#RBT countries understand "saving clause" to protect the internal tax base. Bc of @citizenshiptax + #FATCA US uses "saving clause" to BOTH PROTECT internal tax base + EXPAND tax base by claiming people with @taxresidency in other countries as US taxpayers. taxconnections.com/taxblog/croati…

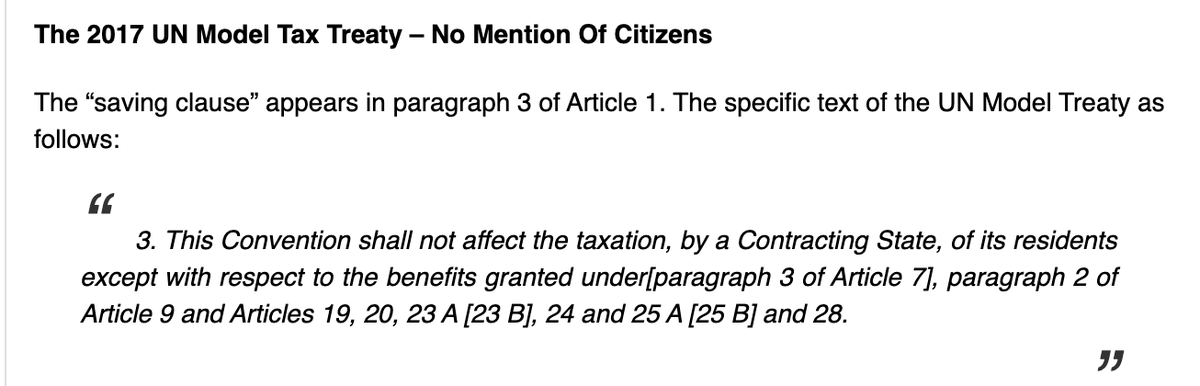

Both OECD + UN Treaties include a "saving clause" which "saves" right of a country to tax its "residents". All countries (including the US) make "residency" a sufficient condition for @taxresidency. Only the US has @citizenshiptax. Hence, "saving clause" speaks only of residents.

The evolution of the "saving clause" found in US Tax Treaties is VERY (really) interesting. Watch how they become tighter over time. Here is paragraph 3 of Article 4 of the 1973 US Romania Tax Treaty. It applies to (1) "residents" (as defined by treaty) and (2) "citizens".

Next step is to expand "saving clause" beyond current "citizen" or "resident". An early example is 1982 Australia treaty defining "citizen" to include a former citizen who expatriated to avoid taxation. Note this expansion does NOT include permanent residents and is for 10 years.

Looking for more. In Par 3 of Art 1 of the 1992 Russia treaty, the saving clause allows the US to tax it's "residents" (as defined by treaty) current citizens and FORMER citizens without regard to why they are former citizens. Notice that "former residents" are excluded.

Denmark paragraph 4 of Article 1: By 2000 both former "long term residents" and "former citizens" are included for a period of ten years: if "loss of such status had as one of its principal purposes the avoidance of tax" (who can prove that?).

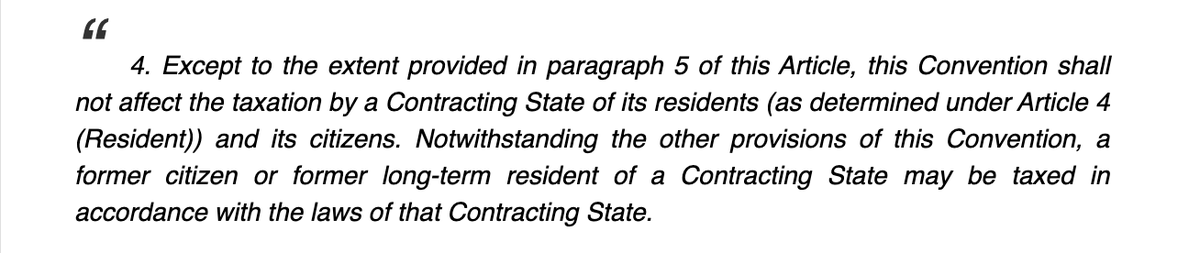

Moving on: The 2016 US Model Tax Treaty reflected in 2022 US Croatia Tax Treaty removes all limitations and the treaty partners agree that the US will be granted full taxing rights, without limitation over current "residents" or "citizens" and FORMER "residents" or "citizens".

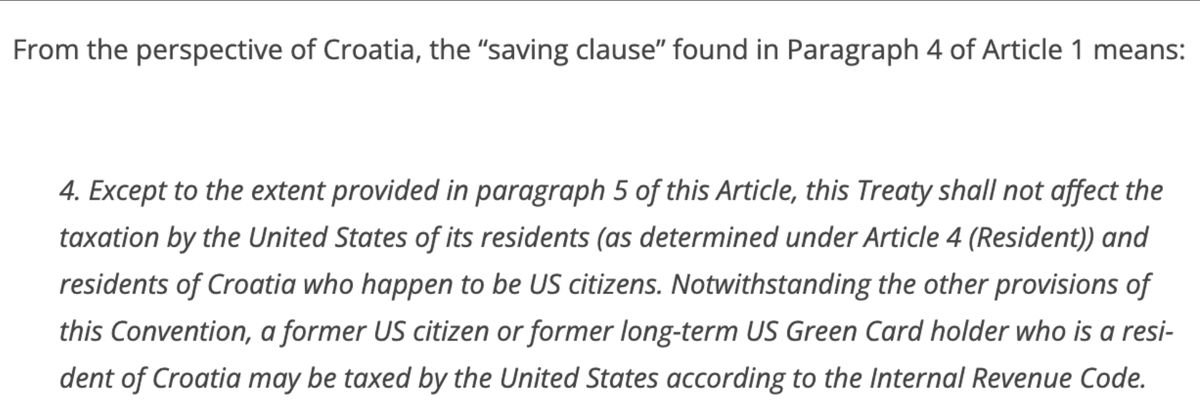

#FATCA of the matter: The "saving clause" found in US Croatia Tax Treaty allows US to impose full tax on US "residents", "citizens", "former residents" and "former citizens". This is how a "saving clause" in the context of @citienship tax expands the US tax base outside the US.

The "saving clause" and #FATCA extend US @citizenshiptax into other countries. The US claims those with @taxresidency in other countries as US tax residents. No sovereign country should agree to a tax treaty that includes "citizenship" in "saving clause". americanexpatfinance.com/opinion/item/2…

@threadreaderapp unroll

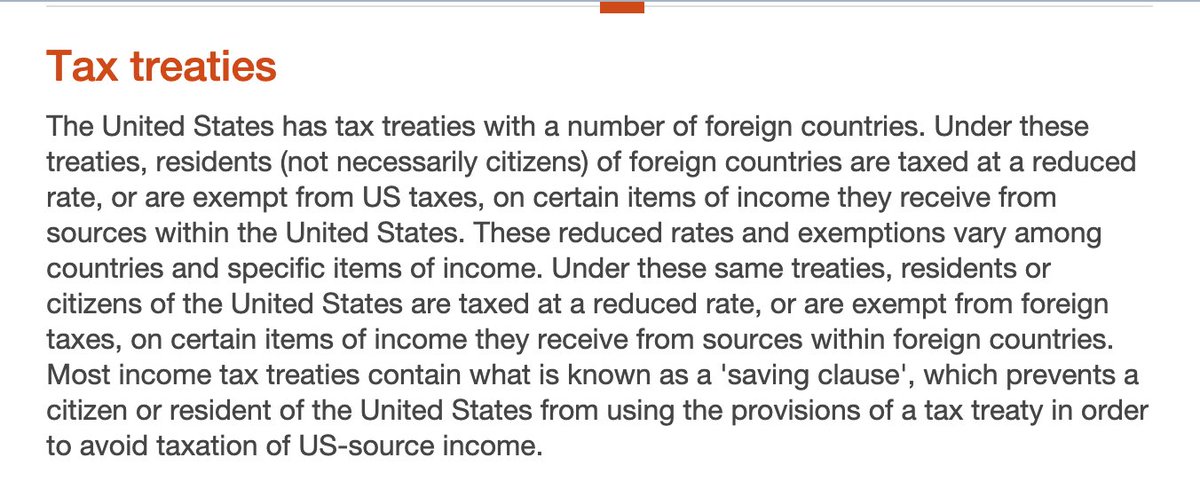

The "saving clause" is commonly understood through a framework that assumes #RBT and NOT @citizenshiptax. By focusing on the protection of the domestic tax base, there is a failure to recognize how #CBT + #FATCA extend the US tax base to other countries. taxsummaries.pwc.com/united-states/…

The idea of the "saving clause" extending US tax rules into other countries is well explained in the article by @FixTheTaxTreaty which succinctly summarizes the problem ... fixthetaxtreaty.org/problem/saving…

• • •

Missing some Tweet in this thread? You can try to

force a refresh