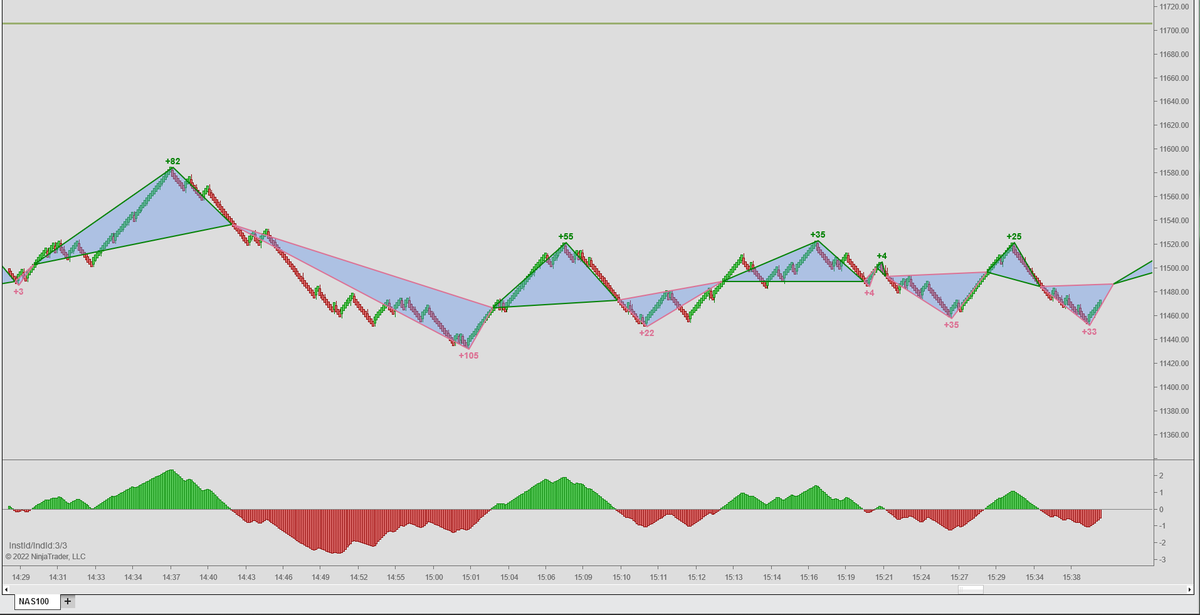

Wanted a way to easily visualise the MFE (max favourable excursion), entry & exit on the chart from various signals to aid research. After a little thinking, triangles I thought would be nice (entry, exit, MFE).

So, here we have MFE in pts from BIAS changes in indie.

So, here we have MFE in pts from BIAS changes in indie.

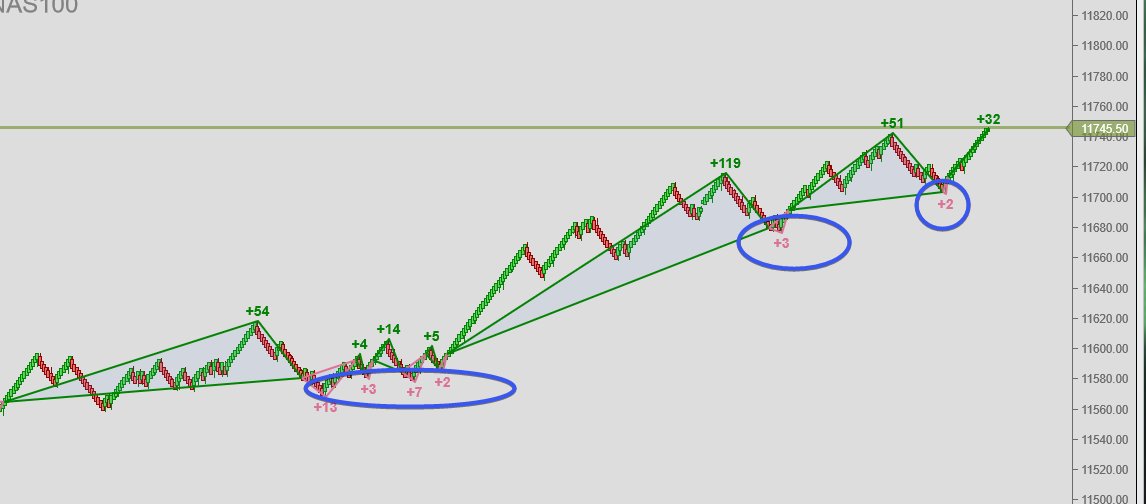

Here's another one. I like looking at MFE like this. Gives me a better idea of what you can actually shoot for and helps me avoid bailing early. Not sure many people optimise on MFE. It makes sense to me (at the moment!)

Going to turn the indie into a library I can use with any of my BIAS outputs/strategies. This is proof of concept hard coded into HA bars at the moment. Looks good to me! Must have the rose-tinted specs on again...

Observation - In a wider uptrend (like this low volume drift! Urghhhh). Failed opposing signals may be good pullback opportunities. OK - That gives me a pyramiding idea...

Just fixing a few 🐛 in this. #Ninjatrader Performance tip - (and the cause of bug!). Drawing objects, even historically before the chart shows, takes a LOT of resources. Try to draw them once, rather than every bar. A bit of thought and you can do this, historically, at least.

• • •

Missing some Tweet in this thread? You can try to

force a refresh