1- #ConnectingTheDots Markets & the economy

Let's start with the economy: There is an abundance of signs now pointing to a "hard landing"

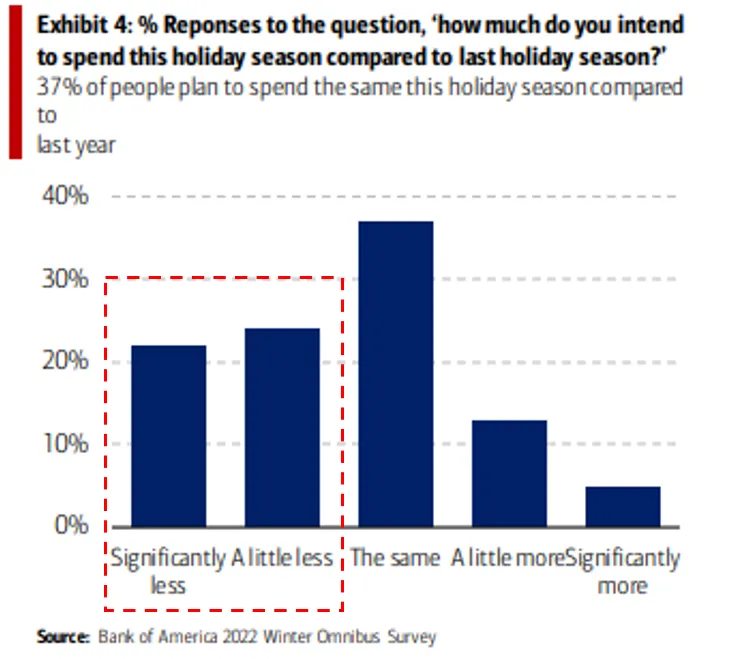

Near term US Retail data tracks very poorly...

Let's start with the economy: There is an abundance of signs now pointing to a "hard landing"

Near term US Retail data tracks very poorly...

2- ...the European consumer is cutting back sharply...

https://twitter.com/fkronawitter1/status/1602594092076212228

3- ... and China is ravaged by Covid. This wave will blow over soon, but what remains afterwards? A property bubble with 20% vacancy rates

https://twitter.com/michaelxpettis/status/1602930721454231552

4- Yet, markets remain resilient after their recent drop. Why? Three reasons, in my view

First, as the debt ceiling is reached, the Treasury can't issue new debt anymore, so it spends down its coffers

First, as the debt ceiling is reached, the Treasury can't issue new debt anymore, so it spends down its coffers

5- This improves market liquidity and in turn risk assets

With ~350bn left today, the TGA will be run down to zero around March

A compromise to raise the ceiling will happen *before* that. Then, UST issuance picks up and - ceteris paribus - Net Liquidity declines again

With ~350bn left today, the TGA will be run down to zero around March

A compromise to raise the ceiling will happen *before* that. Then, UST issuance picks up and - ceteris paribus - Net Liquidity declines again

6- Second, markets will likely also be supported by the Fed

As inflation abates, Powell will feel more room to avoid an "overtighten" which he already said he does not want to do

As inflation abates, Powell will feel more room to avoid an "overtighten" which he already said he does not want to do

https://twitter.com/NickTimiraos/status/1602700934550806528?s=20&t=V4FRojldeNvYTCfW6XijzA

8- I had a negative stance on risk assets coming into this week. But markets remained resilience so far.

Especially the liquidity dynamics are noteworthy

When the facts change, you gotta change. As such I have adjusted my stance accordingly

Especially the liquidity dynamics are noteworthy

When the facts change, you gotta change. As such I have adjusted my stance accordingly

My expectation remains that the dissonance between markets and a "hard landing" will likely be resolved by a market sell-off

However, it appears that the probabilities shifted for this to occur in the New Year

However, it appears that the probabilities shifted for this to occur in the New Year

• • •

Missing some Tweet in this thread? You can try to

force a refresh