#Antony Waste Handling Cell - Undervalued Opportunity in a Defensive Sector? ♻♻🚛

CMP - ₹313

Like and retweet for maximum reach!!

CMP - ₹313

Like and retweet for maximum reach!!

1. Company Overview: Antony Waste has been in the business of waste management for over 2 decades. They have experience in solid waste collection, transportation, processing and disposal services. They primarily cater to Indian Municipal Corporations.

2. Business Model: The Company has 3 main business segments

• Collection and Transportation of Waste: They do door to door collection of MSW from households, slums, commercial establishments and other bulk-waste generators (community bins) from a designated area through primary

• Collection and Transportation of Waste: They do door to door collection of MSW from households, slums, commercial establishments and other bulk-waste generators (community bins) from a designated area through primary

collection vehicles like compactors, dumper placers and tippers and transportation of these materials, to the processing facility, transfer station or a landfill disposal site

• Solid Waste Processing: This involves sorting and segregating the waste received from MSW C&T,

• Solid Waste Processing: This involves sorting and segregating the waste received from MSW C&T,

followed by composting, recycling, shredding and compressing into Refuse Derived Fuel (RDF)

•Other segments: Under this segment, the company provides other services like mechanized sweeping of roads. Additionally, they sell compost derived from the wet waste and also sell scrap

•Other segments: Under this segment, the company provides other services like mechanized sweeping of roads. Additionally, they sell compost derived from the wet waste and also sell scrap

3. Revenue Mix in FY22:

• Collection and Transportation - 62%

• Solid Waste Processing - 23%

• Others - 15%

• Collection and Transportation - 62%

• Solid Waste Processing - 23%

• Others - 15%

4. Projects in Hand: The Company currently has 23 on-going projects. The major projects that the company has are the Kanjurmarg Waste Processing plant which is the largest in Asia. It processes about 60% of Mumbai’s Waste. Apart from that, the Company also has a waste processing

plant at Pimpri Chinchwad where they are setting up a Waste to energy(WTE) plant at a cost of ₹250 Cr which will be operational from March 2023. They have also been awarded a bio-mining contract in Greater Noida. Apart from this, they have won several C&T contacts over the past

2 years in smaller cities like Nashik, Nagpur, Jhansi, Varanasi, etc.

5. Barriers to entry: New entrants in MSW management services face challenges to participate in municipal tenders since most of the tenders have criteria to showcase prior years of experience into waste

5. Barriers to entry: New entrants in MSW management services face challenges to participate in municipal tenders since most of the tenders have criteria to showcase prior years of experience into waste

handling and waste management industry along with a strong financial background. Other management challenges faced by new companies entering in to the business are unskilled and poorly trained labour.

6. Essential Nature of the business: With 1.37 billion people, India has the second largest population in the world. The population is expected to grow at the rate of 1.07% over 2019-2025. The nation also has the youngest demographic profile with a median age of 28.4 years.

This will lead to more consumption, resulting in higher waste generation. There will always be a demand for scientific processing of waste. As the amount of waste generated increases, better technology to process it will be needed.

7. Industry Overview: The Solid Waste Management market in India was valued at ₹5000 Cr in 2020. It is estimated to grow at a CAGR of 14.4% to ₹9800 Cr by 2025. Developed countries such as Sweden, the USA and UK have already moved away from open dumping of waste to a large

extent. A similar trend is now being observed in developing countries such as Sri Lanka and India where governments have realized the danger to the environment posed by open dumping of waste. Local municipalities have adopted a two pronged approach in addressing this issue.

First, municipalities are promoting recycling and waste processing (on-site or at a common plant) to reduce the load on open dump sites and second, they are inviting bidders to set up new scientific landfills as well as converting existing dump sites into a scientific one.

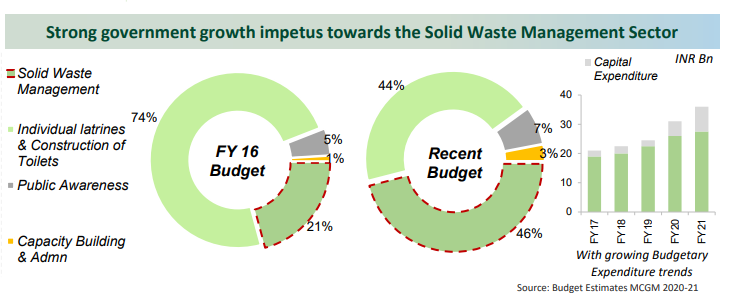

8. Sector Tailwinds:

• Government regulation: The government has started various initiatives like Swachh Bharat to deal with the garbage problem in India. The Swachh Bharat Committee evaluates the performance of various municipal corporations which puts pressure

• Government regulation: The government has started various initiatives like Swachh Bharat to deal with the garbage problem in India. The Swachh Bharat Committee evaluates the performance of various municipal corporations which puts pressure

on the corporations to perform. Moreover, the Supreme Court ruling to deal with all solid waste in India in a scientific way has pushed a lot of municipal corporations to float new tenders for bio mining their garbage dumps

• Increase in privatization: About 35% of the waste

• Increase in privatization: About 35% of the waste

generated in India is processed. Municipal Corporations will not be able to take this to 100% by themselves. They are starting to rely on private players like Antony to bring in technological expertise to deal with the problem in a scientific way.

Micro Cap Club:

valueeducator.com/micro-cap-club/

valueeducator.com/micro-cap-club/

• • •

Missing some Tweet in this thread? You can try to

force a refresh