1/ The token (1/2)

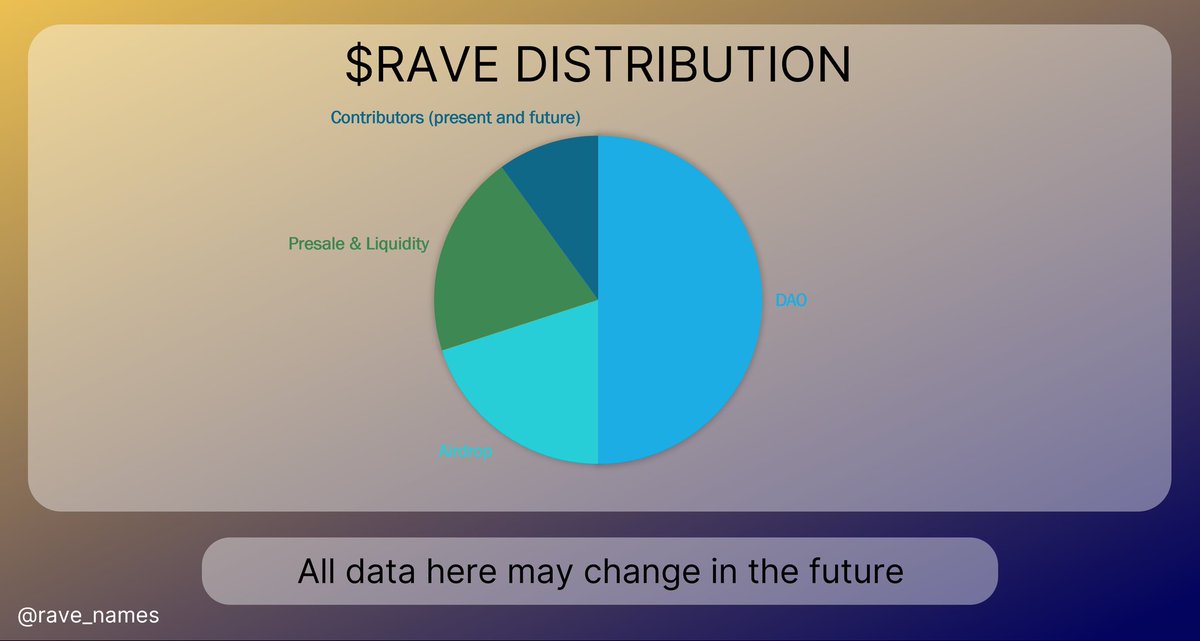

$RAVE will be distributed in the manner outlined in the graphic below. 50% will be directed to the mew DAO, 20% to the airdrop, 20% to the presale, and 10% for contributiors.

The $RAVE token will also have a novel voting-escrow model, where any lock can be...

$RAVE will be distributed in the manner outlined in the graphic below. 50% will be directed to the mew DAO, 20% to the airdrop, 20% to the presale, and 10% for contributiors.

The $RAVE token will also have a novel voting-escrow model, where any lock can be...

2/ The token (2/2)

...terminated, but at a fee. This fee will decay linearly depending on the time since lock the termination occurs at.

...terminated, but at a fee. This fee will decay linearly depending on the time since lock the termination occurs at.

3/ The airdrop

The $RAVE airdrop will be conducted using multipliers, where every address starts with a multiplier of 0 (meaning they get no tokens), and that gets increased to the highest qualified multiplier.

You can ask questions about this at rave.cyou!

The $RAVE airdrop will be conducted using multipliers, where every address starts with a multiplier of 0 (meaning they get no tokens), and that gets increased to the highest qualified multiplier.

You can ask questions about this at rave.cyou!

4/ The model (1/2)

Rave Names - from the inception of the $RAVE token - will be a DAO, not a company. However, we want to outline a pcDAO (partially constitued DAO). What this model aims to achieve, is a governance body (holders of $RAVE) can create a constitution...

Rave Names - from the inception of the $RAVE token - will be a DAO, not a company. However, we want to outline a pcDAO (partially constitued DAO). What this model aims to achieve, is a governance body (holders of $RAVE) can create a constitution...

5/ The model (2/2)

...and the Rave team and contributiors must act in accordance to the constitution. The governance body will also have the authority to manage treasury funds, development goals, and anything else relating to DAO operations.

...and the Rave team and contributiors must act in accordance to the constitution. The governance body will also have the authority to manage treasury funds, development goals, and anything else relating to DAO operations.

6/ Final notes.

The transition from company to DAO is expected to happen between Q1-Q3 2023, and you will hear more news about that as time goes on. Airdrop snapshots will be announced here, when they happen.

All our links are at rave.directory!

🎧

The transition from company to DAO is expected to happen between Q1-Q3 2023, and you will hear more news about that as time goes on. Airdrop snapshots will be announced here, when they happen.

All our links are at rave.directory!

🎧

• • •

Missing some Tweet in this thread? You can try to

force a refresh