Check out my YouTube https://t.co/2iEXlKXWJr where I produce education content around dealer data, price action and volume to help others.

3 subscribers

How to get URL link on X (Twitter) App

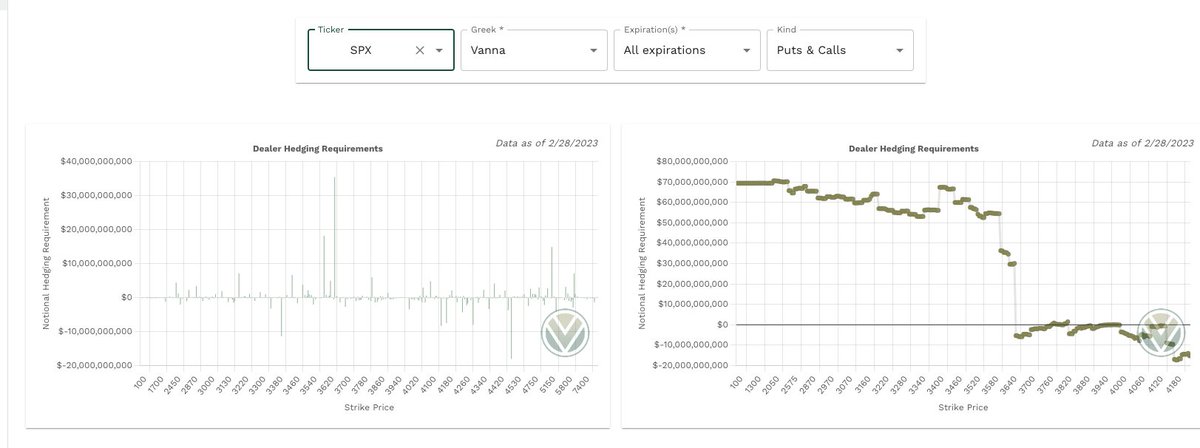

https://twitter.com/Fatty_Trades/status/1608463897421307904We could also see delta structure was most likely to be bullish on $SPY (see morning thread). All these factors (macro news, vanna/gamma, delta correlations) made me like upside. I prefer to primarily trade $ES, $NQ & $SPY, so I use this data to formulate my thesis before open.

https://twitter.com/Fatty_Trades/status/1606036847955546112

The question on your mind is how do I know when to get in? It's a 20 point range including the FVG & OB so we don't just want to buy immediately, we need confirmation. For overnight confirmations on $NQ I prefer the 1m time frame. We close in and the FVG clears quickly.

The question on your mind is how do I know when to get in? It's a 20 point range including the FVG & OB so we don't just want to buy immediately, we need confirmation. For overnight confirmations on $NQ I prefer the 1m time frame. We close in and the FVG clears quickly.

In this instance, I'm using the @Tradytics Dealer Positioning dashboard and viewing deltas, which correlates current dealer side positioning with $SPY moves going back to 6/2021. It's one of the easiest, most effect ways to view the impact delta structure has had historically.

In this instance, I'm using the @Tradytics Dealer Positioning dashboard and viewing deltas, which correlates current dealer side positioning with $SPY moves going back to 6/2021. It's one of the easiest, most effect ways to view the impact delta structure has had historically.

Okay looking like I might try some longs if I can find a good entry but I'm going to be cautious around bearish OB's. Not going to assume they break, just take profits when we approach.

Okay looking like I might try some longs if I can find a good entry but I'm going to be cautious around bearish OB's. Not going to assume they break, just take profits when we approach.

The London session printed its low @ 3943.50. The NY open created two notable bearish OB's and consumed liquidity from London bull move on its way down (note - referencing 3m chart).

The London session printed its low @ 3943.50. The NY open created two notable bearish OB's and consumed liquidity from London bull move on its way down (note - referencing 3m chart).