Here is my morning run down of the current market outlook using Dark Pools, Dealer Positioning and market wide Options Flow to inform our #optionstrading and #futurestrading today. Data can change but it will help formulate a plan.

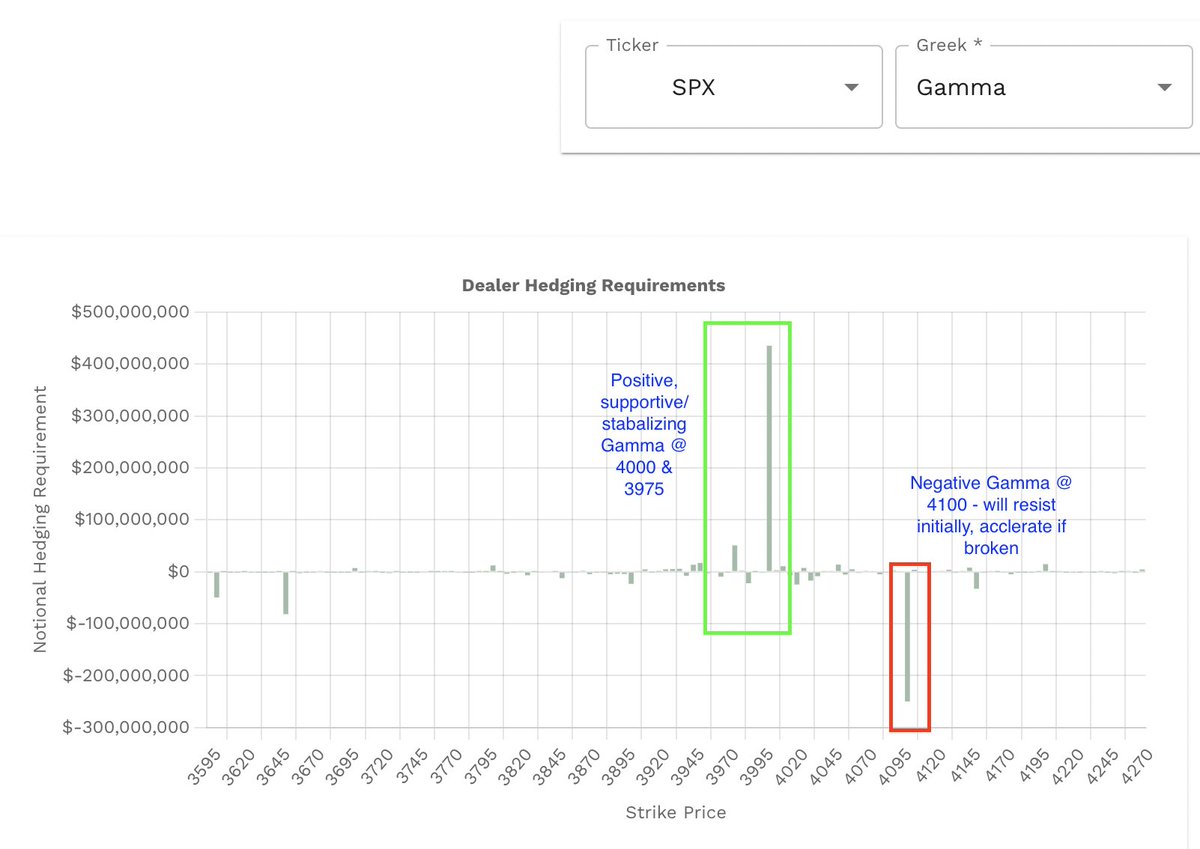

Lets start with $SPX Gamma and Vanna courtesy of @WizOfOps Vol.land. Vanna is the biggest $SPX driver. Notice how the 4000 magnet magnet remains with repellents at 3900/4100. If 3900 gives out, 3800 could become a magnet!

Now let's do the same for $SPY but add in some additional data points from @Tradytics data driven insights. Vanna magnet @ $400. Repel @ $390. Lots of magnets/accelerants below $390 if it gives out. 5-day delta correlations heavily favor downside & volatility.

$SPY Dark Pools help paint the the picture further. Mild amount of sig prints (bearish) with some support below. Still bearish sentiment from block trades. If support is broken or we open below, could be come resistance.

Market net flow was thrown off by calls on a corporate bonds ETF so will not use it this morning until open. Flow map heavily skewed towards puts. Dealer Market Diary starting to show slightly less negative deltas to unroll.

Lastly, we need to make sure we keep all the upcoming macro number releases in mind as they are the big fundamental drivers of the market. We had jobless claims this morning, with PMI tomorrow. The big one is OPEX tomorrow as well!

Ultimately, the $SPX 4000 / $SPY 400 magnet remains but new bearish structure is emerging. The repellents at 3900/390 will play a part, however if we get a nice break below, they will act as significant accelerants with new magnets below! ($384 $SPY & 3800 $SPX)

If you are interested in viewing & using this data plus more with hundreds of other assets, use coupon code FattyTrades for discounts with #volland, @Tradytics & @elitetraderfund funded futures accounts!

• • •

Missing some Tweet in this thread? You can try to

force a refresh