Sailor, biker, adventurer, trade & build 'stuff'.

❤ coffee.

Everybody counts.

🙈🙉🙊

https://t.co/Q8CJomuvoo

How to get URL link on X (Twitter) App

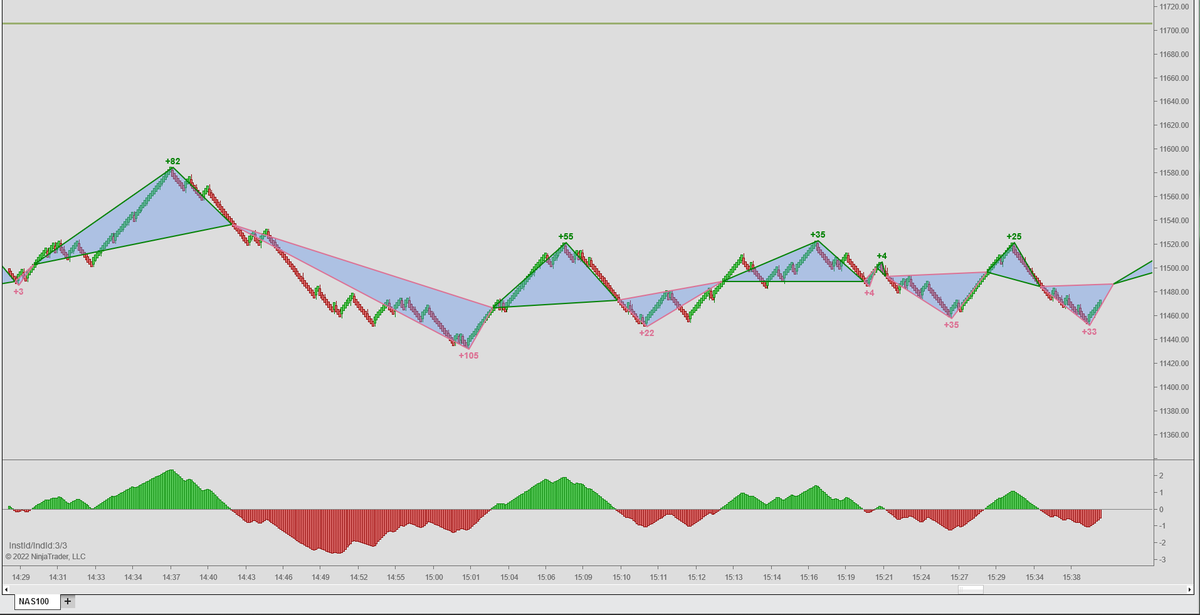

Trained for 80 range and hooked in with profileBars. 90 days of training data on the 7-day chart. Awesome companion! (zones are from HeikenAshi indie)

Trained for 80 range and hooked in with profileBars. 90 days of training data on the 7-day chart. Awesome companion! (zones are from HeikenAshi indie)

You do have to believe, however, that past history is in fact reflective of what might happen in the future...

You do have to believe, however, that past history is in fact reflective of what might happen in the future...

Clear as mud. I am out today, so hope you just keep on playing tennis until I get back...

Clear as mud. I am out today, so hope you just keep on playing tennis until I get back...

Realise how often they get killed (at least in the short term). This should be a lesson for you in itself!

Realise how often they get killed (at least in the short term). This should be a lesson for you in itself!

I find it interesting how it waits a bit, like many traders, and does not take the first pullback...

I find it interesting how it waits a bit, like many traders, and does not take the first pullback...

So, what's the point of this? A tremendous amount of work etc. Apart from getting rid of a bee in my bonnet, so to speak, it gives on-the-fly probabilities. For instance - The probability of a close 10pt higher in the next 2 bars, is X%, and it will do it in real-time

So, what's the point of this? A tremendous amount of work etc. Apart from getting rid of a bee in my bonnet, so to speak, it gives on-the-fly probabilities. For instance - The probability of a close 10pt higher in the next 2 bars, is X%, and it will do it in real-time

Platform froze for a minute there! You should have seen me run downstairs to get my phone! PANIC STATIONS! 😆

Platform froze for a minute there! You should have seen me run downstairs to get my phone! PANIC STATIONS! 😆

Here's another one. I like looking at MFE like this. Gives me a better idea of what you can actually shoot for and helps me avoid bailing early. Not sure many people optimise on MFE. It makes sense to me (at the moment!)

Here's another one. I like looking at MFE like this. Gives me a better idea of what you can actually shoot for and helps me avoid bailing early. Not sure many people optimise on MFE. It makes sense to me (at the moment!)

Will probably spend the time researching stuff, trying to get presents for family, etc. So, if you have any interesting ideas ;)

Will probably spend the time researching stuff, trying to get presents for family, etc. So, if you have any interesting ideas ;)