How to get URL link on X (Twitter) App

https://twitter.com/ForexLive/status/1715098573061124122?s=20However, after the Quarterly Refunding Announcement on August 2nd shocked markets, it seems unlikely that large buyers step in before the next one on Nov 1

2 - What's the reason?

2 - What's the reason? https://twitter.com/NickTimiraos/status/1622306046210412544

2- This was contrary to my expectations, as "leaks" suggested ambiguity that the market would have read dovish

2- This was contrary to my expectations, as "leaks" suggested ambiguity that the market would have read dovish https://twitter.com/NickTimiraos/status/1602700934550806528

2- ...the European consumer is cutting back sharply...

2- ...the European consumer is cutting back sharply...https://twitter.com/fkronawitter1/status/1602594092076212228

2- Now, the wage data likely wasn't an error or outlier

2- Now, the wage data likely wasn't an error or outlier https://twitter.com/jasonfurman/status/1598819086003159040

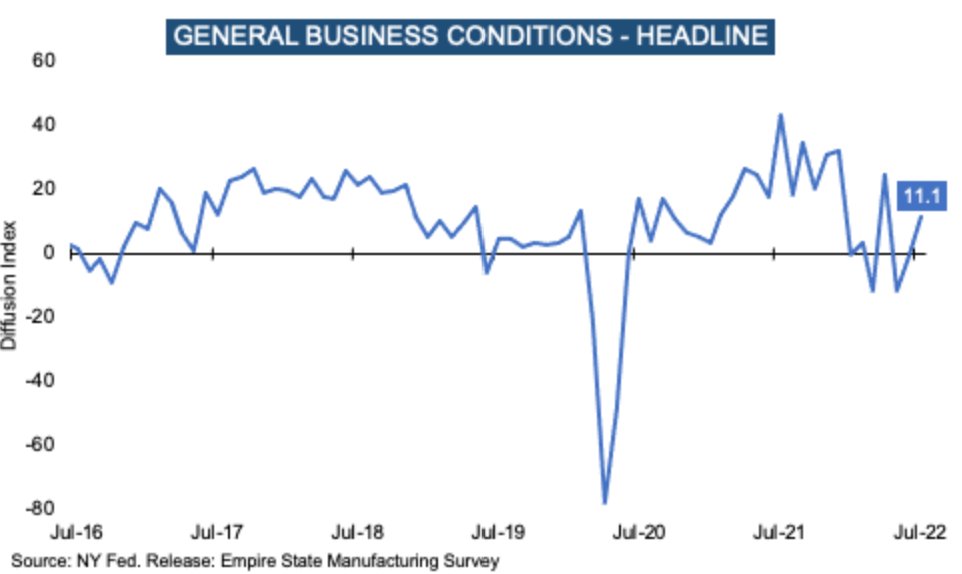

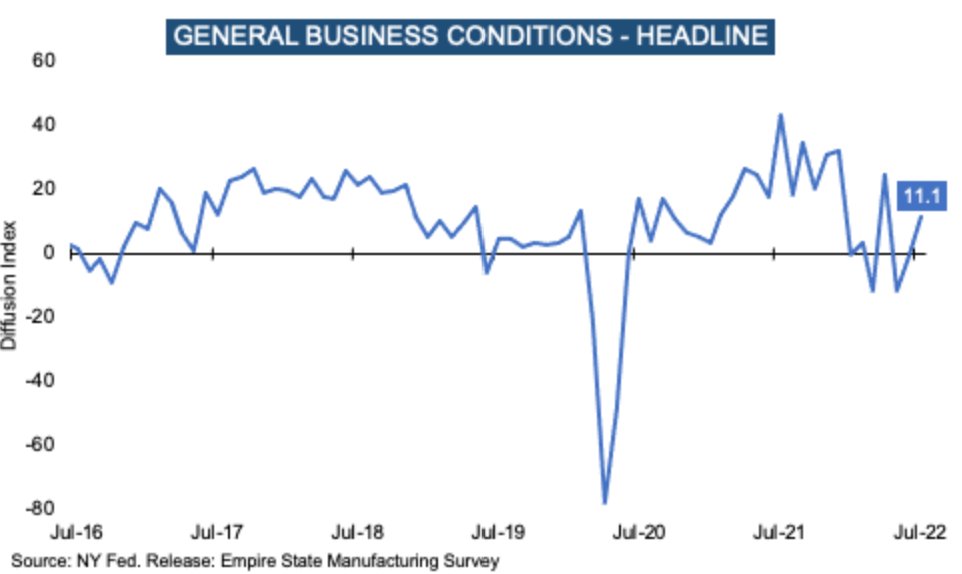

2- Many lead indicators point to significant contraction ahead

2- Many lead indicators point to significant contraction ahead

2- Janet Yellen has scheduled ~$500bn debt issuance between now and Dec 31st. So the ceiling needs to be increased

2- Janet Yellen has scheduled ~$500bn debt issuance between now and Dec 31st. So the ceiling needs to be increased

https://twitter.com/fkronawitter1/status/1580136255693914112

2- So new orders continue to fall off a cliff

2- So new orders continue to fall off a cliff

2- Near-term credit card data suggests spending HELD UP through September - no sign of any deceleration at all

2- Near-term credit card data suggests spending HELD UP through September - no sign of any deceleration at all

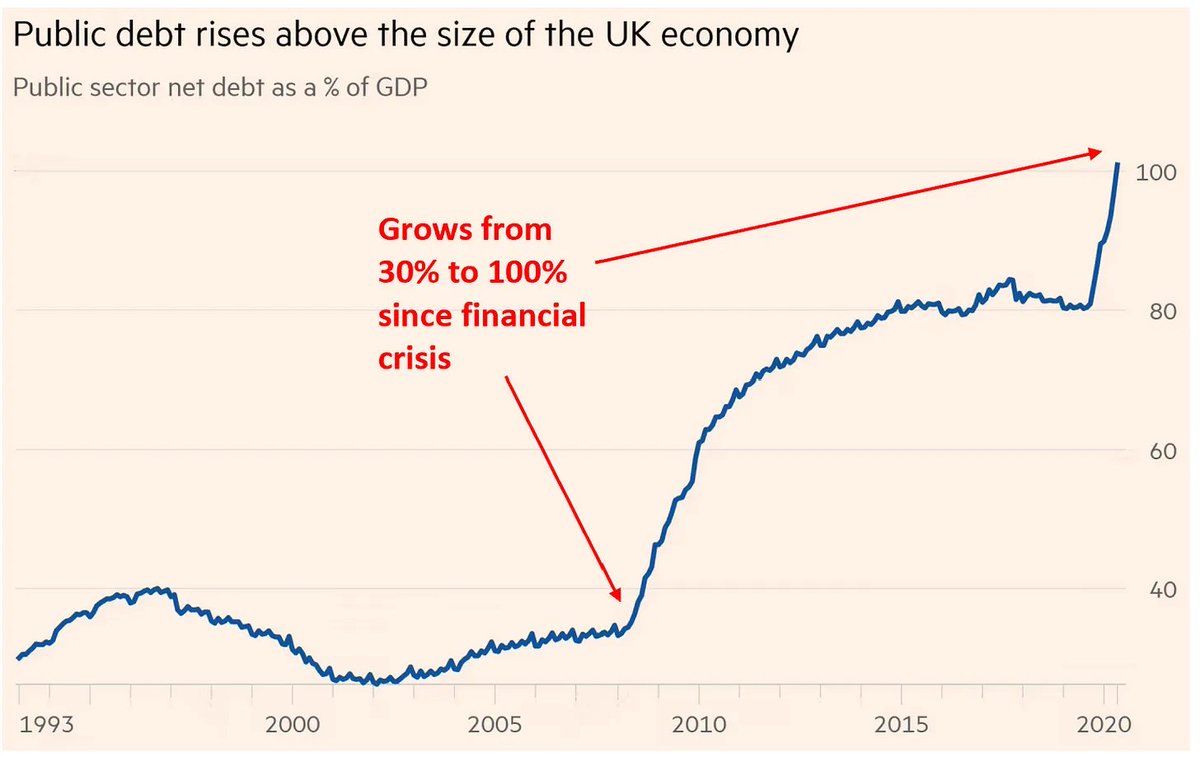

2- A 4-5% yield is simply too HIGH for both public (see chart) and private sector debt

2- A 4-5% yield is simply too HIGH for both public (see chart) and private sector debt

https://twitter.com/fkronawitter1/status/1572943902898032642?s=20&t=52k5zHHawbe2Yb5Lra0dig2- However, unlikely the 2009 or 2020 lows, this is not an equity story. It is an FX and BOND MARKET story

2- NB: August was the PEAK in Gas and Power prices. So for September, this number likely comes DOWN

2- NB: August was the PEAK in Gas and Power prices. So for September, this number likely comes DOWN

2- ...the SUPPLY of new homes is near a RECORD...

2- ...the SUPPLY of new homes is near a RECORD...

2- Industrial data is CRATERING - Yesterday's US Composite PMI at 45, fastest contraction in 13 years

2- Industrial data is CRATERING - Yesterday's US Composite PMI at 45, fastest contraction in 13 years

2- And mortgage demand, which leads home sales, at lowest level in 22 years cnbc.com/2022/06/08/mor…

2- And mortgage demand, which leads home sales, at lowest level in 22 years cnbc.com/2022/06/08/mor…

2- That's the lazy view - there is plenty more detail! Businesses are also asked about their views 6 months from now, and that outlook is dire:

2- That's the lazy view - there is plenty more detail! Businesses are also asked about their views 6 months from now, and that outlook is dire: