The #InflationReductionAct throws the full financial weight of the federal govt behind the clean energy transition.

The result: CO2 & electricity costs in the largest US electricity market, @pjminterconnect, will BOTH decline sharply through 2030, we find in a new ZERO Lab study

The result: CO2 & electricity costs in the largest US electricity market, @pjminterconnect, will BOTH decline sharply through 2030, we find in a new ZERO Lab study

Detailed electricity system modeling performed for the report (doi.org/10.5281/zenodo…) also finds that PJM could cut CO2 as much as 80-90% from current levels by 2035 while maintaining bulk electricity supply costs comparable to or lower than levels experienced in recent years.

The study employs an open-source electricity system capacity planning model (genx.mit.edu) to assess the impact of the Inflation Reduction Act (IRA) on the cost of electricity, emissions, and investment in electricity capacity in @pjminterconnect over 2023-2035 period.

The report also explores how new and expanded federal subsidies for clean electricity resources could enable “deep decarbonization” of the PJM grid while maintaining an affordable electricity supply.

Note: The project was supported by Community Energy, Inc., a developer of renewable electricity, through the Princeton E-ffiliates Partnership, and is published in the spirit of a working paper for public dissemination prior to peer review.

The study concludes that IRA will spark a new, sustained period of growth in PJM electricity consumption, which could rise ~19% from 2021 to 2030 as electric vehicles and heat pumps are adopted across the region.

The law also subsidizes the cost of deploying new renewable energy and maintaining the region’s existing nuclear fleet. As a result, we find that clean electricity could supply 60% [58-66% across sensitivities] of PJM demand in 2030, up from 48% [43-61%] without enactment of IRA.

However, realizing this potential will require a dramatic acceleration in the pace of wind and solar interconnection and transmission expansion in the PJM Interconnection.

The growth of lower-cost, carbon-free electricity under IRA will significantly reduce CO2 emissions from PJM power generation, which could fall 37% [3-66%] from 2019/2021 levels by 2030. In contrast, PJM emissions would increase 12% [0-15%] from 2021 levels without IRA.

IRA also lowers the cost of electricity supply in the PJM region. We find the avg cost of bulk electricity supply incl. transmission & state policy will be ~$42/MWh [~$40-45/MWh] in 2030, about 5-10% lower than w/out IRA + well below costs paid in 2019 (~$50/MWh) or 2021 (~$61)

While IRA puts the PJM region on a path to lower-cost electricity and lower greenhouse gas emissions, the new federal policy is not sufficient to drive deep decarbonization of the PJM interconnection on its own.

Fortunately, by subsidizing the cost of all new carbon-free electricity resources, IRA also makes it cheaper and easier for PJM states to reduce emissions further while preserving affordability.

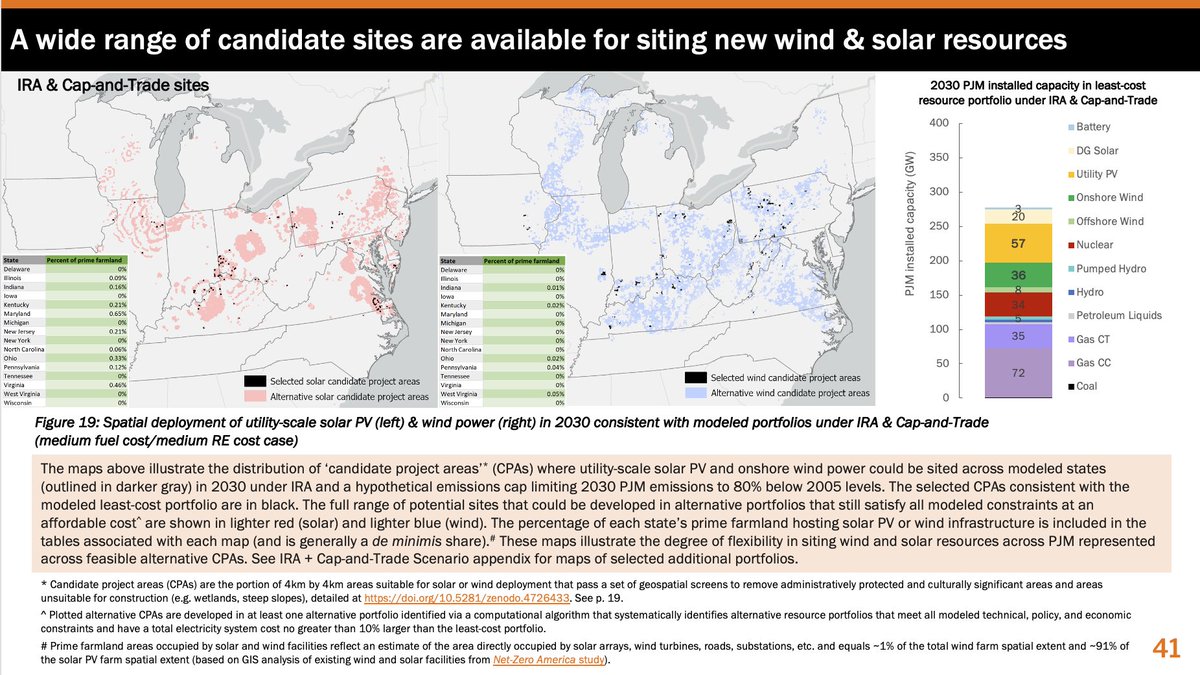

The new study also presents a cost-optimized blueprint of the additional capacity investments and resource deployment required for the PJM region to deeply decarbonize over the 2023-2035 period.

This study finds that, due to passage of IRA, the PJM region could cut CO2 emissions from power generation by 80-90% by 2035 while keeping average bulk electricity supply costs comparable to or lower than levels experienced in recent years (2019 & 2021).

However, deep decarbonization in the PJM region will require much more rapid expansion of low-carbon electricity resources and supportive transmission expansion above and beyond the rates of deployment made economical by IRA.

PJM will also need to deploy more advanced ‘clean firm’ resources like gas plants with carbon capture and storage or long-duration electricity storage technologies, to replace coal- and gas-fired power capacity. Early deployment of these nascent techs can begin soon w/fed support

Please see the full report, which also assesses sensitivity to future natural gas price and renewable energy cost uncertainties and explores and maps a range of alternative resource portfolios that could reach the same goals at affordable cost: doi.org/10.5281/zenodo…

Congatulations to current and former ZERO Lab researchers @qingyu_xu7 @chuanzhang_pu @NehaSPatankar & @Michael48831282 for their work on this study! And thank you to @brentalderfer & Community Energy for the financial support to carry out this work.

/End.

/End.

• • •

Missing some Tweet in this thread? You can try to

force a refresh