You missed $GMX, $MVX, $GNS and $OPX ?

Let me present through its testnet, @Level__Finance, the perp DEX building a whole new way of LPing 👇

Let me present through its testnet, @Level__Finance, the perp DEX building a whole new way of LPing 👇

What is Level Finance?

@Level__Finance is a new DEX built on the @BNBCHAIN providing spot and perpetual trades with up to 30x leverage.

The protocol is similar to $GMX as it also provides low fees, low price impact, dynamic pricing through a chainlink oracle and real yield

1/

@Level__Finance is a new DEX built on the @BNBCHAIN providing spot and perpetual trades with up to 30x leverage.

The protocol is similar to $GMX as it also provides low fees, low price impact, dynamic pricing through a chainlink oracle and real yield

1/

So what are the differences with $GMX and its forks ?

First, Levels is building on the $BNB chain, which is gaining some traction recently, trying to dust-off its ICO degen image from last years.

If we look on-chain, the BSC is ranked 2nd in terms of TVL with $4,97B

2/

First, Levels is building on the $BNB chain, which is gaining some traction recently, trying to dust-off its ICO degen image from last years.

If we look on-chain, the BSC is ranked 2nd in terms of TVL with $4,97B

2/

Addresses are more active than ever on the chain, so who knows, the BSC might gain some narrative in the future!

Going back to levels, they’re also developing a different feature from #GMX, which is the risk management.

3/

Going back to levels, they’re also developing a different feature from #GMX, which is the risk management.

3/

It basically combines the tradfi Tranches system with the Liquidity providers.

Their main objective is to solve issues such as the one that happened on @GMX_IO with the $AVAX market manipulation.

4/

Their main objective is to solve issues such as the one that happened on @GMX_IO with the $AVAX market manipulation.

https://twitter.com/joshua_j_lim/status/1571554171395923968?s=20&t=E4JAiw2n4FZv7VsCZxbC4g

4/

If you’re familiar with tradfi, you might already know what tranches are, if not let me explain it :)

Tranches allow to pool debts/securities together in function of their risk.

5/

Tranches allow to pool debts/securities together in function of their risk.

5/

It’s like buying a bag of same risk assets, but with different characteristics, type, yield, etc.

The risk is defined by a notation, going from AAA for the safest (thus lowest yield) to B or less for the riskiest (thus highest yield).

6/

The risk is defined by a notation, going from AAA for the safest (thus lowest yield) to B or less for the riskiest (thus highest yield).

6/

Tranches were unfortunately popularized during the 2008’s financial crisis which were quoted by rating agencies as AAA while it being full of shitty B

Take a look at the movie The Big Short if you wanna know more 🥂

7/

Take a look at the movie The Big Short if you wanna know more 🥂

7/

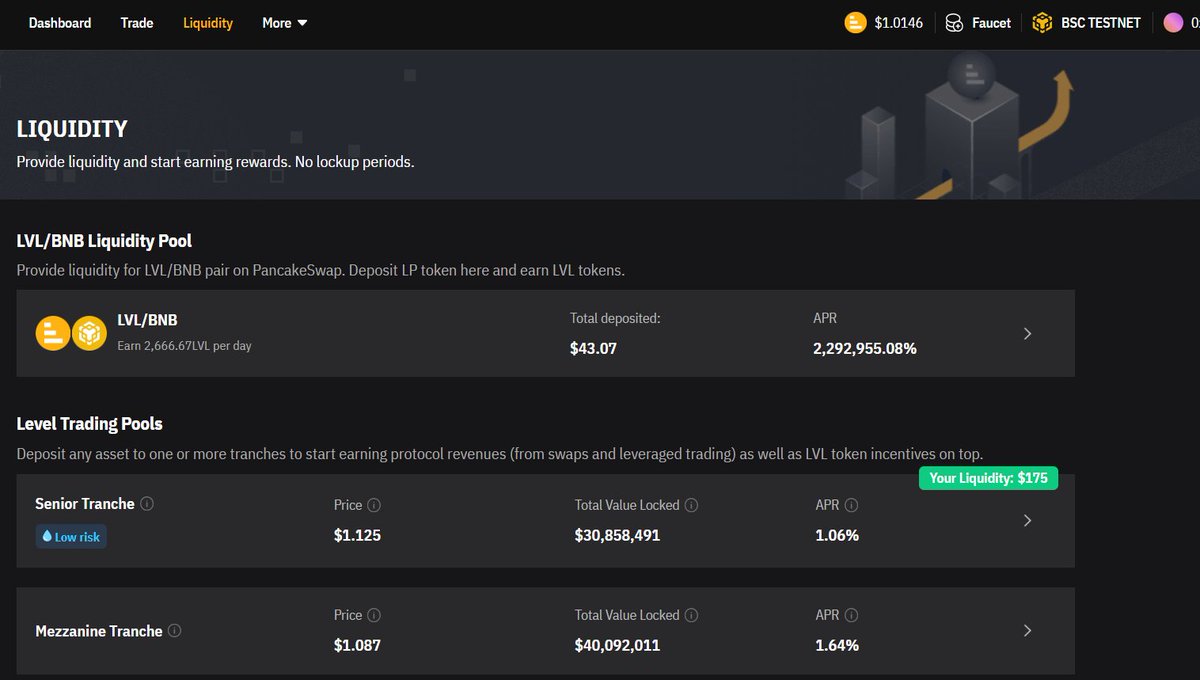

Level is planning to introduce tranches as liquidity pools which will, in function of their quotation, contain different type of assets and let LPs manage their risk and yield.

They will offer 3 types of tranches:

🟢Senior Tranche (AAA) with the lowest risk and APR

8/

They will offer 3 types of tranches:

🟢Senior Tranche (AAA) with the lowest risk and APR

8/

🟠Mezzanine Tranche (AA) with medium risk and APR

🔴Junior Tranche (BB) with the highest risk and APR

The percentage here represents the total profit/loss distribution among tranches.

Remember, as for $GMX, the LPs here are betting against traders.

9/

🔴Junior Tranche (BB) with the highest risk and APR

The percentage here represents the total profit/loss distribution among tranches.

Remember, as for $GMX, the LPs here are betting against traders.

9/

So if I open a 100 BTC position, 10 BTC will come from the senior, 30 BTC from the Mezzanine and 60 BTC from the Junior.

If I make profits or losses, the pools share the outcome based on the percentages.

10/

If I make profits or losses, the pools share the outcome based on the percentages.

10/

In order to manage this protocol, a DAO will be implemented and decide on the team expenditures, treasury, fees (thus real yield collected) through the governance token, the $LGO.

The max supply will be 1000 $LGO and can only be acquired by stacking the $LVL utility token.

11/

The max supply will be 1000 $LGO and can only be acquired by stacking the $LVL utility token.

11/

$LVL will become available through fair launch, no presale or team allocation.

The max supply will be 50M tokens distributed with :

- 10% for strategic partnership (funds for liquidity pools)

- 34% for community incentives (referral, trading contest)

12/

The max supply will be 50M tokens distributed with :

- 10% for strategic partnership (funds for liquidity pools)

- 34% for community incentives (referral, trading contest)

12/

- 20% for the team (4 year lock released every 12 months, starting in December 2023)

- 36% to liquidity provider (rewards and liquidity bootstrapping)

The Liquidity bootstrapping was launched on December 12 and is live until December 26, 2022.

13/

- 36% to liquidity provider (rewards and liquidity bootstrapping)

The Liquidity bootstrapping was launched on December 12 and is live until December 26, 2022.

13/

1 000 000 LVL will be allocated to this bootstrap until March 15th.

14/

https://twitter.com/Level__Finance/status/1602095147218509824?s=20&t=E7KmZnOuhgg2z0BhydL5Pg

14/

This is NFA, and even if I try to stay as neutral as possible in my threads, it’s important to know that the team is anon (accounts created for the project) and the protocol is still in the auditing process with @ObeliskOrg

obeliskauditing.com/audits/level-f…

15/

obeliskauditing.com/audits/level-f…

15/

Regarding partnership and roadmap, we do not have yet data on Level objectives and ambitions.

As mentioned earlier, the protocol is currently in #testnet so let’s discover how to participate!

16/

As mentioned earlier, the protocol is currently in #testnet so let’s discover how to participate!

16/

Step 1 : Install a new Metamask wallet

While doing testnets, it’s always wise to use an empty wallet.

Go to metamask.io Click on "Download" and add it to a new browser.

17/

While doing testnets, it’s always wise to use an empty wallet.

Go to metamask.io Click on "Download" and add it to a new browser.

17/

Step 2: Connect your wallet and move to the BSC test network.

Connect your wallet on the top right of this page test.level.finance

The protocol will automatically suggest moving to the BSC network.

18/

Connect your wallet on the top right of this page test.level.finance

The protocol will automatically suggest moving to the BSC network.

18/

Step 3: Claim the faucets

First, you will need the $BNB faucet that you can get here testnet.bnbchain.org/faucet-smart, validate the captcha, paste your wallet address and validate the request.

19/

First, you will need the $BNB faucet that you can get here testnet.bnbchain.org/faucet-smart, validate the captcha, paste your wallet address and validate the request.

19/

Step 4: Claim platform tokens

Now that we have the gas faucet, we will need tokens for trading.

Go back to test.level.finance/faucet and request the token you wish.

20/

Now that we have the gas faucet, we will need tokens for trading.

Go back to test.level.finance/faucet and request the token you wish.

20/

Step 5: Provide liquidity

You now can provide liquidity in the various tranches you would like to get exposed to test.level.finance/liquidity

I chose for this example the Senior tranche in which you chose the amount and token to provide liquidity.

21/

You now can provide liquidity in the various tranches you would like to get exposed to test.level.finance/liquidity

I chose for this example the Senior tranche in which you chose the amount and token to provide liquidity.

21/

Step 6: Trade and Swap

We can now make some trades and swaps on the platform to test the different features, the leverage, slippage and even getting liquidated.

You also can withdraw liquidity in order to do as much on-chain actions as possible.

22/

We can now make some trades and swaps on the platform to test the different features, the leverage, slippage and even getting liquidated.

You also can withdraw liquidity in order to do as much on-chain actions as possible.

22/

Step 7: Enjoy & feedback

Discover features, try some strategies and give your feedback to the team (with your wallet) in the discord channel #suggestions-feedback.

discord.gg/levelfinance

23/

Discover features, try some strategies and give your feedback to the team (with your wallet) in the discord channel #suggestions-feedback.

discord.gg/levelfinance

23/

I’m tagging some chads around the real yield ecosystem @crypto_linn @CompleteDegen @crypthoem @Subli_Defi @DeFi_educator @Crypt0_Andrew @DegenSensei @Gemhunter9000 @CryptoSources @0x_d24 @fawoz_ @cryptodetweiler @thewolfofdefi @LouisCooper_ @CoinSurveyor

24/

24/

I hope you enjoyed this presentation, do not hesitate RT and tell me in the comments what you think of the project.

Cheers ! 🥂

Cheers ! 🥂

https://twitter.com/OGtestnet/status/1603139958096764936?s=20&t=akwRhagqv6stVzsu6D-QDA

Useful links not mentioned in this thread:

Site : test.level.finance

Twitter : twitter.com/level__finance

TG: t.me/LevelFinanceAnn

Medium : level-finance.medium.com

Discord : discord.gg/levelfinance

Gitbook : docs.level.finance

Github: github.com/level-fi

Site : test.level.finance

Twitter : twitter.com/level__finance

TG: t.me/LevelFinanceAnn

Medium : level-finance.medium.com

Discord : discord.gg/levelfinance

Gitbook : docs.level.finance

Github: github.com/level-fi

• • •

Missing some Tweet in this thread? You can try to

force a refresh