GS/J. Aron➡Canyon Partners➡Akanthos Capital➡Kao Family Office🏦Globetrotter✈ Headbanger🤘Star Wars Fan🌌 Mixologist🍸Diver🤿 | NO INVESTMENT ADVICE

12 subscribers

How to get URL link on X (Twitter) App

Several questions from folks on this thread asking why I think the US Fiscal situation might actually be improving as a result of the Trump 2.0 Playbook.

Several questions from folks on this thread asking why I think the US Fiscal situation might actually be improving as a result of the Trump 2.0 Playbook.https://twitter.com/urbankaoboy/status/1959246416402092261

The thing I like about Bold Bowman is that she’s no bullshit and calls it like it is when the facts change.

The thing I like about Bold Bowman is that she’s no bullshit and calls it like it is when the facts change.

Never quite seen anything like this.

Never quite seen anything like this.

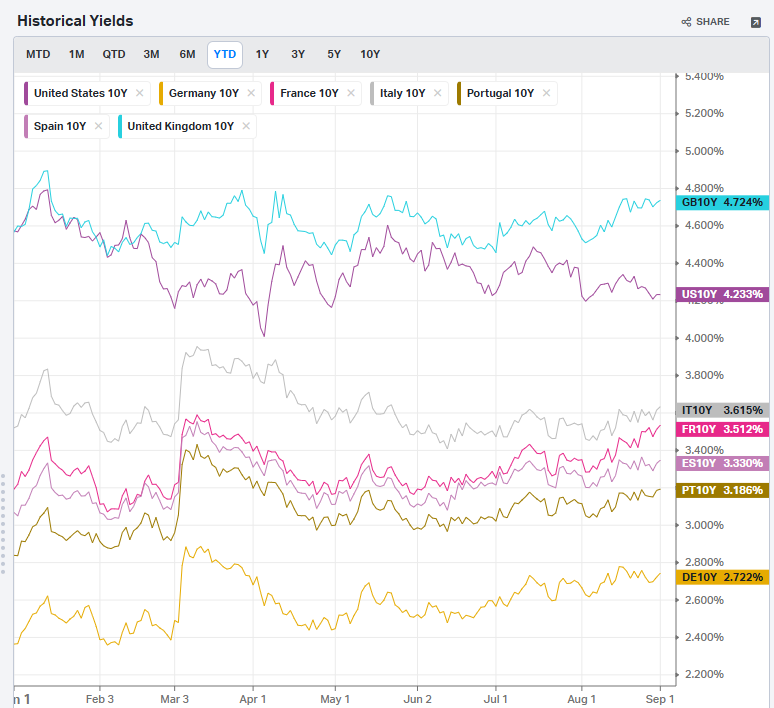

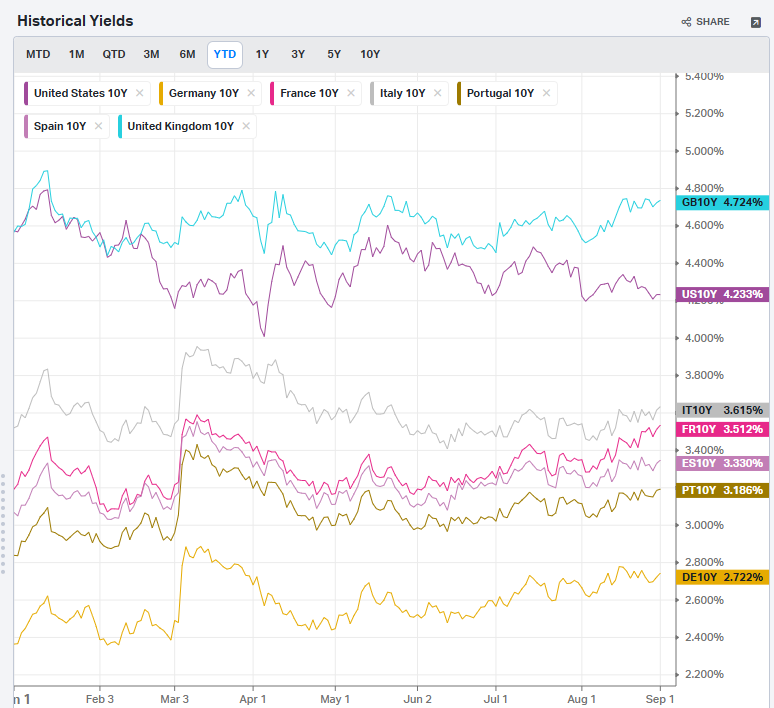

Duration via Long USTs looks very interesting again.

Duration via Long USTs looks very interesting again.

This example shows the world that Trump is fine raising cash with Tariffs — even against an Ally (who is insistent on keeping Pre-Existing Tariffs).

This example shows the world that Trump is fine raising cash with Tariffs — even against an Ally (who is insistent on keeping Pre-Existing Tariffs).

https://twitter.com/urbankaoboy/status/1916864817224360315

I completely agree with @michaelxpettis on the intractability of China’s fundamental problem, which is really a sovereign version of the Innovator’s Dilemma:

I completely agree with @michaelxpettis on the intractability of China’s fundamental problem, which is really a sovereign version of the Innovator’s Dilemma:

“Trump is begging for a deal, and Xi isn’t taking his call.”

“Trump is begging for a deal, and Xi isn’t taking his call.”

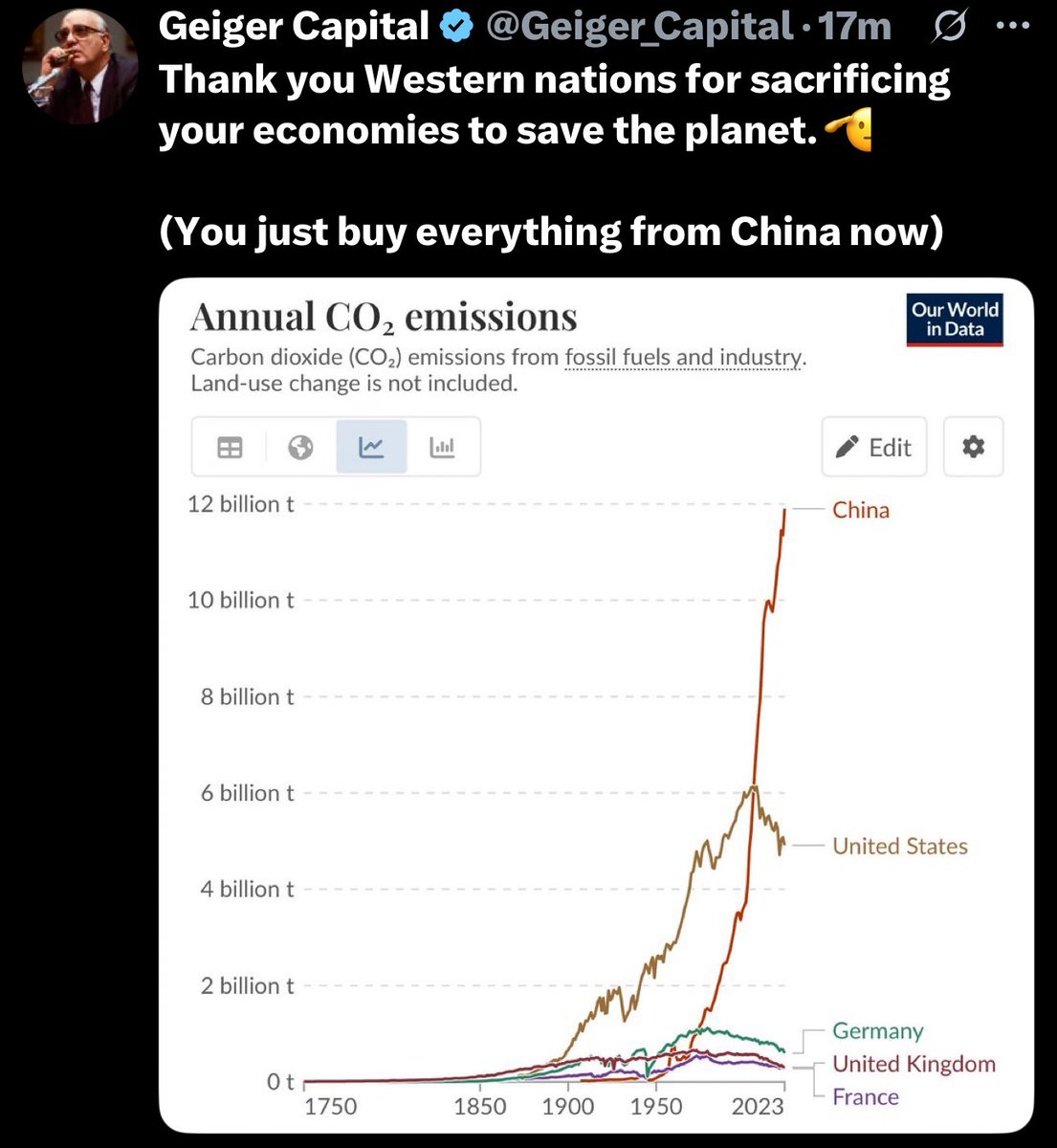

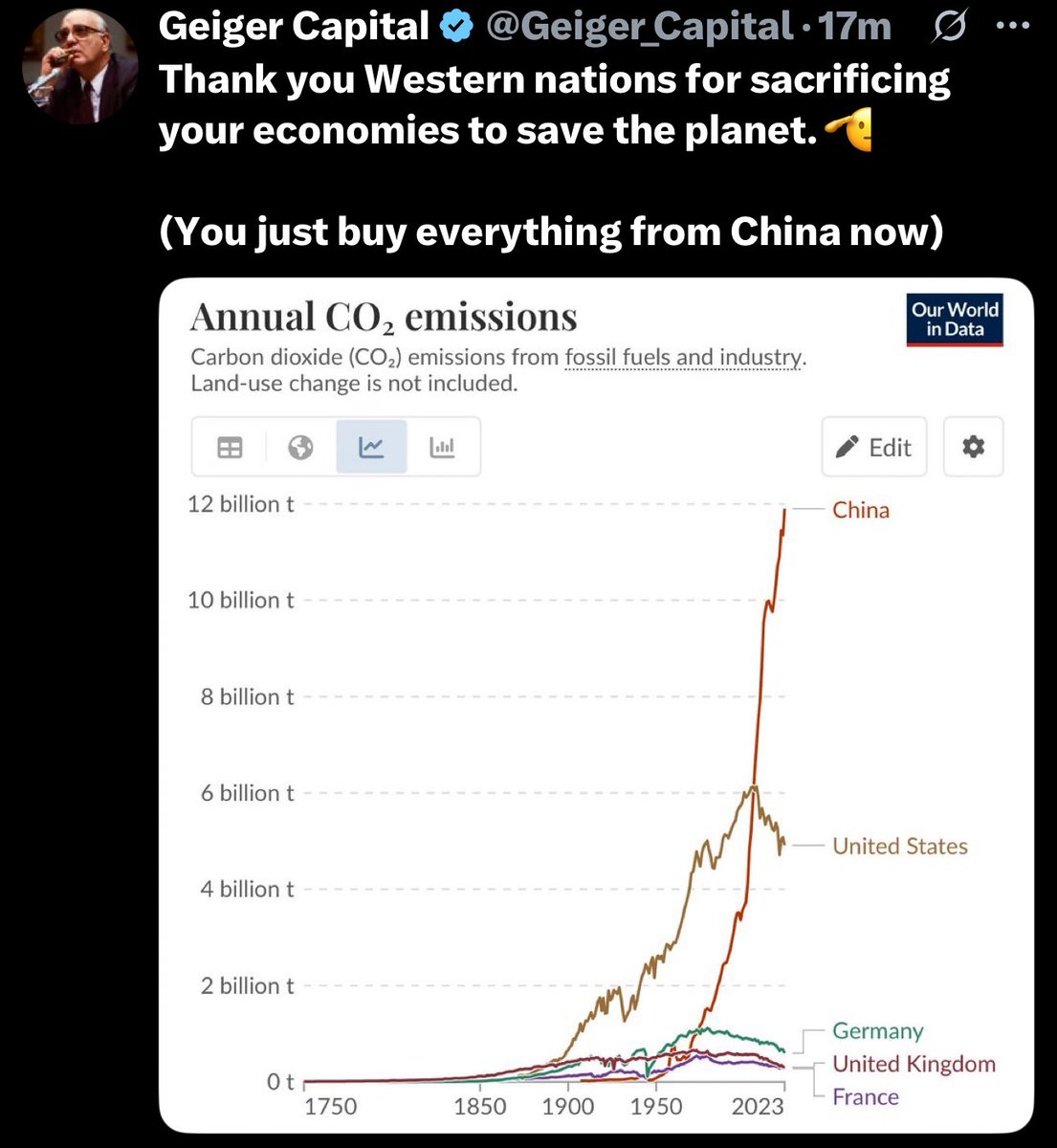

This is an account worth following in light of the Canadian election yesterday going to Carney, who has immediately doubled down on Globalization and Climate Change policies.

This is an account worth following in light of the Canadian election yesterday going to Carney, who has immediately doubled down on Globalization and Climate Change policies.

100% agree with Crusader.👇

100% agree with Crusader.👇

I love this post not just because of the irony of this gentleman “studying RMB Internationalization efforts for 16 years” but because it demonstrates:

I love this post not just because of the irony of this gentleman “studying RMB Internationalization efforts for 16 years” but because it demonstrates:

This is a MUST WATCH — especially if you believe that China holds the cards in this Tariff War.

This is a MUST WATCH — especially if you believe that China holds the cards in this Tariff War.

Not that there is a practical difference between 145% and 245% Tariffs — both are effective Embargoes — but here is a bit of “good news” before you believe the daily media-exacerbated hyperventilation:

Not that there is a practical difference between 145% and 245% Tariffs — both are effective Embargoes — but here is a bit of “good news” before you believe the daily media-exacerbated hyperventilation: https://twitter.com/typesfast/status/1912481362667577719

I see these exclusions as less about picking Big Tech over Small Businesses and more about what industries are Critical Path Industries.

I see these exclusions as less about picking Big Tech over Small Businesses and more about what industries are Critical Path Industries.

Correctamundo.

Correctamundo. https://x.com/urbankaoboy/status/1908883383935197190?s=46

Possible Key Reversal day in the Long Bond signaling the end to this particular Flight to Safety?

Possible Key Reversal day in the Long Bond signaling the end to this particular Flight to Safety?

https://twitter.com/defense_civil25/status/1908315865457602640

https://twitter.com/kobeissiletter/status/1907533834876277016

https://twitter.com/vrntperception/status/1887144442219389172