+ Let's compare the financials of some companies in the energy sector.

+ Analysis of financials can offer important tips for investing.

#ODAS #AKSEN #ZOREN #ENJSA

#bist #bist30 #bist50 #bist100 #XU100

+ Analysis of financials can offer important tips for investing.

#ODAS #AKSEN #ZOREN #ENJSA

#bist #bist30 #bist50 #bist100 #XU100

https://twitter.com/Kai_Charts/status/1603725889577050114

+ It is good that the equities increase regularly.

+ Equity of all companies seems to be increasing steadily.

+ Equity of all companies seems to be increasing steadily.

+ ROE is a measure of a company's profitability that calculates the amount of net income that a company generates as a percentage of its shareholder equity.

+ Regularly increase which also good for companies.

+ Regularly increase which also good for companies.

+ Sales must continue to increase for the continuity of the company.

+ We see that #ENSJA has recorded a good growth in its sales proportionally in the last 3 quarters.

+ Other companies also has growth in their sales.

+ We see that #ENSJA has recorded a good growth in its sales proportionally in the last 3 quarters.

+ Other companies also has growth in their sales.

+ What is the point of sales if it does not make a profit?

+ Profitability is very important for a company in order to enable new investments. (1/2 Net Profit)

+ Profitability is very important for a company in order to enable new investments. (1/2 Net Profit)

+ We see that #ZOREN is struggling a bit in this regard.

+ Other companies, on the other hand, have increased their profitability with similar ratios. (2/2 Net Profit)

+ But remember how #ZOREN is better at ROE.

+ Other companies, on the other hand, have increased their profitability with similar ratios. (2/2 Net Profit)

+ But remember how #ZOREN is better at ROE.

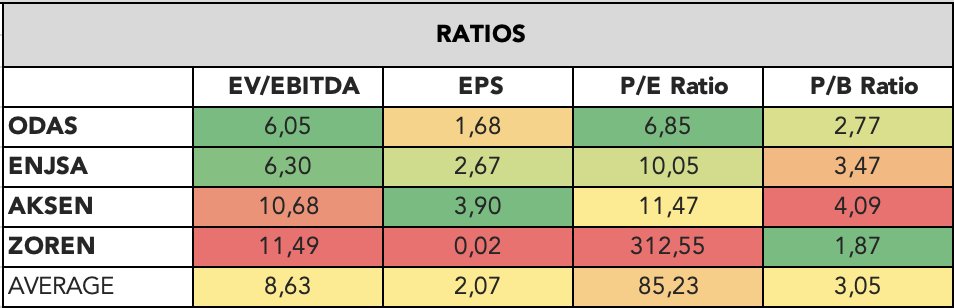

+ Now it's the turn of the ratios.

+ The EV/EBITDA ratio is used to evaluate a company's valuation and financial performance. It is often used by investors to compare a company's valuation to that of its peers in the same industry.

+ The EV/EBITDA ratio is used to evaluate a company's valuation and financial performance. It is often used by investors to compare a company's valuation to that of its peers in the same industry.

+ #ZOREN's P/E ratio is very high.

+ This situation also affects the average. In this case, it is difficult to make a logical inference.

+ Average level doesn't make any sense, unfortunately.

+ This situation also affects the average. In this case, it is difficult to make a logical inference.

+ Average level doesn't make any sense, unfortunately.

+ The P/B ratio, also known as the price-to-book ratio, is a financial valuation metric that compares a company's stock price to its book value.

+ Closer to 1 is good. However, sectoral differences can be observed.

+ All companies looks at similar level.

+ Closer to 1 is good. However, sectoral differences can be observed.

+ All companies looks at similar level.

+ Lastly all ratios at same table.

+ Some automatic colorings can make the ratio appear worse than it is. Please evaluate it based on its distance from the average.

+ Some automatic colorings can make the ratio appear worse than it is. Please evaluate it based on its distance from the average.

+ We briefly looked at the financials and ratios.

+ If you want the continuation of this series or want an analysis of another sector, please leave a comment or DM to us.

+ Thanks for reading.

#ODAS #AKSEN #ZOREN #ENJSA

#bist #bist30 #bist50 #bist100 #XU100

+ If you want the continuation of this series or want an analysis of another sector, please leave a comment or DM to us.

+ Thanks for reading.

#ODAS #AKSEN #ZOREN #ENJSA

#bist #bist30 #bist50 #bist100 #XU100

What will the next industry be?

If it is not in the options, you can specify it as a comment.

#bist #bist30 #bist50 #bist100 #XU100

If it is not in the options, you can specify it as a comment.

#bist #bist30 #bist50 #bist100 #XU100

• • •

Missing some Tweet in this thread? You can try to

force a refresh