Here is my morning run down of the current market outlook using Dark Pools, Dealer Positioning and market wide Options Flow to inform our #optionstrading and #futurestrading today. Data can change but it will help formulate a plan.

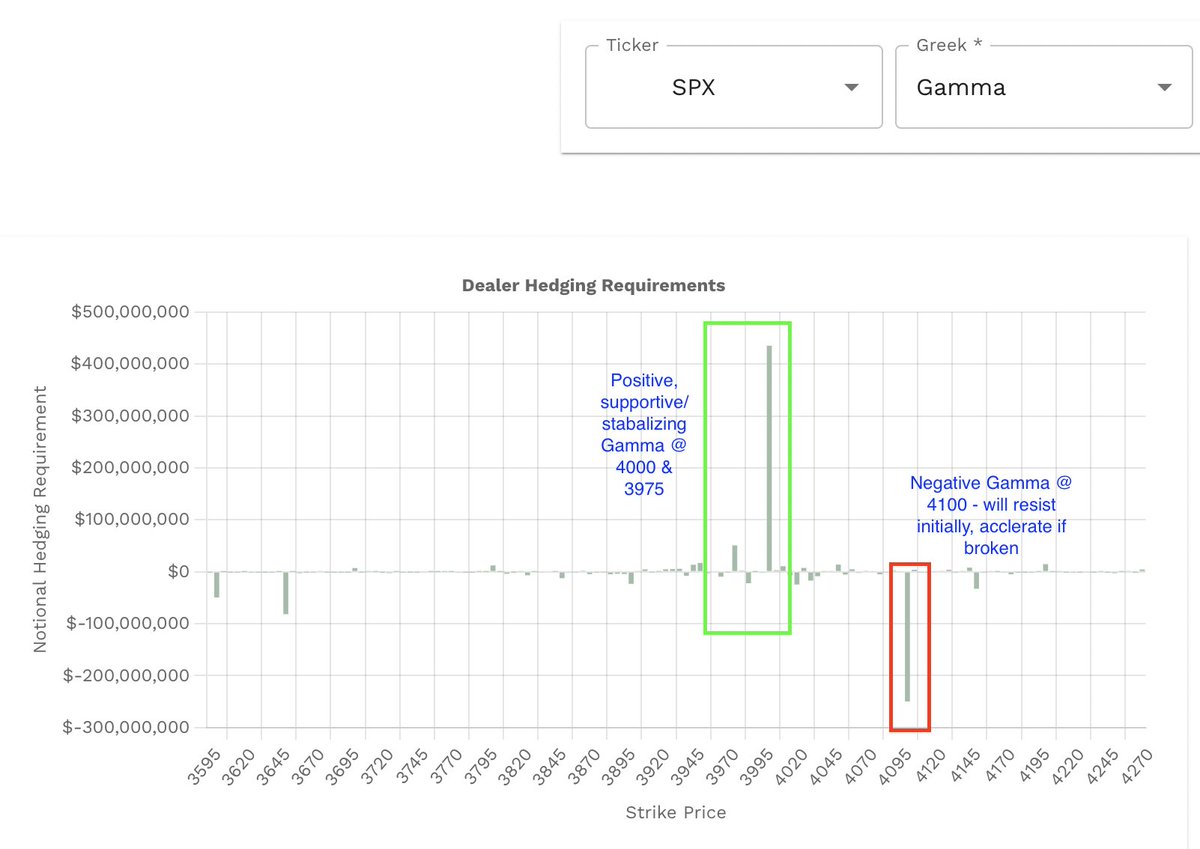

Lets start with $SPX Gamma and Vanna courtesy of @WizOfOps #volland. The magnet at $SPX 4000 has grown by approx $20bil. Repellent at 3850 remain, accelerate if broken. See attached. Positive gamma shows ceiling at 4000 as well.

Now let's do the same for $SPY but add in some additional data points from @Tradytics data driven insights. Vanna magnet @ $400. Repel @ $390. Neg gamma @ $395/$397 could assist move to $400 if broken. The 3-day delta forecast shows we could go either way (expected).

$SPY Dark Pools help paint the the picture further. Sig prints at $393.10, slightly bullish. Clearing $396 would open the way to $400. Big shift in volume and bullish DP sentiment.

Now, take a look at 5-day market net flow and delta positioning across the market. Puts continue to accumulate, most likely for downside protection. Market wide deltas shifted bearish again by about $277 million (-0.277 billion) which is expected for the recent chop.

Lastly, we need to make sure we keep all the upcoming macro number releases in mind as they are the big fundamental drivers of the market. We have inflation expectations today at 11am and CPI tomorrow at 8:30am. This is the big one everyone is anticipating.

CPI should be the event that allows us to move out of this consolidation on higher time frames. The dealer structure and dark pools makes me think we'll be parked at 4000 $SPX / $400 $SPY by the end of the day. However, inflation expectations could throw that off.

@WizOfOps One thing I should note about this - when CPI passes, IV will drop which is why 4000 is favored over 3850. Of course, this assumes no bad news surprises. I would never encourage gambling into CPI.

We just "tractor beamed" to the 3975 "Vanna magnet" on $SPX outlined in the screen shots. I have major regrets for not holding longs since these VWAP holds on $ES 😅. Also, as outlined, $397 breaking on $SPY caused MM buying assistance #volland.

Well... 18 points away on $SPX... what a run. Vanna is no joke.

• • •

Missing some Tweet in this thread? You can try to

force a refresh