Musings of the Day, 12/10/22:

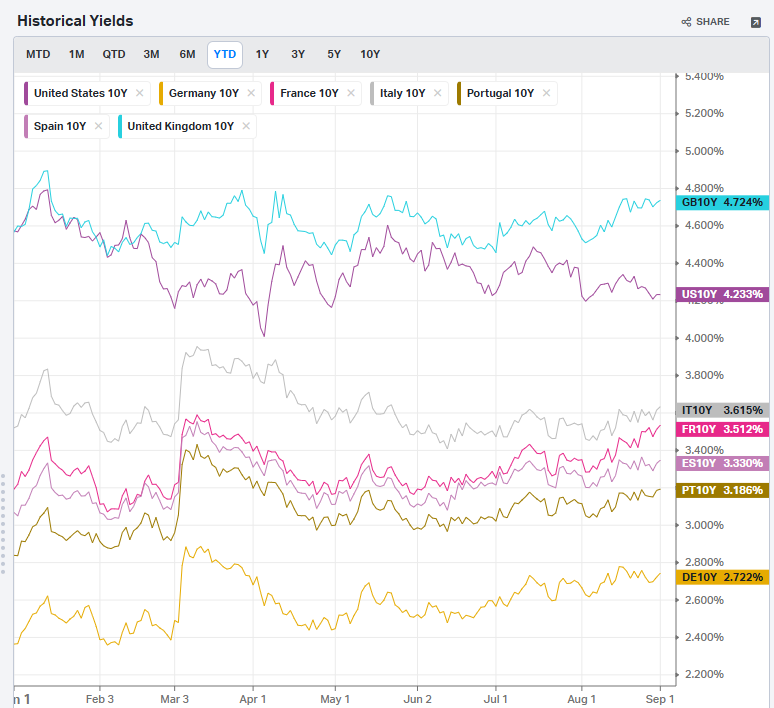

BOE is in same quandary as ECB/BOJ/PBOC — can they out-hawk the Fed?

Conversely, when we truly pivot, will RoW hold out and let Fed out-dove them?

#USDWreckingBall

BOE is in same quandary as ECB/BOJ/PBOC — can they out-hawk the Fed?

Conversely, when we truly pivot, will RoW hold out and let Fed out-dove them?

#USDWreckingBall

https://twitter.com/financialjuice/status/1601591069380050945

Missed this Fir Tree lawsuit over $GBTC. Thanks for flagging this, @DoombergT. Must-read.

https://twitter.com/DoombergT/status/1601529762639269888

From GS this am:

“The last few weeks have demonstrated how prone the market is to FCI easing when the marginal policy decision becomes incrementally dovish.”

“The last few weeks have demonstrated how prone the market is to FCI easing when the marginal policy decision becomes incrementally dovish.”

“As mentioned in prior notes, I believe this would be a mistake...FCI easing is NOT what the Fed needs at this stage of their inflation fight.”

“Based on the current/realised levels of FCI, the GDP impulse fades from close to -2% currently to -1.2% in Q1 and then turns positive by Q3 next year.”

“…risk is that when those negative impulses wash out (temporary on the way up so temporary on the way down), we are left with sticky inflation above the target range, largely driven by high wage growth.”

👆

+Core/Energy Tag-Team as Oil hits Supply/Demand Singularity Point.

👆

+Core/Energy Tag-Team as Oil hits Supply/Demand Singularity Point.

As a gamer I am pleased about this. I don't wanna see a whole bunch of games become "Xbox exclusives" especially since PS5 is a superior platform.

https://twitter.com/FirstSquawk/status/1601346405259685889?s=20&t=V9WnNmCBjNt0WgzzAu8T4g

From Tony P/GS:

“we’re going into 2023 with a stock market that charges an 18 multiple for the prospect of ... 0% earnings growth."

Is that bad?

“we’re going into 2023 with a stock market that charges an 18 multiple for the prospect of ... 0% earnings growth."

Is that bad?

Re: Mental Model-Destructive/Constructive Interference In Econ Cycles

Thinking about where we are in the Oil Cycle reminds me of this this Mental Model from Physics.

(SHORT THREAD)

Thinking about where we are in the Oil Cycle reminds me of this this Mental Model from Physics.

(SHORT THREAD)

Econ cycles come in varying wavelengths; LT cycles = long wavelengths & ST cycles = short wavelengths.

ST cycles often oscillate within LT cycles.

ST cycles often oscillate within LT cycles.

In Oil, LT cycles are driven by capex cycles that have 5-10 year gestation periods and primarily affect SUPPLY. ST cycles are driven by the macroeconomy and primarily affect DEMAND.

In this Mental Model, I’m making a simplifying assumption that this complex interplay between Supply and Demand boils down to LT/ST impacts on PRICE.

Even this simplifying assumption is complicated by the differing wavelengths that result in periods where super-imposed waves are out-of-phase vs. in-phase.

Destructive Interference occurs when one wave is out-of-phase with another -> Overall superimposed wave is DAMPENED.

Constructive Interference occurs when one wave is in-phase with another -> Overall superimposed wave is AMPLIFIED.

Constructive Interference occurs when one wave is in-phase with another -> Overall superimposed wave is AMPLIFIED.

Oil is going into a period of Destructive Interference now, but it will be followed by a period of Constructive Interference.

This is how it is entirely consistent to have a ST bearish view due to macro demand factors while still maintaining a LT bullish view due to LT capex trends.

(END THREAD)

(END THREAD)

The Structural Supply/Demand Singularity in Oil occurs when the ST cycles get back in-phase with the LT capex cycle.

I think there is a good probability of this occurring in 2024.

I think there is a good probability of this occurring in 2024.

https://twitter.com/UrbanKaoboy/status/1554912500889448448

One thing I didn’t mention in this Mental Model is wave AMPLITUDE.

LT cycle may have a very large ultimate amplitude but wavelength is long so an negative (out-of-phase) ST cycle of large amplitude can dominate for periods of time.

👆This is my biggest concern for Oil in ST.

LT cycle may have a very large ultimate amplitude but wavelength is long so an negative (out-of-phase) ST cycle of large amplitude can dominate for periods of time.

👆This is my biggest concern for Oil in ST.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh