Here is my morning run down of the current market outlook using Dark Pools, Dealer Positioning and market wide Options Flow to inform our #optionstrading and #futurestrading today. Data can change but it will help formulate a plan.

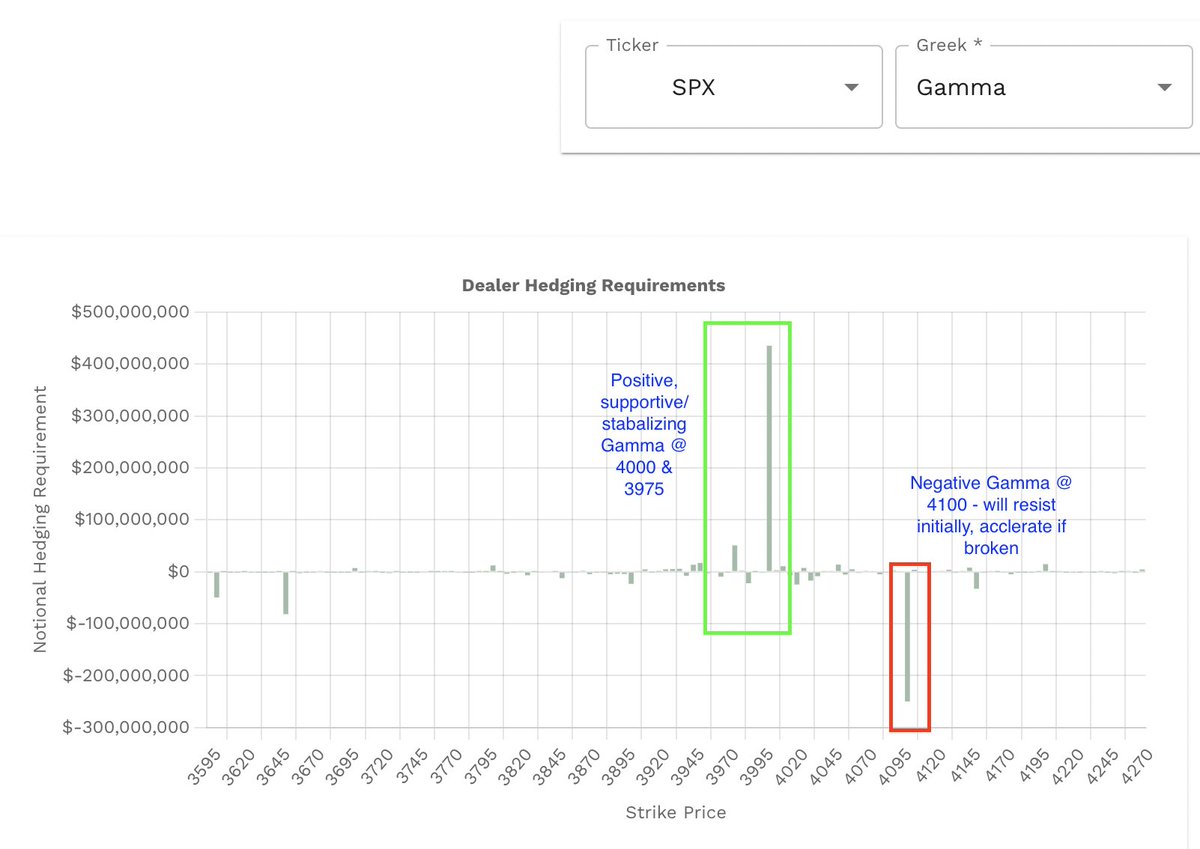

Lets start with $SPX Gamma and Vanna courtesy of @WizOfOps Vol.land. The $SPX Vanna picture has changed dramatically with only having repellents at the extremes! Same with Gamma, we have areas of positive gamma above & below that can be S/R but it's minimal!

Now let's do the same for $SPY but add in some additional data points from @Tradytics data driven insights. Vanna impact similar to $SPX. Gamma shows support @ $384/$388 & resistance @ $393/$396, with accelerants in between. The 5-day delta correlations favor the bears!

$SPY Dark Pools help paint the the picture further. Sig prints at $399.5 are very bearish (potential magnet first). However, we have lots of DP resistance above and block trade sentiment remains bearish.

Now, take a look at 5-day market net flow and delta positioning across the market. 5-day flow shows calls accumulating overall, however market wide deltas went extremely bearish. Lets not forget the negative deltas on DMD de-hedging today! See my post yesterday about it.

Lastly, we need to make sure we keep all the upcoming macro number releases in mind as they are the big fundamental drivers of the market. We have PMI at 9:45 (I'll be flat 1m before just in case) as well as major OPEX today!

Overall, based on the DP data, historical correlations and overall market structure, I do favor the bears into next week. However, this also allows for extreme volatility so there is money to be made on both sides, which I fully intend to do. Today I have no true bias!

• • •

Missing some Tweet in this thread? You can try to

force a refresh