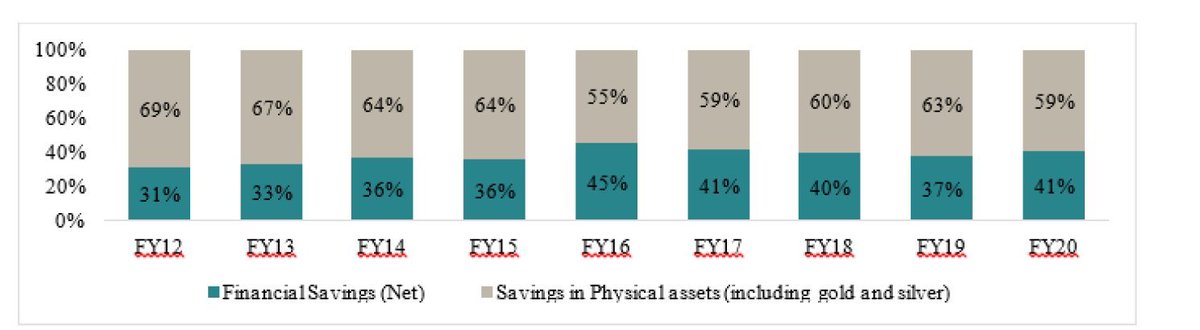

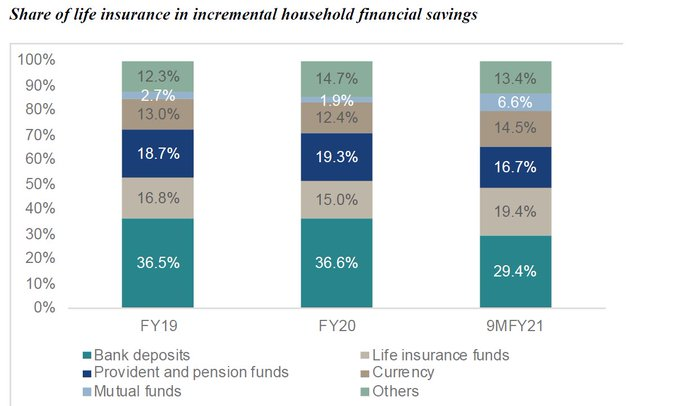

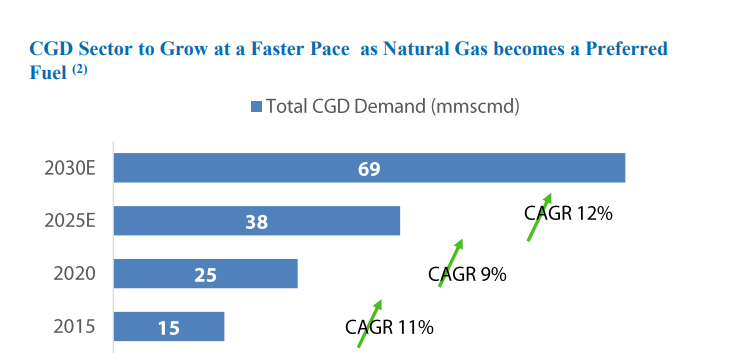

City Gas Distribution is a fast-growing sector:-

As the government pushes India to a Gas based economy.

City Gas Distribution is expected to grow at about 12% CAGR.

(3/17)

As the government pushes India to a Gas based economy.

City Gas Distribution is expected to grow at about 12% CAGR.

(3/17)

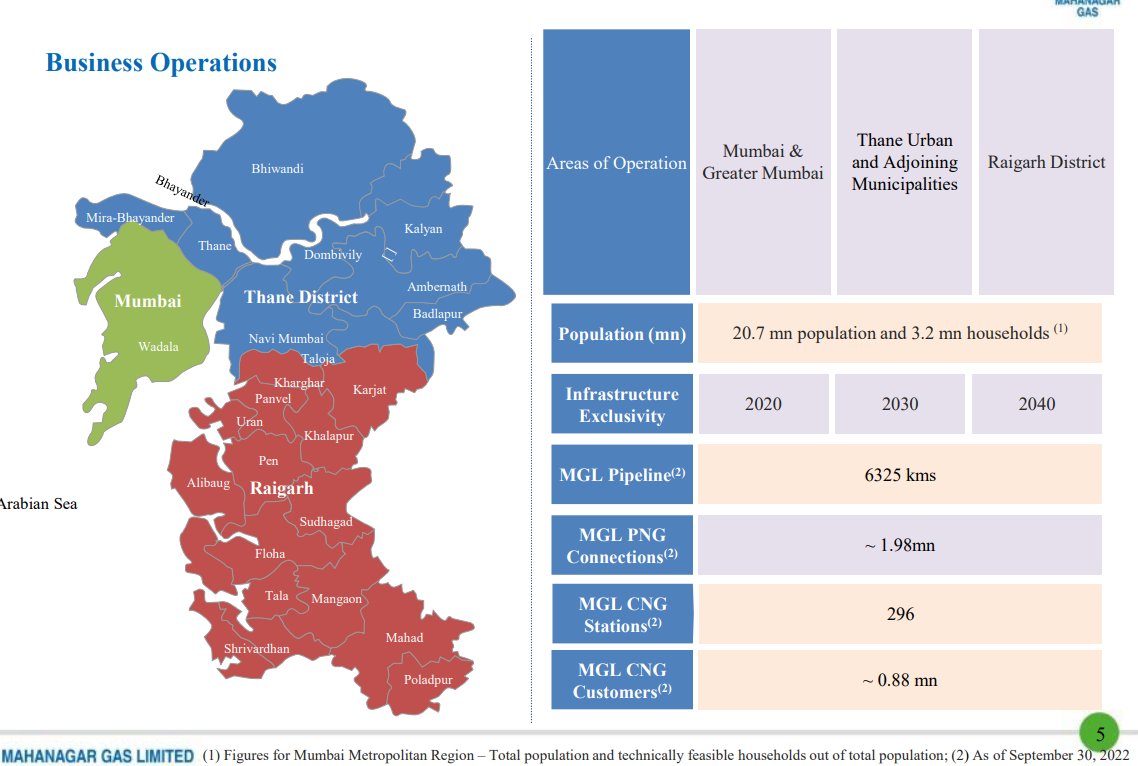

Business of Mahanagar Gas

Mahanagar Gas is the only Gas supplier to

Mumbai and adjoining areas like Thane and Raigad areas.

It supplies PNG and CNG in these areas

(4/17)

Mahanagar Gas is the only Gas supplier to

Mumbai and adjoining areas like Thane and Raigad areas.

It supplies PNG and CNG in these areas

(4/17)

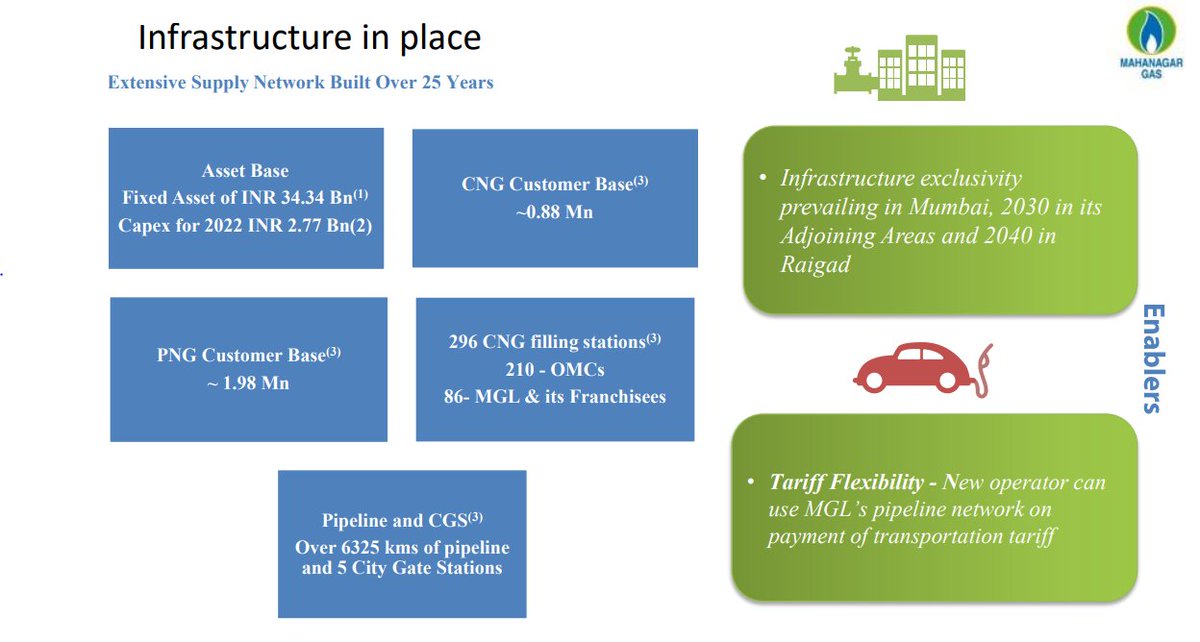

Sole Gas distributor with a strong network:-

Mahanagar Gas Supplies:-

⛽️PNG to 1.98 Million Home users

⛽️It has 296 Gas stations from where it supplies CNG

(5/17)

Mahanagar Gas Supplies:-

⛽️PNG to 1.98 Million Home users

⛽️It has 296 Gas stations from where it supplies CNG

(5/17)

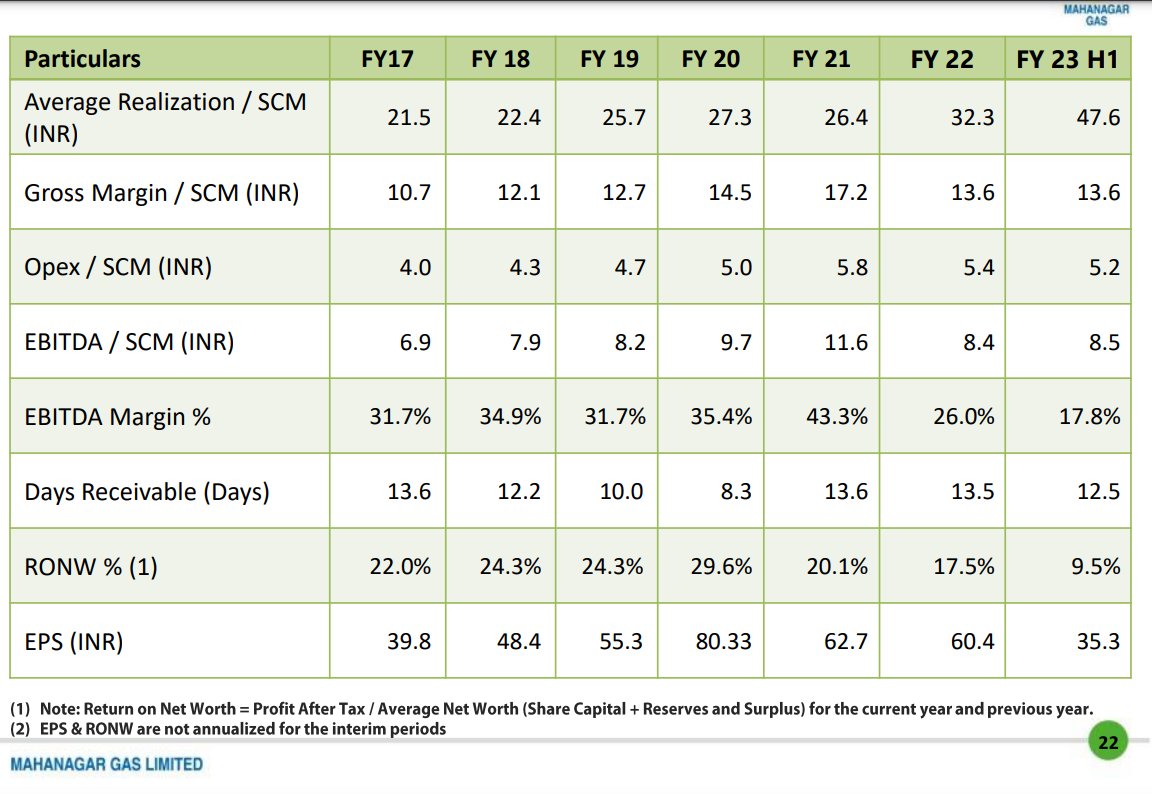

So how is the business performing?

⛽️H1 FY2023 has been very tough for the company

⛽️The margins of the company have shrunk from about 30% to about 17%

⛽️The company reported a slowdown in the gas volumes as gas prices have shot up

(6/17)

⛽️H1 FY2023 has been very tough for the company

⛽️The margins of the company have shrunk from about 30% to about 17%

⛽️The company reported a slowdown in the gas volumes as gas prices have shot up

(6/17)

Sky High Gas prices:-

Russia's war in Ukraine has meant the gas prices have moved up sharply.

Mahanagar gas which used to sell CNG at the rate of Rs 50/Kg now sells CNG at a rate of Rs 90-95/kg

(7/17)

Russia's war in Ukraine has meant the gas prices have moved up sharply.

Mahanagar gas which used to sell CNG at the rate of Rs 50/Kg now sells CNG at a rate of Rs 90-95/kg

(7/17)

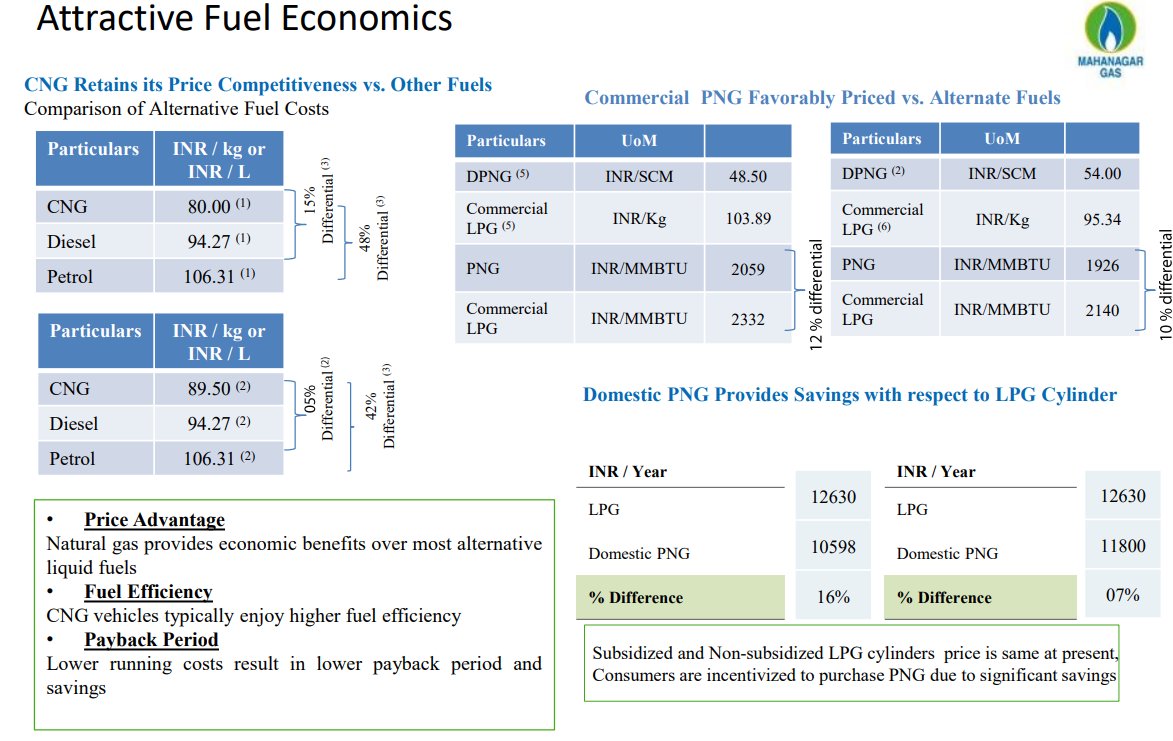

These sky-high CNG prices mean the arbitrage b/w petrol and CNG prices have come done sharply.

The differential w.r.t petrol and diesel is down to 5%

(8/17)

The differential w.r.t petrol and diesel is down to 5%

(8/17)

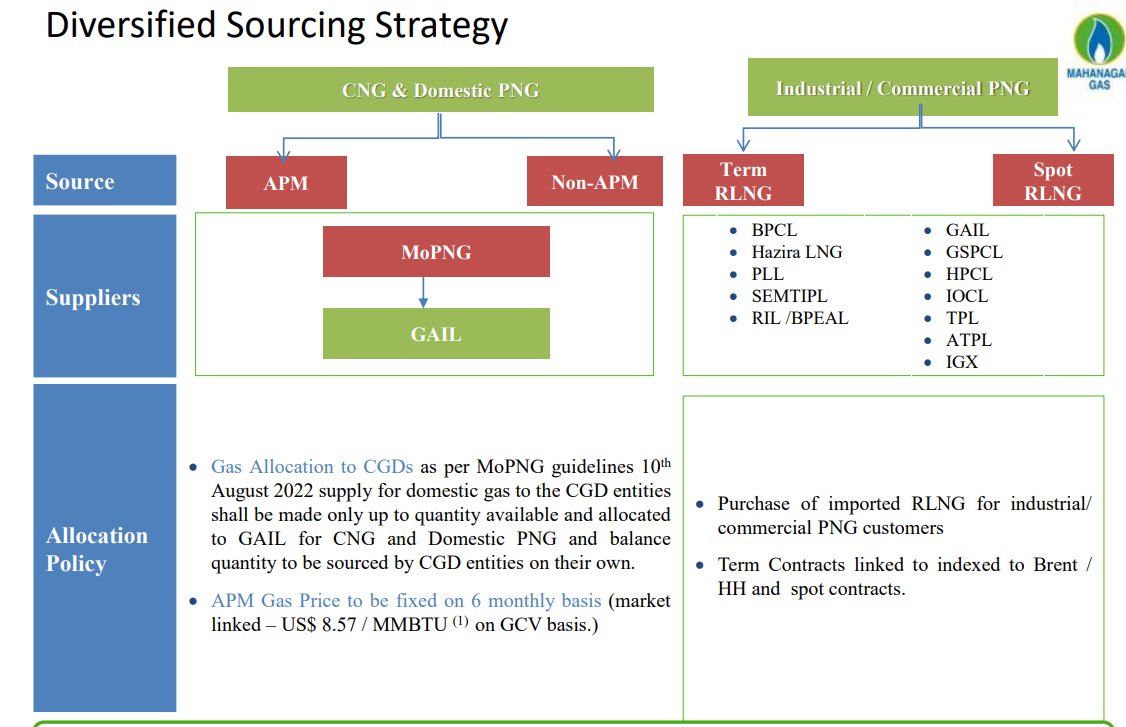

Mahanagar Gas acquired gas thru 2 mechanisms:-

⛽️Administered Price mechanism for which price is set by the govt.

⛽️Spot LNG market which is driven by the market.

(8/17)

⛽️Administered Price mechanism for which price is set by the govt.

⛽️Spot LNG market which is driven by the market.

(8/17)

The prices of both APM gas and sport gas have more than doubled in very short period of time.

Inability of the company to pass on this price rise in the short term has meant an erosion in the margin.

(9/17)

Inability of the company to pass on this price rise in the short term has meant an erosion in the margin.

(9/17)

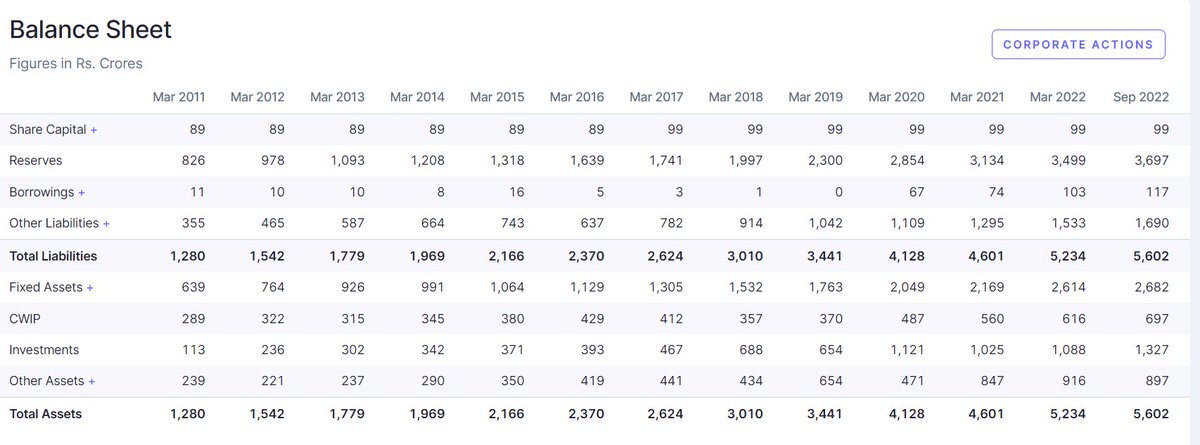

Strong Balance Sheet:-

⛽️Mahangar gas has a strong Balance sheet

⛽️It is a debt-free company

⛽️The company has about 1000cr of cash

⛽️All CAPEX is done from internal accruals

(10/17)

⛽️Mahangar gas has a strong Balance sheet

⛽️It is a debt-free company

⛽️The company has about 1000cr of cash

⛽️All CAPEX is done from internal accruals

(10/17)

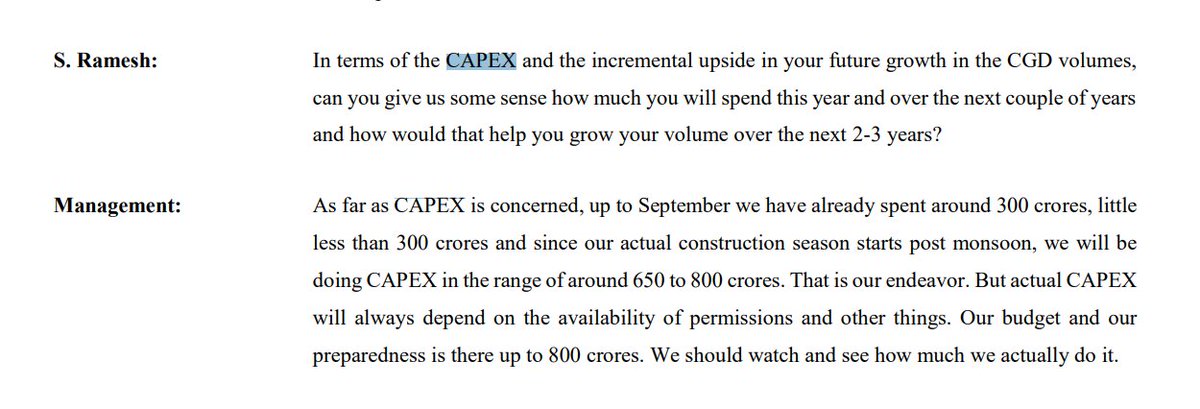

Strong Capex Plans:-

The company has guided for 800crs of capex for the next 3 years.

All of this will be funded by internal accruals

(11/17)

The company has guided for 800crs of capex for the next 3 years.

All of this will be funded by internal accruals

(11/17)

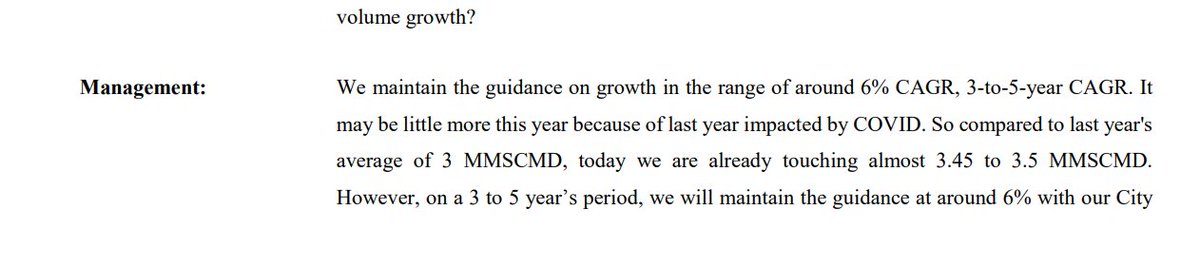

Future guidance:-

⛽️The company has guided fot a 6% volume growth in the next 3 years

⛽️This can expand further with the opening of the international airport in Navi Mumbai

(13/17)

⛽️The company has guided fot a 6% volume growth in the next 3 years

⛽️This can expand further with the opening of the international airport in Navi Mumbai

(13/17)

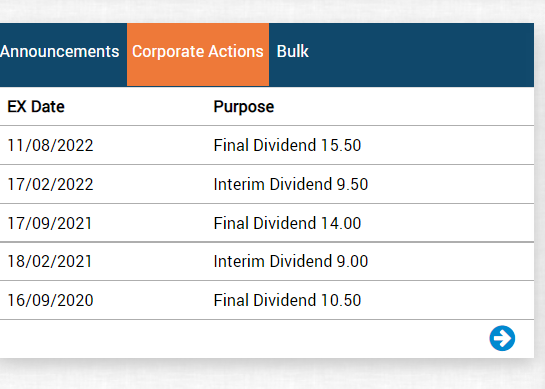

Strong dividend yield:-

Mahanagar Gas paid a dividend of Rs 25 last year.

This translates to a yield of nearly 3%

(14/17)

Mahanagar Gas paid a dividend of Rs 25 last year.

This translates to a yield of nearly 3%

(14/17)

Valuation:-

Mahangar Gas has a monopoly in Mumbai and is a cash-and-carry business.

The stock trades at 18x P/E.

This is not too expensive.

However, growth opportunities are limited in Mumbai.

(14/17)

Mahangar Gas has a monopoly in Mumbai and is a cash-and-carry business.

The stock trades at 18x P/E.

This is not too expensive.

However, growth opportunities are limited in Mumbai.

(14/17)

Conclusion:-

City Gas distributors are facing a perfect storm:-

⛽️ Sky-high gas prices

⛽️Erosion in margins

⛽️Erosion in volumes

⛽️Sky high input gas prices.

All of these are temporary in nature

(15/17)

City Gas distributors are facing a perfect storm:-

⛽️ Sky-high gas prices

⛽️Erosion in margins

⛽️Erosion in volumes

⛽️Sky high input gas prices.

All of these are temporary in nature

(15/17)

As India moves towards a gas-based economy.

The opportunity for City Gas distributors is immense.

These businesses are facing short-term challenges.

However they are worth watching in the long term

(16/17)

The opportunity for City Gas distributors is immense.

These businesses are facing short-term challenges.

However they are worth watching in the long term

(16/17)

Disclaimer:-

This is my study

Not an Investment Advise

Please consult your own investment advisor before investing.

(17/17)

This is my study

Not an Investment Advise

Please consult your own investment advisor before investing.

(17/17)

• • •

Missing some Tweet in this thread? You can try to

force a refresh