The quality of Web3 games and projects can be difficult to gauge

Developing or using a framework allows you to easily evaluate projects faster saving you time and money

Here are 8 research pillars you can use to make researching Web3 projects and games easier 🧵

Developing or using a framework allows you to easily evaluate projects faster saving you time and money

Here are 8 research pillars you can use to make researching Web3 projects and games easier 🧵

Well go over 8 categories

1/ Team

2/ Core Gameplay Loop

3/ Tokenomics

4/ Niche/Originality

5/ Reach/Scope

6/ Progress/Development

7/ Runway/Funding

8/ Is the product good, would you use it?

Score them 1-10 as you go through them

Be brutally honest and objective

Avoid bag bias

1/ Team

2/ Core Gameplay Loop

3/ Tokenomics

4/ Niche/Originality

5/ Reach/Scope

6/ Progress/Development

7/ Runway/Funding

8/ Is the product good, would you use it?

Score them 1-10 as you go through them

Be brutally honest and objective

Avoid bag bias

1/ Team

I love the "bet on people not promises" @HustlepediaYT ethos

It sums up well how important it is to bet on people with previous related experience and have a high chance of delivering

This is to protect yourself in a place where a lot of promises are sold as products

I love the "bet on people not promises" @HustlepediaYT ethos

It sums up well how important it is to bet on people with previous related experience and have a high chance of delivering

This is to protect yourself in a place where a lot of promises are sold as products

Who would you bet on delivering?

First time anon dev who has never made a game before OR

@GoGalaGames co-founder from Zynga (Farmville)

@ultra_io co-founder combined 25 years of gaming experience,

@playSHRAPNEL - team members from halo, COD

First time anon dev who has never made a game before OR

@GoGalaGames co-founder from Zynga (Farmville)

@ultra_io co-founder combined 25 years of gaming experience,

@playSHRAPNEL - team members from halo, COD

However as our favorite blunt analyst @sparkcsays points out its important to dig into the team and projects background via LinkedIn

As often the team experience is over embellished for marketing reasons

often "10 year veteran" = something else entirely

As often the team experience is over embellished for marketing reasons

often "10 year veteran" = something else entirely

https://twitter.com/sparkcsays/status/1594689684558737408?s=20&t=sQUkkAxERZCfG51DmEtW7w

Team being doxxed is a must at this point to improve trust

Having accountability and transparency in a team is important to forge trust with the community

What products have they built in the past?

Ideally there is previous real world experience designing or making games

Having accountability and transparency in a team is important to forge trust with the community

What products have they built in the past?

Ideally there is previous real world experience designing or making games

Using LinkedIn is the alpha for this one

Its the only way to dig into the backgrounds of individual team members

Were they a intern, junior, or leadership role

Did they work WITH or FOR the company highlighted on the project website

WITH = usually they were outsourced work

Its the only way to dig into the backgrounds of individual team members

Were they a intern, junior, or leadership role

Did they work WITH or FOR the company highlighted on the project website

WITH = usually they were outsourced work

2/ Core Gameplay loop

Is it fun, easy to pick up, addictive dopamine feedback to make you want to play more

Is there a sense of progression to improve the longevity and retention of a new player

Is there enough depth to enable replayability

Can you play with friends easily

Is it fun, easy to pick up, addictive dopamine feedback to make you want to play more

Is there a sense of progression to improve the longevity and retention of a new player

Is there enough depth to enable replayability

Can you play with friends easily

The core game need to hold up on its own merit to build and sustain a player base

There needs to be low friction for onboarding with low cost or F2P for participation and optional custodial wallets

NFTs are used as a back layer to enhance the game, not create an onboarding gate

There needs to be low friction for onboarding with low cost or F2P for participation and optional custodial wallets

NFTs are used as a back layer to enhance the game, not create an onboarding gate

Superior - Borderlands style of game, action shooter with randomization

GTA V - constant content updates

Skyrim and Fallout - mods improve novelty and personalization

Battle Royals - hard to win triggers strong rewards, excitement, dopamine loop that makes you want to continue

GTA V - constant content updates

Skyrim and Fallout - mods improve novelty and personalization

Battle Royals - hard to win triggers strong rewards, excitement, dopamine loop that makes you want to continue

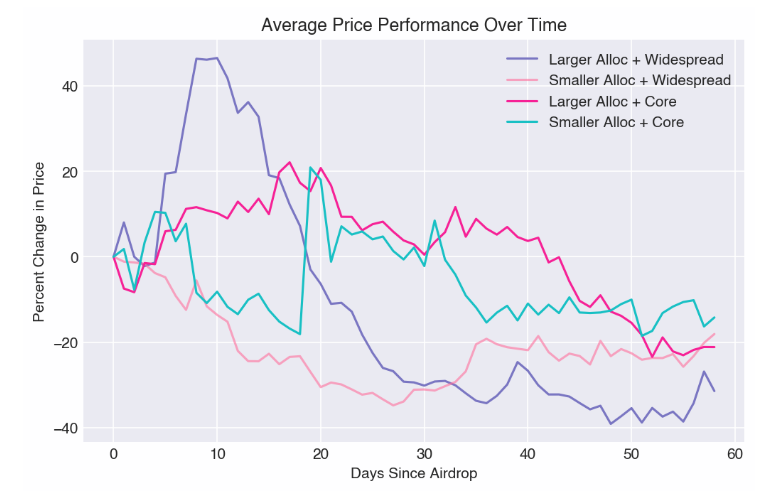

3/ Tokenomics

This can be a very deep topic in itself

Essentially the math behind the in game economy

Difficult to design, no game has created a long term sustainable model yet

Any arbitrage or weakpoints will be exploited due to the underlying financial incentives

This can be a very deep topic in itself

Essentially the math behind the in game economy

Difficult to design, no game has created a long term sustainable model yet

Any arbitrage or weakpoints will be exploited due to the underlying financial incentives

Its important to have an understanding of the following terms:

Market cap - current token price X current circulating supply

Fully Diluted Valuation (FDV) - current token price X total supply

(what the market cap would be if all the supply was in circulation)

Market cap - current token price X current circulating supply

Fully Diluted Valuation (FDV) - current token price X total supply

(what the market cap would be if all the supply was in circulation)

I previously used Illuvium to explain why understanding the difference between MC and FDV is important

TLDR if the FDV is many times higher than the market cap the token price can be 'overvalued' because there is supply that has yet to enter circulation

https://twitter.com/info_insightful/status/1574503194704723981?s=20&t=TmjylnMloXO9VvP0IamqnQ

TLDR if the FDV is many times higher than the market cap the token price can be 'overvalued' because there is supply that has yet to enter circulation

Cliffs - how long you have to wait for your token vesting to start

Vesting - how long it takes to get your tokens when your an investor before the public

Ex. 6 month cliff with 12 month linear vesting = get no tokens for the first 6 months, remaining tokens equally over next 12

Vesting - how long it takes to get your tokens when your an investor before the public

Ex. 6 month cliff with 12 month linear vesting = get no tokens for the first 6 months, remaining tokens equally over next 12

Why is this important?

Low vesting and cliff timeframes for team and investors can indicate lack of commitment/cash grabbing

Makes you aware of potential significant supply increases during vesting (Ex. when multiple cliffs are expiring) to make sure that prices dont turbo dump

Low vesting and cliff timeframes for team and investors can indicate lack of commitment/cash grabbing

Makes you aware of potential significant supply increases during vesting (Ex. when multiple cliffs are expiring) to make sure that prices dont turbo dump

Some things ideally you want to see in tokenomics:

- A cliff of min 6-12 months for team and investors

- ideally 20% max to team

- not using vague categories such as 'marketing'

- team has longest vesting, gets all of their tokens last, takes min 1.5yrs average 2-3yrs

- A cliff of min 6-12 months for team and investors

- ideally 20% max to team

- not using vague categories such as 'marketing'

- team has longest vesting, gets all of their tokens last, takes min 1.5yrs average 2-3yrs

- liquidity 5-10% supply ideally no LESS than the TGE supply, this helps reduce sell pressure

These are guidelines

Ex. Its reasonable for a team to have a the higher 20% allocation of the supply if their vesting period for those tokens is 3+ yrs compared to 6-12 months

These are guidelines

Ex. Its reasonable for a team to have a the higher 20% allocation of the supply if their vesting period for those tokens is 3+ yrs compared to 6-12 months

Some projects can have good products but poor tokenomics

Ex. Immutable X - Only 36% is currently in supply after large ~15% total supply unlock from investor and team cliff expiring

large cliff unlocks/ monthly float inflation increasing token emmissions starting in Sept 2022

Ex. Immutable X - Only 36% is currently in supply after large ~15% total supply unlock from investor and team cliff expiring

large cliff unlocks/ monthly float inflation increasing token emmissions starting in Sept 2022

before cliff unlock circulating supply ~15% at MC of ~150M at the time

This means that since the supply was effectively being doubled at this unlock there would have to be 150M of buy pressure just to keep the price at ~$0.60

Avoid getting dumped on by being aware of unlocks

This means that since the supply was effectively being doubled at this unlock there would have to be 150M of buy pressure just to keep the price at ~$0.60

Avoid getting dumped on by being aware of unlocks

Projects where the FDV is close to market cap have a lot less 'supply overhang' because most of the tokens are already in the current circulating supply

Ex. Phantasma, market cap is FDV = total potential circulating supply are all currently in circulation

Ex. Phantasma, market cap is FDV = total potential circulating supply are all currently in circulation

Im not saying that Phantasma is better than all the other projects in its niche: Immutable, Gala ect

But from purely a tokenomics perspective, then yes because there is a lot less supply overhang

There isnt much incentive to accumulate IMX when there is 64% more supply to come

But from purely a tokenomics perspective, then yes because there is a lot less supply overhang

There isnt much incentive to accumulate IMX when there is 64% more supply to come

4/ Niche/Originality

How strong do they stand out to comparable products in their niche

Is it a distribution platform, game studio, blockchain, singular type of game, an investment guild, ect

If its a game how is it different from others in its genre

How strong do they stand out to comparable products in their niche

Is it a distribution platform, game studio, blockchain, singular type of game, an investment guild, ect

If its a game how is it different from others in its genre

Seedify, vs Ultra, vs Gala, vs, Myria

Immutable X vs Polygon

YGG vs Merit Circle

Gods Unchained vs Splinterlands

If your evaluating a project and it feel like knock-off version of an already existing better similar product, why would you want to invest in it ?

Immutable X vs Polygon

YGG vs Merit Circle

Gods Unchained vs Splinterlands

If your evaluating a project and it feel like knock-off version of an already existing better similar product, why would you want to invest in it ?

5/ Reach/Scope - what the size of the potential users

Is it a singular game or an platform/ game studio ?

How large is the scope or pool of potential players, niche game or more broad game type (card games vs F2P FPS)

Is it a singular game or an platform/ game studio ?

How large is the scope or pool of potential players, niche game or more broad game type (card games vs F2P FPS)

6/ Progress/Development - Is the project showing signs of making progress and achieving deliverables

How active are their socials, is there active communication and updates to the community

What are they doing in bear market to keep the community conviction high

How active are their socials, is there active communication and updates to the community

What are they doing in bear market to keep the community conviction high

Most projects will go silent when the bear hits and die silently

If they magically re-emerges in bull then degens and speculators are are going to have to pump the project

Ex. Gala lots of twitter updates, Immutable X and Polygon large raises and partnerships in bear market

If they magically re-emerges in bull then degens and speculators are are going to have to pump the project

Ex. Gala lots of twitter updates, Immutable X and Polygon large raises and partnerships in bear market

7/ Runway/Funding - who funded them, how large was their raise, are they safe from contagion effects of larger funds

Projects need to be properly funded to make good progress in the bear

Projects that secure funding via VCs indicate to the market stronger teams and lower risk

Projects need to be properly funded to make good progress in the bear

Projects that secure funding via VCs indicate to the market stronger teams and lower risk

8/ Would you actually play/use this product

If there wasent a financial incentive or a speculative premium would you actually play the game/use the product because its good ?

Be aware of your bias and recognize that others could enjoy the product even if you dont personally

If there wasent a financial incentive or a speculative premium would you actually play the game/use the product because its good ?

Be aware of your bias and recognize that others could enjoy the product even if you dont personally

To summarize

For each of the 8 pillars give the project a rating out of 10

Be brutally honest, you can always update the score later

Use this as a guide to help you evaluate project

No projects is going to have a perfect high score in every pillar category

#LFGrow

For each of the 8 pillars give the project a rating out of 10

Be brutally honest, you can always update the score later

Use this as a guide to help you evaluate project

No projects is going to have a perfect high score in every pillar category

#LFGrow

Thats it if you found this @info_insightful

1/ Interact with the FIRST tweet in the thread and follow

2/ Check out my pinned tweet to learn more about NFTs, Defi, airdrops & more

Free weekly newsletter for those interested insightfulinfo.substack.com

1/ Interact with the FIRST tweet in the thread and follow

2/ Check out my pinned tweet to learn more about NFTs, Defi, airdrops & more

https://twitter.com/info_insightful/status/1589415817334005760?s=20&t=7wkCwovcOM2sWpbMNae0Mg

Free weekly newsletter for those interested insightfulinfo.substack.com

First tweet for convenience

https://twitter.com/info_insightful/status/1601280780763734023?s=20&t=IH-I_Duxn8PdaAr23NKRcg

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh