Life insurance is said to be a sunrise industry!

The analysis of a life insurer is completely different from normal companies!

Many people find it very complex!

A thread🧵simplifying the complex jargon of the life insurance industry.

Lets go👇

(1/20)

The analysis of a life insurer is completely different from normal companies!

Many people find it very complex!

A thread🧵simplifying the complex jargon of the life insurance industry.

Lets go👇

(1/20)

Why Life insurance?

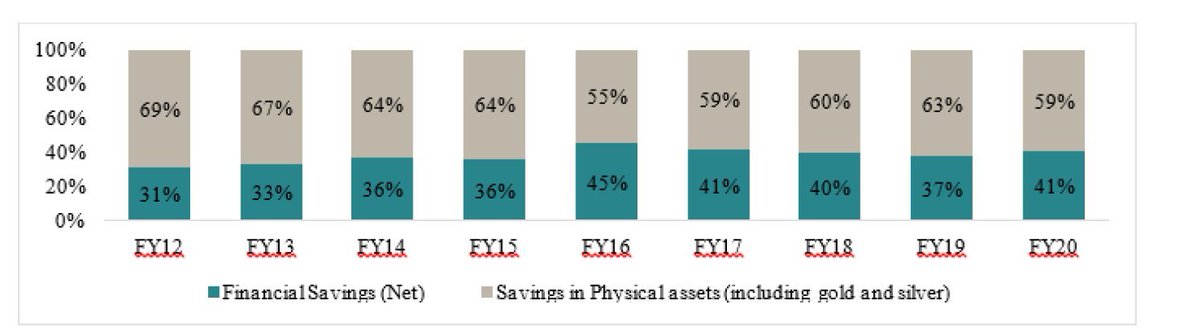

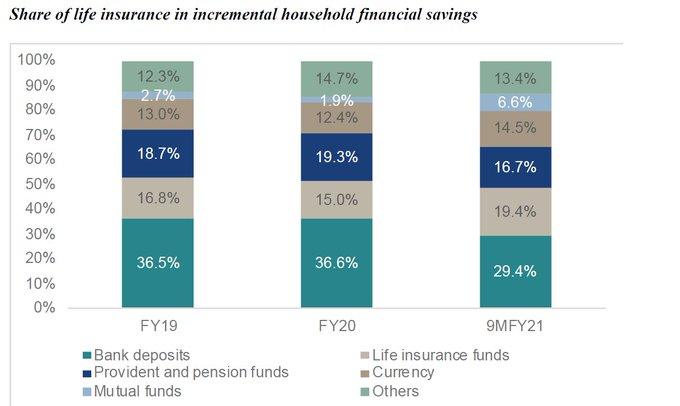

The Financialisation of savings is a rampant theme over the last 5 years.

This means the share of life insurance in the overall savings has increased from 13% to 14.5%

(2/20)

The Financialisation of savings is a rampant theme over the last 5 years.

This means the share of life insurance in the overall savings has increased from 13% to 14.5%

(2/20)

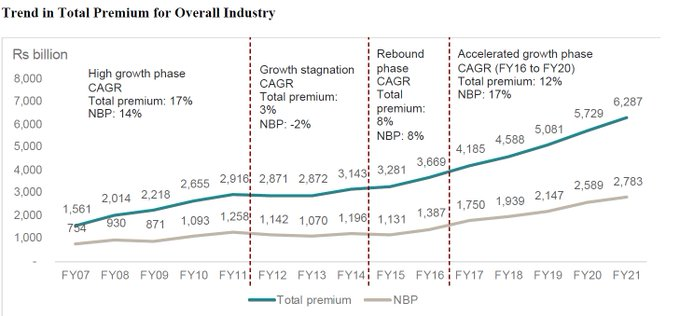

Insurance on an accelerated growth phase:-

The new business premium has grown sharply in the last 5 years by 17%.

Financialisation of savings, as well as young people needing life insurance, will continue to make sure the industry grows at fast pace

(3/20)

The new business premium has grown sharply in the last 5 years by 17%.

Financialisation of savings, as well as young people needing life insurance, will continue to make sure the industry grows at fast pace

(3/20)

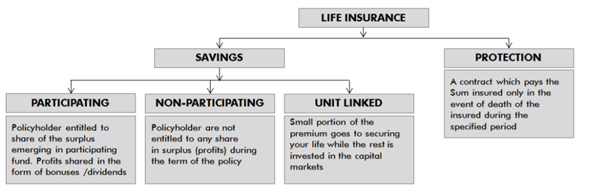

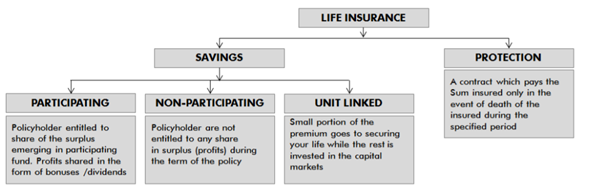

What is life insurance?

Life Insurance is a contract b/w insurance policyholder & an insurer,

The insurer promises to pay a sum of money to the beneficiary when the insured person dies or after a pre-determined period in exchange for the premiums paid by policyholder.

(4/20)

Life Insurance is a contract b/w insurance policyholder & an insurer,

The insurer promises to pay a sum of money to the beneficiary when the insured person dies or after a pre-determined period in exchange for the premiums paid by policyholder.

(4/20)

Savings Products:-

These combine investments with insurance.

They generally promise an assured sum of money at some point:-

🏦Partipating

🏦Non-Participating

🏦ULIP

(6/20)

These combine investments with insurance.

They generally promise an assured sum of money at some point:-

🏦Partipating

🏦Non-Participating

🏦ULIP

(6/20)

Protection

Pure play life insurance plan:-

Here the companies only pay an amount in case of death. No assured payout are given

🏦Term Plan

🏦Annuity

(7/20)

Pure play life insurance plan:-

Here the companies only pay an amount in case of death. No assured payout are given

🏦Term Plan

🏦Annuity

(7/20)

Profitability of each business(VNB margins)-

Protection(Term Plan)-50-70%

Annuities-25-35%

Savings 2-10%

Protection plans are very profitable for insurance companies.

(8/20)

Protection(Term Plan)-50-70%

Annuities-25-35%

Savings 2-10%

Protection plans are very profitable for insurance companies.

(8/20)

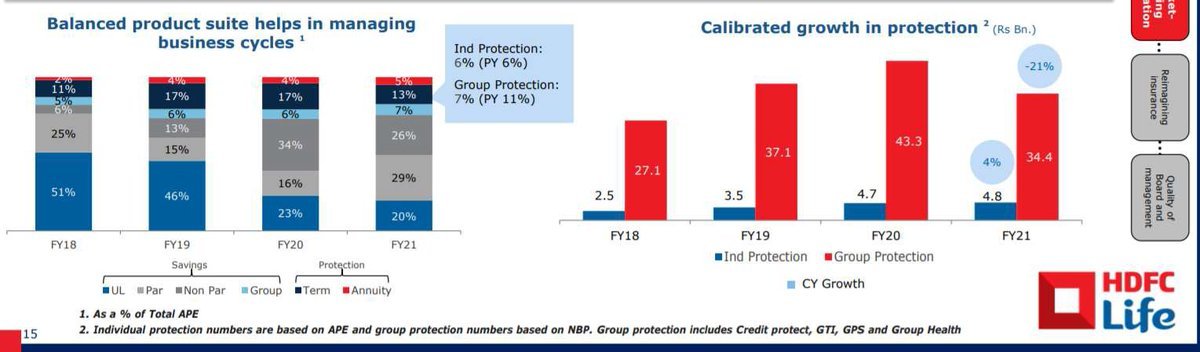

So how does product mix affect company analysis?

Look for companies that have a balanced product mix and are increasing the protection part of the business!

For eg HDFC Life has a balanced mix and is growing the protection part of the business

(9/20)

Look for companies that have a balanced product mix and are increasing the protection part of the business!

For eg HDFC Life has a balanced mix and is growing the protection part of the business

(9/20)

Some terms used in analysis now-

New Business Premium (NBP) -

New business premium is the premium acquired from new policies for a particular year.

This tells us about the basic premium growth of the company and is an important metric

(10/20)

New Business Premium (NBP) -

New business premium is the premium acquired from new policies for a particular year.

This tells us about the basic premium growth of the company and is an important metric

(10/20)

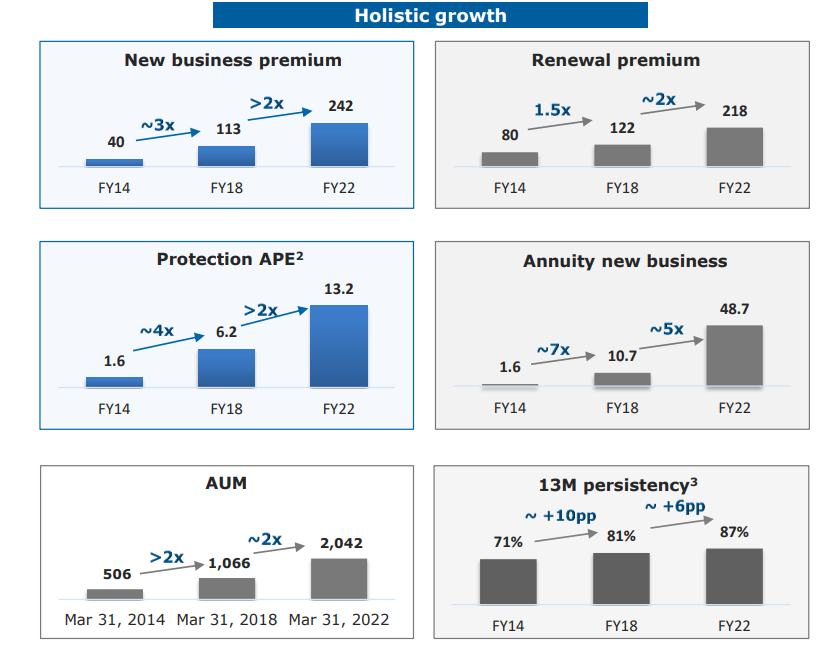

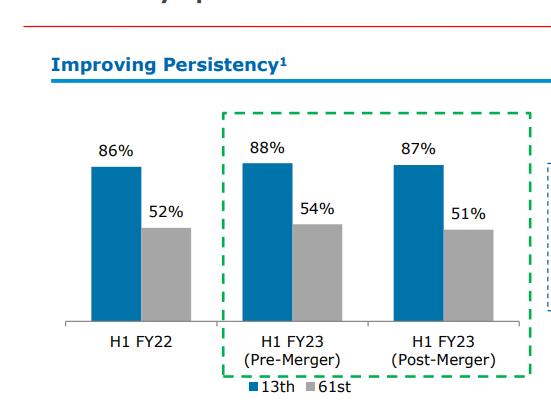

Persistency ratio-

The proportion of policyholders who continue to pay their renewal premium.

It is a barometer for the quality of sale made by the insurer.

Higher the persistency ratios..the better it is!

HDFC life shown here has some of the best persistency ratios

(11/20)

The proportion of policyholders who continue to pay their renewal premium.

It is a barometer for the quality of sale made by the insurer.

Higher the persistency ratios..the better it is!

HDFC life shown here has some of the best persistency ratios

(11/20)

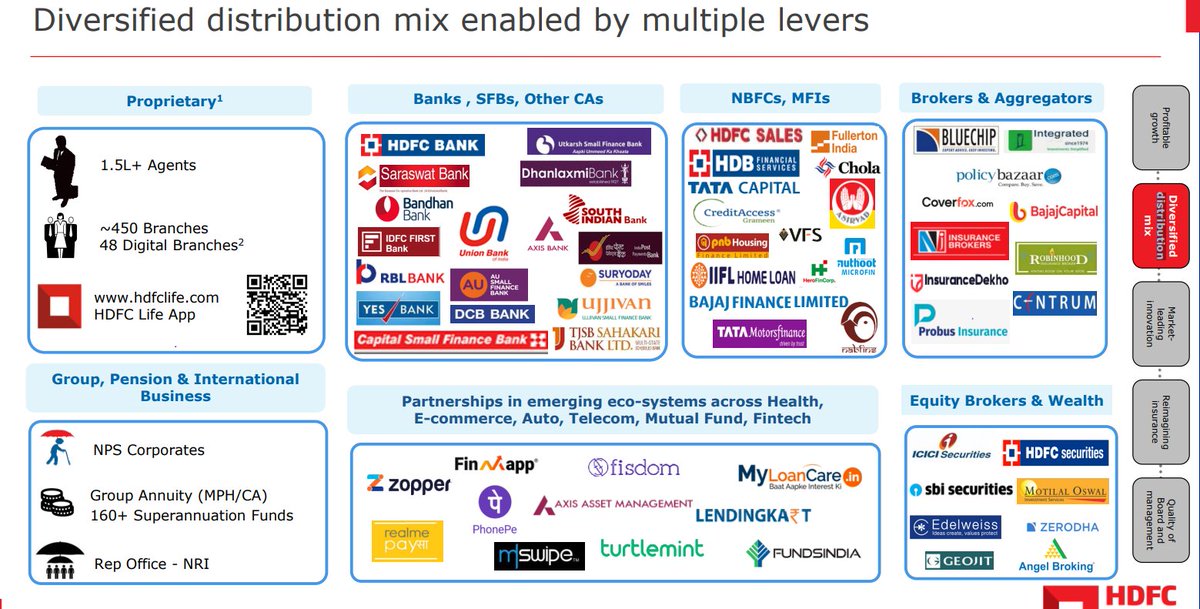

Distribution mode of the policies:-

A strong bank(bancasurrance) network together with agent relationships helps distribute the products better

A large part of HDFC Life's policy comes from Banks

(11/20)

A strong bank(bancasurrance) network together with agent relationships helps distribute the products better

A large part of HDFC Life's policy comes from Banks

(11/20)

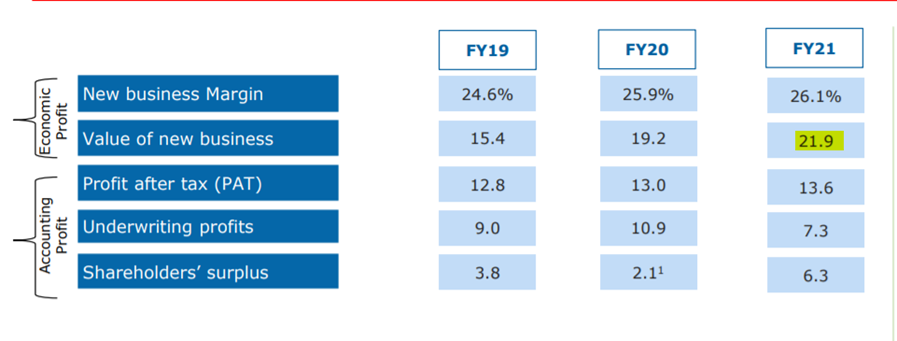

Value of New Business (VNB) -

Present value of expected future earnings from new policies written during any given period.

It reflects the additional value to shareholders expected to be generated through the activity of writing new policies during any given period

(12/20)

Present value of expected future earnings from new policies written during any given period.

It reflects the additional value to shareholders expected to be generated through the activity of writing new policies during any given period

(12/20)

VNB Margin-

It is a measure of the expected profitability of new business.

Just like the profit margins

For example:-

HDFC Life is an as a VNB margin of 26.1%.It means for every Rs 100 of new premium written,the company expects to makes 26.1% as profits

(13/20)

It is a measure of the expected profitability of new business.

Just like the profit margins

For example:-

HDFC Life is an as a VNB margin of 26.1%.It means for every Rs 100 of new premium written,the company expects to makes 26.1% as profits

(13/20)

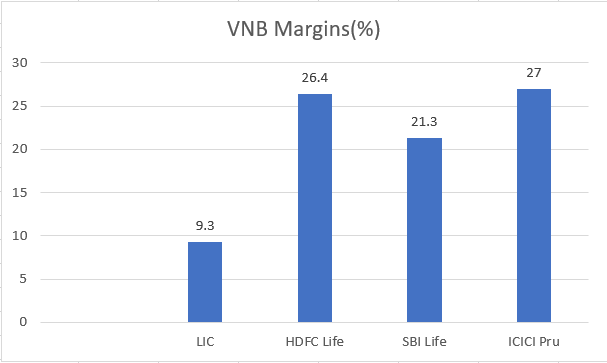

VNB Margins across insurers show:-

HDFC Life and ICICI Pru Life are the most efficient.

LIC is the least efficient.

(14/20)

HDFC Life and ICICI Pru Life are the most efficient.

LIC is the least efficient.

(14/20)

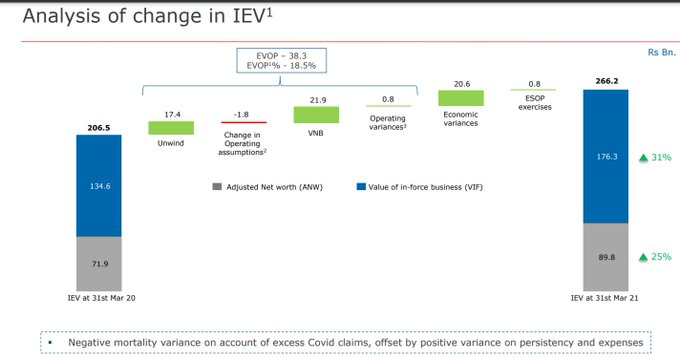

Embedded Value(EV):-

EV is the sum of the net asset value+present value of future profits of a company.

This is one of the valuation metrics for life insurers just as a P/E is used for a normal company

HDFC Life here explains the changes in EV for the company

(15/20)

EV is the sum of the net asset value+present value of future profits of a company.

This is one of the valuation metrics for life insurers just as a P/E is used for a normal company

HDFC Life here explains the changes in EV for the company

(15/20)

Valuation:-

Life insurers are valued on multiples of Embedded Value(EV)

HDFC Life trades at 3x P/EV

SBI Life trades at 2.5x P/EV

LIC trades at 0.8x P/EV

(16/20)

Life insurers are valued on multiples of Embedded Value(EV)

HDFC Life trades at 3x P/EV

SBI Life trades at 2.5x P/EV

LIC trades at 0.8x P/EV

(16/20)

So normal analysis parallels used to analyse Life insurance

P/E becomes P/Embedded Value

ROE becomes Return on Embedded Value

NIM becomes VNB margin which is unearned and is an assumption of future profits and dependent on future interest rates, persistency etc.

(17/20)

P/E becomes P/Embedded Value

ROE becomes Return on Embedded Value

NIM becomes VNB margin which is unearned and is an assumption of future profits and dependent on future interest rates, persistency etc.

(17/20)

Sales growth becomes New premium growth

Long term relationship with clients is measured by persistency ratios

(18/20)

Long term relationship with clients is measured by persistency ratios

(18/20)

Conclusion:-

1. Valuing a Life insurance company is just not based on the Embedded Value

2. Product Mix,Distribution network,VNB margins as well as persistency ratio are some of the important things that need to be monitored!

(19/20)

1. Valuing a Life insurance company is just not based on the Embedded Value

2. Product Mix,Distribution network,VNB margins as well as persistency ratio are some of the important things that need to be monitored!

(19/20)

Disclaimer:-

This is just my study.

This is not investment advise.

Please consult your own investment advisor before making your own investment decisions

(20/20)

This is just my study.

This is not investment advise.

Please consult your own investment advisor before making your own investment decisions

(20/20)

• • •

Missing some Tweet in this thread? You can try to

force a refresh